Wait, won't weight loss take it further from the IRA credit!?! Efficiency is definitely undervalued.Maybe one piece of future cost savings?

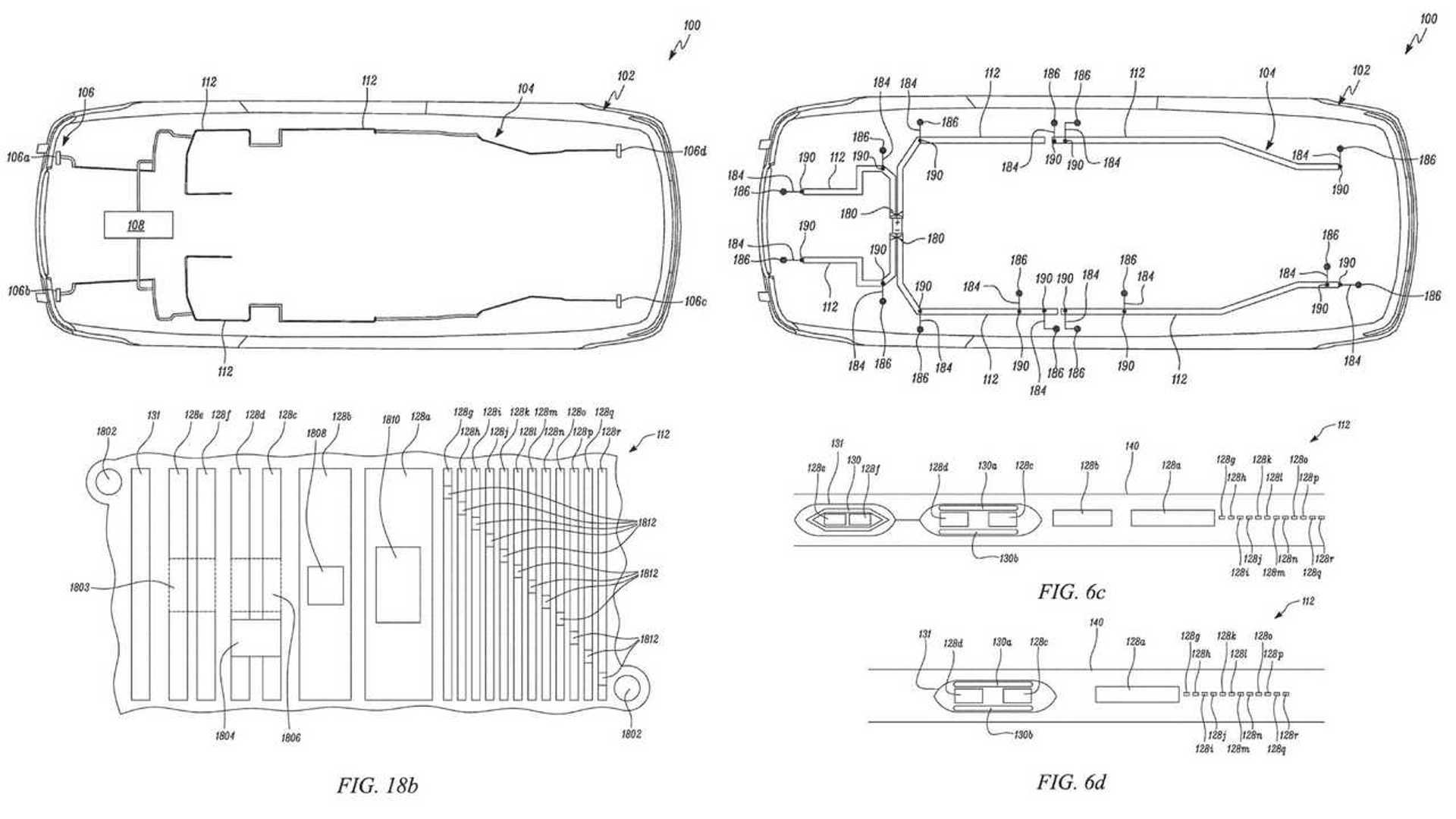

New Tesla Model Y Wiring System Is Revolutionary

Tesla’s new wiring system – revealed in a patent application – promises not only to be much easier to assemble. It can also drastically reduce weight.insideevs.com

