If your check engine light is on, just reset your gas cap, works 95% of the time..If Tesla ever allows 3rd party apps, the first one I am going to write will display a check engine icon and a service is required message.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

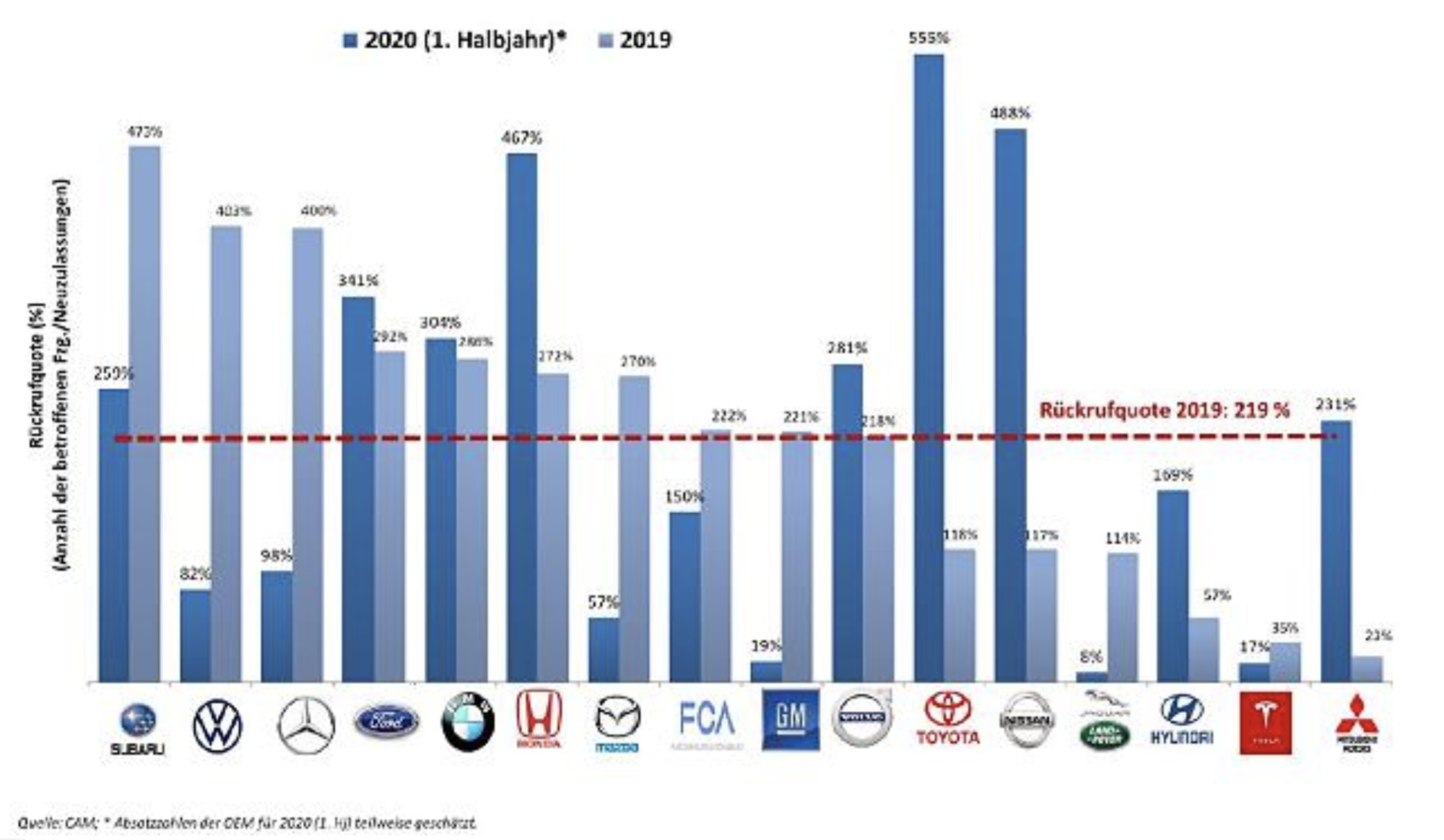

Tesla has an amazing low recall rate in the USA in 1H19 and 1H20

The rate is calculated = # vehicles with defects/ all new registrations

Toyota flop, Tesla top? Neue Rückruf-Statistik zeigt Rekordwerte

The rate is calculated = # vehicles with defects/ all new registrations

Toyota flop, Tesla top? Neue Rückruf-Statistik zeigt Rekordwerte

To utter the term overvalued in reference to Tesla is idiotic. In a clear, loud, and deliberate voice Tesla is undervalued.

