Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

UnknownSoldier

Unknown Member

Boy I sure hope they have improved speed limit sign detection then because I would hate to be denied access because it thinks I should be going 30 when the sign clearly says 50...Beta button approval conditional on driving history over previous 7 days.

Expect to see a lot of very chilled Tesla drivers over the next week.

Artful Dodger

"Neko no me"

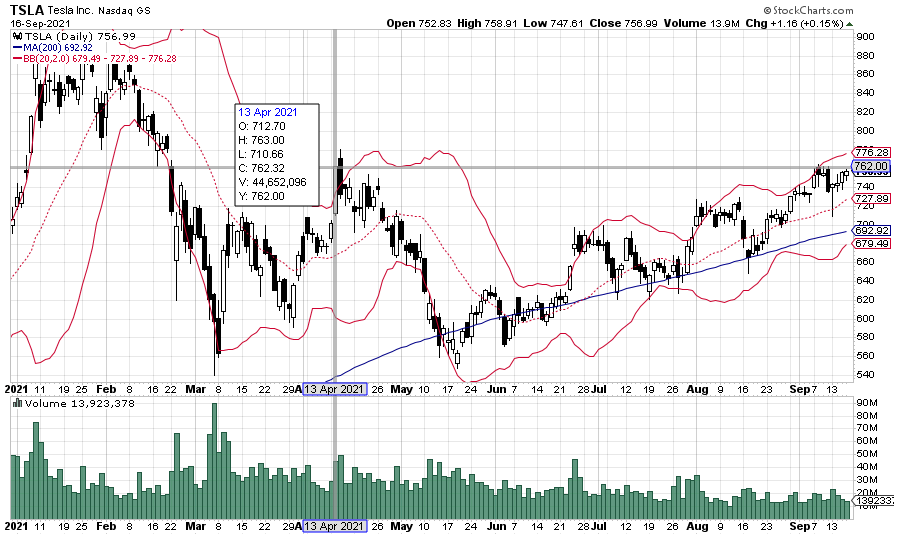

Any TSLA Closing SP above 762.32 today beats the 2021Q2 Highest Close, and could signal a breakout. Here's the Year-to-Date (YTD) Chart:

Today's FSD Beta 10.1 announcement, complete with "the Button" details, could help. GLTA.

Cheers!

Today's FSD Beta 10.1 announcement, complete with "the Button" details, could help. GLTA.

Cheers!

Tslynk67

Well-Known Member

Yesterday I would (not) advise that ~$745 was the target - in fact this has been evident all week, but the calls at 740 strike are now neutralised by puts, strengthening the case furtherTomorrow looks like a complete wildcard to me...

I don't think it will follow this week's pattern.

Do any of you brave souls have predictions for tomorrow?

View attachment 710362

What we did see yesterday is significant volume at 750 for both calls and puts, I wouldn't be surprised if this also falls out of play, most of yesterday's call volume was at 760, so maybe this becomes the red line for the close - if that gets breached there are still significant calls all the way up, so will be a long hard fight, a run above and we could get a delta-hedge squeeze going

But if I had to bet the farm right now, $755, give or take a couple of bucks

Last edited:

Artful Dodger

"Neko no me"

CleanTechnica on Twitter: "Plugin Electric Vehicles Get 28% Market Share in Germany in August! https://t.co/iUuRzGyjnB" / Twitter

"last month’s plugin share (Ed. note: Aug in Germany) ended at 28% (15% BEV)."

Last edited:

Artful Dodger

"Neko no me"

But if I had to bet the farm right now, $755, give or take a couple of bucks

Maybe don't bet the farm for 2hrs, 40min when the new Open Interest data comes out...

Cheers!

Tslynk67

Well-Known Member

Meh, I already bet the Farm and my kids for next week...

I'll give my interpretation after we get the update, then you can string me up if I'm wrong

Tslynk67

Well-Known Member

Last month? Did you see the number for NO this month?What does he mean by that? They are shipping a lot to Germany right now? Like they did to Norway last month

The implication is that Tesla will be the highest sales, Model Y is huge here in Europe and the more people see it, the more will sell, excitement much!

What will SEC think about Elon’s “September record deliveries secured“ tweet?Last month? Did you see the number for NO this month?

The implication is that Tesla will be the highest sales, Model Y is huge here in Europe and the more people see it, the more will sell, excitement much!

View attachment 710434

Tslynk67

Well-Known Member

Nothing? We can interpret this as positive on Tesla deliveries, but it can be equally seen as a straightforward "may the best man win" statement, would be a very weak case if the SEC took umbrageWhat will SEC think about Elon’s “September record deliveries secured“ tweet?

Hopefully the new SEC head is a bit more common-sense than the previous

Artful Dodger

"Neko no me"

TSLA down 3x vs macros in the early Pre-market:

15,500.25 -17.50 (-0.11%)

Data last updated Sep 17, 2021 05:31 AM ET.

Nasdaq 100 Sep 21 (NQ=F)

CME Delayed Price. Currency in USD15,500.25 -17.50 (-0.11%)

TSLA Pre-Market Quotes Live

This page refreshes every 30 seconds.Data last updated Sep 17, 2021 05:31 AM ET.

| Consolidated Last Sale | $754.17 -2.82 (-0.37%) |

|---|---|

| Pre-Market Volume | 16,514 |

| Pre-Market High | $756.11 (04:12:21 AM) |

| Pre-Market Low | $753.25 (05:27:29 AM) |

nativewolf

Active Member

The implications for me are that Tesla is defending market share by shipping anything, maybe the right tactic but I worry re the sales we'll see in China next year. Seems to me that Tesla is almost ceding China market until Model 2. We'll see but the EU subsidy, debt, driven EV binge may be something Tesla just could not ignore. Berlin can't open fast enough, this point next year it will be very telling and will give some indication of strategy for China. Of course once FSD hits Europe than that is a bit of a wall. UK will be earlier adopters I bet (because it has to be confusing as heck driving on the wrong side of the road every day- I mean how do they avoid accidents).

Tslynk67

Well-Known Member

This point was addressed in the UBS note - the reason Tesla are exporting heavily is not just to satisfy the demand, but that CN sales are quite seasonal, starting in October - Martin Vecchia (head of IR) stated that Tesla have absolutely no worries about CN demand at all, see Rob's summary of the main points of this note:The implications for me are that Tesla is defending market share by shipping anything, maybe the right tactic but I worry re the sales we'll see in China next year. Seems to me that Tesla is almost ceding China market until Model 2. We'll see but the EU subsidy, debt, driven EV binge may be something Tesla just could not ignore. Berlin can't open fast enough, this point next year it will be very telling and will give some indication of strategy for China. Of course once FSD hits Europe than that is a bit of a wall. UK will be earlier adopters I bet (because it has to be confusing as heck driving on the wrong side of the road every day- I mean how do they avoid accidents).

Hey, I'm missing my new MX Plaid! Model Y just isn't big enough for wife, three teenage kids and three dogs, and CT is no solution in Europe

Patience is a virtue @Lycanthrope , as we HODL'ers know all too well.

Just think about the Plaid S: they surely are working on a fabulous new Model X Plaid.

Once you have that beast you will instantly forget the time you have had to wait for it.

Practically all of Tesla is working themselves in sweat now to produce delivery numbers that will astound and help the world.

Last edited:

2

22522

Guest

Appreciate the factors considered.The implications for me are that Tesla is defending market share by shipping anything, maybe the right tactic but I worry re the sales we'll see in China next year. Seems to me that Tesla is almost ceding China market until Model 2. We'll see but the EU subsidy, debt, driven EV binge may be something Tesla just could not ignore. Berlin can't open fast enough, this point next year it will be very telling and will give some indication of strategy for China. Of course once FSD hits Europe than that is a bit of a wall. UK will be earlier adopters I bet (because it has to be confusing as heck driving on the wrong side of the road every day- I mean how do they avoid accidents).

In a control volume sort of way,

- Shortages of a desirable product increase status of ownership and eventually demand. Not worried about China.

- Allocating for margin works when aligned with infrastructure/plans. It is important for the European distribution infrastructure to get exercised, and sized, for when Brandenburg comes online. Steering China production selectively toward Europe does that.

- Don't know if useful. UK has half as many cars per capita as the US. And about 1/5 as many people. So to one significant figure, an order of magnitude fewer cars.

The key part of this is that the distribution channel for Brandenburg has to be sized and supported with a continuous flow of vehicles to avoid atrophy. So keeping that distribution channel healthy when sizing up is likely a top 3 logistical priority for Tesla right now. The other 2 logistical priorities are the new factories - with the supply chain factors that go into making them run.

Artful Dodger

"Neko no me"

Meh, I already bet the Farm and my kids for next week...

I'll give my interpretation after we get the update, then you can string me up if I'm wrong

Based on Open Interest numbers released at 7:00 ET this morning, the "C-P Brkpnt" for this Friday's Options expiry has moved to 750: (from 745 the previous day)

For those not familiar, "C-P Brkpnt" or "Call minus Put Breakpoint", is my experimental effort to provide a simple method to evaluate the potential Friday Close SP preferred by Options writers (mostly large Market Makers).

It is the balance point where, if the SP moves either up or down, Options writers have a larger net payout due to the number of open contracts for Calls - Puts at that Strike price.

This effect may be particularly influential today due to it being a "triple-witching Friday". Note that there are ~1.2M open contracts that expire today, which is down about 40K from yesterday but still a very large Options expiry event today.

Cheers!

Last edited:

Tslynk67

Well-Known Member

Evolution at 740 with more calls now than puts, if they have the firepower then the Hedgies might be inclined to target >735<740, but it's fairly marginal I would say although historically I've observed a preference to protect calls more than putsMeh, I already bet the Farm and my kids for next week...

I'll give my interpretation after we get the update, then you can string me up if I'm wrong

The bad news is that puts haven't increased much at 750, but calls have, so expect this to be vigorously defended - we will see today if the Hedgies have been faking it all week...

My absolutely not-an-expert, seriously not advice, reading the tea-leaves, pulled from my a$$ guess: 20% close >735<740, 80% >745<750: do not trade based on this, etc, etc.

Are you filtering the data you use? That point (min payout) sounds like Max Pain which is still at $700. A $750 close looks like an additional $390 million in payouts (non-hedged).Based on Open Interest numbers released at 7:00 ET this morning, the "C-P Brkpnt" for this Friday's Options expiry has moved to 750 from 745 the previous day.

For those not familiar, "C-P Brkpnt" or "Call minus Put Breakpoint", is my experimental effort to provide a simple method to evaluate the potential Friday Close SP preferred by Options writers (mostly large Market Makers).

It is the balance point where, if the SP moves either up or down, Options writers have a larger net payout due to the number of open contracts for Calls - Puts at that Strike price.

This effect may be particularly influential today due to it being a "triple-witching Friday". Note that there are ~1.2M open contracts that expire today, which is down about 40K from yesterday but still a very large Options expiry event today.

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M