Big Time bought shares this week in two tranches, first buy since March 2021. I think that should be a signal. If the OG poor/paper rich investors are buying than WallStreet/Troy are bozos.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

There have also been significant discounts offered on existing inventory in parts of Europe, although people in this thread said they were only seeing it on demo vehicles in their areasThe fact that they are offering a $ 5000 incentive in Canada is potential proof that they are aggressively looking to clear inventory. AFAIK there aren't any new tax rebates being offered in Canada. So maybe it's the new highland refresh or something exciting that will be announced shortly.

CYBRTRK420

Member

Used car market for Model 3s is crashing here in Germany. Not many people want the 3 anymore with the Y being so much better for just a little bit more money. Maybe they'll skip the 3 in Berlin and go directly to next gen vehicle, as hatchbacks are super popular here in Europe.We are barely even discussing a Texas/Berlin made model 3 yet, but we know it will come.

ElectricIAC

Good-Natured Rascal

So we’ve established that everyone has a price that transcends virtue signaling.I am toying with upgrading my 2020 MYLR to a '23 MYP. Demo unit with <1000 miles in SoCal is $59,040 before taxes/title/doc. Advisor I spoke with said they have been slammed since the change to $7500 happened.

Dikkie Dik

If gets hard, use hammer

although people in this thread said they were only seeing it on demo vehicles in their areas

As of today the first discounted vehicles appeared in the Netherlands FWIW, there were none before.

15 M3’s and 2 MY’s, all with an extra 3K discount and 10.000 KM free supercharging.

They’re probably non-matched vehicles still on board of the Hoegh Shanghai due today at the port of Zeebrugge.

Buckminster

Well-Known Member

Farzad said recently that we as TSLA investors are getting disrupted. Elon turning TSLA into a value stock to woo Buffett. Genius.

If you aren't paying for it - you are the product.

If you are paying for it - you are still the product.

If you aren't paying for it - you are the product.

If you are paying for it - you are still the product.

Zerosumgame says that, at scale, gross profit of 1 Megapack is 70x of a vehicle.

This reminded me to look up live registration data, looking good! New record coming up by wide margin.

@Troy is not saying demand is low. He is saying that demand is high, but production increase (China) is even higher. Not so hard to understand, is it?Demand is so low... /Troy

nativewolf

Active Member

Troy is getting attacked for telling the truth. Production will be at a record, not as much of a record as We all hoped. Everyone in the world has figured this out.

UkNorthampton

TSLA - 12+ startups in 1

Tesla Megapack demand - non-Tesla chargers in USA using Tesla Megapacks as buffer for smoother operation. Presumably this is widespread, or will need to be. IRA (inflation Reduction Act) money for non-Tesla chargers will provide some money for Tesla via storage.

Also - so many charger problems. He's almost saying he can't recommend Electric Vehicles at the moment (or he SHOULD just say only Tesla cars using Tesla charging infrastructure are ok for many people until other charging infrastructure improves).

Regarding car, he likes BMW iX, nice car, good audio, long range. adequate charging, ugly at front, few niggles, I think he said it was reasonable/good price at $113k (seems expensive to me!).

Timestamped at Megapack.

Also - so many charger problems. He's almost saying he can't recommend Electric Vehicles at the moment (or he SHOULD just say only Tesla cars using Tesla charging infrastructure are ok for many people until other charging infrastructure improves).

Regarding car, he likes BMW iX, nice car, good audio, long range. adequate charging, ugly at front, few niggles, I think he said it was reasonable/good price at $113k (seems expensive to me!).

Timestamped at Megapack.

Last edited:

EAP is the gateway drug (or discount if you prefer) to FSD revenue.If they give out EAP for free, then no one is paying for it. Assuming the underlying take rate is significant, that has a real impact on margins. Also, people who care most about EAP are already buying it so it's probably not as much of a demand lever as cold, hard cash discounts.

Just a crazy thought (or not?)

We are seeing huge oil companies (and countries) going out of most of their business in the near future because of the transition away from fossil fuel.

We all know how enormous the disruption is.

Do these companies (countries) let themselves go into oblivion just like that? Of course they have seen this coming.

One of their plans, more in plain sight, that can be seen in Europe now, is the way they are lobbying for hydrogen.

In order for them to stay in business.

So, in fossil fuel board rooms there must have been a lot of discussions with the main topic: "how do we survive this?".

In this light: how crazy is the idea that quite a few of these companies team up for a hostile takeover of Tesla?

