TSLA surged upward again on Thursday, increasing the distance from its 50-day SMA. The May 19 bottom looks more permanent. Recent weeks of meandering around the 200-day SMA appear to have ended dramatically amid rising volume. Those who had been reluctant to buy in recent months, may be having second thoughts.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Um....beer drinker"cup of beer", who are you?

I'm with Fidelity. They just charge a small fee for the entire transaction. I sold 30 contracts (Puts) near open today for July 23, 620 strike, and made just under $60,000. Commission for the entire trade was $19.50, and a fee of $1.36. In my tax activity to date I have 6 red trades, and 19 green. I've learned you need to be patient. You don't sell covered calls when the stock has dropped 30% for no good reason. You wait. You don't sell Puts when we are at an ATH. You also don't panic. I've been under water on some 700 strike puts for two months. I just keep rolling it out with a week or so to go for another month at the same strike (but you can get assigned early if your aren't careful).What is your Broker's fee per Contract? With my Broker's $20 per contract fee, the above strategy would be quite costly (especially while learning Options trading). Eg: those 40 Puts alone would represent around 800/mth in fees, but it sounds like that's not the majority of your activity.

How do you manage the fees? What's your "win/loss" ratio? What does it need to be to break even? TIA

Cheers!

Artful Dodger

"Neko no me"

TSLA After-Hours Quotes

Data last updated Jun 24, 2021 08:00 PM ET.

This page will resume updating on Jun 25, 2021 04:00 PM ET.

| Consolidated Last Sale | $681.00 +1.18 (+0.17%) |

|---|---|

| After-Hours Volume | 517,800 |

| After-Hours High | $687.31 (05:21:14 PM) |

| After-Hours Low | $676 (04:30:11 PM) |

I am waiting to sell covered calls for Jan 2023, 1500 strike, until they are around $110/contract. If the stock slowly rises after that, they will either expire worthless, or go into the money. If they go into the money, at that point I can sell my stock at 1500/share, or roll the contracts to a higher strike another year out. If the SP drops 30% again, I buy them back with a 50% or more profit, and wait until the stock comes up again to sell new covered calls. But don't fall in love with a trade - always be willing to admit you made a mistake and fix it. Don't expect to make the same amount every month. Some months you sell calls, some months you sell puts. Don't be greedy either. I could make my mom more money selling Puts with higher strikes, but I want to have a very low risk of assignment with her account because it isn't my money.

Skryll

Active Member

I don't think so. Unlike Mercedes, I assume Panasonic is actually going to invest into itself and grow faster to meet demand. Or are you suggesting Panasonic would be better off selling itself off to somebody else and buy Tesla shares with the proceeds?Mercedes did that. Panasonic will also come to regret it, unless they are buying back in now....

IMHO this is good news for Tesla share holders. Panasonic seems to know what to do with the cash, I assume this will benefit Tesla in terms of battery availability.

Criscmt

Member

The volume after-hours is very low compared to last several days. This seems to indicate that the buying pressure is no where near the levels it has been till today. In other words, not enough buying pressure tomorrow at least from longs, perhaps except from delta hedging shenanigans, in other words Gamma squeeze.TSLA After-Hours Quotes

Data last updated Jun 24, 2021 08:00 PM ET.

This page will resume updating on Jun 25, 2021 04:00 PM ET.

Consolidated Last Sale $681.00 +1.18 (+0.17%) After-Hours Volume 517,800 After-Hours High $687.31 (05:21:14 PM) After-Hours Low $676 (04:30:11 PM)

Any thoughts?

The question is why did Panasonic sell? Did they take profit because they needed cash to expand like you suggest? If so, then it was probably worth it to them, and necessary. Of course it makes for great FUD right now for the Bears.I don't think so. Unlike Mercedes, I assume Panasonic is actually going to invest into itself and grow faster to meet demand. Or are you suggesting Panasonic would be better off selling itself off to somebody else and buy Tesla shares with the proceeds?

IMHO this is good news for Tesla share holders. Panasonic seems to know what to do with the cash, I assume this will benefit Tesla in terms of battery availability.

InTheShadows

Active Member

Haha, he'd probably say "Bro, theta burn to the moon!" I'll ask him when he's done playing Fortnite.Could your 12yo please explain it to me as though to an 8yo? TIA.

