To each his own my friend. I appreciate your input. Have a great weekend, stay safe and stay cool!Unless bought at an IPO, the term principal is somewhat meaningless with a stock. This is especially true for a company that reinvests much of its profits in growth rather than paying dividends. That annual reinvestment might be considered to some degree analogous to the compounded interest on a savings account, but not nearly as certain to regularly translate into investment growth. During a company's strong growth phase, such reinvestment can possibly result in exponential (compounded) growth in a share holder's "paper" profits.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Tslynk67

Well-Known Member

Hey, 132 deliveries in Norway today, nice!

Who knows!!

Didn't Intel buy Mobileye?

Who knows!!

Tslynk67

Well-Known Member

Huh? There is nothing magical about a hexagon. The idea behind a satellite dish is that it concentrates a weak signal. A hexagon is not going to do that. Under the hood, that's for light-weight strength.

Is that strictly true? In astronomy, an array of smaller dishes has a greater impact than a single larger one.

Tslynk67

Well-Known Member

Updated short interest:

15,139,641 shares, $15.002B at risk.

Ihor's estimate was 16.17M shares, 6.81% too high.

View attachment 556608

All of this below is assuming that you don't have margin enabled.

Buying options with cash never uses anything as collateral. You are buying the options, they're yours to sell, exercise, or let expire. (There are delta hedging effects, of course, but this doesn't affect the ownership/lending status of your stock, other than its value.)

Selling options does use collateral. If you sell a put option, 100x the strike price in cash (that is, what you would owe if the option were to be exercised) will be held as collateral. The only way that stock is held as collateral is if you sell a call option, in which case 100 shares of the underlying stock will be held as collateral (and presumably that's where lending may come in). Note that you can't sell a naked call (which has unlimited loss potential, just like actually shorting the stock) without margin, because of this - without margin you must have the actual stock to be held as collateral.

And then spreads are another thing.

In all cases, the long leg of the spread acts as protection against the short leg getting exercised.

In a debit spread (where the long leg's strike price is closer to the current price and is therefore more valuable), the maximum loss is what you paid for the spread, so no collateral is held, you own the spread (but you can't sell the long leg of the spread without having collateral for the short leg, replacing it with another long leg in the same order, or buying back the short leg in the same order!) If the short leg were to somehow get exercised, the long leg guarantees profits even, of 100x the difference between the strike prices.

In a credit spread, the maximum loss is if the short leg (more valuable) gets exercised, causing you to have to exercise the long leg - therefore it's 100x the difference between the strike prices - and that is the cash collateral that must be held. (Note that even in a call credit spread, where the short leg would normally mean unlimited loss potential, the long leg limits the loss, and therefore only cash needs to be held as collateral, not stock.)

What's really weird is that I sell covered calls and puts on a daily basis, but I have no idea what this posts means, I cannot parse it at all. It's gobbledegook to me.

Options are hard...

It's the weekend....Is that strictly true? In astronomy, an array of smaller dishes has a greater impact than a single larger one.

The array of dishes has an effective area (in terms of resolution/ beam width) equivalent to a single dish that covers the same area .Energy collection/ senstivity is limited to the amount of physical antenna area.

The Starlink antenna is really an array of antennas to provide electronic beam steering/ forming which is not possible with a fixed physical antenna. Small antennas have a larger beam width, so an array of those allows more ability for electronic steering.

Tslynk67

Well-Known Member

Right... I was just thinking more people buying shares of TSLA regardless of their initial motivation.

@aubreymcfato and @StealthP3D How is a buy and hold strategy "compounding"?

Compounding would be if shares earned dividends in the form of shares or something... It's not compounding if it's just the value of our shares steadily increasing arithmetically, is it?

Buying and holding call options might be using leverage, -still not compounding without repeatedly rolling winnings into increasing numbers of shares or contracts or something.

Wouldn't compounding require something like getting dividends in the form of shares that themselves will grow into more shares?

What am I missing?

Did someone respond (I'm catching up). It's compound because stock prices appreciate on a daily (trading) basis with an %age on that day, as opposed to a traditional savings account that gives an annual return.

I'm sure there's some smart-ass in the house that can give a proper explanation...

