Fatalists do not have TSLA stock. They short it and then their bankruptcies justify their fatalism. Self fulfilling prophecies.This is so unreal the fatalist in me thinks something negative has to happen.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StarFoxisDown!

Well-Known Member

Operational leverage makes profits scale faster than production once the break-even rate is reached.

IE: if you must make 100K cars to break even, and 110K production gives you $100M in profit, then increasing production by just 10% to 121K gives you 100% more profits.

It's because once all the fixed costs are paid, the Gross Margin per car filters down directly to Gross Profit.

We passed that happy inflection point in 2020Q2, even with the Fremont factory idle for half the quarter. Q3 will produce monstrous profit.

Cheers!

Literally been waiting 2-3 years for this moment(Q3 earnings) because of exactly this. Anyone willing to dive into the details could see what would happen the moment production takes another leg higher but through a rough Model 3 ramp, battery bottlenecks, and a black swan event, it's stayed hidden away from the general investing community. It's why despite the share price going crazy over the past 3 weeks, I'm still bullish that Q3 will support a 500-550 share price or potentially get us up to 600/share.

The silver lining is that all those negatives events allowed everyone here to be a lot wealthier by suppressing the share price for so long

Which is the rational choice, unless you know what the market will do. (or at least have a real reason why you think it will go one way) Dollar cost averaging.

If that continues for more than 12 hours please call your doctor. Side effects of holdoring TSLA can include anxiety, mockery from friends, extreme wealth.

Nah. I wouldn't go back and buy at $344. I'd go back to June of 18 when I bought calls for $50 and sold for $3k.Worrying about that is pointless though. That distracts from the future.

I'd go back and just buy a lotto ticket for one of those 500+ million jackpots then buy each of you guys a roadster 2. (Pandering for internet points)

Rob M is so polite.... you have to love it ... I would have dismissed this clown after the third time he called BEVs electronic vehicles... talking about competition this guy just does not get it ... it is called the innovators dilemma... the game is won ... you are dismissed....

maybe he is thinking there is a new market where the vehicle is powered by electronics...maybe a giant capacitor?

UnknownSoldier

Unknown Member

Fatalists do not have TSLA stock. They short it and then their bankruptcies justify their fatalism. Self fulfilling prophecies.

I mean you either believe humanity can survive the crisis of global warming or it can't. If you don't fundamentally believe that, there's no reason to think Tesla will accomplish anything.

Green Pete

Active Member

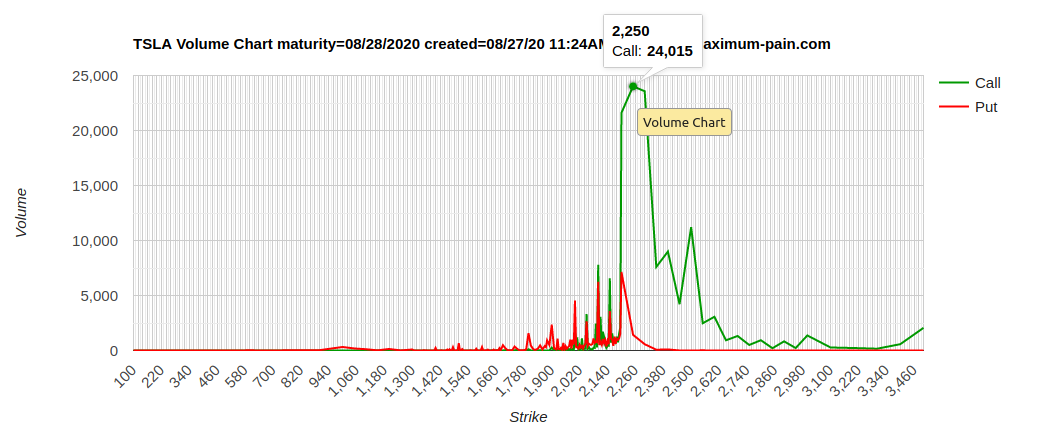

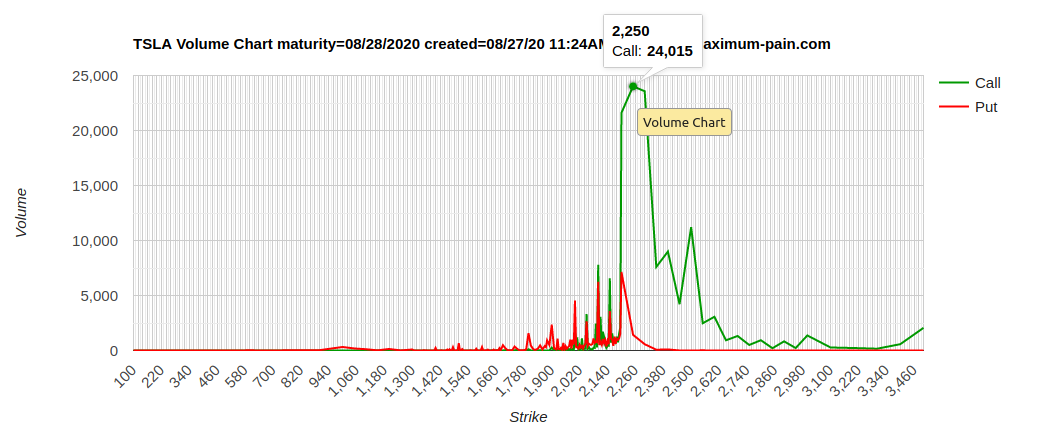

that looks comically desperate. is this crazily abnormal?Then: ( Today at 8:29 AM )

And now: (Today at 11:17 AM)

View attachment 581402

58,094 now on 2250 calls.

I actually can’t. I throw everything I had, two lines of credit, and the kitchen sink into TSLA for the past 6 years.I bought a decent chunk of $TSLA at $344 last year

Yay! I’m so happy

Wah! Why didn’t I buy moooore

How many of y’all can relate?

Although, I wish I bought LEAPS. It’s always never enough haha

mejojo

Active Member

Fatalists do not have TSLA stock. They short it and then their bankruptcies justify their fatalism. Self fulfilling prophecies.

Definition of fatalism

: a doctrine that events are fixed in advance so that human beings are powerless to change them

sdtslafan

Member

I bought a decent chunk of $TSLA at $344 last year

Yay! I’m so happy

Wah! Why didn’t I buy moooore

How many of y’all can relate?

I think anyone who has ever sold TSLA shares or not bought as much as they could feels your pain. I don't think anyone could have anticipated the magnitude of this move, although some have come close. I alternate between just being super thankful for the shares I have and wishing I had bought more. Why did I pay off the mortgage on that rental property when I could have bough more shares? No one can see into the future but the fact that we have shares in this company (despite a lower number than we would have liked) is really something to celebrate!

I'm beginning to feel that Tesla will not succumb to traditional valuation metrics anytime in the near term. This company has single-handedly forged a path toward a sustainable future. What is the value of that? Could be a trillion or more. Traditional metrics for evaluating a company's worth are only meaningful if they matter to the people buying and selling TSLA shares, which does not appear to be the case.

Lets say that there are 2 million people in the world who believe TSLA is worth $10,000 per share based purely on its IP, growth trajectory, and potential to change the world. If each is willing to purchase and hold onto 100 shares, than that sets the price of TSLA stock because all 200M shares are accounted for. If someone wants to buy a share, they will have to pay $10,000 because that's the only way one of these 2 million people will sell. It doesn't matter what the other 7 billion people on Earth value the stock at. I believe this is the type of dynamic that is becoming apparent. In a way, its like Bitcoin because there is a very limited supply. However, demand for TSLA shares is much stronger that demand for Bitcoin because Tesla is providing a great service to the world.

What do you guys think about the future of how companies will be valued? Since we have had low interest rates for so long, is the typical PE ratio of 25-30 too low? Are we moving toward an average PE ratio more like 35-50? Does PE ratio even matter anymore?

