Customers will come to realize that electricity comes with consistent pricing. We know how much it cost and expect it to become cheaper over time. Oil obviously has not been in consumers favor very much.Based on pure supply and demand, of course the price of oil will drop during a global lockdown. The facinating thing is that it has had no effect on Tesla. As the world gradually (or maybe not so gradually) makes the shift to electric power for transportation, oil will get to the point where they can barely give it away. I think this is the beginning of the end for them. It may take a while but it's happening. EV adoption is no longer based on the price of oil, that is for sure.

Dan

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ProfTournesol

Member

I have a problem with getting the right volume numbers premarket, but it looks like somebody like the SP down and keep it down before opening. We'll see in less than an hour when most trading desks will turn on their computers..... let's see.Rejected!

Apr. 20, 5:46 a.m. EDT

Pre-market 754.00 +0.11 (0.015%)

Artful Dodger

"Neko no me"

Oil isn't just 'lower'. This is approaching 1991 levels (Post Iraq War I)

In the face of the plunge in Crude Oil, Tech is fairing better than the broader Market:

- S&P 500 -1.5%

- NASDAQ-100 -1%

Customers will come to realize that electricity comes with consistent pricing. We know how much it cost and expect it to become cheaper over time. Oil obviously has not been in consumers favor very much.

Fluctuating gasoline price is not the case everywhere. In many European countries gasoline price is relatively consistent for consumers. This example is from my country, but most others apply fixed taxes in similar fashion.

Normal situation:

tax free price 0,72€/litre

fixed taxes 0,6504€/litre

VAT 24% (non-fixed tax) 0,329€/litre

total consumer price 1,7€/litre

Oil-crisis situation (getting there now):

tax free price 0,36€/litre

fixed taxes 0,6504€/litre

VAT 24% (non-fixed tax) 0,242€/litre

total consumer price 1,25€/litre

If oil was free situation:

tax free price 0€/litre

fixed taxes 0,6504€/litre

VAT 24% (non-fixed tax) 0,156€/litre

total consumer price 0,81€/litre

I don't know current US prices, but US gallon equals 3,785 litres. That means many Europeans would pay 3,07€ per gallon for their gasoline (0,81€ x 3,785) if oil market price went to zero. EVs are actually better deal than many realize

EDIT: of course 1,25€ is different from 1,7€, but point was that 50% discount in oil price doesn't make driving ICE vehicles 50% cheaper.

Last edited:

As an anecdote, the 2013 Model S 85 with 130K miles I just traded for an X, ended up costing $45K plus $3100 for electricity, $2400 for the extended warranty and $2500 for a new display and MCU. Total $53K. A fully loaded 2013 Camry would cost $26K (after trade in) plus $13K for gas (minimum), plus $6K for maintenance. (The maintenance is based on the Prius I had, but since there was only regular maintenance, there would be little difference. Now I know that some will say "I had a Camry and never took it in", but I went by the recommendations.). Total $45K, so I paid $8K extra for a much better experience. (Cost of tires left out of both calculations so there might be a few hundred dollars difference there.) Had the Model 3 or Y been available back then it would have cleaned the Camry's clock.Shouldn't the TCO of a Model 3/Y still be significantly cheaper than the TCO of an equivalent ICE vehicle? Last time I checked, the Model 3's TCO was similar to a lot of econoboxes, so I can't imagine the Model 3 now being as expensive to own as a BMW 3-series or Audi A4, even with lower oil prices.

Last edited:

ProfTournesol

Member

Ok, today will be a down day. Macro's are down, and it looks easy to get TSLA down and keep it there.I have a problem with getting the right volume numbers premarket, but it looks like somebody like the SP down and keep it down before opening. We'll see in less than an hour when most trading desks will turn on their computers..... let's see.

