Of course I bought in the crack. Typical.Not entirely sure what a double bottom is but I reckon we are about to see a double buttock rn.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StarFoxisDown!

Well-Known Member

Actually, we do know parts of COGS are going down for Tesla and we especially know that as volume is increased, fixed costs at each factory are spread out over more vehicles, dramatically increasing gross margins from each factory. It's like you refuse to acknowledge the basic fundamentals of increasing manufacturing volume.Many of these factors are also largely unknown to us and likely everyone but the skilled procurement people who work directly in this industry -- we have no idea what procurement contracts might look like for the raw materials going into the vehicles and their timeframes, pricing, how new contracts might have been written during the recent commodity spike, etc. Lithium prices are still sky high, Nickel has come down from the highs and joined Cobalt / Aluminum / Steel in moderating but still being historically very high

Copper prices are still way up there

With every 25% increase in weekly volume rate out of Berlin/Austin, gross margins from those factories increase exponentially.

FSDtester#1

Craves Electrolytes

I saw a double bottom this weekend. My niece was changing her twins.Not entirely sure what a double bottom is but I reckon we are about to see a double buttock.

@ThisStockGood. ... that joke was for you! I think it fits your humor!

All of that was already in the post I quoted, I'm extrapolating on the inflationary pressures mentioned after going over the benefits of ramping productionActually, we do know parts of COGS are going down for Tesla and we especially know that as volume is increased, fixed costs at each factory are spread out over more vehicles, dramatically increasing gross margins from each factory. It's like you refuse to acknowledge the basic fundamentals of increasing manufacturing volume.

With every 25% increase in weekly volume rate out of Berlin/Austin, gross margins from those factories increase exponentially.

Buckminster

Well-Known Member

Possible unpopular idea. Would it be possible to reply to my ignore list on a different thread. I do it all the time.

- Quote the message

- Open other thread (I use two tabs with one permanently on this thread) - this would work; Help Fight the FUD

- Insert quote

thx1139

Active Member

Because cars delivered in January instead of December is only an issue for Wall Street, not for government or Tesla. What happens if during earnings call Tesla says all the excess inventory going into 2023 in the United States sold out before the earnings call?The US IRA certainly is creating softness in US deliveries for Tesla in December. If the goal of the subsidy is to promote and sell more EVs then why wouldn't eligibility be from the bill passage date vs January of the next year? Seems obvious that it might slam the brakes on US EV sales, counter to what the bill promotes?

From what I can tell, US inventory is pretty constant vs what it was several weeks ago. About 1500 new.Same in the Netherlands. Total inventory is just three MY’s, all ex demo.

Discounts range from 1K to 2K depending on mileage.

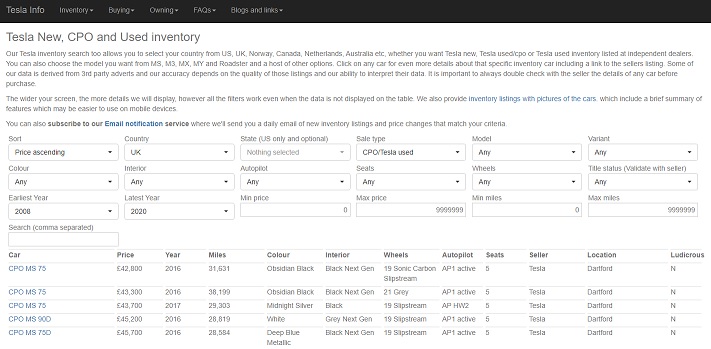

Tesla United States New inventory

Tesla United States inventory including new and used

300 or so CPOs, lots of those are SRs with lowish miles. That's a lot of car for 35k.

But why? Life's too short.Possible unpopular idea. Would it be possible to reply to my ignore list on a different thread. I do it all the time.

- Quote the message

- Open other thread (I use two tabs with one permanently on this thread) - this would work; Help Fight the FUD

- Insert quote

Again, very helpful. I doubt that the administration would want to read this broadly, as it would defeat the purpose of the law. But you never know. There is a lot of lobbying and negotiations on this score. I would imagine that the the foreign policy establishment is supportive of the broadest reading.Commercial Clean Vehicle Credit does not appear to require North American final assembly (by reference, NA requirement is (G)).

If read broadly, this could modify Tesla's approach somewhat.

