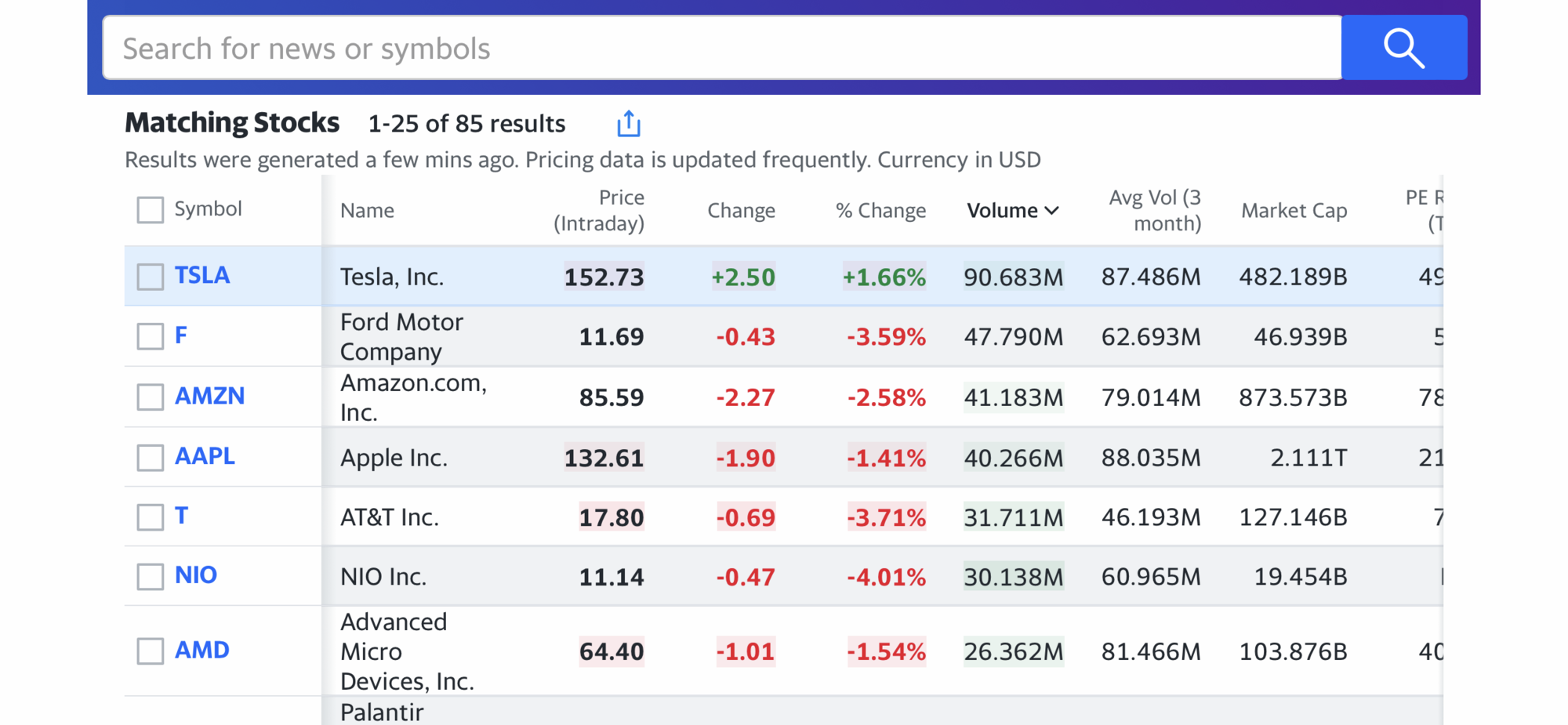

Well... averages are still all negative but TSLA handily outperforming now

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StarFoxisDown!

Well-Known Member

Every TSLA investor is so shook they won't dare call this the bottom lolThat sharp drop on heavy volume around 10:38 ET sure looks like $150 stop loss orders getting triggered.

Nice recovery in the last hour, and a big over-performance against QQQ. Wishing this isn't Lucy with the football again.

EverettRuess

Member

Bottom is in.Every TSLA investor is so shook they won't dare call this the bottom lol

StarFoxisDown!

Well-Known Member

Thanks for taking the fall when the stock drops 5% tomorrow ;PBottom is in.

In order for this to be the bottom for TSLA, it’s not enough that TSLA goes green. NASDAQ has to go green too.

In this epic struggle between market bears and bulls, strength in TSLA could drag the NASDAQ uphill, but the shorts are going to fight this to the death.

If NASDAQ ends green today, I’m calling today the bottom for TSLA and a reversal for the overall market.

In this epic struggle between market bears and bulls, strength in TSLA could drag the NASDAQ uphill, but the shorts are going to fight this to the death.

If NASDAQ ends green today, I’m calling today the bottom for TSLA and a reversal for the overall market.

Not in the UK. Only demo vehicles are discountedI haven’t seen it mentioned here but am assuming it has been discussed: Tesla is also offering €2000-4000 discounts on existing inventory in Europe

Artful Dodger

"Neko no me"

Oh thank God, there is hope of a turnaround for our stock yet!!!!

I wonder how hard the MM's will try to keep it down? Will they be happy with achieving the 150's or will they go for lower yet?

Well, hedge funds clearly wanted to trigger the stops at 150 and weren't going to be denied. Guess that makes 'Oppy' a hedge fund? Anybody know if they're allowed proprietary trading as well as rating TSLA stock?

Put options likely a big factor in the MMD this moring: tip-off is the peak right 09:45 ET when options MMs start to delta hedge for their net exposure after options contracts have traded for the first 15 min of the session:

Is anybody able to post a screenie of the intraday Options Volume chart? TIA.