Tslynk67

Well-Known Member

I believe the numbers won't be out until the 2nd or after and that the anticipation of the stock rising on the 30th is based on speculation that funds that feel they need more tesla stock in their possession within the second quarter will be buying enough before the end of month/quarter which will drive the price up. If I understand correctly, there is a possibility the stock will then drop after the report if it's as expected or worse (or maybe even better than expected, but it gets reported otherwise). So if I understand correctly, if one was betting on this, one could buy a small portion of shares before the 30th in anticipation of a rise, and if it starts to drop afterward sell for a profit? But don't trust what I'm saying, I'm only 3000 pages into this thread so far, a total noob to money and investing, and still slightly overwhelmed and confused as to a prudent course of action for my tiny bit of "dry powder" in this current global atmosphere.

I think the increasing number of cases is already having an effect this afternoon as everything keeps dropping. I would speculate that there will be increasing numbers of cases again reported through the weekend, that are a result of the previous weeks protests and states opening too soon.

OK, this ain't the C19 thread, so apologies... However, #infections goes up because we have more testing, it's normal - the asymptomatic and mild cases that would have beed tested previously, now come onto the radar.

What's more important it the death-rate. Likely that the more venerable have already succumbed, so this will level-off or decrease.

Never forget that Wall Street doesn't give a flying feck about human beings, it's all about production, consumption and profits. Awful, but true.

Tslynk67

Well-Known Member

It's the weekend....

The array of dishes has an effective area (in terms of resolution/ beam width) equivalent to a single dish that covers the same area .Energy collection/ senstivity is limited to the amount of physical antenna area.

The Starlink antenna is really an array of antennas to provide electronic beam steering/ forming which is not possible with a fixed physical antenna. Small antennas have a larger beam width, so an array of those allows more ability for electronic steering.

And?