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StealthP3D

Well-Known Member

“Since 2021, companies have announced investments totaling more than $200 billion in domestic manufacturing here in America. From iconic companies like GM and Ford building out new electric vehicle production to Tesla, our nation’s largest electric vehicle manufacturer, to innovative younger companies like Rivian building electric trucks or Proterra, building electric buses,” the president said.

Biden finally acknowledges Tesla's EV leadership after a year of silence

President Joe Biden on Tuesday acknowledged Tesla and the company's status as the nation's largest producer of electric vehicles.www.cnbc.com

“Well, let me tell you, while Elon Musk is talking about that, Ford is increasing their investment overwhelmingly,” Biden said, pulling a notecard from his jacket pocket.

'Lots of luck on his trip to the moon': Biden shrugs off Elon Musk's economic fears, touts Ford investments

The president had been asked about Musk after a speech in Delaware touting the solid jobs report released earlier Friday.www.cnbc.com

This was after Elon called him a damp sock puppet in human form.

Given that history, do you think POTUS might be a Tesla fanboi in private, but he's staying professional and not making his fanboism obvious? /s

Or is it more likely he uttered the words "Tesla" and "Elon Musk" so no one could write nasty tweets saying that, not once during his entire Presidency did he ever say "Elon Musk" or "Tesla"?

Last edited:

TSLA Siempre

Member

Regardless, Tesla still should have adjusted guidance as all of these events unfolded to better prepare investors and analysts. This gaffe’s on Tesla, not Elon.

Wait…the buck stops with everyone except Elon? Who besides Elon would be responsible? Elon sold stock during a time where they should have revised guidance downward, so not understanding why he gets a pass on this.

verystandard

Member

How many people within the income limit buy a car worth $90k ?

The EV tax credit income limit for married couples who are filing jointly is $300,000. And if you file as head of household and make $225,000 or more, you also won’t be able to claim the credit.Anyway, I think fewer people will buy FSD anyway, since it is quite expensive and monthly subscription is available.

Agreed that the current price of FSD is too high and this is one of the reason I'm holding on my Cybertruck reservation like dear life as I missed out the opportunity to add FSD on my model 3 years ago

Or, Tesla ships it from the factory with a non FSD capable version of software and the delivery center updates it to FSD, or OTAs it after purchase.With regard to the IRA, I'm sure this has been discussed, but in case it hasn't we see a LOT of discussion around how the Model Y 5 seater has been classified as a car and thus subject to the $55K max MSRP. I agree that is totally, absurd but all we and Tesla can do is try to protest with the IRS. However, one thing I don't see much is the impact of FSD on eligibility for even the 7 seat version at current pricing. I believe the IRS rules assume the MSRP is inclusive of all options, so if we go to the board a fully loaded Model Y 7 seater prices out like this:

$89,990 - Total Vehicle Price

- $65,990 - Model Y Long Range Dual Motor All-Wheel Drive

- $2,000 - Red Multi-Coat Paint

- $2,000 - 20’’ Induction Wheels

- $1,000 - Black and White Premium Interior

- $3,000 - Seven Seat Interior

- $0 - Autopilot Included

- $15,000 - Full Self-Driving Capability

- $1,000 - Tow Hitch

This is nearly $10K over even the higher $80 limit! This puts Tesla in a bit of a quandary. The options I see are:

1. Given the take rate of FSD is comparatively lower than other options, they could just say "yep, it's expensive and you lose the credit....sorry".

2. The could drop the base price of the car and other options by $10K to allow room for a $15K FSD. Not ideal, IMO, as this means lower revenue across the board for the few people that will take FSD.

