jkirkwood001

Active Member

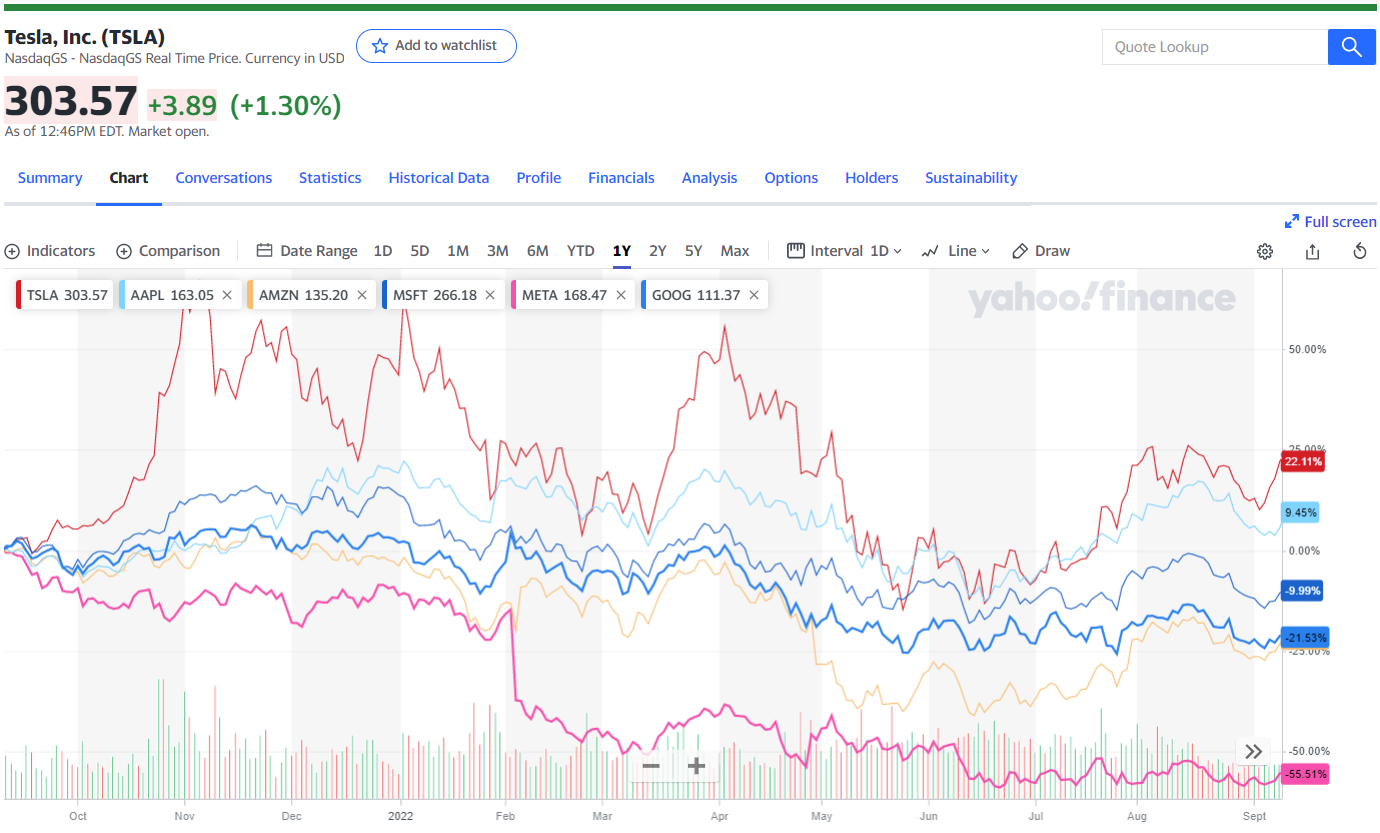

I know we feel it hasn't been a great year for TSLA. but in fact we're up 22% (nothin' to sneeze at), and TSLA is best among tech cos.:

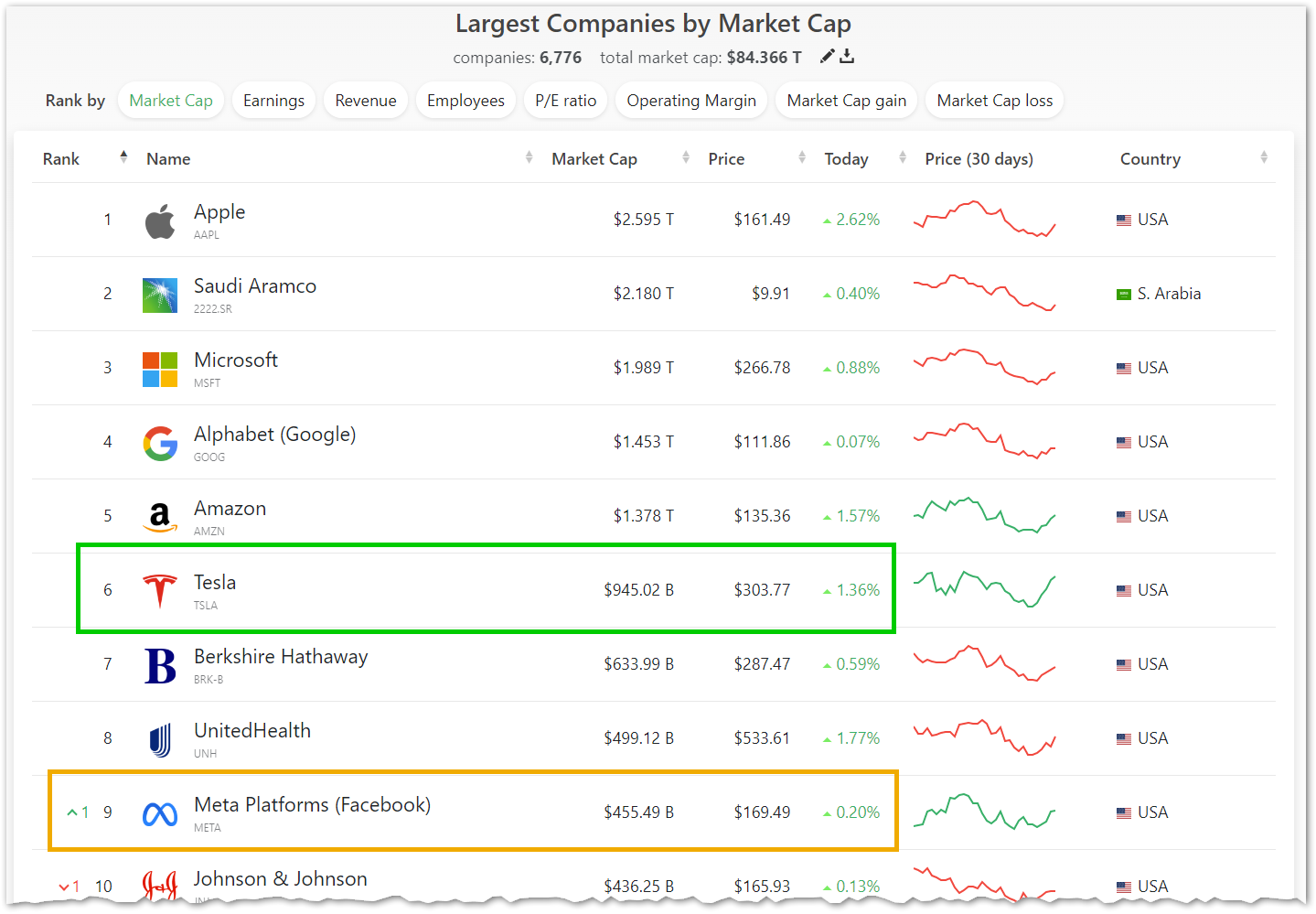

And think about all the Meta investors! TSLA is now worth more than double what used to be Facebook:

companiesmarketcap.com

companiesmarketcap.com

And think about all the Meta investors! TSLA is now worth more than double what used to be Facebook:

Companies ranked by Market Cap - CompaniesMarketCap.com

Ranking the world's top companies by market cap, market value, revenue and many more metrics

Last edited: