Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

I disagree even though I also disagreed with the post in question. That singular post tells me all I need to know about that person, if I didn’t already, thus allowing me to properly weight or regard further posts from them. There’s value in that.This is exactly why we should not be discussing Twitter on this forum, JPR3

My guess is the board at Twitter rejects his offer. I think Elon also knows this. Maybe he's pumping the stock to exit?

My guess is the board at Twitter rejects his offer. I think Elon also knows this. Maybe he's pumping the stock to exit?

The Twitter board almost certainly needs to put this to a shareholder vote.

If they reject this offer without giving the rest of their big investors a chance to vote on this, they will likely be removed.

Lawsuits would also follow.

ZachF

Active Member

Which is odd, since conservatives are a loud minority and decreasing in numbers.

Also, this undermines goodwill with progressives. You know, the crowd that is already supporting clean energy transition.

Well, if progressivism stayed on the path it was (ie Andrew Yang) it would be, but it has morphed into this weird authoritarian wokeism that ~70% country absolutely hates. Because it’s so hostile to even minor disagreements a lot of the coastal areas are bubbles where people don’t publicly disagree, making gauging public support for some of these positions hard.

The areas of country that are run by these neo-progressives are now hemorrhaging people. The city of San Francisco for instance lost almost 7% of its population just last year, which is a number pretty much unheard of outside of war or famine.

The whole discourse is weird now…

willow_hiller

Well-Known Member

Anyone tuning in to Elon's TED talk? I think it's $25 to watch it live, but hopefully they'll post the video shortly afterwards. Head of TED is also teasing a "major surprise," but could be unrelated to Elon/Tesla:

EDIT: TED agenda says "Surprise Speaker" at the end, so that's probably all it is.

EDIT EDIT: Found the livestream link: TED2022 on Livestream

EDIT: TED agenda says "Surprise Speaker" at the end, so that's probably all it is.

EDIT EDIT: Found the livestream link: TED2022 on Livestream

Last edited:

Hell no! Anything worth doing is worth doing in excess. END of discussion!Do you oppose moderation of this thread?

insaneoctane

Well-Known Member

Interesting development. Not directly Tesla related,but the financing and CEO distraction factor certainly should put it on our RADAR as shareholders. Elon tends to play 4D chess. This latest bid for Twitter likely fits into that behavior IMO. I admit that I don't get it yet, but that happens a lot to me with Elon. I hope this is clever vs emotional, but who knows. I wouldn't assume this is left vs right...it appears to be centered around free speech and the vision Elon has for what Twitter could be. If it is 4D chess, then it's likely going to get exciting, pop some popcorn!

All of this said, even with the Shanghai shutdown, Tesla is still on the path to print more money for many more quarters to come and that hasn't changed with this announcement.

All of this said, even with the Shanghai shutdown, Tesla is still on the path to print more money for many more quarters to come and that hasn't changed with this announcement.

Well this morning sucks... first it snowed overnight (and is still snowing) and b) Tesla SP is below 1000 again. Oh yeah, Elon has offered to buy Twitter... don't see the reason would think there are better things he could do with $43 billion, but what do I know...

ZachF

Active Member

Anyone tuning in to Elon's TED talk? I think it's $25 to watch it live, but hopefully they'll post the video shortly afterwards. Head of TED is also teasing a "major surprise," but could be unrelated to Elon/Tesla:

Someday I hope the surprise is a TeslaBot doing the TED talk

Ya? What do the numbers look like for world epidemic?Well, if progressivism stayed on the path it was (ie Andrew Yang) it would be, but it has morphed into this weird authoritarian wokeism that ~70% country absolutely hates. Because it’s so hostile to even minor disagreements a lot of the coastal areas are bubbles where people don’t publicly disagree, making gauging public support for some of these positions hard.

The areas of country that are run by these neo-progressives are now hemorrhaging people. The city of San Francisco for instance lost almost 7% of its population just last year, which is a number pretty much unheard of outside of war or famine.

The whole discourse is weird now…

CLK350

Member

The thread has been inundated with opinions that are not well informed at all IMHO. Has everyone here even read Elon's 2015 autobiography and watched Third Row Tesla's 2020 interview ? Great to get a better feel for what / who Elon Musk is. He hinks from first principles and doesn't back down from a fight. Longstanding fight for Tesla has been vs the entrenched Financial interests, and their oil & gas investments, even if they are suicidal in the long term. Current fight is with the SEC, proxy for Wall Street interests the SEC is supposed to regulate but instead has been captured. *

Posting this as another noteworthy point: it is not like Elon hasn't thought this outlong time ago, possibly back in Fall of last year when Jack Dorsey left as CEO of Twitter to engage fully into Square aka Block. Remember, Elon and Jack are on friendly terms (so there goes 5% on Elon's side, in addition to Oracle's Larry Ellison $15B worth of TSLA, who know how much of TWTR ..) My previous post. unearthed here for convenience

teslamotorsclub.com

teslamotorsclub.com

And what may not have been noted yet: Elon Musk will be talking on TEDx in about 3 hours from now ... then the Earnings Call next week 4/22 will both give extra opportunities for Elon to answer/ amplify his Twitter reform new endeavor.

TLDR; Elon doesn't back down from a fight. And he does think things through, we're just waaaay behind all the time. Mark my words and let's revisit this post same time next year.

(*) sorry no time to dig out specific posts re SEC capture by Wall Street - but see how all its leaders come from Goldman Sachs (same as the Fed's BTW)

Posting this as another noteworthy point: it is not like Elon hasn't thought this outlong time ago, possibly back in Fall of last year when Jack Dorsey left as CEO of Twitter to engage fully into Square aka Block. Remember, Elon and Jack are on friendly terms (so there goes 5% on Elon's side, in addition to Oracle's Larry Ellison $15B worth of TSLA, who know how much of TWTR ..) My previous post. unearthed here for convenience

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

As disinterested as I am in social media, if buying Twitter helps to keep Elon on an even keel, I'm all for it. His mental health and general well being are key to keeping Tesla performing well. I think he's doing it to shut down Elizabeth Warren's account...

And what may not have been noted yet: Elon Musk will be talking on TEDx in about 3 hours from now ... then the Earnings Call next week 4/22 will both give extra opportunities for Elon to answer/ amplify his Twitter reform new endeavor.

TLDR; Elon doesn't back down from a fight. And he does think things through, we're just waaaay behind all the time. Mark my words and let's revisit this post same time next year.

(*) sorry no time to dig out specific posts re SEC capture by Wall Street - but see how all its leaders come from Goldman Sachs (same as the Fed's BTW)

ZachF

Active Member

Ya? What do the numbers look like for world epidemic?

You’d have to go back like centuries to the Black Death for several percentage points of population lost in a single year IIRC.

B

betstarship

Guest

You’d have to go back like centuries to the Black Death for several percentage points of population lost in a single year IIRC.

Not just SF - NY too:

Big population drops in Los Angeles, San Francisco transforming urban California

Los Angeles lost more residents than any other county in the nation during the first year of the COVID-19 pandemic, new census data show.

ByeByeJohnny

Active Member

I'm sick and tired of anyone posting stuff like this as good thing. I don't care how smart or clever anyone is. There are always fights that are better to walk away from. For anyone. Doesn't even matter if one is correct or not. Some fights you can't win and should just walk away from.TLDR; Elon doesn't back down from a fight. And he does think things through, we're just waaaay behind all the time. Mark my words and let's revisit this post same time next year.

Now Elon might have some other motive to buy Twitter but if he thinks he can fix free speech by controlling Twitter he is in for a surprise.

The thread has been inundated with opinions that are not well informed at all IMHO. Has everyone here even read Elon's 2015 autobiography and watched Third Row Tesla's 2020 interview ? Great to get a better feel for what / who Elon Musk is. He hinks from first principles and doesn't back down from a fight. Longstanding fight for Tesla has been vs the entrenched Financial interests, and their oil & gas investments, even if they are suicidal in the long term. Current fight is with the SEC, proxy for Wall Street interests the SEC is supposed to regulate but instead has been captured. *

Posting this as another noteworthy point: it is not like Elon hasn't thought this outlong time ago, possibly back in Fall of last year when Jack Dorsey left as CEO of Twitter to engage fully into Square aka Block. Remember, Elon and Jack are on friendly terms (so there goes 5% on Elon's side, in addition to Oracle's Larry Ellison $15B worth of TSLA, who know how much of TWTR ..) My previous post. unearthed here for convenience

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

As disinterested as I am in social media, if buying Twitter helps to keep Elon on an even keel, I'm all for it. His mental health and general well being are key to keeping Tesla performing well. I think he's doing it to shut down Elizabeth Warren's account...teslamotorsclub.com

And what may not have been noted yet: Elon Musk will be talking on TEDx in about 3 hours from now ... then the Earnings Call next week 4/22 will both give extra opportunities for Elon to answer/ amplify his Twitter reform new endeavor.

TLDR; Elon doesn't back down from a fight. And he does think things through, we're just waaaay behind all the time. Mark my words and let's revisit this post same time next year.

(*) sorry no time to dig out specific posts re SEC capture by Wall Street - but see how all its leaders come from Goldman Sachs (same as the Fed's BTW)

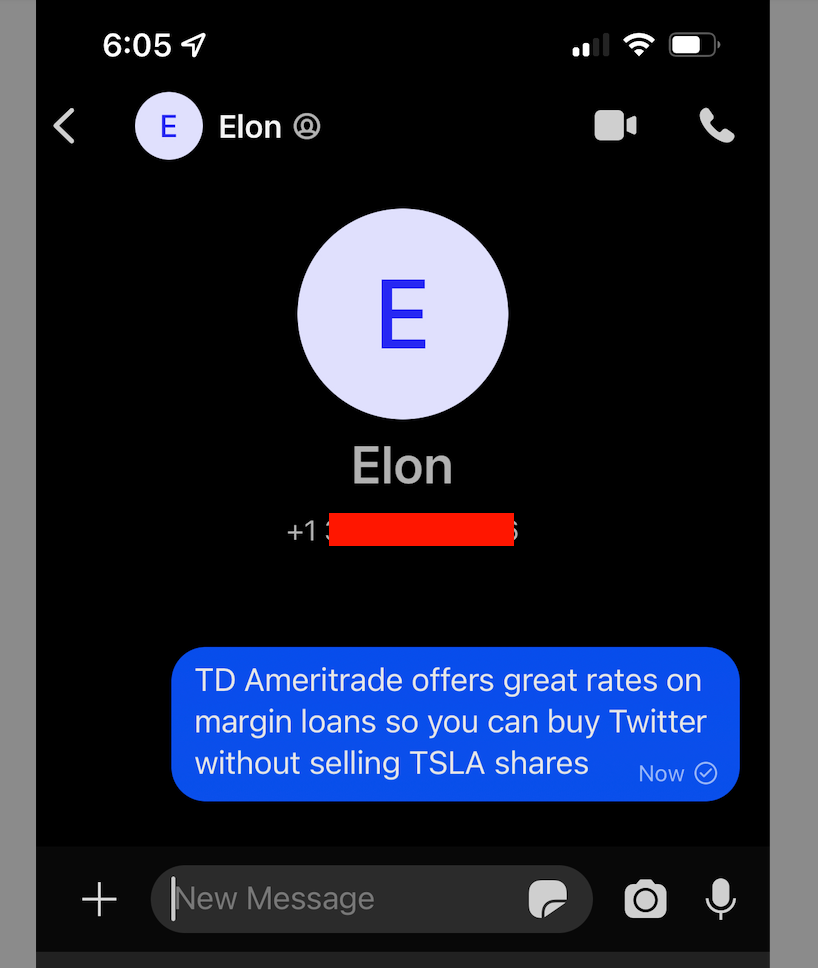

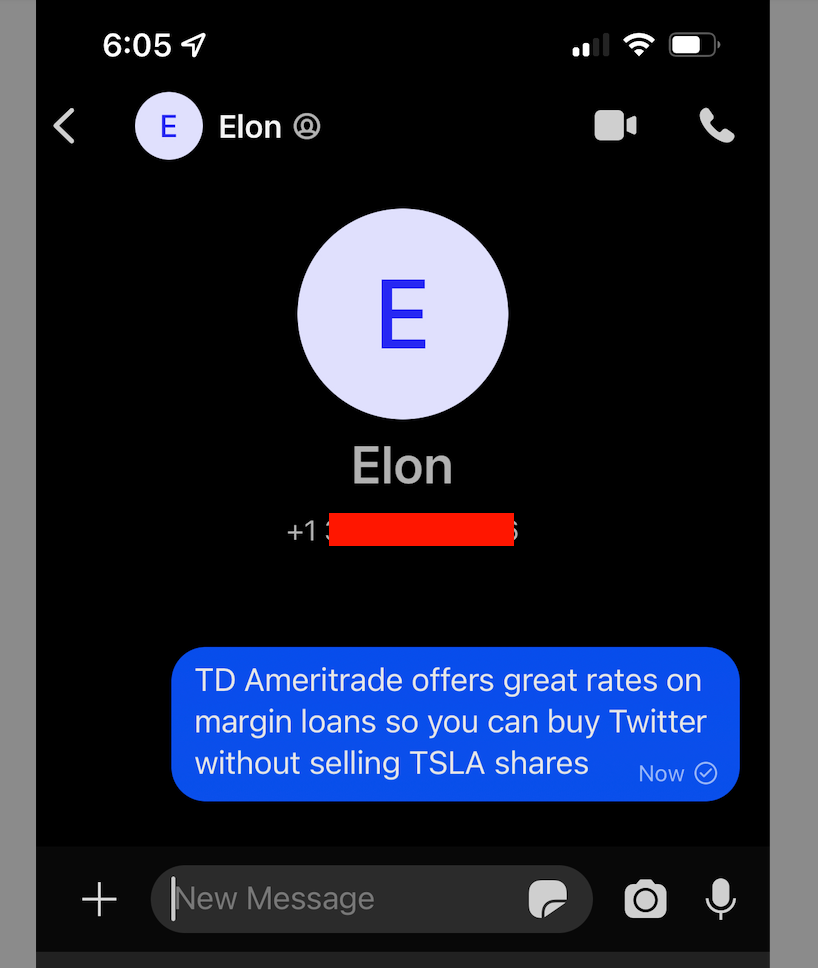

View attachment 793643

Is he even scheduled to talk at the earnings call? It was my understanding he was only one the last one for the year end aspect. I was looking forward to him getting off the calls so we can get some actual clarity on things without his meandering rants.

Regardless he should ABSOLUTELY NOT be using Tesla Earnings call to express his personal ideas for what he thinks needs to be done to a completely unrelated company. Tesla's earning calls need to be about Tesla.

There is no perfect world (and I have a hard time believing there is a majority in either extreme) but I feel it's a bit sad that I talk to people who now are willing to consider an EV, but sh*tlist Tesla because of his perceived antics. I mean, cool, there are not enough Tesla's being build to supply everyone, and Steve Jobs was an asshole too, but I always feel a bit disappointed when people settle for the lesser product to stick it to the man, whoever that might be.Well, if progressivism stayed on the path it was (ie Andrew Yang) it would be, but it has morphed into this weird authoritarian wokeism that ~70% country absolutely hates. Because it’s so hostile to even minor disagreements a lot of the coastal areas are bubbles where people don’t publicly disagree, making gauging public support for some of these positions hard.

The areas of country that are run by these neo-progressives are now hemorrhaging people. The city of San Francisco for instance lost almost 7% of its population just last year, which is a number pretty much unheard of outside of war or famine.

The whole discourse is weird now…

A competing system could be built for less than $10M. Elon has enough star power that he would only need to announce the new system and the free speech principles to launch it. Within a day it would have millions of users. Within a year it would pass twitter.