3. They lower the price of FSD to $5K - tough as it is tantamount to saying "Yeah, FSD was never really worth $15K"...not a great message.

4. They do a mix of price lowering across everything (base price and ALL options including FSD.

5. FSD drops as an option and goes pure subscription only or combination of something like $5K purchase which gives you discounted subscriptions for life or whatever.

Unlike the IRS pushback, THIS decision on the 7 seater is totally within Tesla's control and this is the item they need to address ASAP (IMO) since we are in 2023 now and every day they don't address this is a potential lost sale (or at least loss of FSD purchase for those that are at all price sensitive...and, of course, under the income limits).

I might put figuring out the whole long range Model 3 scenario next on the list....and it also has a similar FSD bogey.

Just my 0.02!

Or people shift to subscription...Q3. How will I know what the manufacturer’s suggested retail price (MSRP) is for a vehicle? (added December 29, 2022)

A3. The MSRP will be on the vehicle information label attached to each vehicle on a dealer’s premises. The MSRP for this purpose is the base retail price suggested by the manufacturer, plus the retail price suggested by the manufacturer for each accessory or item of optional equipment physically attached to the vehicle at the time of delivery to the dealer. It does not include destination charges or optional items added by the dealer, or taxes and fees.

Or (currently) lease the car...

StealthP3D

Well-Known Member

Perhaps, just for fun, Tesla should announce that they intend to aim for 25% growth each year for the foreseeable future. Then, let the ANALysts calculate their "consensus" based upon that. ha ha The Pundits will be stuck saying things like, "We see Tesla far exceeding the goals for this year" which will probably make their tongues fall out and their eyes bleed.

Of course, analysts wouldn't say, "We see Tesla far exceeding the goals for this year", they would say things like, "We think Elon Musk is trying to game the system by guiding so low they could beat it while sleep-walking. It's an abuse of the decades of trust developed between the financial community and auto manufacturers and demonstrates once again that Tesla is not trustworthy, and their word cannot be taken at face value".

Paracelsus

Active Member

Again, the article I posted that you quoted as ‘false’ because it stated Biden hadn’t recognized Tesla was written in January 2022 - and at that time Biden was still ignoring Tesla and SpaceX. The article you posted of the president mentioning Tesla was after the petition and the Times Square ad. Timelines matter. It was a very disappointing time for many of us on TMC. I too thought this administration would embrace the success of Tesla and help pave a much smoother path for them than the last administration. I was anxious for Climate legislation that put Planet first, and for a version of the Green New Deal in its original form. But that’s not what happened either. I absolutely agree with you that it didn’t help Tesla or TSLA for Elon to refer to the sitting president as a wet sock puppet. The public was already properly addressing this administration’s cold shoulder to Tesla at that time with petitions and through the media - so Elon should have received a 15 yard penalty for piling on IMO. But then I also think it is not unfair or unexpected to shape our opinions of the IRA exclusions of Tesla based on these previous lived experiences, and on the similarities to the exclusions of all things Tesla in conferences and conversations not long ago.That contrary to your claim he did in fact say the word "Tesla", on more than one occasion. As I keep having to say, facts still matter to some of us.

This is another blatantly false statement.

“Since 2021, companies have announced investments totaling more than $200 billion in domestic manufacturing here in America. From iconic companies like GM and Ford building out new electric vehicle production to Tesla, our nation’s largest electric vehicle manufacturer, to innovative younger companies like Rivian building electric trucks or Proterra, building electric buses,” the president said.

Biden finally acknowledges Tesla's EV leadership after a year of silence

President Joe Biden on Tuesday acknowledged Tesla and the company's status as the nation's largest producer of electric vehicles.www.cnbc.com

“Well, let me tell you, while Elon Musk is talking about that, Ford is increasing their investment overwhelmingly,” Biden said, pulling a notecard from his jacket pocket.

