Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

MC3OZ

Active Member

I know we have all been wondering how Model 3 sales are going in Sweden, luckily our man JPR007 has come through:-

JPR007 on Twitter

JPR007 on Twitter

gerebgraus

Member

I do not know about shorties, they no longer have worthwhile things to say. But I have noticed that car stocks were beating indices big time and not only Tesla. So I assume that the optimism was based on the massively improved COVID expectations. Carmakers are hit with COVID both with production and demand issues. I.e. they have a very high COVID beta.The major indices ended up red today, but TSLA gained 5,66%. Yesterday many longs were crying manipulation. Is today shorties turn to cry foul play?

Can’t we just conclude that the stock price eventually finds its rightful place, despite all the strings being pulled?

MC3OZ

Active Member

JPR007 is on a roll:- Thread by @jpr007: @JosephVVallace A. EXISTING ICE INDUSTRY It would be a bit pointless to do that analysis for the dying ICEV industry for several reasons : -…

This quote is interesting....

I'm not so sure about this myself, my guess is all car makers are doing much the same thing in much the same way, getting the same deal on raw materials, parts and equipment...

So maybe other car makers are getting the same deal as VW and Toyota as everyone knows what everyone else is paying.. or they need to negotiate those deals to survive.

Strictly speaking that isn't overhead cost.. but it sets the scene...

I assume overhead cost is IT, Admin, R&D etc.

Again I assume other car makers need to match Toyota and VW to complete...

Most of this activity is in Japan and Germany where wages are higher, but perhaps not as high as California.

Regardless, this $3,000 overhead cost is a target Tesla can aim for, and possibly an insight into the Bear argument, the Bear argument is wrong, but I can see them looking at the numbers and drawing the wrong conclusions.

This quote is interesting....

[It turns out that the almost entire ICEV industry has benchmarked itself to a very similar level of Overhead Costs per Vehicle, right around $3,000

In other words, notwithstanding all the talk, the industry leaders have failed to pursue the real Economies of Scale that are available to them

- both VW and Toyota have MUCH HIGHER overhead cost structures than they should have

I'm not so sure about this myself, my guess is all car makers are doing much the same thing in much the same way, getting the same deal on raw materials, parts and equipment...

So maybe other car makers are getting the same deal as VW and Toyota as everyone knows what everyone else is paying.. or they need to negotiate those deals to survive.

Strictly speaking that isn't overhead cost.. but it sets the scene...

I assume overhead cost is IT, Admin, R&D etc.

Again I assume other car makers need to match Toyota and VW to complete...

Most of this activity is in Japan and Germany where wages are higher, but perhaps not as high as California.

Regardless, this $3,000 overhead cost is a target Tesla can aim for, and possibly an insight into the Bear argument, the Bear argument is wrong, but I can see them looking at the numbers and drawing the wrong conclusions.

Last edited:

MC3OZ

Active Member

JPR has also had these thoughts on Tesla (the guy sure is prolific):- Thread by @jpr007: @JosephVVallace @skjoldp Let me write that slightly differently : “And as Tesla ramps up production in Shanghai, Brandenburg, Fremont, Nevad…

I've had similar thoughts myself in relation to service, 2 Million cars per year gives Tesla the scale were service can be fully built out at a reasonable cost.

To help us visualize where that might happen, we can see that Overhead Costs per Vehicle tend to fit within the band of $2,000~4,000 once unit volumes exceed about 2,000,000 vehicles per year

I've had similar thoughts myself in relation to service, 2 Million cars per year gives Tesla the scale were service can be fully built out at a reasonable cost.

Krugerrand

Meow

I’m not saying there is no manipulation on a daily basis, especially around expiry. But as Papafox says, the stock price eventually corrects and finds the place it deserves. It can be frustrating (and costly) for short term players, but long term hodlers probably do not suffer from these manipulations.

My issue is only with the definition of ‘eventually’. Is that sooner than soon? Or later than late? I mean, how many YEARS did it take to ‘eventually’ get a bit closer to the proper price, only to go down again and be *here*? ‘Eventually’ people run out of patience waiting for the eventuality—as has been demonstrated in this thread over the past number of YEARS.