The revolution is afoot. It is time to speak with the voice of a lion.

I think you meant "It is time to speak with the voice of a ELON"

I just used to flick the cover of the odometer till the light went away...same was true of the low gas light.If your check engine light is on, just reset your gas cap, works 95% of the time..

Tes La Ferrari

Active Member

I just used to flick the cover of the odometer till the light went away...same was true of the low gas light.

Software update: ICE style.

I cant believe this topic lasted most of the dayWonderful. The odd vehicle here and there within the last decade. You’re right, and you missed the point. Congratulations.

this thread devours new information and processes it so quickly we get ornery ... kind of like the lion after a big dinner leave me alone .. let me sleep

also the Lion avatar is really frightening looking

I’m surprised by Jag/Land Rover. Not the reputation I’m I’m used to hearing.Tesla has an amazing low recall rate in the USA in 1H19 and 1H20

The rate is calculated = # vehicles with defects/ all new registrations

View attachment 570020

Toyota flop, Tesla top? Neue Rückruf-Statistik zeigt Rekordwerte

The value of existing shares doesn't get hurt by a company issuing new stock. You own a smaller part of a more valuable company. Paging @Curt Renz, who has explained this (many times) before.

Indeed, any expressed concern about share dilution following a possible Tesla subsequent offering is a red herring. Any money raised would belong to all shareholders. Admittedly each current shareholder would own a smaller percentage slice of the pie, but the pie would be bigger. If the new money were just placed into a fixed income certificate, it would essentially be a wash. But if the money is soundly invested in company growth, the pie could swell to become hugely larger with ever widening slices.

UnknownSoldier

Unknown Member

On a day like this, it's nice to have a video such as what I link.

Today we declare war on TSLA bears!

JUST IN: WAR DECLARED ON s!

Edit: I know some of you guys probably wouldn't go for movies like that, but Starship Troopers is an amazing film. It's both an adaptation of the famous science fiction war novel by Robert A. Heinlein and a brutal critique and repudiation of the 'ideal militaristic society' (read: fascism) that Heinlein envisioned. It was and is a very controversial film among fans of Heinlein because of this.

Today we declare war on TSLA bears!

JUST IN: WAR DECLARED ON s!

Edit: I know some of you guys probably wouldn't go for movies like that, but Starship Troopers is an amazing film. It's both an adaptation of the famous science fiction war novel by Robert A. Heinlein and a brutal critique and repudiation of the 'ideal militaristic society' (read: fascism) that Heinlein envisioned. It was and is a very controversial film among fans of Heinlein because of this.

larmor

Active Member

Besides this list, there is another list of venture funding on self driving tech-- both chips, hardware, and software, and Tesla is disrupting this even more with directly observed-video recorded miles and sensors.

I am frustrated, aggravated, and down right pissed off about the valuation argument...

Ford plans $11 billion investment, 40 electrified vehicles by 2022

General Motors to spend $20 billion through 2025 on new electric, autonomous vehicles

VW Challenges Rivals With $66 Billion for Electric Car Era

Toyota unveils images of upcoming all-electric cars, accelerates EV plans by 5 years - Electrek

https://www.industryweek.com/techno...t-9-billion-in-china-in-race-for-ev-dominance

FCA to invest billions to electrify 30 models | Car News | Auto123

Volvo Follows Tesla's Lead on EVs by Building Its Own Batteries

Porsche boosts its investment in electric cars

Hyundai Motor tees up flying cars, electric vehicles with $52 billion investment - Roadshow

Daimler announces $11 billion investment in electric vehicles - Electrek

Do not call me Fanboy. If you must, just call me Captain Obvious. It is blatantly obvious to the most casual observer that Tesla has disrupted the entirety of the automotive and petroleum industries.

To utter the term overvalued in reference to Tesla is idiotic. In a clear, loud, and deliberate voice Tesla is undervalued.