'Lots of luck on his trip to the moon': Biden shrugs off Elon Musk's economic fears, touts Ford investments

The president had been asked about Musk after a speech in Delaware touting the solid jobs report released earlier Friday.www.cnbc.com

This was after Elon called him a damp sock puppet in human form.

There are valid criticisms to be made but they should never include completely false statements.

In recent chat, Elon himself said he hasn’t missed any important meetingsWait…the buck stops with everyone except Elon? Who besides Elon would be responsible? Elon sold stock during a time where they should have revised guidance downward, so not understanding why he gets a pass on this.

Didn’t this exact same scenario happen in the past? Big delivery miss when Tesla first started major exports because EOQ logistics got screwed up? Q1 2019 perhaps?Ok.

I’m feeling confident that the earnings call will be good for TSLA as long as Elon is not on the call or at least doesn’t go all worst-case scenario apocalyptic mode as he usually does.

(Planning for worse case is great. Talking about it like it’s expected is not).

I’m of the belief that much of the undelivered cars in Q4 were logistics issues out of Tesla’s control and not cars that weren’t purchased. We’ve seen:

1. Cars stuck at the port in Shanghai.

2. A RoRo destined for Europe stuck in Australia due to fumigation and other port issues.

3. A shipment of cars stuck at the airport in Berlin awaiting a ship bound for Taiwan.

4. Massive COVID issues in China.

5. A ship delayed getting into Zeebrugge toward the end of the quarter due to other ship traffic.

6. A massive snowstorm/extremely cold temps in North America in the last 2 weeks of the quarter.

Sorry, I just don’t believe that Tesla built many tens of thousands of cars with no customer in mind. Has demand dropped some? Sure. Economy’s not doing well. Has it plummeted to the extent that bears want you to believe? No. Tesla hasn’t even permanently lowered prices yet—something which will probably be necessary but won’t scare me.

I think the earnings call will clarify these issues and calm investors quite a bit.

Regardless, Tesla still should have adjusted guidance as all of these events unfolded to better prepare investors and analysts. This gaffe’s on Tesla, not Elon.

edit: ninja'ed by @deshkart

Gigapress

Trying to be less wrong

Looking at Tesla’s share of EV revenue, volume and batteries in isolation does not indicate much about the future because all other EVs are being subsidized either by investor capital or ICEV and Hybrid sales.I realise it is not popular to say this, but a corresponding story is so far playing out in the BEV market. The data shows that Tesla is year-on-year losing market share by volume, by GWh, and by revenue. I last posted this graph about 11-months ago. Clearly Tesla has put its first team into bat in the vehicle market, and the seconds are playing in the storage market (and crikey knows who are in the solar market). The first team are playing an excellent game. The second team may be about to get a second wind for a while. And the third team are playing in some 0.1% league.

View attachment 891986

As far as I’m aware, none of the legacy auto companies have disclosed their gross margins on their pure EVs. Making EVs at a loss or thin profit while it’s still a small percentage of the total is doable for these companies, but it’s not a scalable, sustainable strategy. They’re all banking on being able to improve their margins on EVs over time.

No one is even close to Tesla’s level of manufacturing efficiency and scale. In the end game, Tesla could win by offering the lowest prices.

Mark Alset

Member

Yeah, #2. They could be polished lead in the shape of the Tesla logo. After the owner unbolts them, they could be hung in the garage (or put up for sale on eBay).

Or they could just add the third row seats to all cars, and give buyers the option to have them removed after delivery (and if removed, give the buyer a $3000 check). The Y was designed to have the rear seats removed, so this seems like the best solution.

Everyone who wants a 5 seat MY could then just buy the 7 seat Model Y, get the credit, and have the seats removed upon delivery. Adds some work, but not something a service/delivery center can't handle. Seats can then be shipped back to Tesla for use in another 7 (ahem 5) seater.

I know it seems stupid, but this would also get around the dumb IRS guidelines.

