EVNow

Well-Known Member

I added a 538 link, that's quite illuminating. Incidentally, the most progressive candidate is probably the oldest in '20 primary.Party aside, Older folks tend to be more "conservative".....

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I added a 538 link, that's quite illuminating. Incidentally, the most progressive candidate is probably the oldest in '20 primary.Party aside, Older folks tend to be more "conservative".....

Since the new factory is not operational, it has no impact on profitability.

So if Tesla's guidance forecasts a loss in Q1, then something else is going on.

Furthermore, 200-300M in profit each quarter is insufficient to fund the sheer quantity of projects they've announced.

The big question on the conference call will be "how do you plan to get to 2-3B net income in 2019?"

A Q1 loss forecast makes that pretty brutal.

Spoken like a true “young-un”Party aside, Older folks tend to be more "conservative".....

I see you've been reading your Tom Paine (The Age of Reason, 1794):You rang?

Not that the situation in the UK is commiserate as Venezuela,

That's like saying Norway ~ Venezuela.Corbyn ~ Maduro

Other than that not much similarities.

GREEN !GREEN !

To be honest, I don't buy this logic. The market has its mechanisms. Wall street is not a monolithic piece of steel. Take the example of Amazon, Jeff didn't care what WS thinks. Sure, people tried to attack and had their moments. But who prevailed? Jeff and the people who bought his vision. Big time.I liked what Jack Rickard said about Tesla and profits the other day: to paraphrase: "You have to understand: I'm entirely against profits at all. You shouldn't be showing a profit at all. When you show a profit you have to write a check to the United States government and the state of California. You're giving my invested money away to government people! If you make any money, put it back in the company to make growth more next year. And if you don't do that, it's corporate malfeasance. Growth companies are supposed to grow, not make money!"

But, it needs to be done to keep Wall Street content, because unfortunately Tesla is not insulated from what Wall Street thinks of it.

Presumably China should have similar demand for model 3 as Europe, if not more. The latest Glovis is going west to China. Hopefully it was empty before loading up.Depends on how full they're filling the ships. At 1 ship per week filled only to 2k cars (like the Glovis Captain), that's 17,4k cars to Europe by the end of March. But if they've started filling closer to the max ~6k per ship, that's 52k by the end of March. Really doubt that, though, that would be almost all of their production. It had earlier been stated that Tesla had been planning on sending 3k per week to Europe, which would be 26,1k by the end of March.

Where did the 18k deliveries for Q1 figure come from, exactly? How would we even know that? Q1 isn't even a third over yet.

BTW: Glovis Cosmos is halfway through the Panama Canal right now. These things are almost starting to seem routine

Presumably China should have similar demand for model 3 as Europe, if not more. The latest Glovis is going west to China. Hopefully it was empty before loading up.

China is Tesla’s 2nd largest market. The Model 3 will simply slay it in China.

Fantastic, thank you very much!

Here's a tabulated version, sorted by revenue value (from bearish to bullish), and left off the irrelevant .1 million digits:

[TD2] $6,805m [/TD2] [TD2] $6,820m [/TD2] [TD2] $6,848m [/TD2] [TD2] $6,851m [/TD2] [TD2] $6,895m [/TD2] [TD2] $6,899m [/TD2] [TD2] $6,926m [/TD2] [TD2] $6,976m [/TD2] [TD2] $6,985m [/TD2] [TD2] $7,020m [/TD2] [TD2] $7,032m [/TD2] [TD2] $7,067m [/TD2] [TD2] $7,082m [/TD2] [TD2] $7,084m [/TD2] [TD2] $7,089m [/TD2] [TD2] $7,139m [/TD2] [TD2] $7,188m [/TD2] [TD2] $7,192m [/TD2] [TD2] $7,226m [/TD2] [TD2] $7,440m [/TD2] [TD2] $7,523m [/TD2] [TD2] $7,715m [/TD2]

Evercore UBS JMP Goldman Sachs Undisclosed Wolfe Research BofAML Deutsche Roth JPMorgan Undisclosed Undisclosed Thomson First Call Consensus Elazar Advisors Macquiarie RBC Wedbush Undisclosed Piper Oppenheimer Needham Canaccord

Yes, and it appears to be pretty clear to me that the shorts are trying to manipulate Thomson First Call consensus as well for Q4'18 TSLA results:

Everyone who owns $TSLA stock, options or bonds and agrees that this is market manipulation which is harming investors, please file a SEC Investor Complaint:

- There's evidence of significant gaming of the First Call consensus by bearish analysts, the top 2 revenue estimates are actually ALL from bearish analysts:

- "Canaccord" initiated TSLA coverage half a year ago with a bearish outlook. They gave a number of mostly bearish interviews and stopped talking about Tesla after the positive Q3 results altogether ...

- "Needham" of "Tesla's True Value is 'Closer to $200'" infame has the second highest revenue estimate ... Total silence from Needham after the positive Q3 earnings report.

- "Oppenheimer" is the first genuine bullish analyst.