InTheShadows

Active Member

This is the site I used to begin teaching him. Selling Puts: The Complete Guide for Finding and Managing Great Put Selling Trades (No Opt In Required)Best I've found: The Essential Options Trading Guide

But a great way to learn is this thread: Applying options strategy 'the wheel' to TSLA (start with page 1 young padawan)

His win rate this year is 21:1. The 1 loss was because I told him to cut it short on July 3 because that was the day for him to learn about TSLA LEAPS. He's been all smiles the last two days.

pz1975

Active Member

I try to do this too once ATHs are breached. I sold a bunch of $1,425 covered calls in the $800s when the IV was high and bought them back in the $590s when the IV was low. I ended up with 80ish% profit in the low 6-figures. I plan to do the same but with a higher strike once we get into the high $800s again, slowly selling more if it keeps rising to $1,000. Like you said, I'll either end up making a big profit on the sold calls or have to sell some shares (but still <15% of what I own) at some crazy SP like $1,500 (cost basis $50-60). Win win.I am waiting to sell covered calls for Jan 2023, 1500 strike, until they are around $110/contract. If the stock slowly rises after that, they will either expire worthless, or go into the money. If they go into the money, at that point I can sell my stock at 1500/share, or roll the contracts to a higher strike another year out. If the SP drops 30% again, I buy them back with a 50% or more profit, and wait until the stock comes up again to sell new covered calls. But don't fall in love with a trade - always be willing to admit you made a mistake and fix it. Don't expect to make the same amount every month. Some months you sell calls, some months you sell puts. Don't be greedy either. I could make my mom more money selling Puts with higher strikes, but I want to have a very low risk of assignment with her account because it isn't my money.

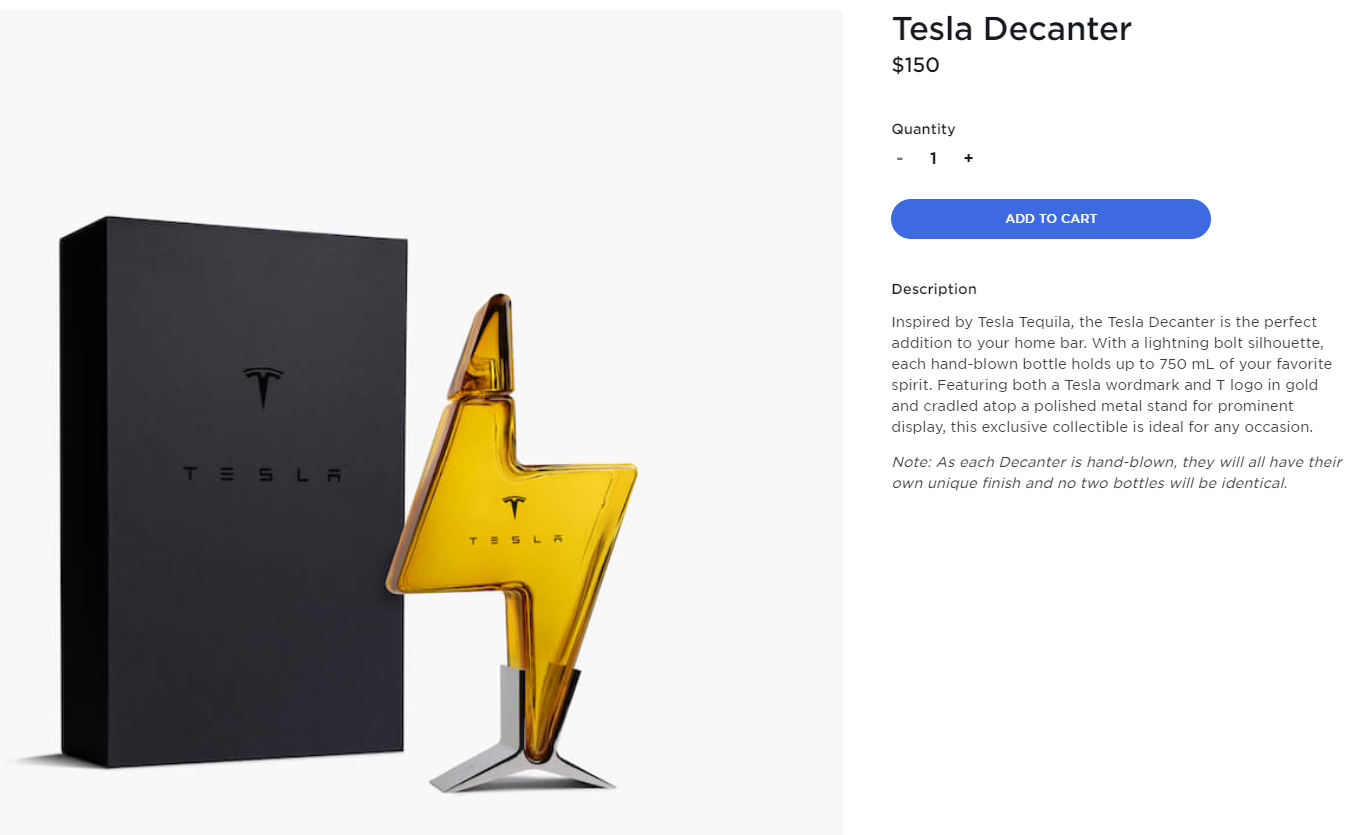

OT, but: If you wanted a Tesla decanter without the Tequila they are now on sale for $150: Tesla Decanter