TrendTrader007

Active Member

as of today, TSLA is -74.75% from high to low over last 14 months

so where would we be if we were to follow following historic drops:

META drop of -77.07% over 14 months in 2021-2022 would put TSLA at $94.99

NFLX drop of -76.78% over 6 months in 2021-2022 puts TSLA at $96.20

NFLX drop of -82.66% over 13 to 14 months in 2011-2012 gets me $71.86 for TSLA

BIDU drop of - 79.26% over 20 months in 2021-2022 gets me tsla at $85.94

BIDU drop of -76.58% over 13-14 months in 2007-2008 gets me TSLA at $97.04

we have already exceeded AAPL and AMZN drops in 2007-2008

i will look at NVDA as well

NVDA -85.48% over 13 months in 2007-2008 puts TSLA squarely at $60.16

so bad news: we could go lower

probability is going lower than $100 is less, in my opinion, due to $100 possibly proving to be floor and fact we have fallen for so long and all bad news rapidly getting priced in

good news:

regardless of whenever or wherever we bottom, TSLA likely to recover just like all other company stocks did and eventually far exceed November, 2021 high $414.46

this is just cherry picked data and really inconclusive but instills in me certain degree of optimism in that we may be closer to end of these horrible 14 months for TSLA shareholders. as far as i am concerned, i will just sit it out and eventually all the selling will be exhausted at some point in not too distant future.

definitely, not financial advice

i just might speculate about what TSLA recovery might look like once we are done going down, which we shall know sometime in near future, likely this month. hard to tell-could be today, tomorrow or after ER but will become clearer pretty soon after TSLA hits final bottom

of course, there is always possibility of 1999-2002 style downturn but i am not taking that possibility too seriously due to very strong TSLA fundamentals and various catalysts in 2023-2024. i could be wrong. in any case, i am fully capable of waiting the storm out no matter how long or how deep TSLA drops

unlike those who despair at bottom and celebrate at tops

so where would we be if we were to follow following historic drops:

META drop of -77.07% over 14 months in 2021-2022 would put TSLA at $94.99

NFLX drop of -76.78% over 6 months in 2021-2022 puts TSLA at $96.20

NFLX drop of -82.66% over 13 to 14 months in 2011-2012 gets me $71.86 for TSLA

BIDU drop of - 79.26% over 20 months in 2021-2022 gets me tsla at $85.94

BIDU drop of -76.58% over 13-14 months in 2007-2008 gets me TSLA at $97.04

we have already exceeded AAPL and AMZN drops in 2007-2008

i will look at NVDA as well

NVDA -85.48% over 13 months in 2007-2008 puts TSLA squarely at $60.16

so bad news: we could go lower

probability is going lower than $100 is less, in my opinion, due to $100 possibly proving to be floor and fact we have fallen for so long and all bad news rapidly getting priced in

good news:

regardless of whenever or wherever we bottom, TSLA likely to recover just like all other company stocks did and eventually far exceed November, 2021 high $414.46

this is just cherry picked data and really inconclusive but instills in me certain degree of optimism in that we may be closer to end of these horrible 14 months for TSLA shareholders. as far as i am concerned, i will just sit it out and eventually all the selling will be exhausted at some point in not too distant future.

definitely, not financial advice

i just might speculate about what TSLA recovery might look like once we are done going down, which we shall know sometime in near future, likely this month. hard to tell-could be today, tomorrow or after ER but will become clearer pretty soon after TSLA hits final bottom

of course, there is always possibility of 1999-2002 style downturn but i am not taking that possibility too seriously due to very strong TSLA fundamentals and various catalysts in 2023-2024. i could be wrong. in any case, i am fully capable of waiting the storm out no matter how long or how deep TSLA drops

unlike those who despair at bottom and celebrate at tops

Last edited:

JRP3

Hyperactive Member

Again, the article I posted that you quoted as ‘false’ because it stated Biden hadn’t recognized Tesla was written in January 2022 - and at that time Biden was still ignoring Tesla and SpaceX. The article you posted of the president mentioning Tesla was after the petition and the Times Square ad. Timelines matter.