- Without the fake revenue entries the true median consensus would be below $7b - at around $6.8b-$6.9b...

A sample complaint could be something like:

I believe the SEC is obligated to at minimum read every complaint made by an investor. Even if they don't act on it, it creates a track record that later SEC administrations can use to form new policy, restrictions on short sellers, more effective regulation of Wall Street analysts, etc.

Suspected illegal market manipulation: two of the most bearish $TSLA analysts (Canaccord and Needham) are apparently gaming the 'Thomson First Call consensus' analyst estimates to manufacture an artificial 'miss' on $TSLA by entering artificially high Q4'2018 revenue estimates 6-8% higher than the consensus, which estimates are not consistent with their publicly bearish views of the company. Their apparent intent is to profit from any adverse price reaction, should Tesla "miss" the artificially heightened revenue consensus.

Similar suspected illegal price and market manipulation distortion of the "FactSet" consensus was performed with the January 2 Tesla (TSLA) "Delivery Report", which created a price drop from a $332 closing price on December 31 to below $300 on January 2 - a more than 10% intraday drop. Bearish analysts entered unrealistically high production estimates for Tesla, which created an artificial "consensus miss" that adversely affected investor sentiment and caused a big drop in the $TSLA price - from which short sellers profited.

As a $TSLA investor I was significantly harmed by their action.

It's a classic 'short and distort' tactic that appears to be illegal according to the Securities Act of 1933, also known as the "Truth In Securities Act".

So it's helpful to file complaints even if nothing happens straight away - the squeaky wheel gets the grease, eventually.

Non-U.S. investors can file complaints as well.

(Paging @ZachShahan and @Papafox.)

China is Tesla’s 2nd largest market. The Model 3 will simply slay it in China. That white interior is golden, I’m glad Tesla spent time to get the color of the white interior just right, most whites come a bit yellow, but Tesla white is perfect. It’s also easy to clean. Costs about $1,000 more and lots of females I know opt for it.

Where do you see that? I only see a statement of 40x improvement, but that wording has been there for over a year according to the wayback machine.

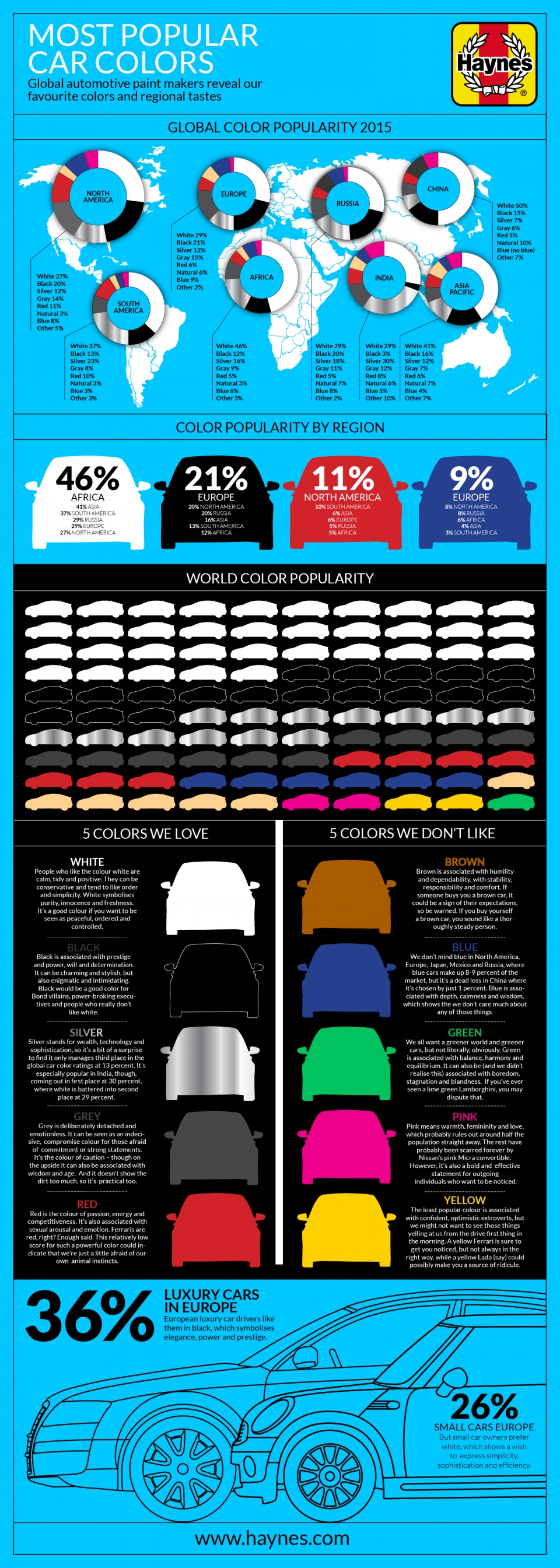

Traditionally white is predominantly the color of mourning in China.....

Traditionally white is predominantly the color of mourning in China.....