The revolution is afoot. It is time to speak with the voice of a lion.

Geez who stepped on your cat today?Wonderful. The odd vehicle here and there within the last decade. You’re right, and you missed the point. Congratulations.

Knightshade

Well-Known Member

Do not call me Fanboy. If you must, just call me Captain Obvious. It is blatantly obvious to the most casual observer that Tesla has disrupted the entirety of the automotive and petroleum industries.

To the casual observer, an electric car is just a regular car with a battery.

Obviously legacy companies that sell 10 times as many cars as Tesla and have been making cars for generations could just put batteries in their cars anytime they want and compete with them, so the fact they don't means not many people want such cars yet and when they do they'll just make and sell them.

That's what the casual observer thinks.

Mind you- the casual observer is an idiot, but if I had a dollar for every time I've heard the above line of thinking from them...well, I'd own a lot more Tesla stock I suppose

StealthP3D

Well-Known Member

Below is what Craig wrote this morning regarding the macro-market:

In summary, the reality of a potential bumpy road to recovery caught up with equity market momentum last week. Uncertainty over the path of the COVID-19 outbreak, a looming fiscal cliff, and rising geopolitical risk with China prompted some of the recent profit taking pressure. However, we do not expect momentum to meaningfully stall based on a backdrop of unprecedented global stimulus and continued progress toward a virus vaccine. The technical setup for the broader market remains constructive and currently indicates near-term weakness should be bought. We reiterate our year-end price objective on the SPX of 3,600.

That aligns pretty well exactly with what I wrote before the weekend ended.

Craig just added some financial industry gobbley-gook to make it sound more "official".

He must read this thread?

This would be more appropriate coming from Krugerrand but whatever.I am frustrated, aggravated, and down right pissed off about the valuation argument...

Do not call me Fanboy. If you must, just call me Captain Obvious. It is blatantly obvious to the most casual observer that Tesla has disrupted the entirety of the automotive and petroleum industries.

To utter the term overvalued in reference to Tesla is idiotic. In a clear, loud, and deliberate voice Tesla is undervalued.

The revolution is afoot. It is time to speak with the voice of a lion.

Last edited:

Thekiwi

Active Member

Why all the fuss about a Model S refresh? There's still no real indication that one is coming, right?

This is probably the last important refresh for S/X.

At some point model S & X become little more than a rounding error. I think that point is coming fast and any future refreshes/facelifts after this years possible one are just for a niche market and pretty much meaningless for shareholders as profits from other products dwarf S/X/R by an order of magnitude. Hopefully future S/X/R profit will at least cover cost of Elon’s CEO rewards, while the gigantic profits from 3/Y/2/Semi/Energy will undoubtedly provide all the margin needed to achieve the dreams of even the TSLA Uber-bulls.

TheTalkingMule

Distributed Energy Enthusiast

What argument? It's at $274B. That's entirely appropriate and maybe even a bit on the high side.I am frustrated, aggravated, and down right pissed off about the valuation argument...

There's always going to be noise, but that's all it is at this point. 2016 is long behind us now, Elon's on cruise control.

StealthP3D

Well-Known Member

Indeed, any expressed concern about share dilution following a possible Tesla subsequent offering is a red herring. Any money raised would belong to all shareholders. Admittedly each current shareholder would own a smaller percentage slice of the pie, but the pie would be bigger. If the new money were just placed into a fixed income certificate, it would essentially be a wash. But if the money is soundly invested in company growth, the pie could swell to become hugely larger with ever widening slices.

To be completely accurate here, any money raised would need to make the company become more productive than it would have been without the extra capital (and that increase in productivity of the extra money would have to be equally large to what the rate of productivity growth without the capital raise would have been in order for the additional investment to break even from the standpoint of a shareholder).

The money should only be raised if it can supercharge the growth above and beyond what it would have been. You can argue against this only by saying the shareholders should "take one for the

I'm all for rapid growth but from where I sit it looks like rapid growth will be self-funding and it's not a good idea to try to accelerate it by a few months because this introduces all kinds of additional risk and complications. But, as always, I will defer to our proven management team who has far better visibility into hundreds of considerations surrounding such a decision and who have proven their skill and insight over the last several years beyond any reasonable doubt.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K