Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Time to react ..The stock was just driven down $15 in the minutes before the open with huge spoofing orders (sell orders for up to 5,000 shares). This clearly carried over to the open. "They" are great at creating fear through their fake orders.

added some lotto 930 calls for tomorrow ... playa gotta play the game

On the call, Elon said they were not working on it yet, but that they would have one sometime in the future. So, yes, the plan is to have a smaller car--at least for some markets.Because during the 2019 AGM Q&A session, Elon told us they plan on a $25K compact car in 2023 or '24 if things go well.

Did you not know this, or did you forget? Or ignoring it because it's 3.5 years old?

This open makes no sense!

It doesn't make sense if you are truly paying attention to the financial details.

HOWEVER, from an overall outside casual point of view, the call might have seemed concerning:

- No Cybertruck this year

- No longer working on the more affordable Tesla car to address the large economy auto market

- Doubling down on FSD and Optimus, two future techs with no revenue at all for the foreseeable future

I could see how some investors could be spooked, particularly those who feel Tesla is "just an auto company". For those who HODL TSLA though 2022 will be an outstanding year, and the call was super bullish.

nativewolf

Active Member

@wooter do you have kids? You think mom's car full of car seats, drink box's, skates, etc etc is going to get exchanged for a robotaxi? That the kids going to the school in a robotaxi (why not a bus?) are going to get picked up by a parent for after school soccer, lacrosse, chess, swimming, horseback riding,etc in a robotaxi?Just none launching this year.

I am hopeful this is a lesson learned from the way-too-soon "introductions" of the Roadster 2, Semi, and CT-- and instead they're going to save new product announcements until they have the major production engineering already figured out, meaning no more multi-year waits between announcement and on-sale.... if so it's a definite improvement overall.

I think the fact they've already got massive backlog demand on existing products with crazy high margins, and a mountain of cash in the bank, gives them easy opportunity to do this as they no longer need flashy new intros way ahead of being ready.

AFAIK the only requirement is they think it more likely than not they will remain profitable going forward.

Which seems pretty darn likely to everyone but Gordon.

See, NYC has insane cost to owning your own car. And fantastic public transit that nearly always gets you there significantly faster. Plus a ton of cabs and ubers if you really want to be in a car.

And yet nearly 50% of the population own at least 1 car.

So this has me with a lot of trouble buying the idea 9 out of 10 folks in all the other places it's much easier and cheaper to own your own car will just stop owning cars nationwide with robotaxis.

The only thing on your list I find likely is a fair # of 2-3 car households might drop down to 1 or 2 (depending on needs and household size)

I certainly expect RTs, once common, safe, and easily available everywhere, to replace individually owned cars better than 1:1, but find all these 5:1 or 10:1 ratios pretty unrealistic...

Really? After that earnings call we're STILL on the "ELON IS SANDBAGGING STUFF" theme?

What, that folks have claimed he was sandbagging on in the last 2 years turned out to be right?

Not Austin opening, not Berlin opening, not 4680 in production, not cybertruck production, not 25k car intro, not S/X refresh, not FSD wide rollout... so what?

Is it nothing? Because I'm pretty sure it's nothing.

Elon himself has told us he generally means exactly what he says-

Yet folks keep insisting OMG 69 degree people chess secret sandbag messages!

Can't second @Knightshade point here enough. New Yorkers still own cars! In spite of the incredible cost of keeping a car in NYC and not just the alternative transport options. I think robotaxi business case is far overblown. I've tried to envision who could reliably use it and I can't get to much vehicle replacement; instead I see it replacing Uber and some commuting. A 2 hour commute in a robotaxi is still a 2 hour commute but if metro has an incident I could see people paying for that. Uber is used by travelers and single people out drinking (and increasingly for takeout). If you pull those 2 data points you will capture the majority of Uber rides. People don't use Uber to commute to work unless they are desperate. My wife just left for work, she has 3 bags. She'll leave 1 in the car. She drops son off for high school. She goes to an office where she is thinking about a new PT job and doing a trial. She'll do 2-3 errands. She'll go grocery shopping, then she'll go pick him up at 5 and head home. That's just a very normal sort of day for a parent. Are you going to pick a child up and go grocery shopping and bring your bags and briefcase and thermos in and out of 5 robotaxi's ? Don't think so.

Uber lost 6.7 billion. Lost 6.7 billion. How they have a market cap is beyond me. Cumulative net losses at Uber have to exceed the market cap of 4xbillion. Why do you put a lot of value in a model that is going to disrupt that market? The market cap has fallen by 50% over the last couple of years. Covid. Uber responded by getting into catering, delivery in general, etc. They have a great database on when and where people want rides. That's valuable but so far the rides aren't. Revenues of 11 billion and loss of 6.7. I don't care if all the losses are drivers salary that still only 11 billion in revenue. That's not the business case that carries Tesla into 2030. Even if they can double revenue that leaves a gulf between Ark's numbers on robotaxi and 22 billion in revenue. I don't see the replacement of vehicles. In fact... I see the opposite. I could see a parent sending a older kid to school on a robotaxi and having a more leisurely morning. Less car utilization and more cars. By 2025 if Tesla can't sell people EVs someone else can. It's the next 3 years where Tesla is uniquely advantaged and punting the future after that to FSD was not reassuring to me.

"They" desperately want to keep TSLA below $900. We often see these types of games with TSLA after earnings. As others have pointed out, it can take a couple or a few days for the market to digest the TSLA earnings. What the reality might be is that is takes a couple or a few days for the MMs to unwind their bad positions.

Whatever, I am glad for the dip, bought 20 more shares.

It probably doesn't help that a lot of bullish short term bets are being unwound. Such is life with the stock with the biggest option market, by far. It should settle down in the next few hours or days, macros permitting.

When you tell the world you will not make a cheaper product and that you're going to start playing with robots instead of making cars....What is happening?

I thought it was going up 5% this morning

The Accountant

Active Member

Long-time lurker, first time poster in this specific forum. I studied economics in college, have worked in the automotive aftermarket for over 20 years now, and have a fair amount of experience in small-scale manufacturing/production. I have been a cars and racing guy most of my life, and have also always been fascinated by technology (my brother and I were weened on Atari 2600 Combat and Pitfall!). I have been following Tesla since they started stuffing batteries into the Lotus Elise, and I've been a Tesla investor since 2018. Immediately after I drove a friend's Model 3 for the first time I was confident the entire auto industry was about to completely change. My friend also said to me at the time, "I've never even really liked cars, but this thing is awesome. My dad and I both ordered one. He bought his just to show the technology off to his friends." It was at that point that I invested a small chunk of change in Tesla stock. My only regret is that I didn't initially buy more (join the club, right?)!I fortunately bought the big Covid dip of early 2020 much more heavily.

First, I wanted to say thank you to all the long-time posters here. I have thoroughly enjoyed following along, have learned a lot, and have made some nice money as a result of my time invested here. Thank you very much for your continued insights and for supporting each other!

I'm not sure why, but I finally felt compelled to finally chime in on a few topics after yesterday's EC.

Large-scale production- I have friends and coworkers who are convinced that car company XYZ (insert your flavor of the day) will quickly catch up or surpass Tesla sales with their version of an EV. I feel like Elon tackles this subject every time he speaks, but it just doesn't seem to sink in for many people. Manufacturing things is difficult, particularly complex things. Building an efficient machine that 'builds the machine' on a grand scale is a painstaking and time-consuming process. I see Tesla as being incredibly far out in front of everyone in this regard and I think much of that lead starts with the thinking from the top down. I about spit out my drink last night when I heard the mgmt. team's reaction to the financial analyst who asked about R&D and incubators. The one gent (can't remember name) was incredulous and even dropped an F-bomb. To him it was so incredibly obvious how wrong that way of thinking was about what they are trying to achieve. They were all like, "What is this guy even talking about?" Everything on that whole segment of the call about embedding mgmt. into the production process spoke of how these Tesla factories are completely rewriting the rules of manufacturing on a grand scale. To me, this hearkens back to the industrial revolution...a clean-sheet way of doing things without the constraints of the old ways. That is a fundamentally different environment for innovation, and these guys are establishing a new benchmark for output. That doesn't even take into account the fact that these groundbreaking production facilities are being built in less time than it takes the average contractor to build a new home. It makes my brain hurt just thinking about that fact. Unless the traditional auto manufacturers are setting aside much or most of what they've done or learned in the past about how to operate, they will never again achieve a leadership role in the auto industry.

Priorities and foundations- I'm sure the internet will be rife today with complaints about no new Tesla vehicles in 2022. I think that is an incredibly short-sighted view. Refining and pushing production of their already successful products through the roof is going to build the foundation for the next wave of incredible products. This is just a phase of a much greater cycle that must occur to provide the required foundation. It reminds me of the laser focus on the Model 3 when it was released. Getting past that hurdle is what took Tesla from a boutique manufacturer of luxury cars to a mass producer. The single-minded focus to ensure the success of the Model 3 at all costs is one of the things that really drove me to invest in the company. Yes, there was still talk of all the wild innovations tumbling around in mgmt.'s heads (and there always will be because that is what excites them), but at the end of the day it was all about checking off bullets on the Model 3 checklist to get from point A to point B. That's what we're seeing again in '22.

Component shortages- The company I work for manufactures products composed of a single-page BOM and we have been struggling over the past year to ship them. I can't fathom what that list looks like for these cars. As mentioned on the call about seat adjusters, the tiniest widget can derail the ability to deliver a vehicle. Surpassing past shipments and those of everyone else in the industry was a monumental accomplishment for Tesla in 2021. These component shortages strain and stress every fiber of the organization, particularly the employees. Having a line of people many thousands deep who are screaming, "Where's my *sugar* I ordered?!?" can be detrimental to the collective mental health. In manufacturing, 2021 was the equivalent of making the Tesla team 'battle-hardened'. I believe they are going to come out the other side much stronger and shred all expectations when the shackles of supply constraints slip partially or completely from their wrists.

Dojo- I've already seen some comments from the public about how Dojo is worthless if Telsa isn't even going to use it for FSD. Anyone thinking that way is completely missing the point. Elon's comments about Dojo last night were merely a window into how he thinks about any problem with a lack of constraints. He was simply stating that they will use the best tools to get the job at hand complete. If using GPUs allows them to solve FSD, great. Then they will use Dojo to enhance FSD if possible. Or, maybe they will use Dojo for something else. Maybe it will only be good for making lattes. Or, maybe they will build something that nobody at Tesla has even conceived yet, and whatever that 'thing' is may only be spawned from what they are going through right now. The process of development and discovery will dictate the way forward, and that is something fluid and dynamic. They will use, design, and bulid whatever tools they need to get from A to B. Dojo is just one attempt to help bridge that A-to-B span. It could prove to be worthless or priceless. They just won't know until they know, and Elon was simply recognizing that fact in his typically matter-of-fact way.

Overall, I am more bullish than ever on Tesla after last night's call. This year will be a circling of the wagons and a consolidation of funds and capability. The revenue and profits generated by scaling in '22 will fund Tesla's future. Everyone wants their shiny new toy today, but chasing that path would be foolish from a business perspective. I believe the plan they laid out is the correct one. Exercising some patience now will make the company significantly more durable, which will pay them and their shareholders back in multiples in the years ahead.

For the record, I am still not a Tesla owner. Being a car nut, I've really, really wanted one for a long time. I drive my friends' Teslas and we've had a bunch of them come through our business. They perpetually impress me. I decided early on however that I would put any available Tesla car money into Tesla stock instead. The current apple of my eye would be a revised Model Y Performance from Austin (white paint over white interior if anyone is dying to gift me one). With Austin going into full swing soon, being patient seems to become more challenging by the day!

Thanks for reading my musings.

Wow . . just Wow

I was about to post my thoughts on the Earnings Call but this trumps every thought I had.

Why the hell have you been lurking for so long? This post was great. Please post more.

TheTalkingMule

Distributed Energy Enthusiast

Way to much volume. Whoever wants us closing below 900 tomorrow is about to get steamrolled.

Trying to convert shares to LEAPs in my IRA and running into "margin" issues with Fidelity saying my shares are all locked into sold LEAP. They ain't! grrrrrrrr!

Trying to convert shares to LEAPs in my IRA and running into "margin" issues with Fidelity saying my shares are all locked into sold LEAP. They ain't! grrrrrrrr!

Grabbed 50 shares and a decent chunk of Jan 23 puts on F and GM this morning. They are up. They should not be.

I haven't been this concentrated in Tesla since 2020.

I haven't been this concentrated in Tesla since 2020.

First thanks for all the contributors in this thread, Your insights are awesome.

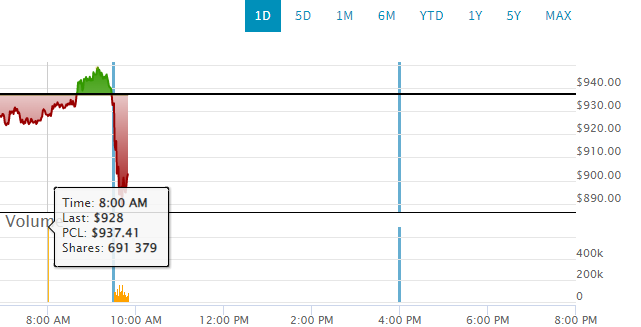

Second, anyone noticed the huge premarket ticker entry of almost 700k shares? That's6.5 0.65 Billion $

I'm annoyed when the volume chart is messed up like that. But someone was on a huge fishing trip in the

darkpools.

Any Insights?

edit: decimal error in multiplication happens even to an engineer

Second, anyone noticed the huge premarket ticker entry of almost 700k shares? That's

I'm annoyed when the volume chart is messed up like that. But someone was on a huge fishing trip in the

darkpools.

Any Insights?

edit: decimal error in multiplication happens even to an engineer

Last edited:

Man I am soooo tempted to give some 2/4 calls a twirl.

And I did...drug addict that I am 1015 calls for 2/4

edit 2...which now look like a disaster.

And I did...drug addict that I am 1015 calls for 2/4

edit 2...which now look like a disaster.

Last edited:

I think we trained the market to respond to Tesla growth as a matter of how many car models or factories. Now to learn that they can hit 50% growth with fewer factories, that's interesting. It potentially describes overcapacity despite those killer margins.

Meanwhile, FSD is the push because the ramp is happening too fast before FSD is ready. Tesla vehicles are underutilized until FSD with Robotaxi takes hold - this is necessary for the mission. So my conclusion is that FSD is late compared to factory ramps, hence the push now to solve it.

On one hand my heart sank hearing of no new vehicles this year, on the other hand I'm more bullish from an FSD future. Everything else is noise from this point on.

Meanwhile, FSD is the push because the ramp is happening too fast before FSD is ready. Tesla vehicles are underutilized until FSD with Robotaxi takes hold - this is necessary for the mission. So my conclusion is that FSD is late compared to factory ramps, hence the push now to solve it.

On one hand my heart sank hearing of no new vehicles this year, on the other hand I'm more bullish from an FSD future. Everything else is noise from this point on.

thx1139

Active Member

Components shortages are very very real, my wife does IT sales which has been mostly application development and infrastructure work. Few years back her firm was acquired by a audio visual company. With that came a line of work to do conference and team room installation of av equipment and with the pandemic and her Microsoft 365 and Microsoft Teams room sales knowledge the business has been booming. Companies like Crestron that supply some of the components and some of the companies that sell industrial large scale flat screens are pushing them out to 6 month waits for equipment because of chip shortages. Her customers dont like to hear this, especially since the 6 months dont start until they sign contracts and purchasing organizations in many companies she deals with are total pains that love to slow down the contract process. Managers get angry with her when their purchasing departments drag there feet.Component shortages- The company I work for manufactures products composed of a single-page BOM and we have been struggling over the past year to ship them. I can't fathom what that list looks like for these cars. As mentioned on the call about seat adjusters, the tiniest widget can derail the ability to deliver a vehicle. Surpassing past shipments and those of everyone else in the industry was a monumental accomplishment for Tesla in 2021. These component shortages strain and stress every fiber of the organization, particularly the employees. Having a line of people many thousands deep who are screaming, "Where's my *sugar* I ordered?!?" can be detrimental to the collective mental health. In manufacturing, 2021 was the equivalent of making the Tesla team 'battle-hardened'. I believe they are going to come out the other side much stronger and shred all expectations when the shackles of supply constraints slip partially or completely from their wrists.

No they are not. *sugar*. The point of Tesla is to exchange 1 EV to 1 gas car, to switch to sustainable energy. FSD was an after thought. It's a top layer of cake that doesn't need to be there. Making EVs and getting gas cars off the road has been working just fine.Tesla vehicles are underutilized until FSD with Robotaxi takes hold - this is necessary for the mission.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K