Until one day soon Insurance requires purchasing it.The problem with this is that those who really need it are the least likely to purchase it.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Lately, I've been hearing people say that the reported inventory numbers might be skewed because of duplicates. That is, there could be duplicate configurations at a location that only show up once on the Tesla inventory page. So numbers we get from sites like tesla-info.com might be misleading.

It seems that duplicates would be unlikely to skew the results much, if at all.

For Model Y in the US, there are 160 different hardware configurations you can order. I don't see a lot of locations that would have large numbers of duplicate units with the exact same configuration:

2 trim levels x 5 colors x 2 wheel choices x 2 tow hitch choices x 2 interior choices x 2 seat configurations = 160 total configurations

Some locations might have duplicates of some of the most popular configurations, but I don't see that as something that would skew the inventory numbers much.

It seems that duplicates would be unlikely to skew the results much, if at all.

For Model Y in the US, there are 160 different hardware configurations you can order. I don't see a lot of locations that would have large numbers of duplicate units with the exact same configuration:

2 trim levels x 5 colors x 2 wheel choices x 2 tow hitch choices x 2 interior choices x 2 seat configurations = 160 total configurations

Some locations might have duplicates of some of the most popular configurations, but I don't see that as something that would skew the inventory numbers much.

StealthP3D

Well-Known Member

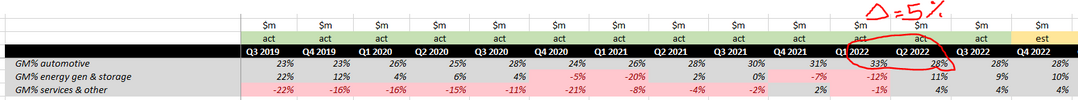

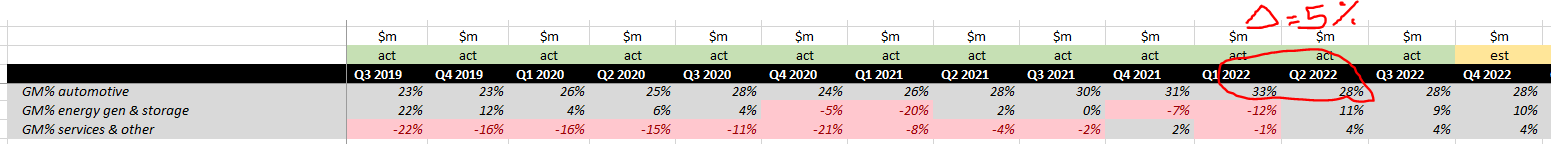

Fair point, and the maximum drag to GM% from ramp effect in recent years is of the order of 5% :

If it is 'only' a 5% drag due to ramp effect then that on its own is no big deal. However if there is reason to think that overall GM% margins will become compressed due to selling price (ARPV) being reduced in order to maintain the volume ramp as competition becomes more of a factor, then that inevitably will lead to less attractive financials.

-----------(entire middle of post deleted to focus on expansion drag on net and gross margins)----------

The expansion drag effect should persist at least until the end of this decade. In my modelling I assume that a S-curve kicks in with decellerating auto growth for Tesla later in the decade. That ought to be beneficial in respect of ramp drag at that point, except that non-automotive ramp is becoming much more significant in those years (at least in the Tesla-base case, where energy needs to be ramping strongly). So that ramp drag is something investors need to live with for a long time to come, even if it might be a bit patchy occasionally.

I don't know where to start on this, I don't have much to take issue with the final conclusions because they are so broad and general and long-term, they are nearly meaningless and it seems a lot of very specific and very recent data was mined to try to a broad understanding how this might play out over time. While I applaud the discussion, I think it's a misguided way to come to the broad, general conclusions because we know there is always a cost to growth. That is best modelled in from a general case without using specific data from limited timeframes without controlling for other variables and a general lumpiness of data.