Buckminster

Well-Known Member

Pertinent threads of the day:

Who will be the new TWTR CEO?

Analyst TSLA Price Targets

Gigafactory locations and products - Mexico imminent?

EV and Battery Credits - IRA starting in <2 weeks

TSLA buyback

FSD discussion - V11 rolling out to Beta this week

P/E ratio - future TSLA valuations - how low can it go

H/W 4.0 discussion (investors) - Radar etc. coming in ~4 weeks?

The demise of the OEMs - Elon called their pending bankruptcy a couple of days ago

Who will be the new TWTR CEO?

Analyst TSLA Price Targets

Gigafactory locations and products - Mexico imminent?

EV and Battery Credits - IRA starting in <2 weeks

TSLA buyback

FSD discussion - V11 rolling out to Beta this week

P/E ratio - future TSLA valuations - how low can it go

H/W 4.0 discussion (investors) - Radar etc. coming in ~4 weeks?

The demise of the OEMs - Elon called their pending bankruptcy a couple of days ago

StarFoxisDown!

Well-Known Member

Ok.....but again, we know some of the COGS are already dropping. Steel prices are lower than they were in this time in 2020. Price of aluminum has dropped 50% since March 2021. Copper is practically the same price as it was in late Dec 2020. As far as I'm aware, Tesla doesn't have long term contracts for these commodities, they just have long term contracts on Lithium.All of that was already in the post I quoted, I'm extrapolating on the inflationary pressures mentioned after going over the benefits of ramping production

So Tesla has already taken the hit from these commodity price increase and will these headwinds will turn into tailwinds as these commodity prices drop further. Whenever the contract on Lithium expires, Tesla will have the benefits from the IRA, which will drastically offset the new price of Lithium that they'll pay.

Meanwhile, we know that worldwide, economies are about to go through a softening or even a recession, which means the cost of all of the commodities listed above with the exception of Lithium (due to EV adoption) will continue to drop. This isn't even taking into account the drop in shipping costs, which has plummeted and will plummet even more if the auto industry goes into a contraction (the ICE part).

Last edited:

Buckminster

Well-Known Member

Do I need to setup a "Gary Black STFU" thread? He creates the "Twitter overhang" overhang and then swaps it for something else.

ElectricIAC

Good-Natured Rascal

Just tweet @ EM to ban them.Do I need to setup a "Gary Black STFU" thread? He creates the "Twitter overhang" overhang and then swaps it for something else.

JRP3

Hyperactive Member

Ross Gerber was on Yahoo Finance talking about his bid for a board seat and how he would try to get the board to be more active.

So they'll get on the line and build cars?Ross Gerber was on Yahoo Finance talking about his bid for a board seat and how he would try to get the board to be more active.

ElectricIAC

Good-Natured Rascal

FSD test dummies.So they'll get on the line and build cars?

Artful Dodger

"Neko no me"

That sharp drop on heavy volume around 10:38 ET sure looks like $150 stop loss orders getting triggered.

Nice recovery in the last hour, and a big over-performance against QQQ. Wishing this isn't Lucy with the football again.

NASDAQ reported the 10:36 minute with 784k volume: (yup, triggering the stops)

But it was transient. There's too much buying interest at these prices to hold it down long. Right now, shortzes are tryin' hard to cap the day at 150 again to avoid any possible momo.

Cheers!

Ross Gerber was on Yahoo Finance talking about his bid for a board seat and how he would try to get the board to be more active.

Does this imply that Sen. Warren is a TSLA shareholder?

U.S. Senator Warren questions Tesla board oversight of Musk purchase of Twitter

Artful Dodger

"Neko no me"

Nominated for "Moderators' Choice: Posts of Particular Merit". Thank-you. Sincerely.

Both are going on right now. We know rates are increasing and QT is continuing - which should be driving real deflation. Most of this is just a Fed decision though, it can stop as quickly as it started.This sounds like the classic definition of deflation.

The stock market is forward looking, the economy could be in for a rough ride if the stock market is right.

The initial comment appeared to be based more on emotion about stock declines which, IMO, is related to the "capitulation" phase of the investment cycle rather than deflationary concerns.

This is against the backdrop of Tesla growing far more quickly than deflation is shrinking the economy, it's almost keeping up with asset price deflation.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M