Yes. Even with 75 cycles, if the cost was low enough, you swap batteries. 75 tankfuls of fossil fuel (3000 miles of fuel ) would pay for a new battery. Of course even 300 cycles makes it a million mile battery in a car.If this becomes reality, does this mean an instant era of sustainable electric air travel on top of terrestrial transport? If this is true we are even more wealthy than we are currently imagining.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Funny how we are thinking along the same linesI did the same thing!!!!!! Shared to daughter some cash gifts and asked her to open a trading account. ***She's up $18k since Feb***

Our son turns 21 later this year - will likely take another 2-3 years of college before entering the paid workforce. We were thinking of opening a trading account for him with some seed money and let him manage it. Some learning before he starts earning a living.

Only question is - should we open an IRA account instead of a standard brokerage account for him to avoid any tax liabilities from his trades? Would also give him a head start on starting a retirement account. Added bonus - he won't be able to take out the money to buy the latest X-box with bunch of games

Funny how we are thinking along the same lines

Our son turns 21 later this year - will likely take another 2-3 years of college before entering the paid workforce. We were thinking of opening a trading account for him with some seed money and let him manage it. Some learning before he starts earning a living.

Only question is - should we open an IRA account instead of a standard brokerage account for him to avoid any tax liabilities from his trades? Would also give him a head start on starting a retirement account. Added bonus - he won't be able to take out the money to buy the latest X-box with bunch of games.

he will still be able to take the money out, just with an additional 10% penalty :/

Any comments on what seems to be a multi-million dollar wager on TSLA reaching $2,500 next week? Like yesterday's large bet on $1,500, seems like somebody knows something.

Is this as risky as it seems?

https://twitter.com/ValueAnalyst1/status/1281886141109751809?s=19

These could've been used for day trading, because they give a ton of leverage. Have to wait and see open interest Monday when market opens to know whether people actually accumulated these.

Frank?

You have assumed something..it isn't the Seller that establishes the value of a stock. It is the buyer. yes?

The Seller only offers the object for sale at a price. If no buyer agrees then the seller's offer has no worth in determining the value.

Normally, yes. But funds forced to buy due to the S&P 500 inclusion, especially index funds, are completely price inelastic. If TSLA goes to $100,000, they will still be buying. They will literally be forced to buy at any price.

Words of HABIT

Active Member

...

@You’re not thinking big enough. You’re trying to talk yourself out of becoming stupid rich for a whole myriad of reasons, which I won’t go into. And so are a whole bunch of other people here. Y’all just can not accept your good fortune and go with it. But I get it, trying to wrap Tesla’s march to world dominance is tough. What’s happening right now, before your very eyes, has never happened before it human history and we’ve got a front row seat.

Think MUCH bigger and stop trying to neatly wrap up TSLA SP in a box based on past knowledge and data and how you think it needs to be to make sense.

Hold the bloody shares people, like your life depends on it. It’s time for the little guy to hold the wealth of the world and try our hand at doing better.

@Krugerrand, your post 4827519 has got to be one of the best I've read yet. Specifically the section I've bolded.

We have traditional old school behemoth companies (the big banks, big oil and gas, big auto) that are being decimated. There is a massive wealth transfer underway with hundreds of billions of $ from the owners of these labour intensive, bricks and mortar, soon to be archaic companies, to the new order, nimble, innovative tech, mobile, renewable energy and environmentally friendly companies the likes of Square, Paypal, Apple, Amazon, Zoom and Tesla. This wealth transfer has been greatly accellerated by CV-19, and will continue until capitulation of the old guard. Ironically the old guard still has no idea what is coming, and they are totally caught off guard, clueless in fact. The old guard will be shocked to wake up one day and realize this is no bump in their road, but the end of their road. TMC, this very thread, Tesla, TSLA & the Investment World: the 2019-2020 Investors' Roundtable shares how to profit during this time. Tesla's secret sauce is detailed on every one of its 8951+ pages. Summary for those who havn't read them all: Tesla is by far in the best postion to profit from this seismic shift in the coming days, weeks, months and years. This is our opportunity. Seize it.

Please invest responsibly. Press the '*' key for sending a fax. This concludes our national broadcast message. Regular programing will now resume in 3, 2, 1...

Last edited:

MartinAustin

Active Member

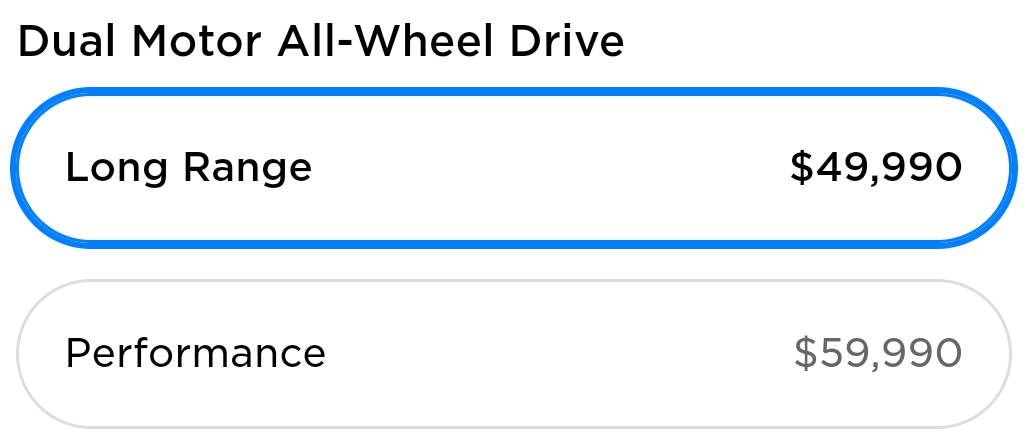

Tesla just lowered the price of the Model Y!!! Profit Guaranteed IMO

ssq

Member

@Papafox thank you for your incredible service to the investors over the years, I eagerly wait for the daily updatesThanks @TrendTrader007 . I must admit that my experience with Deep In the Money leaps has been extremely positive. The 2021 200s that I bought when TSLA was at the bottom of a deep dip are up as much as 1500%, and this is where a large portion of my money resided this past year. I'm rather fond of them ; ). As you say, when the price of TSLA goes down, the leaps decreased in value somewhat less than stock did, particularly when I was near the money. My main reason for favoring shares at some point is that if the macros ever decide to do a big swan dive, I can shed shares faster in my IRA than I can leaps. Maybe now is not the time to make this transition, however. As with most of you, I expect the market to be surprised by how much profit and cash flow TSLA turns out in Q3 and Q4. I expect moderately-wide availability of antibody therapeutics to be a game changer in the COVID19 situation this fall while we await a vaccine, which will be important with macros.

If I may ask, are you planing any steps on 2021 2022 DITM LEAPs? I have a few, and was wondering if it makes sense to roll them up ..Vs.. exercise them eventually. Would appreciate your thoughts on this.

Yeah, can't wait until Monday, when I'll be sitting around doing nothing with my feet up but maybe becoming richer by 6 or 7 digits.God damn weekend.....all this sitting around doing nothing with my feet up....gotta wait till Monday....how many hours away is the open.....god damn weekend

Tesla just lowered the price of the Model Y!!! Profit Guaranteed IMOView attachment 563612

Any reason left why someone would get the 3 instead of the Y?

EDIT: Welp. Just saw that California is increasing registration fees for EVs (on a sliding scale), up to $175 more annually for cars priced $60,000+. Looks like my annual registration will go from $718 to $893.

Last edited:

MC3OZ

Active Member

Casgains Academy - today:

This is true to the extent that Jeff Dahn's team has probably completed all R&D for Battery Day, and is now doing early work on the next generation..

What that products that R&D will enable, and when they will be available is hard to determine..

It looks like Battery Day will be a step change in the price and capabilities of batteries, but that isn't the end, merely a good start....

Seems like another 20 years of significant improvements in battery tech is possible, it is hard to imagine all those promising R&D leads going nowhere.. but rapid on going change is probably the wrong expectation... getting just a bit better every year for 20 years is a reasonable expectation.

MC3OZ

Active Member

Any reason left why someone would get the 3 instead of the Y?

A 3 and Y is a good combination for most 2 car families...

We did a road trip in the 3 and with 3 passengers, the luggage space was smaller than we would ideally need.

But as a daily driver I personally expect to find the 3 a bit more fun than the Y... the 3 is fun, the Y should be fun, just not quite as much fun.

For track recreation, I expect a Performance 3 to be a better track car than a Performance Y, even though a Performance Y will be very good for a crossover.

For a 1 car individual or family, the versatility of the Y is hard to beat.

Maybe when they lower the price of the 3 by $3K also. They're similar cars and they obviously found the secret sauce with the Y, now they're going to start cooking the 3 with it too... and maybe the 2, too!Any reason left why someone would get the 3 instead of the Y?

Yes indeed.

Based on recent TSLA moves I was already planning to surprise my wife with a red Model Y AWD. Might end up combining it with revealing the explosion of our IRA.

It's gonna blow her away.

Living in Ireland, I must admit the last two sentences made me wince a little.

Uhhhhh wtf is going on. Seriously. About to get an AWD model Y instead of the RWD we have on order because they lowered the price by $3k. I'm happy to be in the cult, but do I really have this little control over my personal decisions?

I think @ReflexFunds (sp?) was interested in knowing what else Tesla was applying their machine learning expertise towards. I can tell you the answer - figuring out exactly what to do to make me buy way more Teslas than any reasonable person would ever need.

I think @ReflexFunds (sp?) was interested in knowing what else Tesla was applying their machine learning expertise towards. I can tell you the answer - figuring out exactly what to do to make me buy way more Teslas than any reasonable person would ever need.

Does S&P work both ways? If the market tanks and people are dumping their S&P funds, will they have to sell TSLA? Or in that case would TSLA go down anyway whether they were in S&P or not?

Getting ready some powder for the dip on the no demand Y/price reduction articles on Monday.

lol those FUD articles will have no effect on the SP. Maybe in premarket we will see shorties trying to dig another hole for themselves. Also this picture is bullish for macros.....

Slightly off-topic, but it's a weekend. The release of this Nikola Tesla biopic is planned for next month.

Wikipedia: Tesla (2020 film) - Wikipedia

Deadline - yesterday: [WATCH] ‘Tesla’ Trailer: Ethan Hawke In Michael Almereyda’s Biopic – Deadline

Wikipedia: Tesla (2020 film) - Wikipedia

Deadline - yesterday: [WATCH] ‘Tesla’ Trailer: Ethan Hawke In Michael Almereyda’s Biopic – Deadline

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K