One example, the circled data in the table above represents the automotive GM% difference between Q1 and Q2 2022 of 5%. However, you are using gross margins including regulatory credits which should be backed out of such an analysis due to their high variability. Tesla recorded $344 million in regulatory credits for Q2 2022, down 49% from Q1 which was $679 million. That's a loss of around $1,200 per vehicle due to quarterly regulatory credit variation which is essentially random (not correlated to quarterly sales at all). Backing this out would have the effect of reducing the 5% drag to GM you attribute to ramp costs by over 20%.

Another example is that Q2 had a rather precipitous drop of over 15% in production over Q1 due to COVID shutdowns. That naturally had a strong downward pressure on GM's that is seperate from the drag of ramp on GM's. We don't have enough data to quantify which impacts contributed how much. But I would guess COVID shutdowns had an even stronger impact on GM's than that of not backing out regulatory credits:

If sharply lower regulatory credits, disrupted production due to COVID shutdowns and costs of ramping all had negative impacts on GM's in Q2, but they only fell 5%, then it looks to me like those impacts might be hiding some very significant gains in terms of manufacturing efficiency (in addition to the higher selling prices and potentially other hidden positive impacts).

Using the quarter over quarter GM decline between Q1 and Q2 2022 to estimate the impact of ramping on GM's is simply not possible and a misguided use of the data we have. Stepping back and looking at the big picture is almost always more productive than trying to extract meaning by using a magnifying glass.

One large variable in terms of overall margin potential, which you correctly state is not knowable, is margin compression due to pricing pressures which would either be due to market conditions (most likely, IMO) or competitive pressures from other manufacturers (very unlikely, IMO). Either possibility can be potentially offset by further increases in production efficiency. I think this, combined with changes in market prices, is the most important variable when speaking of long-term margins and any attempt to quantify long-term margins without discussing production efficiency is suspect.

You make no attempt to quantify how production efficiency could impact Tesla's competitiveness going forward and that is the same mistake many analysts make when they just assume all manufacturers are roughly equal in their ability to manufacture efficiently and to constantly improve that efficiency. That it must cost the same to produce a product that is comparable in functionality to a competitor's product. But Tesla's constant production innovations and optimizations have been blowing that misguided notion wide open (at least for those willing to look at the trends). That's why Tesla's current margins are so much higher than competitor's margins.

Ignoring cost to produce for a moment, Tesla's current margins are not really limited by what other manufacturer's sell their products at, margins are limited by how much people are willing to pay, how much they can afford in any given economic climate. Because there are not enough cars available of the kind people want to buy in the price range they are willing to pay. As the cost to produce continues to decline and volumes continue to rise I will suggest that Tesla's biggest competitor will continue to be themselves as they ramp volumes ever higher.

All manufacturers are not approximately equal, and this is not a static dynamic, Tesla's lead in terms of cost to produce is slowly increasing. Look at the trend of Tesla's cost to produce each car over time. I would suggest this is not entirely attributable to volume efficiencies that have been realized so far, and that will continue to accrue, but also to a superior way of looking at every challenge and the desire to take on those challenges in an efficient manner.

Elon has made no secret that he has big goals in terms of increasing speed of production throughput as well as continuing to increase the density of manufacturing in three dimensions. The reason Tesla strives for volumetric production efficiencies is because this leads directly to a reduction in the investment required for building new production facilities. This plays directly into the cost to continue ramping production and is a big deal as Tesla ramps production from 2 million vehicles/year to 20 million/year.

Not only does a smaller factory cost less to build, but more cars per day from a smaller footprint has compounding returns in efficiency. A smaller plant requires less time for people and materials to move about. A smaller plant requires less land area to clear and build (which further reduces capital expenses) and improves efficiency of movement outside the building. Any competitor who thinks Elon's next factories will be cut/paste copies of existing factories are in for a rude awakening because Elon did not go into automaking to be like the rest. Every generation is a big improvement, Elon does not believe in limitations beyond those imposed by physics itself as guided by economics. These efficiencies manifest slowly, as each new generation of plant is optimized, and production gradually increases.

