I guess the bromance with Elon is over. Now that VW knows that Tesla will not partner with them, it's game on. I look forward to that challengeYeah, I was thinking of sharing that earlier.... but really, there's not much to see.

More interesting out of Germany: here's VW's Diess whining about Europe trying to force the auto industry into a "painful transition", and by "painful transition" he means having a mere 30% of vehicles being electric by 2030.

“There’s a misperception about the automotive industry.”

Meanwhile, his company's EVs be like...

Earl of Frunkpuppy on Twitter

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Elon is already in North CarolinaNorth Carolina supposedly in discussions about building a Tesla factory there:

A Tesla expansion in North Carolina? It could be on the table

Nothing solid yet, though. I could picture it as a potential Cybertruck site; the timeframe would work.

Well.............. did you do it?

I respond reluctantly since the real mods will soon freak out if anyone responds beyond this point. My rationale is there is some generic interest in the dialogue about what to do with brokers who use traditional arguments which don't have much grounding with the reality of Tesla which we know here. Plus my experience profited greatly from both the contemporary administration's sage political tactic, diversion, and very wise advice from two TMC posters on dealing with brokers which I reference below, and shamefully used against this broker.

From our e-mail to broker. (Omitted are relevant facts about our situation. My wife is 40 years younger and my health is shaky. But if I were her age and fit, the advice would be the same: blame the accountant.) Begins with the first line:

“Investing is like driving on icy roads in winter—sudden moves are to be avoided.”

……………………………………………..

“From an investment perspective only, the reason to sell this stock at all is because one is leveraged and needs to cover short sales. That is not our situation, quite the opposite. Which raises questions which I don't expect you to answer but my accountant, wife, and I will be examining this month. What is the urgency to sell now? Why 20% rather than 10%? What are the tax consequences, save the Roth IRA, for example, until later? Et cetera.”

Useful quotes from TMC, with heartfelt thanks:

Tesla, TSLA & the Investment World: the 2019-2020 Investors' Roundtable

“Whenever your broker or adviser calls you to do something, it means they are on the other side and losing too much money.”

And,

Tesla, TSLA & the Investment World: the 2019-2020 Investors' Roundtable

“Aww, let the poor wealth manager get their way. Transfer the 20% to another brokerage and watch it grow there yourself!”

Agree on this, Tesla’s quarterly gross income has been a step function that step up every 2 years instead of being a straight line In log scale graph, mainly because stamping and painting are expensive to build and only become economical once in scale.My understanding is that CT’s advantages go beyond just saving fixed cost.

Take the Alien Dreadnought perspective and Elon’s insight that “The best part is no part and the best process is no process”:

Thought of in this way, the paint shop removal makes GFs cheaper, smaller, more productive and quicker to build.

Replacement of the giant stamping machine(s) with Origami Folders may give some of the same advantages?

I would also guess the bulletproof capability is just a happy result of the above, plus making the Exoskeleton strong enough for better than F150 payload and towing capacities even after removing the frame.removing the frame.

If those can be eliminated from the factory, the car factory would only have a GS, which is quick and cheap to build, and quite flexible to changes in the future.

This would help them build car factories much quicker with much less risk, so they can massively speed up their scaling when needed.

Ps: While researching on this topic, it struck me how much Tesla Charts looks like Amazon 10 years ago, roughly 4B gross income doubling every two years, just about to lift bottom line up with it. FYI AMZN was $80 back then.

Last edited:

The Accountant

Active Member

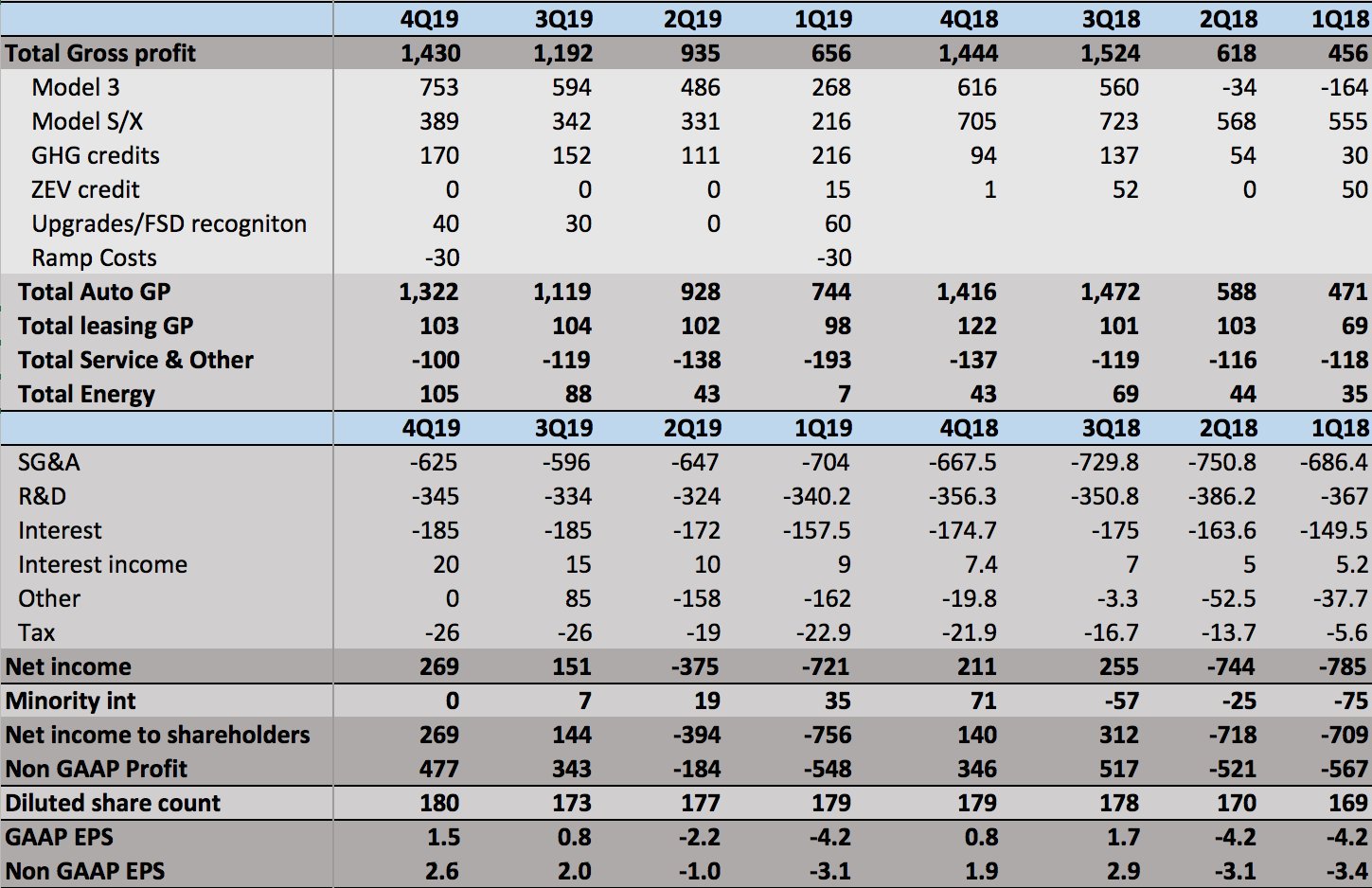

I'm posting here given its a weekend, but if you have comments on the model please reply in the Earnings Projections Thread: Near-future quarterly financial projections

Q419 Earnings Estimates:

P&L

Revenue $7,325m (+$1,022m QoQ, +$100m YoY):

Gross Profit $1,430m

Opex $970m

Net Income $269m (+$58m YoY, +$118m QoQ)

GAAP diluted EPS $1.5, Non GAAP EPS $2.6:

Key Revenue & Margin Assumptions:

In this model I have kept Model 3 like for like production cost flat QoQ. This excludes credit revenue, one off software upgrades (Acceleration boost), deferred FSD recognition and China one off ramp costs which have all been broken out separately.