Edit: I see that line was from the article and not your words, so at the time it was written it was correct.

bigsmooth125

Member

I have to agree with thesmokingman and dislike this post. False statements and blatant lies should be welcomed as long as they make me feel better.That contrary to your claim he did in fact say the word "Tesla", on more than one occasion. As I keep having to say, facts still matter to some of us.

This is another blatantly false statement.

“Since 2021, companies have announced investments totaling more than $200 billion in domestic manufacturing here in America. From iconic companies like GM and Ford building out new electric vehicle production to Tesla, our nation’s largest electric vehicle manufacturer, to innovative younger companies like Rivian building electric trucks or Proterra, building electric buses,” the president said.

Biden finally acknowledges Tesla's EV leadership after a year of silence

President Joe Biden on Tuesday acknowledged Tesla and the company's status as the nation's largest producer of electric vehicles.www.cnbc.com

“Well, let me tell you, while Elon Musk is talking about that, Ford is increasing their investment overwhelmingly,” Biden said, pulling a notecard from his jacket pocket.

'Lots of luck on his trip to the moon': Biden shrugs off Elon Musk's economic fears, touts Ford investments

The president had been asked about Musk after a speech in Delaware touting the solid jobs report released earlier Friday.www.cnbc.com

This was after Elon called him a damp sock puppet in human form.

There are valid criticisms to be made but they should never include completely false statements.

good news:

regardless of whenever or wherever we bottom, TSLA likely to recover just like all other company stocks did and eventually far exceed November, 2021 high $414.46

Ahem...Cisco...cough.

I'm a bull and buying, even today,....but some very profitable companies never made a new high two decades later.

Fred42

Active Member

How would you know that?Elon hasn't decided how he wants to handle Model Y wrt the IRA.

Elon gave us more clues. The tweet about the extremely strong long-term fundamentals but at the same time unpredictable short-term market madness was even stronger, especially when he stressed in another tweet to please take both of those to heart. He was sending a signal but at the same time trying not to get in trouble with the SEC.

The best clue from Elon is when he sells. He always sells at the local tops. Probably 10/10 success rate that beats all the TA in the universe.

NY Times - this evening:

Father Deliberately Drove Car Off Cliff, Authorities Say After Dramatic Rescue

Excerpt:

Dharmesh A. Patel was arrested on suspicion of attempted murder and child abuse after his Tesla careened off a treacherous cliff in Northern California with him, his wife and two children inside, the authorities said.

The rescue was described as almost miraculous. A family of four whose car had careened off a treacherous cliff-top road in Northern California, plummeted more than 250 feet and trapped them on Monday managed to survive and avoid life-threatening injuries.

But now, the authorities say their car’s dramatic drop wasn’t an accident, but an “intentional act,” and that the father could face charges...

Father Deliberately Drove Car Off Cliff, Authorities Say After Dramatic Rescue

Excerpt:

Dharmesh A. Patel was arrested on suspicion of attempted murder and child abuse after his Tesla careened off a treacherous cliff in Northern California with him, his wife and two children inside, the authorities said.

The rescue was described as almost miraculous. A family of four whose car had careened off a treacherous cliff-top road in Northern California, plummeted more than 250 feet and trapped them on Monday managed to survive and avoid life-threatening injuries.

But now, the authorities say their car’s dramatic drop wasn’t an accident, but an “intentional act,” and that the father could face charges...

Paracelsus

Active Member

No worries @JRP3 - it was a very long quote from the article and perhaps I should have also italicized the quote instead of just using quotations to make that more clear. I will certainly keep that in mind in my future posts. Thank you.You said "ever", not "in some specific time period". I said that statement of yours was false, not the article.

Edit: I see that line was from the article and not your words, so at the time it was written it was correct.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M