RobStark

Well-Known Member

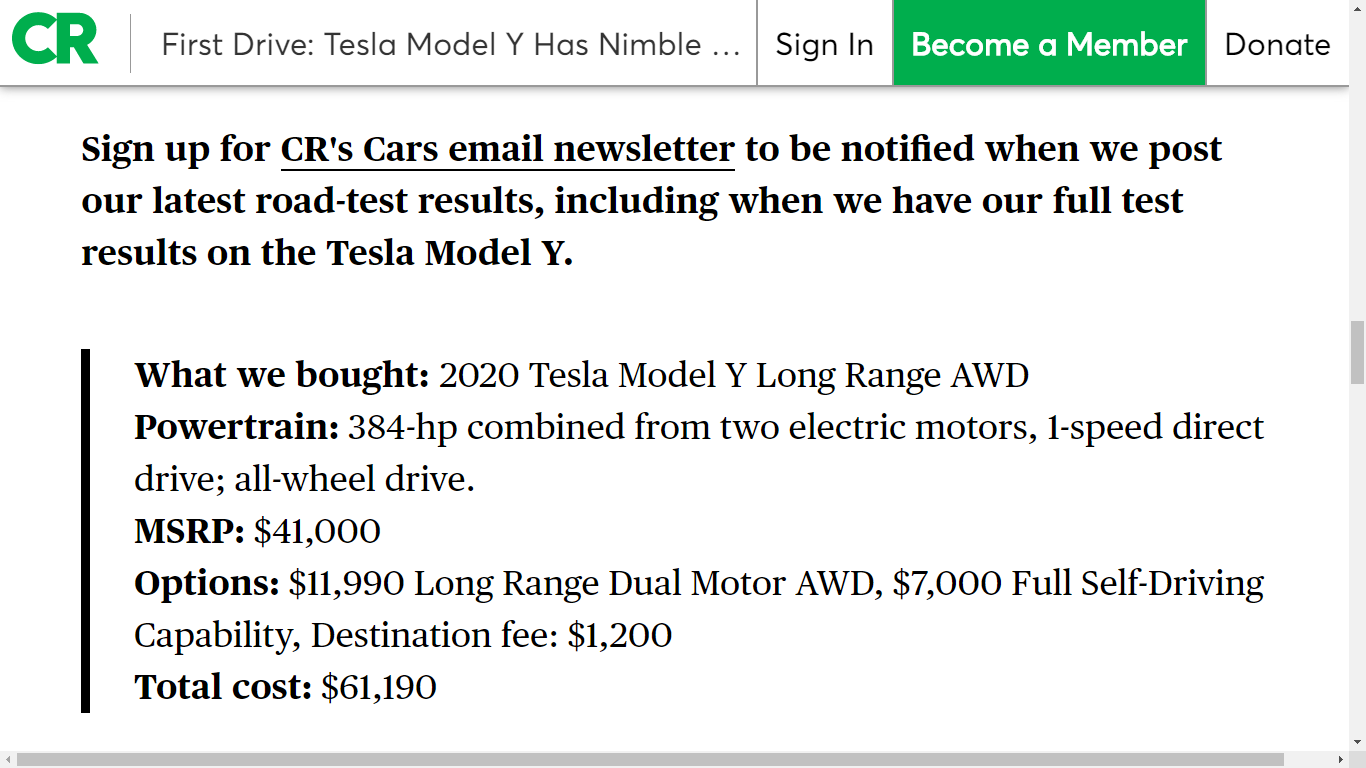

Consumer Reports has taken delivery of their very own Model Y. They will being doing a full evaluation and report. Plus given semi regular updates form various CR writers and their impressions. They say they encourage EV shoppers to buy the biggest battery with the longest range as a hedge against cold-climate effects and unforeseen needs.

Go back to bed...And?

'Unintuitive controls'....is it a 6 year old or is it a 90 year old doing the test drive?Consumer Reports has taken delivery of their very own Model Y. They will being doing a full evaluation and report. Plus given semi regular updates form various CR writers and their impressions. They say they encourage EV shoppers to buy the biggest battery with the longest range as a hedge against cold-climate effects and unforeseen needs.

View attachment 556793

View attachment 556794

RobStark

Well-Known Member

'Unintuitive controls'....is it a 6 year old or is it a 90 year old doing the test drive?

Mostly dudes in their 50's

Is that strictly true? In astronomy, an array of smaller dishes has a greater impact than a single larger one.

Indeed.

j6Lpi429@3j

Closed

Did some more reading on zoox. Not only is the CTO the son of the co-founder (an absolute co-incidence im sure), but the glassdoor reviews suggest a company whose own engineers know is in trouble. Plus its founded by a designer without any technical background, the opposite of Elon and Tesla.

I dont know what Amazon *think* they are getting for their billion dollars, but I think in practice they may as well have just burned the money. Amazons moves with zoox and rivian seem like the petty squabbling of a billionaire too proud to just buy tesla semis. One day the shareholders of amazon will haul bezos over the coals about this...

I dont know what Amazon *think* they are getting for their billion dollars, but I think in practice they may as well have just burned the money. Amazons moves with zoox and rivian seem like the petty squabbling of a billionaire too proud to just buy tesla semis. One day the shareholders of amazon will haul bezos over the coals about this...

Jack6591

Active Member

TroyTeslike (@TroyTeslike) on Twitter

Great numbers, my apologies Troy, didn’t mean to steal your thunder.

Great numbers, my apologies Troy, didn’t mean to steal your thunder.

StealthP3D

Well-Known Member

I'm sure there's some smart-ass in the house that can give a proper explanation...

Did someone call?

Come on people, let's not make this complicated. Just look at the stock chart of any company that has been growing for many years. As the company grows, the same percentage growth compounds. The share price tends to follow the growth of the business. We have seen $100 rises in TSLA in a single day. People who bought at the IPO price are watching the shares appreciate in ONE DAY a multiple of what they paid for those same shares at the IPO.

That is compound growth!

Seems to be at near China speed.Tesla Giga Berlin's building structure is about to begin construction

Pillars and Beams arriving at Giga Berlin. We're about to see some buildings start to go up

StarFoxisDown!

Well-Known Member

TroyTeslike (@TroyTeslike) on Twitter

Great numbers, my apologies Troy, didn’t mean to steal your thunder.

I did want to say, while I know I'm very critical and vocal of Troy's methods for his estimates, his work in the early days was very crucial and important for investors. I would completely stop being critical if Troy waited until say the beginning of the 3rd month to put out his initial estimate and then revise from there throughout the rest of the month.

Mike Smith

Active Member

Kathie Wood says V-shape recovery is still intact. She's been completely right so far.

Tesla talk at 22:50

Tesla talk at 22:50

Jack6591

Active Member

Indeed.

Curt,

I am a possibilian, what we don’t know, is enormous compared to what we do know.

More than anything, I hope to live long enough to understand all that the James Webb Space Telescope reveals.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K