Artful Dodger

"Neko no me"

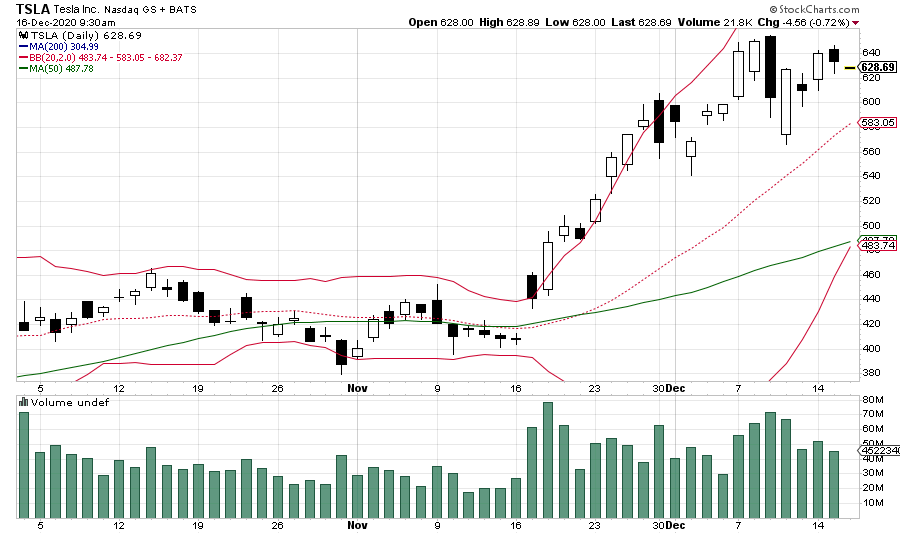

Here is today's TSLA Tech chart as of 09:30 EST: (Note: Upper-BB at Market Opening was $682.37)

Cheers!

Cheers!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

All my stocks have strong long-term growth prospects. That is why I want to maintain meaningful exposure to each of them.

tl;dr version for people on the other side of the paywall?

Nothing would surprise me but I'm coming to believe the S&P index fund managers just don't give a rip. They're going to do their job on Friday and buy the shares they need to buy.

European options I would guess.

Currently a lot more sellers than buyers...seems the front runners just taking profits?Might be the case, but given that the average daily volume is ~50m shared traded and the indexes alone need 120m shares, it again begs the question, where will these come from and what affect will it have on the price?

Will they buy in after-market, will we see an infinity squeeze in after-market, or will front-runners flood the place looking for profits?

Nite that said front-runners want to maximise their profits too, so it’s in their interest to set higher limit sell orders.

TBH, looking forward to this nonsense being over...

Not at all.

Their goal is to get their shares at exactly the market price as close to inclusion date as possible.

So the earlier ahead of inclusion they buy (and the earlier they sell other stuff to buy it) the larger their risk of index error.

That's why historically inclusion buying is almost always done at close the day before inclusion.

Ah.. yes.

So all the action we see, is just MM milking the option buyers.. I guess you are correct.

How to best profit from this.. I should have sold options instead of buying I guess. :-D

Edit:

Then, we can assume there wont be a SP dip after friday, not until wednesday next week. Any dip should be bought by the index funds, as they can buy and push SP up to fridays close, and get them shares at the correct price.

Does not help, but keep in mind that Tesla was down on good macros as well yesterday.Macros are also tanking

But how does that work when they need to buy >100M shares at the close price on Friday? Where are those shares going to suddenly come from at that closing price?

tl;dr version for people on the other side of the paywall?

Comes from the (allegedly by some) 200 million front-run shares purchased specifically to sell to them.

This is (very roughly) 15% of float. Why do people keep acting like this is some unobtainable number of shares?

Tesla's trading volume spiked 1460% from its daily average during Tuesday's record-shattering rally (TSLA)

That's from a day -30 percent of float- traded in a single day.

Im long, but used the opportunity to drop my shares at open and then bought back 6$ lowerVolume of shares being traded back and forth is a very different thing than shares being traded once and held.

One share could be traded a thousand times in a day.

One share can only be acquired by a index fund once.

My thinking as well...if you are b/m'd against the S&P why would you want to wait knowing the size of this index entry is unprecedented. A sensible plan would be to at least build out a portion of your eventual position (say 10 to 15%) early while the price appears weak. This all assumes your fund is starting with no position which from the Bloomberg article most all would be.Consensus seems to be that the index funds don't care about the stock price when they buy, so they can wait until Friday, even late Friday. But what about the benchmark funds? They are in it to make the biggest profit possible. So one would think they should be buying ahead of any liquidity problems. But I think they are all waiting for the first one (which may be happening as I type...)

CBut what about the benchmark funds? They are in it to make the biggest profit possible.