gabeincal

Active Member

The 4 slice toaster solves gabenicle's breakfast problem by avoiding everyday friction with the wife and saves time. 1min x 365 days add up.

Friction?! It’s creative time!!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

The 4 slice toaster solves gabenicle's breakfast problem by avoiding everyday friction with the wife and saves time. 1min x 365 days add up.

Hey, I resemble that remark.You forgot sell everything you own, dig in couches (Yours or strangers), waste 5 1/2 hours of your day posting on this forum while the market is open, hit 'like' on many forum posts, hit 'disagree' on many forum posts, and last but not least.....dream of becoming a 'teslaniare'. If you hang out here long enough and listen to some of the oracles...you will eventually become one.

I have no argument with your facts, but all your theorizing here is bunk. You have no idea what caused the TSLA price changes. For some reason you imagine that because some extra shares were sold yesterday that that had a big effect, even though all the similar stocks did pretty much the same thing, in fact the entire NASDAQ did about the same thing (see Rob Maurer's bit of chart illustration about 45 seconds into Tesla Daily). For sanity's sake, note that the volume yesterday was about 5-6 million more shares than the day before or after, less than 10% extra. There's just no there there, never mind a tsunami.

Oddly, while you were throwing away $200K in your trading account, I was making $220K in mine. I wrote 100 TSLA 12/11 620 puts @$31 when TSLA was at 601.70 yesterday late in the day. Closed the position today near the end of trading when TSLA was at 623 for $9.44. If I'd been even slightly brilliant I could have made much more on this trade by timing it better, but I'm no magician. Of course I'm down much more than that on my shares and calls I've been holding through this blip, but making some use of this wild swing is, as you say, some small solace.

You might want to rely a bit less on emotion and fantasy in your trading. It will improve your luck.

What’s going to happen with parking lots when most people ride an FSD enabled Tesla?

View attachment 616474

You guys may want to call your 401k administrator, don’t go by what is posted online. None of my company documents say this rollover can be done, but I just discovered a few weeks back that my after-tax portion of 401k can be rolled over to a Roth IRA. No tax on my after tax contributions, but have to pay tax on gains. Still a huge benefit and back-door entry for me for a Roth IRA which I don’t qualify for otherwise