I swear if i hear 'fiduciary responsibility' one more time......

Rob M is so polite.... you have to love it ... I would have dismissed this clown after the third time he called BEVs electronic vehicles... talking about competition this guy just does not get it ... it is called the innovators dilemma... the game is won ... you are dismissed....

maybe he is thinking there is a new market where the vehicle is powered by electronics...maybe a giant capacitor?

Rob M is so polite.... you have to love it ... I would have dismissed this clown after the third time he called BEVs electronic vehicles... talking about competition this guy just does not get it ... it is called the innovators dilemma... the game is won ... you are dismissed....

maybe he is thinking there is a new market where the vehicle is powered by electronics...maybe a giant capacitor?

In the beginning of the debate, Trainer introduces why he thinks TSLA is a risky investment as compared to other autos. By the end it is clear all other auto stocks are risky. It's a bit painful to listen to Trainer use fancy words to describe how outdated his company's method of investing is, so i recommend you fast forward when ever he speaks and resume to listen to Maurer who is definitely worth your time.

Then: ( Today at 8:29 AM )

And now: (Today at 11:17 AM)

View attachment 581402

58,094 now on 2250 calls.

is the delta hedging on these calls driving the buying?

I think you're on to something here, @vikings123 . For the past few weeks, IV has remained relatively flat, until recently (and most importantly, it spiked up today). Today, IV increased from 82.9 to 94.2, which is the most significant rise we've seen since before the Q2 earnings report. Does anybody know if MM's are able to control IV? There have been a number of us asking why IV hasn't gone up that much recently considering the stock has been rising so much. Along with that, it seems extra fishy (to me at least) that the IV rises significantly right before a very significant drop in Tesla stock price which is correlated with a tons of calls being sold.

If MM's are able to control IV, I wouldn't be surprised if they bought calls while maintaining IV relatively flat, and then allowing it to increase right before they sell for massive profits. If that is the case, who are the sellers of the calls the MM's bought? And would they be the kinds of investors that would sell their underlying stock once their covered call is no longer in play?

View attachment 581395

Yes I believe this is another big advantage the MMs have. My understanding is that IV is a function of demand and supply just like the underlying stock. So I’m surprised the IV stayed at consistent levels during the run these past two weeks, maybe because the stock was moving only in one direction. I honestly don’t know enough to say if IV was being controlled by MMs.

If the naked covering theory is true I think MMs or hedge funds were basically doing controlled call buying stealing shares from unsuspecting investors. One way to do this is by keeping IV low and accumulating enough. I don’t know what the lunch hour drop was about but it definitely spiked IV to high levels-TD says it is at 99% now from around 84% yesterday.

All this is speculation on my part but it is clear there are games being played. I would be very careful going into tomorrow. I started converting some of my options into shares, not going to get greedy.

smorgasbord

Active Member

1) business progress

What part of Tesla's business progress do you refuse to believe will last for years?

What part of beating your wife do you enjoy the most?

Jeez, I didn't say what you say I said. I think you missed the "alignment" aspect of my statement:

"the current positive alignment of business progress, analyst appreciation, supportive macro-environment, FOMO, S&P 500 inclusion, etc. "

Which is that all of things won't always all be true. Alignment.

In fact, almost all of your response either repeats what I have already said, or ignores what I have already said. But, to accommodate your point by point:

1) Business Progress: As I clearly said, this won't be a smooth progression upwards. It not only hasn't been in the past (2019Q1 or covid this year anyone?), with Tesla now being so large and doing more simultaneously than ever, it almost certainly won't be completely smooth in the future. Since I need to be even more clear, I believe in Tesla and its future dominance in autos, cars, energy generation, storage, and TaaS. I'm not talking a 20 year hold thesis, because, well, I'm not under 35 years old. Far from it. If I were, I'd buy as much as I could on any dips and continue to hold as I have for the past decade.

2) Analyst appreciation: I guess you missed where I already said that analysts today have been chasing TSLA's rise. That won't always be the case and many will find an excuse to turn negative.