TSLA rallying at bit since the bottom which occurred (suspiciously) at 11:59 a.m. with robust volume today at 83.3M shares traded by 1:00 p.m.

Cheers to the Longs!

Last edited:

EverettRuess

Member

You are welcome.Thanks for taking the fall when the stock drops 5% tomorrow ;P

ElectricIAC

Good-Natured Rascal

I miss the days of $15-25K discounts on demo cars.Not in the UK. Only demo vehicles are discounted

TrendTrader007

Active Member

Last time bears and shorts attempted to decimate Tesla between 2018 through 2019 it eventually cost them billions

this time around after making billions off shorting and manipulating Tesla stock between November 2021 through present day, probability favors bears and shorts losing to tune of trillions over next several years

i got my own strategy to take money from shorts over next several years and it will cost them

a lot

this time around after making billions off shorting and manipulating Tesla stock between November 2021 through present day, probability favors bears and shorts losing to tune of trillions over next several years

i got my own strategy to take money from shorts over next several years and it will cost them

a lot

Interesting outperformance compared to F and NIO - these are the most active stocks right now.

finance.yahoo.com

finance.yahoo.com

Most Active Stocks Today - Yahoo Finance

See the list of the most active stocks today, including share price change and percentage, trading volume, intraday highs and lows, and day charts.

Skryll

Active Member

accumulate and HODL is the only thing that comes to my mind. margin, options all those fun tools of 2015-2021 have only hurt me for the last 12 months, and could easily longer...Last time bears and shorts attempted to decimate Tesla between 2018 through 2019 it eventually cost them billions

this time around after making billions off shorting and manipulating Tesla stock between November 2021 through present day, probability favors bears and shorts losing to tune of trillions over next several years

i got my own strategy to take money from shorts over next several years and it will cost them

a lot

StarFoxisDown!

Well-Known Member

TSLA can absolutely bottom before the macro's bottom. If the stock could break solidly above the high it set this morning on strong 2nd half of day volume, it would certainly suggest a bottom with a strong intraday reversal.In order for this to be the bottom for TSLA, it’s not enough that TSLA goes green. NASDAQ has to go green too.

In this epic struggle between market bears and bulls, strength in TSLA could drag the NASDAQ uphill, but the shorts are going to fight this to the death.

If NASDAQ ends green today, I’m calling today the bottom for TSLA and a reversal for the overall market.

But we've seen plenty of these head fakes over the past few weeks so who knows really. Idk, I still feel like hedge funds want this to close under 150 for at least a couple days so hard for me to see this being the bottom.

Explain DCA to her

the more you buy, the less costly overall it is

Commercial Clean Vehicle Credit does not appear to require North American final assembly (by reference, NA requirement is (G)).Helpful. Are the materials/parts sourcing and assembly criteria different from the other vehicle credit?

c) QUALIFIED COMMERCIAL CLEAN VEHICLE.—For purposes of this section, the term ‘qualified commercial clean vehicle’ means any vehicle which— ‘‘(1) meets the requirements of section 30D(d)(1)(C) and is acquired for use or lease by the taxpayer and not for resale, ‘‘

(2) either— ‘‘(A) meets the requirements of subparagraph (D) of section 30D(d)(1) and is manufactured primarily for use on public streets, roads, and highways (not including a vehicle operated exclusively on a rail or rails), or

(C)

which is made by a qualified manufacturer,

(D)

which is treated as a motor vehicle for purposes of title II of the Clean Air Act,

MountainRatMat

Member

You also have to consider that the COGS (Cost of Goods Sold) is decreasing because Texas and Berlin are ramping up. Economies of scale will be realized at those two factories where they used to be cash incinerators as the factories were being built with little to no output.So the $3750 discount only applies to December deliveries in the United States. Expected that Fremont produced about 110K 3s and Ys. Texas an additional 30K Model Ys. So if lets say 60% of those were sold in October and November. That leaves about 56K that could have gotten the $3750 credit. That would be a hit of $210M. if 430K deliveries this would be about a $450 per delivered car hit. Also this mix will be the highest price that these cars have been since nearly all of the cars ordered at lower prices were previously delivered.

This might be offset by inflationary pressure but there are so many factors that go in to this calculation that we can only guestimate until the true numbers are released.

Stretch2727

Engineer and Car Nut

There are no material/assembly criteria. This is why some automakers are hoping they can use this as a loophole around the requirement. One article I quickly found.Helpful. Are the materials/parts sourcing and assembly criteria different from the other vehicle credit?

Automakers, South Korea urge US to tap commercial electric vehicle tax credit

Many automakers and the South Korean government are urging the Biden administration to tap a commercial electric vehicle tax credit to boost consumer EV

There was another article where Manchin quoted as having a big issue if the administration allows this as it was not the intent of the bill.

Found right from the source.

Last edited:

I have thought a lot about this. I think that $TSLA brand destruction and Tesla brand destruction are very different topics that just happen to rhyme.IMO it's not his behavior, it's the fears that he is destroying demand. If he keeps up the act but sales continue to rise in the next few quarters that concern will fall away.

In my work I’m surrounded by people of all political associations and the firehouse table is a forum where few topics are off limits; unsurprisingly the Musk saga is very popular of late. My experience in discussions with my colleagues has been very different from TMC. Reactions have actually been quite positive and fits their understanding of EM as a disruptor that DGAF. No cancellations; but firemen are also cheap, so many now waiting for that sweet IRA govt. cheese in ‘23.

I’ll admit as a $TSLA investor I have been doubting some of my convictions due to recent antics and acquisitions; I believe that to conflate consumer demand for Tesla products with investor demand for TSLA shares is narrow sighted…and smells like opportunity.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M