The future is always hard to see, and there will be surprises along the way, some positive, some negative. But the overall trend is clear and without seeing a reason why that trend is coming to an end, I will continue to bet on Elon and his teams to continue to improve at a rate faster than the rest. The Chinese will be the closest competitors, but I don't think even they will be able to match the efficiency of the systems Tesla is implementing. Chinese manufacturing rides on Elon's coat tails which is why they invited him in to begin with. The Chinese are not infallible, they are just smart, focused and willing to work hard. If they had the vision to exceed what Elon is doing, they wouldn't have invited him in, they follow in his footsteps. At best they can match it a few years later. Never say never but the trend is your friend and I have not seen that the trend is not favorable.

Attachments

Last edited:

Functional element is hard carbon.I agree. But they have been producing lignin since 2015. They also have working pilot factory for a battery grade lignin here in Finlnd. And they announced partnershup with Swedish upcoming battery factory Northwolt last summer. I just hoping Tesla would join this development too.

Northvolt Partners With Stora Enso For Lignin-Based Battery Anodes - CleanTechnica

Northvolt is looking to make battery cells using locally sourced sustainable materials such as lignin, which is derived from trees.cleantechnica.com

In SoCal, I haven't seen a delivery center stacked with waiting inventory so I also don't follow that logic. Think all reported will be reflected on the site + some could show up for multiple areas since it would only be a <30 mile drive to move between center. So 1 car is available at 3-4 different spots.Lately, I've been hearing people say that the reported inventory numbers might be skewed because of duplicates. That is, there could be duplicate configurations at a location that only show up once on the Tesla inventory page. So numbers we get from sites like tesla-info.com might be misleading.

It seems that duplicates would be unlikely to skew the results much, if at all.

For Model Y in the US, there are 160 different hardware configurations you can order. I don't see a lot of locations that would have large numbers of duplicate units with the exact same configuration:

2 trim levels x 5 colors x 2 wheel choices x 2 tow hitch choices x 2 interior choices x 2 seat configurations = 160 total configurations

Some locations might have duplicates of some of the most popular configurations, but I don't see that as something that would skew the inventory numbers much.

Also, Not that it changes much but isn't it 100 total configs?

MYLR x 5 color x 2 wheel x 2 tow hitch x 2 interior x 2 seat = 80

MYP x 5 color x 1 wheel x 2 tow x 2 interior x 1 seat = 20

For what it’s worth, it’s been nearly a month since the first IDRA packages arrived in Texas and we’ve still been seeing an inflow of massive packages on an intermittent basis. How many days of 32 axel deliveries before we can safely say this is actually 2 Gigapresses being delivered?

thesmokingman

Active Member

^^that's what winning looks like.

Pretty much everyone is on the sidelines until earnings and the margin picture becomes clear, even TSLA bulls.

Predictable… Very true.Much/most of the decline was predictable, although it is difficult for some to accept.

Do a simple discounted cash flow on any fast-growing company and you can see that a majority of the value of the company is tied to what happens 10+ years out. Increase the discount rate by 5 percentage points (4.25 already plus 0.75 in the coming months) and you can see that the 10+ year value decreases by at least 39%.

Some companies such as Apple are increasing sales at a much lower pace and therefore the increase in discount rate will have less of an impact. That's why you see Apple decline in value much less.

Some companies such as startups and Tesla are increasing sales at a higher pace and therefore the increase in discount rate will have more of an impact. That's why you see these companies decline in value more. Apparently, startups are seeing 80%+ declines in value in the private markets. This is causing havoc in their cap tables because any new money raised will more or less wipe out existing shareholders.

I suspect that this phenomenon was what Musk was referring to with the DCF equation that he tweeted.