My only saving grace, because I have no other virtues, is that I am a tenacious ************, so yeah, **** ** *** ********! I can out wait ‘eventually’.

Krugerrand

Meow

Why should anyone suffer from these obvious manipulations?

It is our cross to bear?

Typed out, that’s funny.

It would be nice if Tesla made cars that actually got their supposed range. There are any number of threads on this subject. The class action suit will be a fudsters dream. Check current thread in Model S driving.

Something something your mileage may vary.

Krugerrand

Meow

She’s a lot more succinct there, eh?

And I vote, no. They won’t do that unless they run out of customers in China. And who in their right mind is expecting that to happen when the factory has only been open for a couple months and hasn’t even reached full production. Nope, not going to happen.

Rohan

Member

Oh no... do you think he can fix them?Elon has broken 33m Twitter followers.

ByeByeJohnny

Active Member

Oh no... do you think he can fix them?

Someone already asked that hours ago. So yeah, he's probably fixed them all by now.

I think you are missing the point of that quote... because Toyota and VW have much higher volumes than everyone else, their overhead cost per vehicle should be much lower.JPR007 is on a roll:- Thread by @jpr007: @JosephVVallace A. EXISTING ICE INDUSTRY It would be a bit pointless to do that analysis for the dying ICEV industry for several reasons : -…

This quote is interesting....

I'm not so sure about this myself, my guess is all car makers are doing much the same thing in much the same way, getting the same deal on raw materials, parts and equipment...

So maybe other car makers are getting the same deal as VW and Toyota as everyone knows what everyone else is paying.. or they need to negotiate those deals to survive.

Strictly speaking that isn't overhead cost.. but it sets the scene...

I assume overhead cost is IT, Admin, R&D etc.

Again I assume other car makers need to match Toyota and VW to complete...

Most of this activity is in Japan and Germany where wages are higher, but perhaps not as high as California.

Regardless, this $3,000 overhead cost is a target Tesla can aim for, and possibly an insight into the Bear argument, the Bear argument is wrong, but I can see them looking at the numbers and drawing the wrong conclusions.

MC3OZ

Active Member

I think you are missing the point of that quote... because Toyota and VW have much higher volumes than everyone else, their overhead cost per vehicle should be much lower.

Yes, I know that is what he is try to say, and just taking the simple examples of in house design of common components and in house software development you would assume those costs are spread over all relevant vehicles so costs should be lower.

But VW and Toyota also have a much bigger operation to run..

I just think there must be some reason why they are stuck at the this $3,000 per vehicle limit, perhaps it is simply poor management, I'm just entertaining other options... not that they are easy to find.

TSLA Pilot

Active Member

Welcome back @BenPrice. I remember you leaving to go to rehab. Glad to see you're back; hopefully you're doing well.

While I'm certain there was a prior history, the drama reached it's peak back on March 20-22 with a dispute between a moderator and @KarenRei. Postings can be found on this thread as well as the Coronavirus thread (a bunch of relevant postings got moved there) if you want to go back and review the drama you missed out on. Karen left, some mods decided to take a break, a number of other posters left and/or stopped their financial contributions to the website, and it's never been the same since.

I sincerely hope that the remaining members and moderators as well as some new posters can build this back up to the fantastic place it was before. I continue to lurk and glean whatever knowledge I can as there are still a number of good posters here, but I've discovered that not only did @KarenRei and @Fact Checking provide excellent contributions, they also stimulated great discussions that brought out the best from others. There are probably about 20 members that I really made sure to read every one of their postings, even if I was skimming quickly to catch up and I really miss their contributions. I sure hope they decide to simply take a time-out of a few weeks as opposed to never coming back as that would really be a shame.

I've been on a couple of other forums where the most-valuable posters (MVPs) have decided to take their ball and go home and it really is a sad time and the forum never is as good after. I really fear that happening here, but hold on to the hope that after a brief lull, it will return to it's former glory.