3) Macro Environment. As I clearly stated, Covid's impact on the economy could easily get worse. And since China is a big part of Tesla's business, any trade issues with China could potentially hurt Tesla. And there are easily a half dozen other scenarios one could imagine happening, like some countries enacting high tariffs to prevent a US company from dominating. Do you know the situation in India, and how, for instance, that has stopped Apple for years? Are you confident that remain unique for India and/or not applicable to Tesla?

4) FOMO: This is tied to the stars being aligned. Yes, that alignment word again. Tesla will have hiccups on the business front, analysts will change their views, macro-environment situations will shift. As a result, FOMO will go away.

5) S&P Inclusion bump ends a few days after the inclusion date of record. There are many articles looking at how the stock prices of companies being added perform, and the bump is almost always temporary. BTW, 26M shares will not be "permanently removed from the float." They're simply tied to Index Funds and so become more at the mercy of macro-events, as many investors, for instance, sell off their index funds when they get scared. That may even end up being less stable than current long-term TSLA HODLers.

My glasses are not rose-colored, IMO, but crystal clear. I refuse to wear shite-colored glasses just because TSLA has suffered big drops in the past.

It is a mistake of logic (linear thinking, reasoning by analogy) to believe because TSLA behaved a certain way in the past that it will always behave that way in the future. Things change. Tesla has changed. They didn't have factories and design teams ramping up on three continents before, or "mind-blowing" new battery technology, or a "quantum leap" rewrite of FSD software, or Autobidder software creating exploding demand for utility-scale batteries and virtual power plants. Now they do.

As long as you refuse to believe there's any possibility of a downside for TSLA, you are fooling yourself. I agree that Tesla's business has never looked better than it does today, but I don't believe things in the future will ALWAYS LOOK at least as good as they do today. And, there's certainly the risk of a macro-event taking down the share price of most companies, Tesla included (especially after S&P inclusion) in the future. If you're a 20- or 30- something, I agree you just ride that out. If you're much older, you need contingency plans.

I guess the most astonishing thing for me in this thread is how short many people's memories are, or that "this time it's different." The best time to prepare for a rainy day is when the sun is shining.

lafrisbee

Active Member

yeah, I understood how to game the game but got tripped up by not knowing that the funds in my account were not really in my account. The only reason the "Faith rule" funds are not marked as such in an account is just so the company you are using for trading can make another nickel by keeping the funds for an extra day. It would be NOTHING to the trading companies to list the funds in an "In Transtion" column. So I got caught. Their bots will just play with my money for 48 hours.Those hedge fund supercomputers doing work. Sudden drop in macros followed by swift recovery for no reason at all. High frequency trading will one day be remembered as the most destabilizing thing that ever happened to the stock markets.

I just hope the MM's can control some part of this rise till I get back in tomorrow morning.

lafrisbee

Active Member

OT

I hope Tesla makes this employee a special place in the company. (If he doesn't have to join Witness protection). Something along the lines of Education him to handle the best job he can within the company. And some shares.

Tesla Employee Assists FBI to Disrupt Russian-Born Criminal Suspect

I hope Tesla makes this employee a special place in the company. (If he doesn't have to join Witness protection). Something along the lines of Education him to handle the best job he can within the company. And some shares.

Tesla Employee Assists FBI to Disrupt Russian-Born Criminal Suspect

Or someone should start a gofundme for him...i am sure we can get a lot of supporters on here and on twitter.OT

I hope Tesla makes this employee a special place in the company. (If he doesn't have to join Witness protection). Something along the lines of Education him to handle the best job he can within the company. And some shares.

Tesla Employee Assists FBI to Disrupt Russian-Born Criminal Suspect

Artful Dodger

"Neko no me"

TSLA dropped at 4x macros. That's not 'following'.Just following the market. AAPL and AMZN have also dropped.

Cheers!

I swear if i hear 'fiduciary responsibility' one more time......

FUD douchery?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K