By the way, this phenomenon is why SpaceX's ongoing up-round at $137 billion valuation is so remarkable. Perhaps unique. In 20 years of existence, the company has never had a down-round and has raised money throughout. This might be due in part to the fact that SpaceX is growing at a more measured pace than most startups and Tesla.

My guess is that most of us here did predict it, but wouldn’t allow ourselves to act on it.

In bull markets perceptions are expansive and reach out 10 years… as a recession closes in, so does perception… down to 18 months or so.

Note to self…

MartinAustin

Active Member

Sorry for the off-topic post. I wasn't talking about TSLA (clearly)I have the feeling this is going to be a 10% day

You can't jump to that conclusion based on the info we have. Maybe he sold the puts last Friday when the SP was in the low 100's. He would have received ~$60 per contract and now the SP is in the 120's so he may have netted $20 profit. We don't know.What does Leo mean:

"shares will be assigned @ $160 this month"??

TSLA isn't $160... I've been here a long time, yet I still never quite understand what's going on.

_________________

EDIT- Thank you @juanmedina , @MikeC and @Mengy , for answering:

"Puts that he sold are getting assigned." and "...obligating him to buy at $160 at a future date regardless of where the stock is trading.".

So he's complaining about his poor speculations, not as a credible long term investor? Heck, my LEAPS withered away terribly, but I don't complain because I knew what I was getting into (risk) -and I knew my level of speculative understanding was rudimentary, but I couldn't resist the lure of options, so I did it anyway.

petit_bateau

Active Member

You're welcomeI don't know where to start on this, I don't have much to take issue with the final conclusions

This is interesting on Autopilot safety. Looking for the original source.Nah, driver was TSLAQ. He’d been driving laps on the bridge for hours praying for a phantom braking event that causes an accident. There were 4 more of his buddies in the cars behind him. /tinfoilhat

Giga Berlin phase 1 is 500k, phase 4 2mIt's not clear to me what the ultimate Austin and Berlin capacities are for Phase 1. 500k apiece? 1 million?

We see new stamping press foundation work happening at both Austin and Berlin. Austin's is happening a bit under wraps with only periodic glimpses from drones, but Berlin's looks like it is still several months off from completion. So the round number of 500k apiece doesn't seem to make sense.

willow_hiller

Well-Known Member

Looking for the original source.

Source is here: Official Tesla Model Y 2022 safety rating

There's a tab called "Safety Assist" that describes their assessments of active safety features.

superblast

Member

Probably referring to the scores seen here: Tesla, TSLA & the Investment World: the Perpetual Investors' RoundtableThis is interesting on Autopilot safety. Looking for the original source.

Congo Line

(not the dance)

Roadster deliveries in 2023?

Given the lack of updates about status of Roadster deliveries and also the fact that I could be easily be earning 3.5% on my deposit money, I just called to ask for my deposit back. Took 20 minutes to get someone on the line; after taking my info and then having some muffled conversations with people in the background, the person came back and said "I'm being told that Elon has said we will deliver these in Q2 or Q3 of this year". I asked her to verify that she meant 2023. More muffled convo in background, and then she says "yes, in 2023".

I'm not sure how confident to be with this info, but I told her I would hold off on cancelling for a few months and see where this goes.

Personally I haven't seen anything on Twitter or elsewhere to support this; seems like most people were thinking 2024 for Roadster deliveries to start.

Given the lack of updates about status of Roadster deliveries and also the fact that I could be easily be earning 3.5% on my deposit money, I just called to ask for my deposit back. Took 20 minutes to get someone on the line; after taking my info and then having some muffled conversations with people in the background, the person came back and said "I'm being told that Elon has said we will deliver these in Q2 or Q3 of this year". I asked her to verify that she meant 2023. More muffled convo in background, and then she says "yes, in 2023".

I'm not sure how confident to be with this info, but I told her I would hold off on cancelling for a few months and see where this goes.

Personally I haven't seen anything on Twitter or elsewhere to support this; seems like most people were thinking 2024 for Roadster deliveries to start.

