Artful Dodger

"Neko no me"

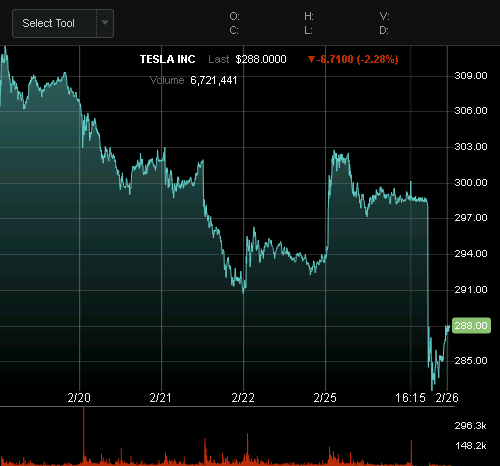

Pop Quiz: Indentify which one of these TSLA share price wiggles in the past week coincided with:

Bonus Question: Find the "Elon Tweet" on this 5-day chart of the QQQ:

(a NASDAQ-100 ETF)

Ooh, to have Elon's 'god-like' power over the entire Market must be an awesome thing. /S

The SEC should be ashamed. More importantly, they should be 'outed'. They are not protecting Investors, they are harming them, while padding the profits of short-sellers (who are NOT Investors).

This is pure abuse of authority by the SEC.

- Elon's Tweet

- CR's Model 3 downgrade

- China Tariffs deadline extention

- SEC court filing re contempt

Bonus Question: Find the "Elon Tweet" on this 5-day chart of the QQQ:

(a NASDAQ-100 ETF)

Ooh, to have Elon's 'god-like' power over the entire Market must be an awesome thing. /S

The SEC should be ashamed. More importantly, they should be 'outed'. They are not protecting Investors, they are harming them, while padding the profits of short-sellers (who are NOT Investors).

This is pure abuse of authority by the SEC.

Last edited: