Esme Es Mejor

Member

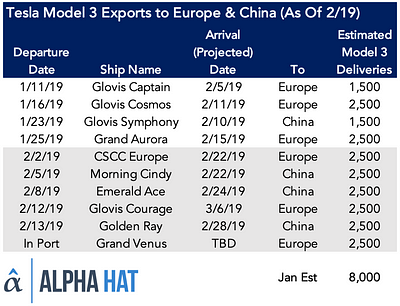

I just don't believe that they've sent near 30k to Europe. The data I've seen suggests no more than an average of 2,5k per ship, and possibly a lower average. Meaning 20k, maybe less. Same to China. Looks like 40k, maybe less, by RORO from Pier 80. Not excluding other means of shipping, but RORO shipping from Pier 80 is certainly going to be the predominant means for those markets.

Then you have US + Canada + Mexico, and "all other international, S+X only". E.g. UK, E. Europe, S. Korea, Australia, New Zealand, Taiwan, etc etc etc.

Yeah, that’s a big part of why I have a hard time believing the growth in Norway applies to the rest of Europe. I believe Alpha Hat estimated 1500 cars on the first ship to Europe, and 2500 each on the next few ships. It’s possible they increased the numbers on the last 3-4 ships, but we shouldn’t count on it. If those remained at 2500/ship, then they only sent 19k Model 3s to Europe. And you can’t deliver what you don’t send.