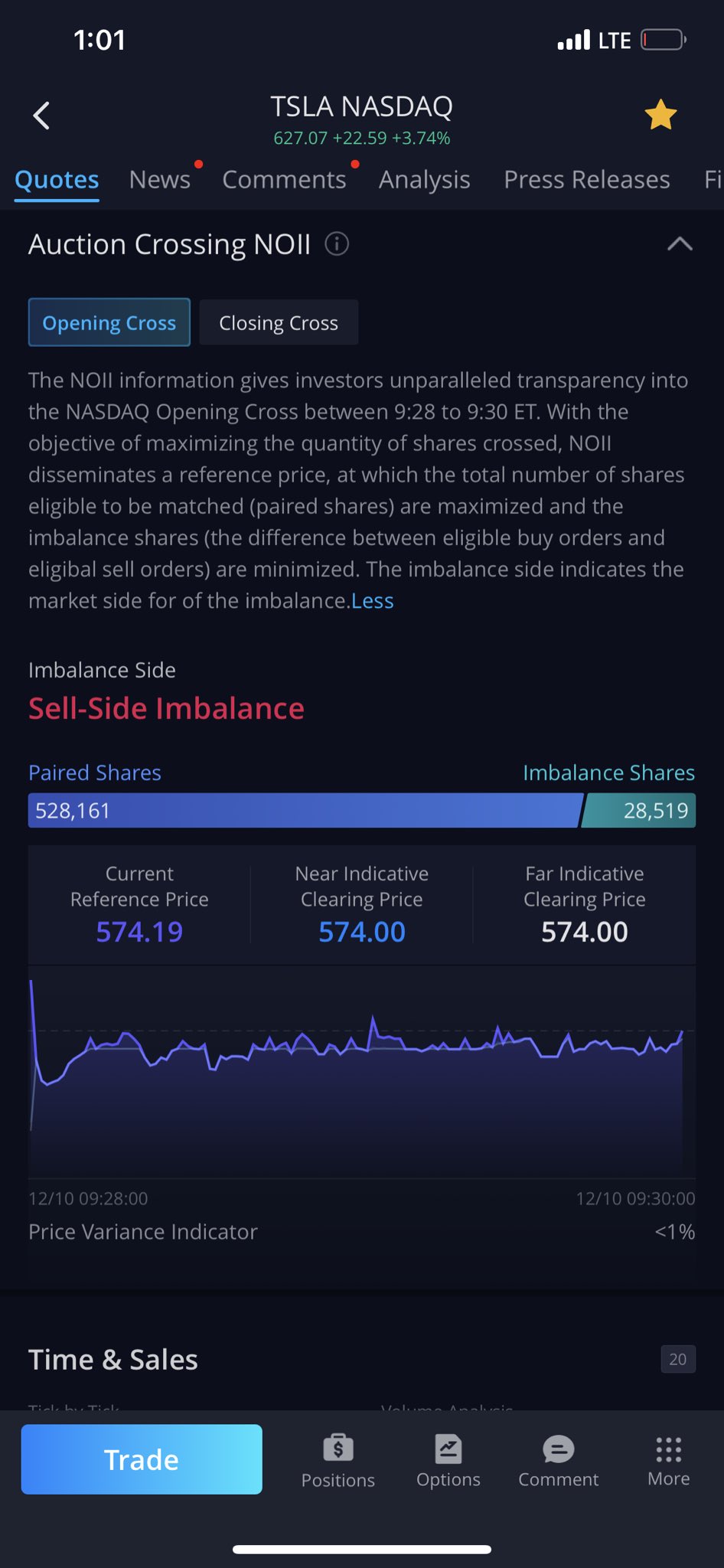

Yeah, your screenshot is of the "Opening Cross" (that's why the SP is around $574). You need to select the "Closing Cross" button from the top row:

Cheers!

Why do you always post with such an arrogant and superior tone?I have no argument with your facts, but all your theorizing here is bunk. You have no idea what caused the TSLA price changes. For some reason you imagine that because some extra shares were sold yesterday that that had a big effect, even though all the similar stocks did pretty much the same thing, in fact the entire NASDAQ did about the same thing (see Rob Maurer's bit of chart illustration about 45 seconds into Tesla Daily). For sanity's sake, note that the volume yesterday was about 5-6 million more shares than the day before or after, less than 10% extra. There's just no there there, never mind a tsunami.

Oddly, while you were throwing away $200K in your trading account, I was making $220K in mine. I wrote 100 TSLA 12/11 620 puts @$31 when TSLA was at 601.70 yesterday late in the day. Closed the position today near the end of trading when TSLA was at 623 for $9.44. If I'd been even slightly brilliant I could have made much more on this trade by timing it better, but I'm no magician. Of course I'm down much more than that on my shares and calls I've been holding through this blip, but making some use of this wild swing is, as you say, some small solace.

You might want to rely a bit less on emotion and fantasy in your trading. It will improve your luck.

I agree with your general point and personally think trying to come up with specific reasons for short term movements is a waste of time, but on the other hand, these types of moves based on market dynamics ($5B EXTRA of TSLA sold over 1 or 2 days) do have obvious effects. If the stock price shoots up next week, a week when we expect huge buying pressure, will you just shrug and say "it could be due to any number of reason, no one really knows what caused the spike?"

Man, you're grumpier than that cat that posts here!

Well, it depends. I believe that the sudden demand for shares will cause the stock price to go up sharply. And there will be a forced reduction of future supply, as these shares now in index funds (and more in index benchmarked funds) will stay out of circulation. So the change will be semi-permanent. This will work in a manner most similar to a sharp reduction in shorting. The only thing that can stop that is if people happy to sell have stocked up on shares to unload to the funds, which seems unlikely to cover much of the need, but is not impossible. I have no opinion on whether there will be an overshoot followed by a retrenchment. Maybe, since there usually is. But I'm guessing that the big players will manage the whole thing better than that, competing for maximum profit from dumb money.