I think flat production cost QoQ is likely conservative - Tesla has consistently reduced production costs QoQ & > production drives > margins (fixed cost leverage, < staff hours/car, supplier scale saving passed on). Main risks are larger one off GF3 headwind & more +ve one offs in Q

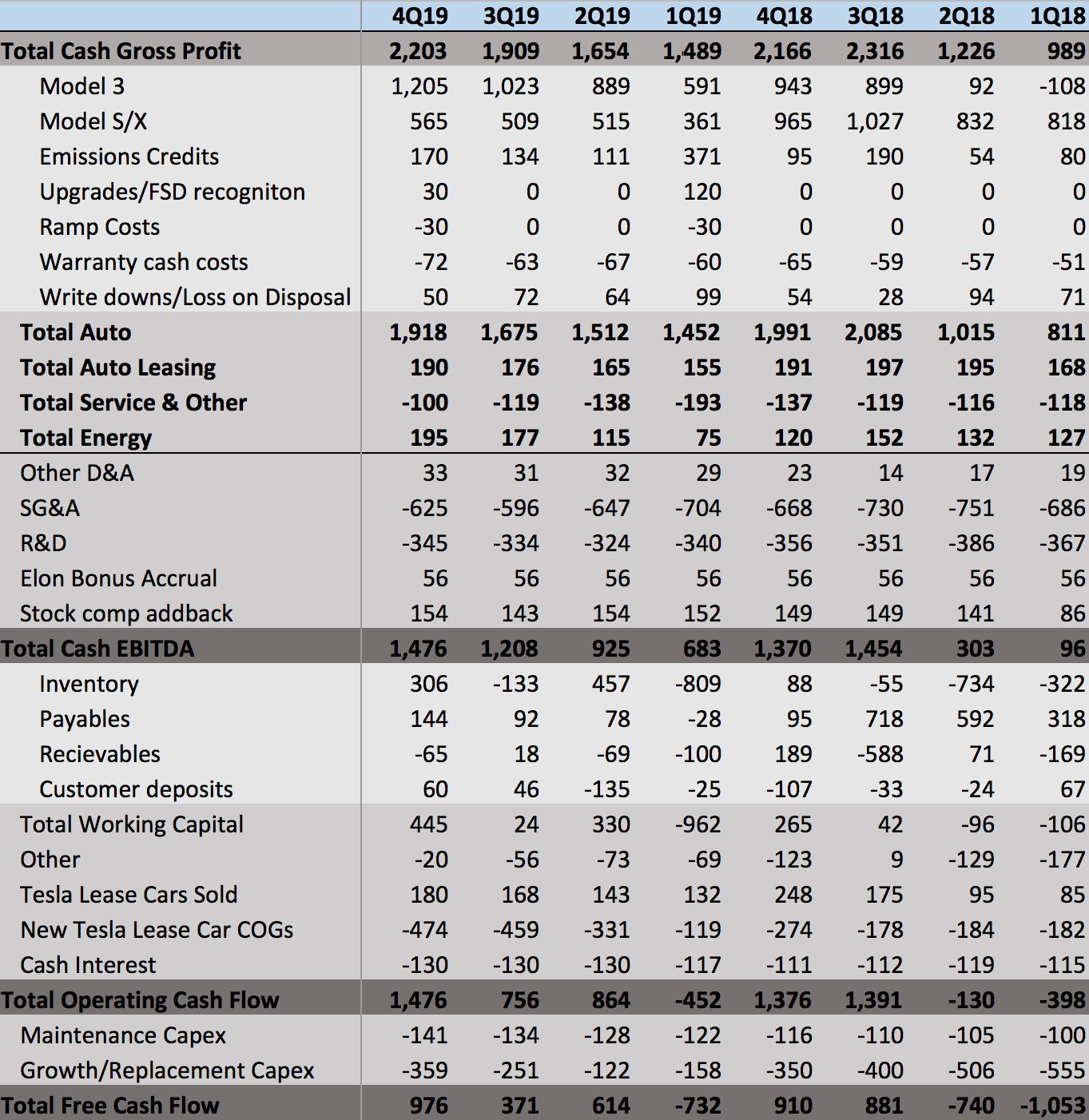

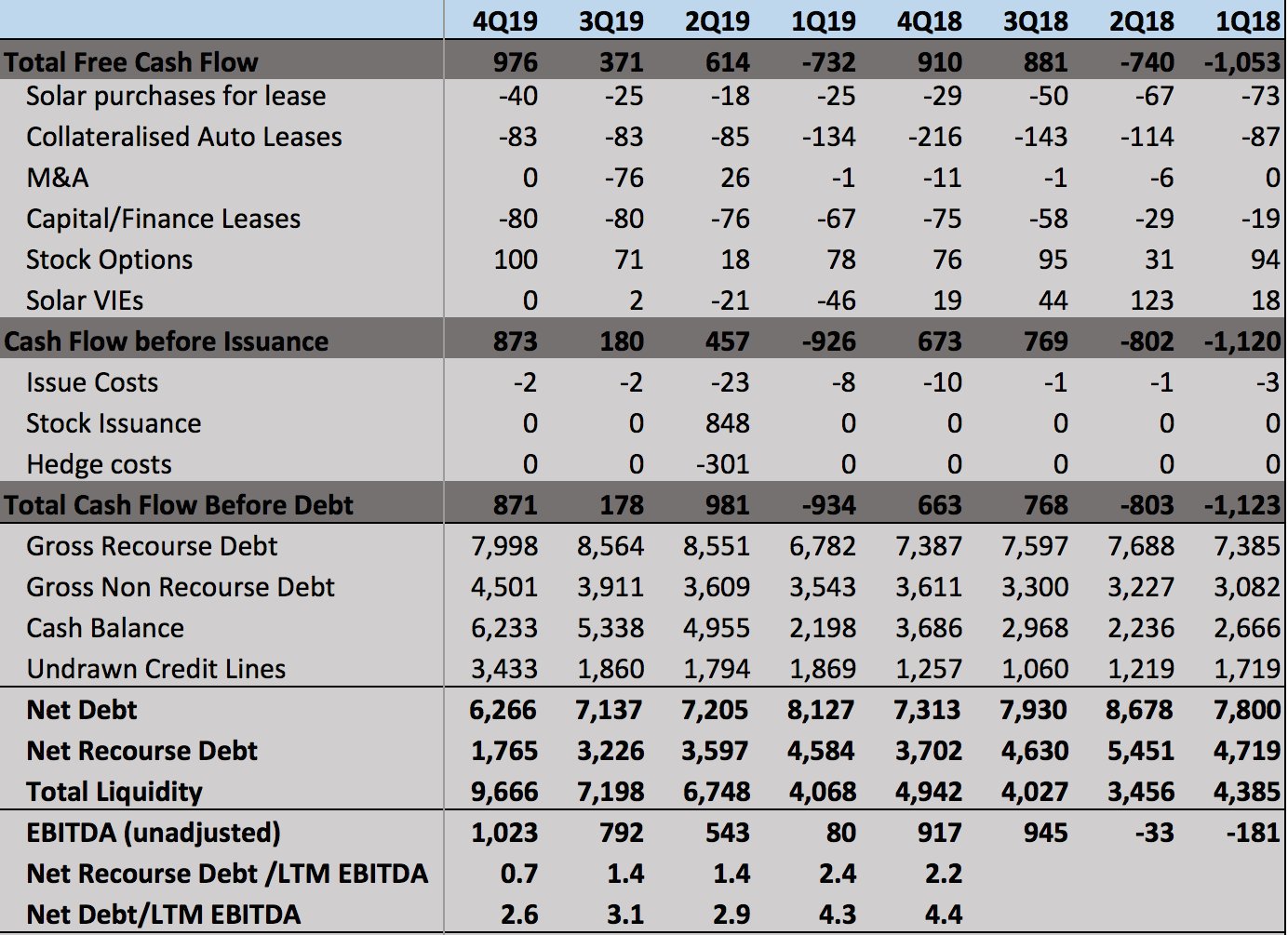

Cash Flow

Operating Cash Flow: $1,476m ($1,031m before Working Capital)

Free Cash Flow: $976m

My cash flow statements use different presentation & include many estimates for past Q line items but Operating Cash Flow & Free Cash Flow for Q4 uses Tesla definition.

My Cash Gross Profit Line = Gross Profit plus non cash cost addbacks for Depreciation, Warranty Reserve and Net Deferred Revenue

Net debt down $871m QoQ to $6,266m.

Net debt/EBITDA down to 2.6x from 4.4x at 4Q18.

Net recourse debt down more than half YoY to $1,765m from $3,702m at 4Q18. This includes $4,200m converts which are all in the money (but not convertible until 3 months before maturity).

Q4 Total Liquidity: $9,666m.

Including $6,233m unrestricted cash and $3,433m undrawn bank lines.

I would expect to see credit rating upgrades after Q4.

Revised my rating from Like to Love

If these numbers come in....

THE HEADLINE should read:

Tesla completes GF3, pays down Debt while growing Cash to $6.2B

.....delivering Record Revenues, Record Profits, Record Cash Flow

THE HEADLINE will read:

Expiring Tax Credits Bolster Tesla's Q4 Results

Looks like a new tent has shown up at Fremont:

It’s possibly the same tent that Machine Planet, a.k.a. Paul#######, a.k.a. The Keeper of The Blocklist, a.k.a. Shorty AirFarce commander took some drone photos of. According to a permit reg. discovered by the pinnacle of journalistic integrity that is Lora K., it might be a “storage tent to support general assembly”.

There is no evidence Tesla has paid to be in any movies or TV shows. Sometimes companies provide cars for loan though, without charging.Whoa. Just saw the bad guy pulled up in a Model s in Gemini Man. Did Tesla paid to be in a movie? I noticed all sorts of product placements so it's def not free to be in this movie.

StealthP3D

Well-Known Member

Whoa. Just saw the bad guy pulled up in a Model s in Gemini Man. Did Tesla paid to be in a movie? I noticed all sorts of product placements so it's def not free to be in this movie.

Some products have to pay to get in a movie, other products the producer wants in the movie because it helps tell the story. The producer (or even the writer) probably figured a Model S could best evoke the desired feelings/message to viewers. And, obviously, they had to pick a car of some make and model.

Kind of odd when the movie got paid by Coke and Ford. The Tesla served no purpose and just looked like a product placement. Seems like Ford paid a good chunk since most the cars are Ford.There is no evidence Tesla has paid to be in any movies or TV shows. Sometimes companies provide cars for loan though, without charging.

JRP3

Hyperactive Member

#Gf4 #Gigafactory4

@Gf4Tesla

First resistance stirs

Today on Jan 12th about 40 protesters gathered at the station Fangschleuse to protest against #Gigafactory4.

#Gf4 #Gigafactory4 on Twitter

JRP3

Hyperactive Member

MarcusMaximus

Active Member

cybering everything and only offering that vs conventional style would be a disaster

Until “cyber” is the conventional style, sure.

Dear Mods: have you made changes to the size of pictures that can be pasted in comments? I had to only choose a small section of my 4k screen grabs this week when there was no problem before.Drone videos are starting in Germany too. Here's the latest from GF4.

Some notable features:

Some trees here with a car driving past:

View attachment 499347

A few more trees. No car this time. Progress

View attachment 499349

Finally, more trees here (parking bay unrelated)

View attachment 499350

Or is it just a connection issue on my end?

Mod: Mods have no control over this, and to my best knowledge, nothing changed at the TMC end. --ggr

Last edited by a moderator:

MarcusMaximus

Active Member

Whoa. Just saw the bad guy pulled up in a Model s in Gemini Man. Did Tesla paid to be in a movie? I noticed all sorts of product placements so it's def not free to be in this movie.

One of the bad guys in His Dark Materials also pulled up in a Model X.

SW2Fiddler

We Are Cognitive Dissidents

the bad guy pulled up in a Model s in Gemini Man

The Tesla served no purpose and just looked like a product placement. Seems like Ford paid a good chunk

Well there you go!

Apparently, a lot of Tesla software has been uploaded in their Github repo:

green on Twitter

green on Twitter

Green Pete

Active Member

One of the bad guys in His Dark Materials also pulled up in a Model X.

And the last episode of season two of the handmades tale, and iirc an episode of person of intererest in 2016 a model s drove itself around. As I have pointed out before. I have put products in TV shows for free before. Certainly there are times when companies pay for placement, but also times just when companies ask for a loaner/free sample to use. Or maybe the people with the descicion power just want to use their power to showcase a brand. It happens

Green Pete

Active Member

Apparently, a lot of Tesla software has been uploaded in their Github repo:

green on Twitter

~seems like that person should not be tweeting about that?~

Edit: happy to be wrong

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K