Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

If Ark Invest predictions come true with the median SP of $7,000 in 2024 we are with an as of this minute $442 gain in 2020 not anywhere near to catch up with the predicted movement ahead

SunCatcher

Member

I think MMD is just having "Second Breakfast".This is the holy mother of all MMDs

Pezpunk

Active Member

This is the holy mother of all MMDs

4%? meh, i've seen worse. big numbers aint what they used to be.

FTFYThis WAS the holy mother of all MMDs

mickificki

Member

Sorry if repost, full interview with Ron Baron today.

Watch CNBC's full interview with billionaire investor Ron Baron

Watch CNBC's full interview with billionaire investor Ron Baron

SMAlset

Well-Known Member

But the ASP of those Toyota cars is probably 1/3 to 1/2 of Tesla's ASP. So the difference is not that big, especially if you look forward a few more years.

such a good point. And Toyota’s cost for materials on all those extra vehicles factors into that as well.

Thank you @Fact Checking. You have my vote for most opportune TMC post of 2020!

You advise either getting registered as a shareholder in your name or spreading holdings over 3 of the biggest brokerages.

Would there be any further protection to be gained by doing both?

What are these three biggest brokerages?

Due to holding all my options at IB and them appreciating a huge amount, I now have 75% of my portfolio and a very large sum parked there. I've been super happy with them as a broker, but I should look into these kinds of things in the near future for sure.

Tesla employee calling in rich and retire is a major concern for me at this point.

I believe Tesla stock options only vest after 5 years. And there are probably only a few moments per year where they can be exercised (correct me if I am wrong). And why would you want to quit working for the coolest boss, coolest company and coolest mission?

StealthP3D

Well-Known Member

Quite a bit of profit-taking going on now, wonder where this will settle.

It's pretty hard to predict situations like this but one scenario that I find likely is for it to settle down today in the mid-800's today and have a third leg up Wednesday. But the best plan of action if you're a shareholder is to do what the name "shareholder" implies! HODL!

If any of you have a sell order at 999, which a week ago was a joke, you might want to adjust it.

Indeed, those with artificially high GTC stop limits, implemented to prevent shares from being lent to short sellers, may need to be quite attentive. I've been adjusting my limit upward with unusual frequency this year.

Much of the reason for the recent TSLA up-move is shareholders being unwilling to sell. That keeps the asked price quite high. Stay long and strong.

that might be a bad omen ....Currently on CNBC you have the DOW ticker, S&P 500 ticker, and Tesla ticker in the bottom right corner lolView attachment 507794

Pretty common terms in Silicon Valley are 4 year vests with 1/4 vesting after 1 year, then 1/48 every month. Also common are 4 years with 1/4 per year. 5 years would be unusual. I'm not sure what Tesla is doing.I believe Tesla stock options only vest after 5 years.

G

goinfraftw

Guest

So, just working through questions (for me):

If I were the folks running the S&P 500, would I want a stock, no matter how much it's market cap is, be in this index at such volatility? ...or would I want to ensure it's priced accordingly based on appropriate forward-facing multiples before adding it in?

If I were the folks running the S&P 500, would I want a stock, no matter how much it's market cap is, be in this index at such volatility? ...or would I want to ensure it's priced accordingly based on appropriate forward-facing multiples before adding it in?

Update: I'm down to about 75% TSLA 25% cash after selling about another 5% in the $830s and another 5% at $880 both this morning. I'll sell another 5% if we get to high $900s. I've sold in the $600s as mentioned in the prior post, and the $700s.

rationale in quoted post above. I also think there's a reasonable chance the nature of this move involves some fundamental change to the short position. it could be Blackrock or some other mammoth whale getting in, which, would be more durable.

to be clear, that quoted post is my take on circumstances re Tesla, another key part of the equation of selling some or not is one's unique personal circumstances.

We've gone down twice by $50 or more today during the regular trading hours... I don't think that has happened once before over the past several days of this massive move. This is not TA, which I do not do, but, this change to me suggests there's a decent chance the underlying dynamic of this massive surge has changed materially. fwiw, as you can see from prior post quoted, I navigate adjustments to my position size by using my estimate of fair value as a north star so to speak.

Artful Dodger

"Neko no me"

Good technical support at $840

Tesla to partnet with Red Bull, because this sucker has Wiings.

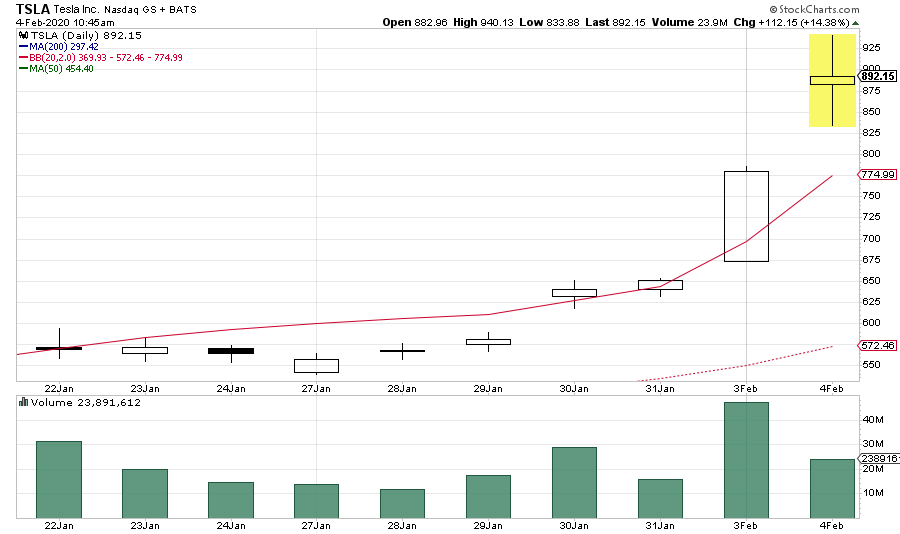

23.9M shares of TSLA traded in the 1st hour. Will we break 50M today?

HODLings.

Cheers!

Tesla to partnet with Red Bull, because this sucker has Wiings.

23.9M shares of TSLA traded in the 1st hour. Will we break 50M today?

HODLings.

Cheers!

TradingInvest

Active Member

As for euphoria, here is my perspective.

I bought the majority of my TSLA position in Feb 2015, when the P/S ration was 8.06. I still use P/S as the primary guide to valuation for very high growth companies in which I strongly believe. I use it only as my price target, not my investment decision. At 8.06 I thought TSLA was a bargain. I still do. That would be $1115 per charge would consider selling only if P/S exceeded 15. That would be at $2076 today. Of course, The sales will be much higher when that happens because TSLA will continue to have naysayers. Thus I might well not sell even for 2,076. Were that to happen I would certainly look at alternatives.

At some point Tesla's sales will reach 2T and P/S of 2, with 100 million total shares. That implies $40,000 share price is very likely in 10 years. Shorts thought @$30 it was the best short opportunity in the world. Then again they thought @$200 was the best short opportunity in the world. And they created a block list so they don't hear the noise from us.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M