Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

No, they've been buying throughout the day. Only the Index Funds need to track the S&P 500 as closely as possible. And since TSLA will likely have a reduced weight after the rebalancing, it was probably those Index funds selling at 10:00 am today.Will benchmark funds be buying at the closing cross?

Our friend AJ is back and hard at work. This is like saying "we are inviting AAPL investors to ponder how much the stock would be worth if it was to stop making iPhone. We're just sayin."

Is it because his initial forecasts for Tesla China was such a huge hit (job)?

Is it because his initial forecasts for Tesla China was such a huge hit (job)?

short term impact at worst. he's a moron.Our friend AJ is back and hard at work. This is like saying "we are inviting AAPL investors to ponder how much the stock would be worth if it was to stop making iPhone. We're just sayin."

Is it because his initial forecasts for Tesla China was such a huge hit (job)?

JusRelax

Active Member

I was wondering what caused the tsla price increase 5 minutes before closeOur friend AJ is back and hard at work. This is like saying "we are inviting AAPL investors to ponder how much the stock would be worth if it was to stop making iPhone. We're just sayin."

Is it because his initial forecasts for Tesla China was such a huge hit (job)?

View attachment 646044

I would just like to mention to all that I learned a valuable lesson worth sharing (for long term investors).

Please don’t fret over not making money on all price movements; most of it is just noise. only the suits make money on these...and even the suits lose nearly as often as they win. This is the reason that arkk beats hedge funds.

It’s more likely to lose money on these movements...at least from my experience.

Better to shop for extreme bargains and avoid all the noisy input.

I’m (by nature) compelled to stay informed; an impulse I cannot avoid. However; acting on the information is avoidable, and from my (limited) experience; especially in regards to TSLA, action is not helpful. Make decisions based on your knowledge, experience, and skill, and live with them.

Long term you’ll find that others with more knowledge, experience and skill will have made better decisions; but this is irrelevant.

Many will not share the worst decisions they’ve made. Also, the goal is to profit from investments; not to profit THE MOST.

remember; bears make money, bulls make money...but pigs get slaughtered.

Please don’t fret over not making money on all price movements; most of it is just noise. only the suits make money on these...and even the suits lose nearly as often as they win. This is the reason that arkk beats hedge funds.

It’s more likely to lose money on these movements...at least from my experience.

Better to shop for extreme bargains and avoid all the noisy input.

I’m (by nature) compelled to stay informed; an impulse I cannot avoid. However; acting on the information is avoidable, and from my (limited) experience; especially in regards to TSLA, action is not helpful. Make decisions based on your knowledge, experience, and skill, and live with them.

Long term you’ll find that others with more knowledge, experience and skill will have made better decisions; but this is irrelevant.

Many will not share the worst decisions they’ve made. Also, the goal is to profit from investments; not to profit THE MOST.

remember; bears make money, bulls make money...but pigs get slaughtered.

Last edited:

I was wondering what caused the tsla price increase 5 minutes before close

650 is a key price to knock sold puts out of the money.

Very close to max pain as well, knocking out as many option buyers of calls and puts as possible in general.

After falling behind early, the home team slowly crawled their way back to keep it close late into the game. A final rally in the closing minutes took them over the top for a narrow victory and marking the 10th consecutive game of alternating wins and losses. Let's see if that late rally will carry over the weekend into Monday's contest. Unlike some recent games, the fans really turned out for this one with attendance well above the average.

Today

Score: 654.87

Margin of W/L: 1.71

Attendance: 42,449,395

Season

Record: 26-27

Total points in wins: 654.96

Total points in losses: -705.76

YTD gain/loss: -50.80 -7.20%

Avg margin of victory: 25.19

Avg margin of defeat: -26.14

Best W: 110.58 2021-03-09

Worst L: -68.83 2021-01-11

Last 10: 5-5

Streak: W1

Today

Score: 654.87

Margin of W/L: 1.71

Attendance: 42,449,395

Season

Record: 26-27

Total points in wins: 654.96

Total points in losses: -705.76

YTD gain/loss: -50.80 -7.20%

Avg margin of victory: 25.19

Avg margin of defeat: -26.14

Best W: 110.58 2021-03-09

Worst L: -68.83 2021-01-11

Last 10: 5-5

Streak: W1

gabeincal

Active Member

I would just like to mention to all that I learned a valuable lesson worth sharing (for long term investors).

Please don’t fret over not making money on all price movements; most of it is just noise. only the suits make money on these...and even the suits lose nearly as often as they win. This is the reason that arkk hedge funds.

It’s more likely to lose money on these movements...at least from my experience.

Better to shop for extreme bargains and avoid all the noisy input.

I’m (by nature) compelled to atay informed; an impulse I cannot avoid. However; acting on the information is avoidable, and from my (limited) experience; especially in regards to TSLA, action is not helpful. Make decisions based on your knowledge, experience, and skill, and live with them.

Long term you’ll find that others with more knowledge, experience and skill will have made better decisions; but this is irrelevant.

Many will not share the worse decisions they’ve made. Also, the goal is to profit from investments; not to profit THE MOST.

What helps me usually when I think in terms of 'what I left on the table' instead of 'what I took' is that it is NEVER possible to make all of the profits on all movements. Even if it was, it would be grueling to do so.

Ultimately it all depends on what's enough and what makes the individual happy with regards to the percentage of returns and most importantly the amount of effort, stress and worry they like to put against that percentage figure.

Thank you for sharing your learnt lessons, we can all learn from each other on this forum!

UkNorthampton

TSLA - 12+ startups in 1

Tempted to grab one more call contract at $700 for next week. $7 is too juicy to ignore. My thought is that we'll see all this SP smashdown unwind Mon/Tues and approach $700 by midweek. Hmmmmm

[UK] I have to sell in taxable account before 2nd April & buy in tax-free on or after 6th April. I'm thinking of selling Monday 22nd or 29th. Hopefully shares around same price on 6th April (or lower), but I think that's unlikely with delivery numbers (assuming published by then). Not much I can do other than delay re-purchase for a dip, but I don't like to be out too long in case of sudden upward movements. Maybe buy back in on Friday 9th or 16th April

Artful Dodger

"Neko no me"

Ha, there will be 900K Models 3/Y produced annually at Giga Shanghai by 2023 (the phase 1 Model 3 line is already at 300K/yr and the 1st Model Y line in phase 2 is ramping right now, with the 2nd Model Y line coming by year end; stamping and 2nd Gigapress under construction now).Is it because his initial forecasts for Tesla China was such a huge hit (job)?

More likely, AJ just got wind of a "Model 2" factory coming to China real soon (like 2022 for start of production). That'll ramp to another 2-3M cars per year NLT 2024/5.

So let's call it 3-4M Tesla from China by then, with a large (profitable) export market too.

But poor, poor AJ's stuck in 2027...

Cheers!

Last edited:

gabeincal

Active Member

European with a wealth tax (which since a couple of months is becoming less and less of a problemIs that post tax $300? Just sayin’, it matters. Could end up being more like $150. Ask me how I know

Artful Dodger

"Neko no me"

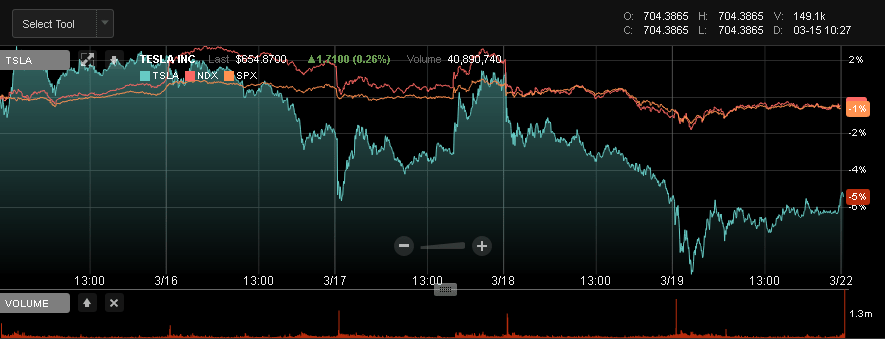

TSLA moved at 5x vs the macros for the week: (5-Day chart from NASDAQ)

Notice especially the large off-hours drops on Mar 17/18 (see the "cliffs" between days). This is when the SP is most subject to manipulation due to low volume; most retail investors excluded.