As a part of this strategy, manipulating the decline of the price of TSLA, making use of the macroeconomic situation as a beautiful disguise?

A control of Tesla by a takeover would give them a clear and profitable path into the future, at the pace of their liking.

Maximising fossil fuel profits vs renewable profits as long as possible, controlling for a big part (Tesla) the speed of the transition.

Could they easily disguise their ownership of TSLA?

I've seen examples of competing companies illegally teaming up for official tenders for a small fraction of the money involved.

If anyone here can reason the above is a crazy thought I will be more than delighted to hear about it.

We are seeing huge oil companies (and countries) going out of most of their business in the near future because of the transition away from fossil fuel.

We all know how enormous the disruption is.

Do these companies (countries) let themselves go into oblivion just like that? Of course they have seen this coming.

One of their plans, more in plain sight, that can be seen in Europe now, is the way they are lobbying for hydrogen.

In order for them to stay in business.

So, in fossil fuel board rooms there must have been a lot of discussions with the main topic: "how do we survive this?".

In this light: how crazy is the idea that quite a few of these companies team up for a hostile takeover of Tesla?

As a part of this strategy, manipulating the decline of the price of TSLA, making use of the macroeconomic situation as a beautiful disguise?

A control of Tesla by a takeover would give them a clear and profitable path into the future, at the pace of their liking.

Maximising fossil fuel profits vs renewable profits as long as possible, controlling for a big part (Tesla) the speed of the transition.

Could they easily disguise their ownership of TSLA?

I've seen examples of competing companies illegally teaming up for official tenders for a small fraction of the money involved.

If anyone here can reason the above is a crazy thought I will be more than delighted to hear about it.

Last edited:

Hopefully there's enough momentum now, what with many governments legislating the phase-out of ICE, that transition to zero carbon transportation is inevitable. Hydrogen just fails so miserably that it's hard to see it gaining momentum, at least for road transportation: the genie of BEV is well and truly out of the bottle.Just a crazy thought (or not?)

We are seeing huge oil companies (and countries) going out of most of their business in the near future because of the transition away from fossil fuel.

We all know how enormous the disruption is.

Do these companies (countries) let themselves go into oblivion just like that? Of course they have seen this coming.

One of their plans, more in plain sight, that can be seen in Europe now, is the way they are lobbying for hydrogen.

In order for them to stay in business.

So, in fossil fuel board rooms there must have been a lot of discussions with the main topic: "how do we survive this?".

In this light: how crazy is the idea that quite a few of these companies team up for a hostile takeover of Tesla?

As a part of this, strategy manipulating the decline of the price of TSLA, making use of the macroeconomic situation as a beautiful disguise?

A control of Tesla by a takeover would give them a clear and profitable path into the future, at the pace of their liking.

Maximising fossil fuel profits vs renewable profits as long as possible, controlling for a big part (Tesla) the speed of the transition.

Could they easily disguise their ownership of TSLA?

I've seen examples of competing companies illegally teaming up for official tenders for a small fraction of the money involved.

If anyone here can reason the above is a crazy thought I will be more than delighted to hear about it.

Most aviation and long distance shipping, however, probably need synthetic fuels and the fossil majors want a slice of that action. Methanol and ammonia, though, are far superior to hydrogen, so I'm surprised they are not being pushed harder than hydrogen by the majors.

2x M3 & 2x MY in Belgium discounted, that's it... I'm not going to lose sleep over €12k (less VAT) in lost revenue!As of today the first discounted vehicles appeared in the Netherlands FWIW, there were none before.

15 M3’s and 2 MY’s, all with an extra 3K discount and 10.000 KM free supercharging.

They’re probably non-matched vehicles still on board of the Hoegh Shanghai due today at the port of Zeebrugge.

There's also 2x of each used, no discounts on those

In terms of profits and margins, it's mouse-nuts, but bears will use the optics of the move to promulgate their never-ending BS

Todesbuckler

Member

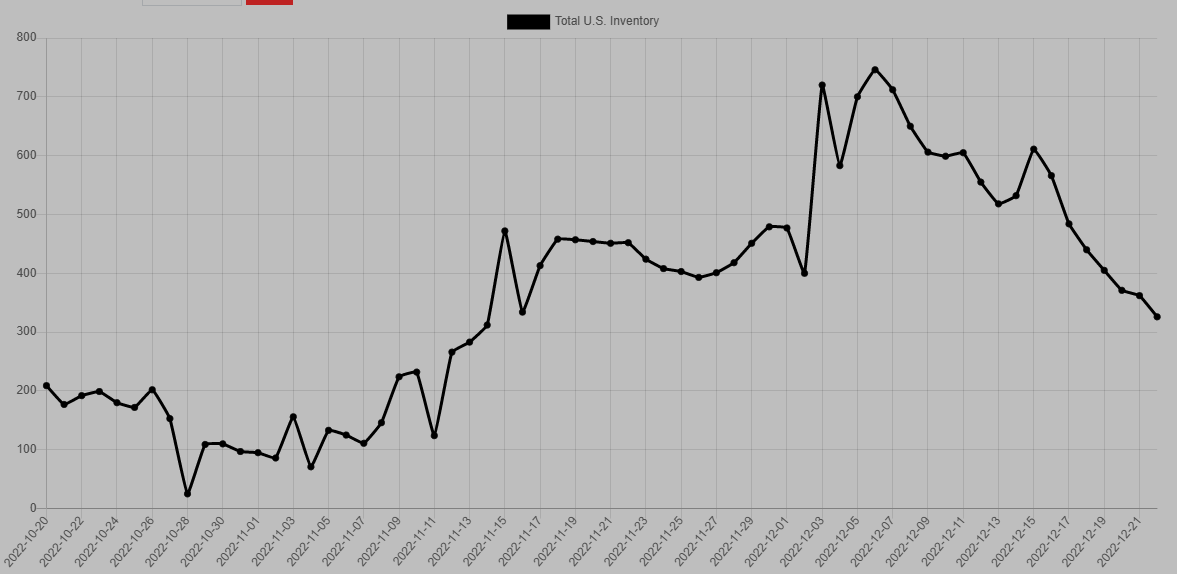

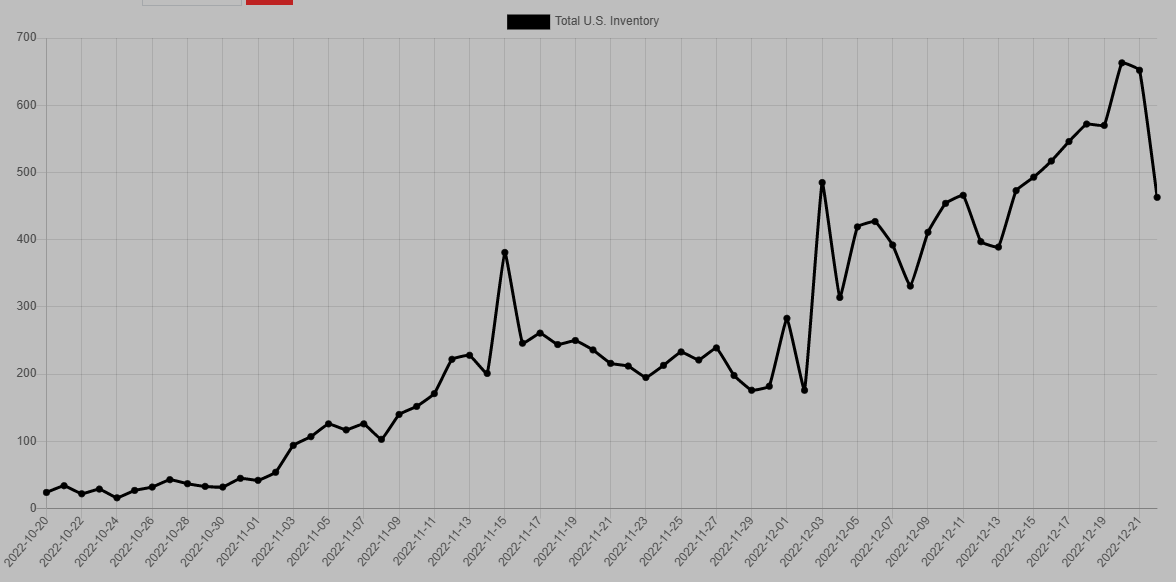

Just found this website tracking Tesla US used and new inventory (except for duplicate vehicles at the same place):

Model 3 new inventory is already declining for some time:

Model Y new inventory starts to decline with new discount:

For S/X new inventory is rather staying flat (no discount here).

Model 3 new inventory is already declining for some time:

Model Y new inventory starts to decline with new discount:

For S/X new inventory is rather staying flat (no discount here).

thx1139

Active Member

Dont understand why the US discounting to clear inventory. Just seems weird with the IRA credits right around the corner. Unless Tesla simply doesnt have enough space to store them seems like why not wait until January to sell them? I see 1377 in inventory at Tesla buyers guides, worldwide inventory and support for owners 650 of them are S and X. With expectations of ending the wave the most units produced now until end of the year would go into inventory anyway.

Also this winter storm hitting a huge part of country next couple of days will hurt deliveries. Could this be part of equation to get people to go out in this nastiness and take delivery of a car?

Also this winter storm hitting a huge part of country next couple of days will hurt deliveries. Could this be part of equation to get people to go out in this nastiness and take delivery of a car?

Even more importantly, almost all the growth in the USA next year will come from Model Ys made in Texas.

Minimum Y price is $66k. Y Perf min price is $70k. ASP is probably about $68k after accounting for estimated mix and extras.

Average COGS globally (all models, not just Y) from Q1 '21 through Q1 '22 was $36k before inflation kicked in hard and the overhead on the new factories dragged on costs. It was $39.2k last quarter. Balancing out the cost improvements in Texas, some permanent inflation, and the fact that wages are higher in Austin than in Shanghai, I think $38k is a safe estimate for Model Y costs for Texas next year.

Model Y battery is about 80 kWh. With $45/kWh battery subsidy --> $3.6k bonus

68 - 38 + 3.6 = $33.6k gross profit per Y and just shy of 50% gross margin.

Now you might say, "well Tesla can't sustain $68k ASP on Ys next year". Oh really? Even with customers getting a $7500 discount coupon from Uncle Sam? The price might go down as the market is flooded with volume but certainly not by so much that Tesla can't sell everything they can make for 40% margin or more. Tesla could lower the price by 15 grand and still achieve ~35% gross margin and $19k profit per Y.

This is the basic mathematical reality and yet some people (*ahem* @Troy) are actually worried about demand in the US. This estimate might be off by a +/- a few thousand dollars but that doesn't really matter. The point is that we have a hit product to end all hit products and people have so much tunnel vision on Twitter distractions and the current stock price and end-of-quarter discounts that they can't see this. The only serious concern for Tesla's car business next year in the US is how fast Giga Texas can ramp. It's that simple.

Even crazier, the Y will likely claim the title of best-selling car in America in 2023 while earning these 50% margins at $68k ASP. The RAV-4 was #1 (excluding pickup trucks) in 2021 with 407k units sold. This suggests that the Y will even overtake the mighty F-series pickup family by 2024 or 2025 as Giga Texas's output continues to expand and prices are lowered to more affordable levels. Ford loves to run marketing campaigns touting that the F-150 has been America's most popular vehicle for more than 40 years in a row, but they will need a new slogan soon. My question is how many 300-mile range Ys could Tesla sell for $45k and 25% margin in 2026? Probably 1 million+ in the USA alone.

Cybertruck, S, and X will make up most of the remainder of the growth.

CT has demand absurdly far ahead of what Tesla could possibly produce in 2023. It would be a great success if Tesla could make 100k of them next year and they would all sell easily to a fraction of the 1M+ people waiting in line.

S&X still aren’t yet at peak sales volume achieved in 2017 yet the product is vastly better than it was then, as reflected in the $105k+ price tag customers are currently willing to pay. If prices go down anywhere close to where they used to be, I would imagine S&X sales can blow way past the 100k sales record set in 2017.

There is no demand problem. There is only a question of production ramps and how far above 30% auto gross margins will go in 2023.

But @Gigapress , isn't this an extremely optimistic outlook?

If we do go into a deep recession in 2023, I'm talking about the possibility the market and economy get even worse than they are today, then isn't it reasonable to assume this "demand problem" could form very quickly? Auto sales always take a serious hit in big recessions, most large expenditures like them do. This isn't to say people won't still want to buy Teslas, but in difficult financial times people do tighten their belts, and let's be honest the majority of Tesla's revenue is still from auto sales, expensive high end auto sales at that.

To be clear, I'm not saying we have a demand problem today, but given the dour outlook for 2023 right now I don't think it's unreasonable for someone like Troy to be concerned about potential demand problems for next year. As investors we need to be very aware this could materialize very quickly if things go even further south, which they likely will yet.

Long term Tesla will be fine, but I think we need to be open to some possible murky waters in 2023. Things might not go as smoothly as we'd like them to.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K