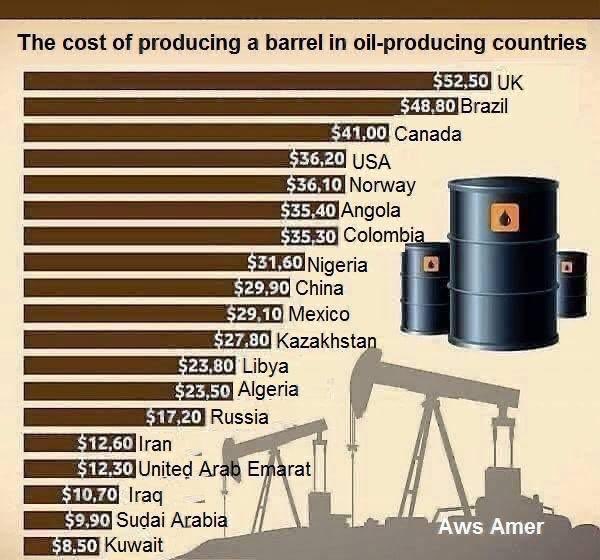

And because the cost of producing it is not at 1991 levels, it's a losing strategy. In particular, the Tar Sands needs around $80-$100 bbl to break even.Oil isn't just 'lower'. This is approaching 1991 levels (Post Iraq War I)

RobStark

Well-Known Member

I don't know current US prices, but US gallon equals 3,785 litres. That means many Europeans would pay 3,07€ per gallon for their gasoline (0,81€ x 3,785) if oil market price went to zero. EVs are actually better deal than many realize

EDIT: of course 1,25€ is different from 1,7€, but point was that 50% discount in oil price doesn't make driving ICE vehicles 50% cheaper.

For 4/20/20

The cheapest gasoline station in Los Angeles is selling regular unleaded for $2.29/gallon.

The average gas station in Los Angeles is $2.44/gallon.

The average USA price is $1.82/gallon.

ZachF

Active Member

There is a lot more to buying a Tesla than prices of Oil, electricity, etc. Whatever.

But I thought it might help to have a little perspective on oil since it will be big news in the coming weeks...

I saw that the price of one canadian oil producer reached -.01... now -.60

Oil Production...Who produces and how much over time...

Yashar Huseyn on Twitter

Oil Price drops... to lowest price ever...

When it comes to oil production costs, "Fiscal break-even" is more important for petro-states than raw production costs. Remember, many of these petro-states barely have a value-adding economy outside of oil production, and oil pays for most/all government revenues and imports.

j6Lpi429@3j

Closed

The oil price may affect tesla purchasing decisions in the US, but I don't see it as an issue here in the UK.

The ONLY issues I ever see mentioned by people to me are range and charging. Almost everyone is flabbergasted at the actual range of a tesla, so thats simple customer-education and easily solved.

Charging ease is the #1 issue here. Off street parking is not that common.

I honestly believe that if you cut the price of gasoline in the UK by 50% it would have zero impact on sales of Teslas this year. People here *want* less-polluting and climate-change-friendly cars, they just worry about the purchase cost and the charging locations.

With luck, the UK might spend some money on charging infrastructure as a post-covid stimulus. Our transport minister drives a tesla model 3.

The ONLY issues I ever see mentioned by people to me are range and charging. Almost everyone is flabbergasted at the actual range of a tesla, so thats simple customer-education and easily solved.

Charging ease is the #1 issue here. Off street parking is not that common.

I honestly believe that if you cut the price of gasoline in the UK by 50% it would have zero impact on sales of Teslas this year. People here *want* less-polluting and climate-change-friendly cars, they just worry about the purchase cost and the charging locations.

With luck, the UK might spend some money on charging infrastructure as a post-covid stimulus. Our transport minister drives a tesla model 3.

Words of HABIT

Active Member

Wrong. Refer back a few posts toAnd because the cost of producing it is not at 1991 levels, it's a losing strategy. In particular, the Tar Sands needs around $80-$100 bbl to break even.

False.And because the cost of producing it is not at 1991 levels, it's a losing strategy. In particular, the Tar Sands needs around $80-$100 bbl to break even.

Oil price war tests Canadian energy producers’ years-long drive to cut costs

For example, Suncor Energy Inc., Canada’s largest integrated oil company, last month reported a cash operating cost of $28.55 per barrel in its oilsands operations last quarter, down 17 per cent from five years ago. The company has net debt of 1.22 times its earnings before interest, taxes, depreciation and amortization, down from 1.49 times in 2015, according to data compiled by Bloomberg.

Canadian Natural Resources Ltd. had adjusted cash production costs of $21.05 a barrel in 2018, down 43 per cent from $37.18 in 2014. The company had net debt of two times its Ebitda at the end of last year, down from three times in 2015.

This article is Canadian, so converted from CAD to USD is respectively $30 and/to $40.

ProfTournesol

Member

A "cash" operating costs, suggest not all costs are included as it would be named "operating costs"Wrong. Refer back a few posts to

False.

Oil price war tests Canadian energy producers’ years-long drive to cut costs

For example, Suncor Energy Inc., Canada’s largest integrated oil company, last month reported a cash operating cost of $28.55 per barrel in its oilsands operations last quarter, down 17 per cent from five years ago. The company has net debt of 1.22 times its earnings before interest, taxes, depreciation and amortization, down from 1.49 times in 2015, according to data compiled by Bloomberg.

Canadian Natural Resources Ltd. had adjusted cash production costs of $21.05 a barrel in 2018, down 43 per cent from $37.18 in 2014. The company had net debt of two times its Ebitda at the end of last year, down from three times in 2015.

This article is Canadian, so converted from CAD to USD is respectively $30 and/to $40.

RobStark

Well-Known Member

New article from Sam Korus in this week's ARK newsletter:

Auto Loan Delinquencies Are Putting the Auto Industry at Risk

Thesis is that in tough times, more people are willing to default on car loans because of Uber, etc. That, combined with EV-related factors form a triple-whammy for car dealerships.

"Service accounts for a third of auto dealerships’ gross profit will be in harm’s way because the cost of maintaining electric vehicles is a fraction that of gas-powered vehicles, particularly those with over-the-air software updates. Financing and insurance accounts for another third of dealers’ gross profits, both of which should be disrupted in the shift from gas-powered to electric vehicles. Traditional auto manufacturers also have significant exposure to auto loans on their balance sheets and have been incentivizing sales with cheaper financing. If auto loan delinquencies and defaults continue to rise, dealerships could go bankrupt and auto makers could lose both their distribution networks and their ability to generate sales with cheap financing."

Streaming, Auto Loans, Airlines, Cancer Detection, Fintech & Chips

Auto Loan Delinquencies Are Putting the Auto Industry at Risk

Thesis is that in tough times, more people are willing to default on car loans because of Uber, etc. That, combined with EV-related factors form a triple-whammy for car dealerships.

"Service accounts for a third of auto dealerships’ gross profit will be in harm’s way because the cost of maintaining electric vehicles is a fraction that of gas-powered vehicles, particularly those with over-the-air software updates. Financing and insurance accounts for another third of dealers’ gross profits, both of which should be disrupted in the shift from gas-powered to electric vehicles. Traditional auto manufacturers also have significant exposure to auto loans on their balance sheets and have been incentivizing sales with cheaper financing. If auto loan delinquencies and defaults continue to rise, dealerships could go bankrupt and auto makers could lose both their distribution networks and their ability to generate sales with cheap financing."

Streaming, Auto Loans, Airlines, Cancer Detection, Fintech & Chips

Last edited:

Can't be too soon to suit me.If auto loan delinquencies and defaults continue to rise, dealerships could go bankrupt

JRP3

Hyperactive Member

Watch out for the "Model H", from the competition

New Jersey solar firm claims it has an electric 1,500-hp, 700-mile SUV

New Jersey solar firm claims it has an electric 1,500-hp, 700-mile SUV

JRP3

Hyperactive Member

New Munroe video, quick look at the front motor, different rotor design than the Model 3 front motor. Lighter aluminum rotor.

He mentioned the low reverse speed in Tesla's which made me think that would be an unfortunate limitation which I hope Tesla eliminates in the Cybertruck. Sometimes when off road you need to use full power in reverse to get out of bad situation.

He mentioned the low reverse speed in Tesla's which made me think that would be an unfortunate limitation which I hope Tesla eliminates in the Cybertruck. Sometimes when off road you need to use full power in reverse to get out of bad situation.

OT:

Starlink photobombs ISS.

SpaceWeather.com -- News and information about meteor showers, solar flares, auroras, and near-Earth asteroids

Starlink photobombs ISS.

SpaceWeather.com -- News and information about meteor showers, solar flares, auroras, and near-Earth asteroids

“The base model is planned to have a 150-kWh battery pack with an expected range of 500-plus miles from a single charge”Watch out for the "Model H", from the competition

New Jersey solar firm claims it has an electric 1,500-hp, 700-mile SUV

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K