AOL Instant Messenger grew quite quickly despite ICQ already having an established base. Same with Yahoo Messenger, same with Skype. People want a better platform and Elon could go that route for far less cost than buying twitter.

I don't think twitter is worth $1B but it's Elons money and he should do whatever he wants with it.

That would make this Twitter takeover gambit, assuming it will deliberately fail, rather a master stroke in gaining publicity for his own platform.

scubastevo80

Member

When are we going to get an Elonshire Hathaway holding company we can invest into - batteries, transportation, utility, AI, robotics, insurance, space exploration, internet, social media. Analysts wouldn’t be able to value but I believe this would be the investment opportunity of a lifetime.

Conglomerates are a fad that passed decades ago, for good and proper reasons (the whole is less than the sum of its parts). Most fads are best left in the past.When are we going to get an Elonshire Hathaway holding company we can invest into - batteries, transportation, utility, AI, robotics, insurance, space exploration, internet, social media. Analysts wouldn’t be able to value but I believe this would be the investment opportunity of a lifetime.

You could argue that Tesla insurance will create a great deal of float that could be used to fund the new ventures of Elonshire Hathaway, but I don't think that would be for the best. It's unnecessarily complicated.

ZachF

Active Member

Not just SF - NY too:

Big population drops in Los Angeles, San Francisco transforming urban California

Los Angeles lost more residents than any other county in the nation during the first year of the COVID-19 pandemic, new census data show.www.latimes.com

NY, LA, Chicago, SF, Boston and Seattle metro areas are all shrinking now. 5 years ago Seattle was one of the fastest growing urban agglomerations out there. SF metro area shrank 2.6% and the city itself shrank almost 7%.

Texas, Florida, Utah, Idaho, and Tennessee are growing 2-3% per year now.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K