G

goinfraftw

Guest

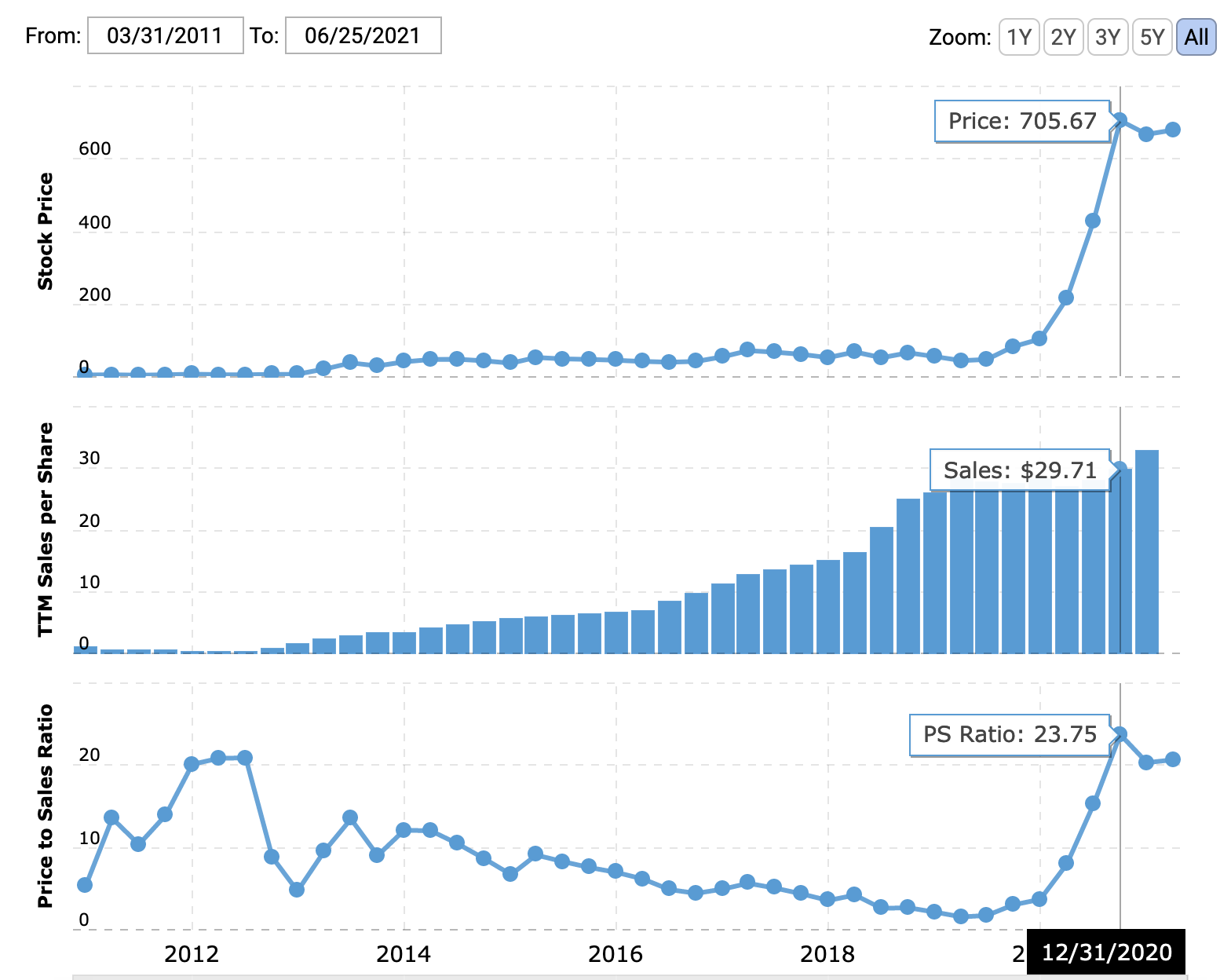

As an investor, I really like the P/S ratio. Here's TSLA's since IPO:

www.macrotrends.net

www.macrotrends.net

If you look at the bimodal P/S chart with the two peaks, 1 before the Model S ramp-up and the other in 2020 (maybe Model Y?), my first thought is wondering what the market is trying to price that will realize so much revenue to account for such an exorbitant P/S ratio and compared to a "normalized FAANG" P/S ratio of ~10 from its current point, ~18-19, right now (it's similar to NVIDIA currently).