Well here's an idea for the MODS: put your egos aside and remember that it's those that post that make a thread of value.

Seeing as how Karen and FC added massive value to the thread, an apology and an invitation to "please return" is in order (and overdue).

That's the obvious sentiment here.

To be blunt, the thread exists because of the content.

The best content left.

Ask it to come back . . . it's not rocket science.

Thx!

JRP3

Hyperactive Member

Karen has said she's not coming back. The offending mod seems to have disappeared. Let's move on.Well here's an idea for the MODS: put your egos aside and remember that it's those that post that make a thread of value.

Seeing as how Karen and FC added massive value to the thread, an apology and an invitation to "please return" is in order (and overdue).

Oh no... do you think he can fix them?

Absolute numbers don't tell the whole story:

Elon is now in the Top 50 biggest Twitter accounts.

49th, but he's moving fast.

ZeApelido

Active Member

Tesla is using blockchain technology to help with its Gigafactory Shanghai logistic - Electrek

See I knew Elon was going to give me 4.6 bitcoins if I just clicked on that link!

See I knew Elon was going to give me 4.6 bitcoins if I just clicked on that link!

TSLA Pilot

Active Member

Karen has said she's not coming back. The offending mod seems to have disappeared. Let's move on.

"Not coming back" doesn't equal "never."

It doesn't hurt to ask; we miss her content!

Thx.

Perhaps,The Ultium battery chemistry is NCU811, Nickel, Cobalt, Unobtainium.

"Takes a licking and keeps on ticking" ? No maybe ; "still going... "

Artful Dodger

"Neko no me"

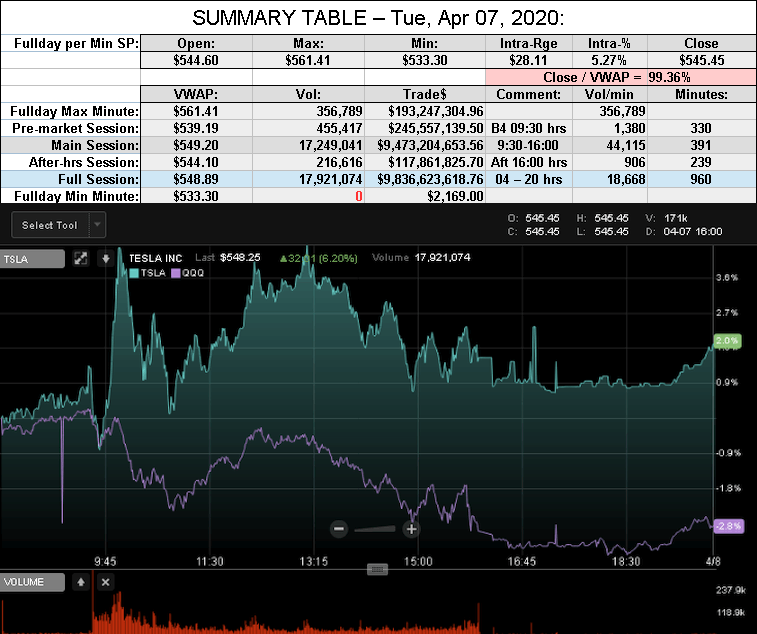

After-action Report: Tue, Apr 07, 2020: (Full-Day's Trading)

FINRA Short/Total Volume = 59.78% (61st Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 47.38% (61st Percentile rank FINRA Reporting)

Comment: "TSLA / beta = QQQ"

VWAP: $548.89

Volume: 17,921,074

Traded: $9,836,623,618.76 ($9.84 B)

Closing SP / VWAP: 99.36%

(TSLA closed BELOW today's Avg SP)

Volume: 17,921,074

Traded: $9,836,623,618.76 ($9.84 B)

Closing SP / VWAP: 99.36%

(TSLA closed BELOW today's Avg SP)

FINRA Short/Total Volume = 59.78% (61st Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 47.38% (61st Percentile rank FINRA Reporting)

Comment: "TSLA / beta = QQQ"

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K