Knightshade

Well-Known Member

You can't jump to that conclusion based on the info we have. Maybe he sold the puts last Friday when the SP was in the low 100's. He would have received ~$60 per contract and now the SP is in the 120's so he may have netted $20 profit. We don't know.

I don't think that's true.

Tracing back his remarks he appears to have sold 3 million shares worth of puts in the 160-170 strike range no later than Dec 12-14, with stock price around 160-170-- since Dec 14 is the first time he specifically cites the amount that he continues citing as recently as a few days ago on the puts.

EDIT- It's looking like he specifically did this (or announced he did anyway) on Dec 14th.... having mentioned Elon selling the previous 2 days- so it appears he did this thinking Elon was done selling and he was helping create a floor around 160-170. Indeed several of his later remarks specifically cite this as a reason for doing it.

Last edited:

thesmokingman

Active Member

That's some good customer retention there! /sRoadster deliveries in 2023?

Given the lack of updates about status of Roadster deliveries and also the fact that I could be easily be earning 3.5% on my deposit money, I just called to ask for my deposit back. Took 20 minutes to get someone on the line; after taking my info and then having some muffled conversations with people in the background, the person came back and said "I'm being told that Elon has said we will deliver these in Q2 or Q3 of this year". I asked her to verify that she meant 2023. More muffled convo in background, and then she says "yes, in 2023".

I'm not sure how confident to be with this info, but I told her I would hold off on cancelling for a few months and see where this goes.

Personally I haven't seen anything on Twitter or elsewhere to support this; seems like most people were thinking 2024 for Roadster deliveries to start.

Roadster deliveries in 2023?

Given the lack of updates about status of Roadster deliveries and also the fact that I could be easily be earning 3.5% on my deposit money, I just called to ask for my deposit back. Took 20 minutes to get someone on the line; after taking my info and then having some muffled conversations with people in the background, the person came back and said "I'm being told that Elon has said we will deliver these in Q2 or Q3 of this year". I asked her to verify that she meant 2023. More muffled convo in background, and then she says "yes, in 2023".

I'm not sure how confident to be with this info, but I told her I would hold off on cancelling for a few months and see where this goes.

Personally I haven't seen anything on Twitter or elsewhere to support this; seems like most people were thinking 2024 for Roadster deliveries to start.

That sounds kind of preposterous to me, we've not heard nor seen any movement on a Roadster production line being built at all. CT line is being built now and it will take 6-8 months to get up and running, IF it goes smoothly. Roadster production line would need to start NOW to have any chance of any Q3 deliveries I'd imagine.

Don't get me wrong, I'd love to see it, I just don't think it's realistic. Early to mid 2024 sounds more likely to me, if even that soon.

I think the lack of announcements is a shift in communications. Rather than promising things years off, they seem to be getting a bit more disciplined about only promising what they are confident they can deliver. Thus the radio silence on Gen 3 until now and general radio silence on a lot of things. Seems like they are shifting out of “Kickstarter” mode and more into a production mentality where they talk about shipping or eminently shipping products.Roadster deliveries in 2023?

Given the lack of updates about status of Roadster deliveries and also the fact that I could be easily be earning 3.5% on my deposit money, I just called to ask for my deposit back. Took 20 minutes to get someone on the line; after taking my info and then having some muffled conversations with people in the background, the person came back and said "I'm being told that Elon has said we will deliver these in Q2 or Q3 of this year". I asked her to verify that she meant 2023. More muffled convo in background, and then she says "yes, in 2023".

I'm not sure how confident to be with this info, but I told her I would hold off on cancelling for a few months and see where this goes.

Personally I haven't seen anything on Twitter or elsewhere to support this; seems like most people were thinking 2024 for Roadster deliveries to start.

I hope so, “Elon Time” is tolerable in a startup, we should be beyond it now. Though FSD still seems to be in this vortex.

Not saying your car comes this year. But maybe if/ when we hear about Roadster next the timeline will be more solid.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K