Back in 2012, that was the Model S (introduced in June 2012). The most obvious output is a mixed income stream of greater software services packaged on top of the "S3XY CARS" millions-of-cars ramp-up over the next 2 years with awesome profit margins.

Tesla Price to Sales Ratio 2010-2023 | TSLA

Historical PS ratio values for Tesla (TSLA) over the last 10 years. The current P/S ratio for Tesla as of May 10, 2024 is <strong></strong>. For more information on how our historical price data is adjusted see the <a...

If you look at the bimodal P/S chart with the two peaks, 1 before the Model S ramp-up and the other in 2020 (maybe Model Y?), my first thought is wondering what the market is trying to price that will realize so much revenue to account for such an exorbitant P/S ratio and compared to a "normalized FAANG" P/S ratio of ~10 from its current point, ~18-19, right now (it's similar to NVIDIA currently).

Back in 2012, that was the Model S (introduced in June 2012). The most obvious output is a mixed income stream of greater software services packaged on top of the "S3XY CARS" millions-of-cars ramp-up over the next 2 years with awesome profit margins.

Artful Dodger

"Neko no me"

I try to do this too once ATHs are breached. I sold a bunch of $1,425 covered calls in the $800s when the IV was high and bought them back in the $590s when the IV was low. I ended up with 80ish% profit in the low 6-figures. I plan to do the same but with a higher strike once we get into the high $800s again, slowly selling more if it keeps rising to $1,000. Like you said, I'll either end up making a big profit on the sold calls or have to sell some shares (but still <15% of what I own) at some crazy SP like $1,500 (cost basis $50-60). Win win.

Are you still able to do this inside your TFSA? How did your Accountant's tax predictions work out? Was their a 'threshold' reached which triggered this?

Cheers!

I don’t post much as I’m newer and trying to learn the ropes on here. But, what about new investors that are willing to hold? I wasn’t able to afford my first Tesla until early 2020 and started to buy stock towards the end of the year once I was able to. I’ve been buying dips ever since. I’m nothing compared to big fish, but I’m trying and would honestly be upset to be left out of something I love. I have a preorder in for starlink and I have high speed DSL. Leaving out new investors like myself would paint a bad look I believe.The argument could be made that investment by long-term TSLA shareholders adds value compared to other, random investors. Long-term TSLA investors have proven themselves and helped protect Tesla.

TSLA shareholders who held, say, through the summer of 2019 are exactly the kind of investors you’d want to own stock in Starlink and having them invest would benefit the SpaceX investor.

Not a bulletproof argument, but at least a leg to stand on if the SpaceX board wanted to approve the idea.

sonofjorel

Member

Thanks for posting this! I just ordered one for myself. Maybe I should have ordered a few to give as gifts but I’m sure my circle wouldn’t have the same appreciation for it.OT, but: If you wanted a Tesla decanter without the Tequila they are now on sale for $150: Tesla Decanter

View attachment 677407

Krugerrand

Meow

And yet it was Jim Cramer I saw in my mind’s eye when you were margin called and stropping around.Didn't watch any of them. Never liked him ...don't like him now.

Screaming horn honking button smashing showmen aren't my cup of beer.

mblakele

FSD Beta (99)

OT, but

No, no, no. If you already know it's OT, simply don't post it.

Krugerrand

Meow

You’ll be a long term stock holder by the time the Starlink IPO. Don’t sweat it.I don’t post much as I’m newer and trying to learn the ropes on here. But, what about new investors that are willing to hold? I wasn’t able to afford my first Tesla until early 2020 and started to buy stock towards the end of the year once I was able to. I’ve been buying dips ever since. I’m nothing compared to big fish, but I’m trying and would honestly be upset to be left out of something I love. I have a preorder in for starlink and I have high speed DSL. Leaving out new investors like myself would paint a bad look I believe.

peletourneau

Member

Thanks for the head up! Now, deciding what to fill it with.......OT, but: If you wanted a Tesla decanter without the Tequila they are now on sale for $150: Tesla Decanter

View attachment 677407

Your Tesla Shop Order Is Confirmed |

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K