The dumb money here will be all the funds whose managers think that TSLA is too hard, so they'll go neutral by buying whatever the S&P mandated percentage is. That will be most of them. Why would they put their jobs at risk by trying to be clever about something they know they don't understand? And, as TSLA is too hard, most of them currently have no position. So we'll be seeing massive buying, pretty much all right at inclusion time. If there's enough lying around to sell (meaning loosely held), the things will be orderly. If not, things will get weird.

But I can tell you one thing for sure. If the NASDAQ does pretty much the same as TSLA, whatever it might be, I won't be attributing any of TSLA's action to anything funky. Yesterday, adding 10% to volume and 1% to the float on a macro big down day apparently did little. We'll all have a front row seat to see what the next couple of weeks bring. I doubt very much it will be indistinguishable from the rest of the NASDAQ stocks.

Yeah. I find that stupidity annoys me more and more. Possibly because in this plague year other people's stupidity is threatening to kill my friends and relatives. Gets me down. Sorry about taking it out on y'all.

And what I wrote was 'Wow! Then there were dozens of tech stocks that were "hammering". What idiocy.' That's not the same as "callled me an idiot." We all say idiotic things from time to time. Your problem here is that you keep repeating things that are completely baseless. You don't even try to justify them. What's this "blatantly obvious that TSLA would be in the high 600s right now" nonsense? You're truly just making stuff up and not even trying to support it. And because this board is populated by bulls (mostly), people just let that kind of thing go as understandable enthusiasm.My “theory” was that TSLA was hammering the bid yesterday, for which you called me an idiot. Hindsight, it is blatantly obvious that TSLA would be in the high 600s right now without the newly created shares.

As for the rest of it, please be sure to post whenever you screw up and leave money on the table. Oh wait, you never do that.

Congrats on your brilliant trading.

Whatever.

Best of luck to you.

Try again. Eventually you might get it.So the answer is “because COVID”. Got it.

Oh, that's fine. What's stupid is "TSLA did this thing because of something unique to TSLA or Tesla.... blah blah blah... manipulation... blah blah blah.... THEY did it...." when nothing is happening to TSLA that isn't happening to every similar stock, or even the entire market. It's just plain stupidity.Thanks for the explanation. Stupidity is usually the answer, but I think how we communicate can explain a lot of the problem here. When people say "the stock went down because of X" they may mean "there's a good chance that the stocks price movement down was at least in part due to X." That's annoying to type out each time. That's my opinion on what happened yesterday. If the stock shoots up next week, most people will say "the stock went up because of the inclusion" when what they mean is "they stock very likely went up because of the massive buying pressure caused by the inclusion."

Sorry I must have missed the explanation of this data. What exactly are the opening and closing crosses telling us or giving info on? Are we tallying up to see how the imbalance is trending for the next couple of weeks? What insights is this data providing us?

Now four days. This is good!So after a close at 599, we have three days closing over 600. Getting more and more solid.

And what I wrote was 'Wow! Then there were dozens of tech stocks that were "hammering". What idiocy.' That's not the same as "callled me an idiot." We all say idiotic things from time to time. Your problem here is that you keep repeating things that are completely baseless. You don't even try to justify them. What's this "blatantly obvious that TSLA would be in the high 600s right now" nonsense? You're truly just making stuff up and not even trying to support it. And because this board is populated by bulls (mostly), people just let that kind of thing go as understandable enthusiasm.

As for posting when I screw up, I've done that a fair amount. Does this count as admitting screw-ups? It was a discussion with... you (in part). I'll note that in this as in everything else, you do no research and base your statements on knowledge you do not have. This is not the way to invest successfully. Get a grip.

Sorry, if I post too much without substance. Will keep it to a minimum. Sometimes just looking for feedback as I am flying solo all the time, don’t have a partner in this trading stuff, but this is not the proper forum.

Fair enough. In the end, I have no quarrel with you. I was just fairly certain Tesla was hammering the stock yesterday. No, I did not have research to back it up. Don’t know how I would even manage that. Still think I was right.

Yes, I try to trade while running a couple of businesses. Frequently do impulsive things in between giving instructions. Don’t have time to do this properly.

Sorry, if I post too much without substance. Will keep it to a minimum. Sometimes just looking for feedback as I am flying solo all the time, don’t have a partner in this trading stuff, but this is not the proper forum.

You seem to be doing just fine.

All the best.