Large MMs/hedgies have a much easier time moving the SP in $50 "warp-jumps" during the pre-Market when volume is ~40x less than during the main session.

This is how they moved the SP to Max-pain (to their own benefit) on literally no news. It's like playing a fooseball game when the referees are players, and go for beers with the other team after-hrs.

Notice especially the large off-hours drops on Mar 17/18 (see the "cliffs" between days). This is when the SP is most subject to manipulation due to low volume; most retail investors excluded.

Large MMs/hedgies have a much easier time moving the SP in $50 "warp-jumps" during the pre-Market when volume is ~40x less than during the main session.

This is how they moved the SP to Max-pain (to their own benefit) on literally no news. It's like playing a fooseball game when the referees are players, and go for beers with the other team after-hrs.

Tslynk67

Well-Known Member

I dunno, this could be the start of a beautiful relationship...I am shocked I tell you, shocked...

View attachment 646020

I'm not seeing a catalyst for this game changing next week...

As you might be aware, I had $650 as the MM's target today, and regardless of the close, I think they were pushing for that

Anyway, I had 17x cc780 and 14x cc720 expiring today. I closed these positions for pennies a couple of hours before the bell and resold $660 & $664 strikes to land en extra $2700, which I converted to 4x $TSLA closer to the close

Looking forward to more green Monday/Tuesday and selling a pile of CC's, which will be converted to more $TSLA

Nicely done. I had a bundle of 30 covered calls expire today that I had rolled from before the Q4 earnings call (got caught out early in January by the huge price jump). At one point I was down $250K on the position, but ended up making about a $90K profit (for a total swing of ~$340k). Rolled them down over the last 6 weeks from $1050 all the way to $715 this morning. Proceeds were all put towards exercising call contracts for 1,000 shares at $300 strike.

Forgot to mention, I took the stock with me on vacation this week. I'll be back online Monday AM and I'll get this whole "red" business sorted out. BTW, TSLA can slam some Tequilla shots. What an animal that guy is.

Dying for some real news. Can we at least get a CT update from Elon or a new Ark price?

Dying for some real news. Can we at least get a CT update from Elon or a new Ark price?

Could have given us a heads up. Very rude of you to not do so.Forgot to mention, I took the stock with me on vacation this week. I'll be back online Monday AM and I'll get this whole "red" business sorted out. BTW, TSLA can slam some Tequilla shots. What an animal that guy is.

Dying for some real news. Can we at least get a CT update from Elon or a new Ark price?

ZeApelido

Active Member

VW's genius strategy is unfolding.

1. Make absolutely shitake software.

2. Wait for Chinese military to ban Tesla's

3. Successfully sell to Chinese military since they have no fear VW could ever figure out how to pull out the sensor data and spy on them.

4. ???

5. Profit.

1. Make absolutely shitake software.

2. Wait for Chinese military to ban Tesla's

3. Successfully sell to Chinese military since they have no fear VW could ever figure out how to pull out the sensor data and spy on them.

4. ???

5. Profit.

corduroy

Active Member

As you might be aware, I had $650 as the MM's target today, and regardless of the close, I think they were pushing for that

Anyway, I had 17x cc780 and 14x cc720 expiring today. I closed these positions for pennies a couple of hours before the bell and resold $660 & $664 strikes to land en extra $2700, which I converted to 4x $TSLA closer to the close

Looking forward to more green Monday/Tuesday and selling a pile of CC's, which will be converted to more $TSLA

This is the way.Nicely done. I had a bundle of 30 covered calls expire today that I had rolled from before the Q4 earnings call (got caught out early in January by the huge price jump). At one point I was down $250K on the position, but ended up making about a $90K profit (for a total swing of ~$340k). Rolled them down over the last 6 weeks from $1050 all the way to $715 this morning. Proceeds were all put towards exercising call contracts for 1,000 shares at $300 strike.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K