Maybe there's a 3rd option: Tesla does not get any credit, ICE manufacturers don't pay any fine, but they can't sell their ICE cars. Or in limited quantity. Tesla demand would explode, and CO2 would decrease faster.This "consumer group" got the CO2 impact totally backwards.

If Tesla does not sell carbon credits, then the polluters would have to pay fines to the government instead.

So the question is: who is more effective in using the money to reduce CO2 emissions and transition the world to sustainable energy use ?

And the answer is obvious: Tesla is far more effective!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

2daMoon

Mostly Harmless

Sneaky of you to reply to this before I realized Ogre had beat me to the PUNch and I deleted the original.Who has the time to read the crap posted on here for longer than a few seconds and, then, backtrack over many years to resurface it again? It's a TSLA fan site, super small inkling of the Internet

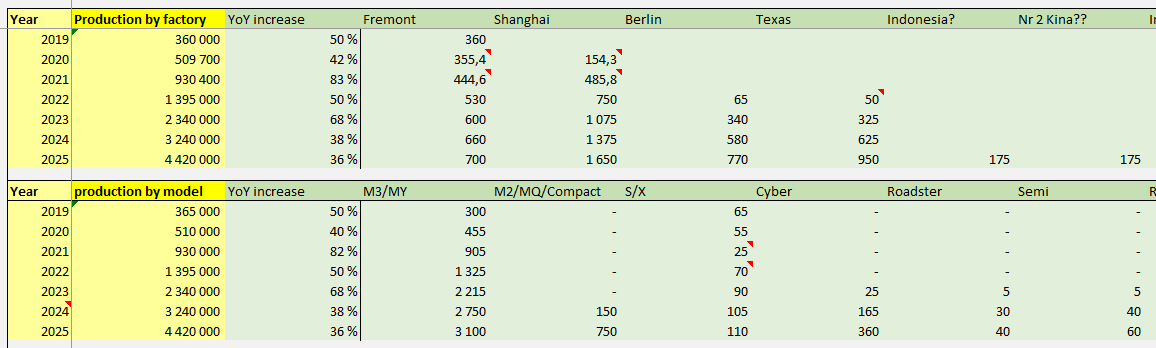

I have an epiphany that actually Mary leads, in 2025. Here's the math:View attachment 829789

The AP Interview: GM's Barra talks electric vehicles, future

General Motors CEO Mary Barra outlined an ambitious plan for her company to sell more electric vehicles in the U.S. than Tesla by the middle of this decade.apnews.com

TL: DR

You led Mary...You led

View attachment 829790

2022 H1 (Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable):

GM 1,087,615 -17.8% from 2021

Tesla 228,700 +47.4% from 2021, ~98% from Fremont factory

2025:

GM: 1.5 million

GM has the excuse of chip shortage for sales decline since 2020, but the decline started at least from 2016, per Statista (graph below). By this time of next year, it will be clear that the decline continues and its EVs sales won't be able to reverse that

Tesla: >0.5 million from Fremont, 1 million from Giga Texas, >1.5 million total. Giga Shanghai will easily produce more than 1 million next year, in its 4th year of production; from the scale of Giga Texas and what's already completed, Giga Texas will at least match that by year 4 (2025), and majority of its production will be sold domestically, as Giga Shanghai takes care of China and most of Asia and Giga Berlin takes care of Europe, etc.

So there you have it: in 2025, Tesla sales more than GM in the US, EVs or not. Remember: Mary leads = Tesla sales more than GM, Q.E.D.

Bonus: when that day arrives (Tesla becomes unequivocally #1 automaker in production and sales and every meaningful metric), $TSLA will be added to the symbolic, meaningless Dow Jones Industrial Average.

UP 8.61% AHEveryone ready for Netflix......the all mighty bellwether for how well the entire economy is doing.......to tank the stock market????

.............

- EPS: $3.20 vs $2.94 per share, according to Refinitiv.

- Revenue: $7.97 billion, vs. $8.035 billion, according to Refinitiv survey.

- Global paid net subscriber additions: A loss of 970,00 subscribers vs. expectations of a loss of 2 million, according to StreetAccount estimates.

Strong signal that bottom was in and bears are getting trapped for those who watch TA. Like I said, Tslq ETF came out exactly on the day when the market gave the strongest bull signal.UP 8.61% AH

- EPS: $3.20 vs $2.94 per share, according to Refinitiv.

- Revenue: $7.97 billion, vs. $8.035 billion, according to Refinitiv survey.

- Global paid net subscriber additions: A loss of 970,00 subscribers vs. expectations of a loss of 2 million, according to StreetAccount estimates.

What's to stop someone from buying shares, getting verified, and then selling them immediately? Seems too easy to game for there to be any huge benefit.

Kenypowa

Member

UP 8.61% AH

- EPS: $3.20 vs $2.94 per share, according to Refinitiv.

- Revenue: $7.97 billion, vs. $8.035 billion, according to Refinitiv survey.

- Global paid net subscriber additions: A loss of 970,00 subscribers vs. expectations of a loss of 2 million, according to StreetAccount estimates.

And NFLX Q3 new sub outlook is worse than expected. I guess NFLX has been hammered so much that the worst may be in the past.

I had to link via Plaid so it would be a rolling verification, not a 1-time thing.What's to stop someone from buying shares, getting verified, and then selling them immediately? Seems too easy to game for there to be any huge benefit.

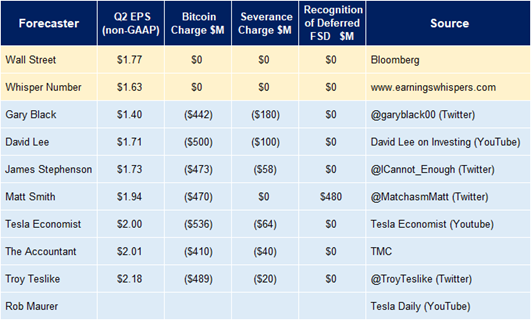

Troy's Q2 earnings forecast. Very interesting.

Through saytechnologies they'll be able to see share count and trade historyWhat's to stop someone from buying shares, getting verified, and then selling them immediately? Seems too easy to game for there to be any huge benefit.

Through saytechnologies they'll be able to see share count and trade history

Do they keep checking in every day? As @kclifton mentioned for Plaid.

I’m already hesitant about providing my info to them in the first place and I’m definitely not okay with giving constant, daily access to my account.

You may be able to limit them, but they pull that info upon registration and periodically from that point on. Skimming their website I didn't see how often they access the data.Do they keep checking in every day? As @kclifton mentioned for Plaid.

I’m already hesitant about providing my info to them in the first place and I’m definitely not okay with giving constant, daily access to my account.

PKEllefsen

Member

I'm having a hard time seeing tesla growing their deliveries by 50% in 2024. I doubt they'll manage to do so in 2025 or 2026 either unless three new factories are announced very soon. Giga Texas should in theory be slowed down a bit in 2023 by introducing 2 or 3 new models (semi might be postponed to 2024). 2023 should be an insane year though unless we have more shutdowns in china or battery shortage becomes a greater challenge.

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

Point of order-- not that these lawsuits aren't silly... but aren't the fines GREATER than the cost of buying the credits?

(if they weren't, they'd just pay the fines, instead of giving $ to a competitor after all).

Since that's the case, one could argue a cheaper option to remain in violation (buying credits instead of paying fines) slows them down in getting out of violation.

This may well be to Teslas benefit economically on many levels- but not necessarily to the mission.

I will not be capable of running at my peak potential after you shove a cattle pod up my ass. But I WILL now be running.

I'm having a hard time seeing tesla growing their deliveries by 50% in 2024. I doubt they'll manage to do so in 2025 or 2026 either unless three new factories are announced very soon. Giga Texas should in theory be slowed down a bit in 2023 by introducing 2 or 3 new models (semi might be postponed to 2024). 2023 should be an insane year though unless we have more shutdowns in china or battery shortage becomes a greater challenge.

View attachment 830309

I think all the actual factories can be expanded and output more than doubled.

The Accountant

Active Member

Now updated for Dave Lee and Troy Teslike:

Why would Semi or Cybertruck slow Austin? They are non-overlapping in terms of plant floorspace and the factory was build around multiple vehicle lines.I'm having a hard time seeing tesla growing their deliveries by 50% in 2024. I doubt they'll manage to do so in 2025 or 2026 either unless three new factories are announced very soon. Giga Texas should in theory be slowed down a bit in 2023 by introducing 2 or 3 new models (semi might be postponed to 2024). 2023 should be an insane year though unless we have more shutdowns in china or battery shortage becomes a greater challenge.

View attachment 830309

Strong signal that bottom was in and bears are getting trapped for those who watch TA. Like I said, Tslq ETF came out exactly on the day when the market gave the strongest bull signal.

As per technical analysis. We closed above 295 on QQQ and now officially in bull trend territory. Day traders who were waiting for a trend signal will now jump in. Bears will have to cover their shorts. Yesterday was a nice bear trap.

Momentum should get going after Earnings if it is not a miss. NFLX up 5% AH on the news they only lost 940k subscribers instead of 2M. WS has merciful forgiveness these days

Words of HABIT

Active Member

Bottom is in*. Still expect ATH by beginning of January '23 once P&D #s are out for Q4 '22.

Old Trend Line

New Trend Line

* me thinks

Old Trend Line

New Trend Line

* me thinks

Last edited:

Nothing.What's to stop someone from buying shares, getting verified, and then selling them immediately? Seems too easy to game for there to be any huge benefit.

Though it’s possible whatever perks they do might be done similar to the way dividends are issued. You have to be a shareholder of record on a specific date.

Doubt they would do anything which is big enough a deal that anyone would go through the headache unless they already owned shares.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K