It's important to note that Musk has a feud with SBF-backed Semafor and that this is a one-sided and slanted account. It imputes motives to Musk that likely were never there. And it avoids certain facts, such as that Musk was the Chairman of OpenAI, the first $100 million in to the organization, and one of its absolute prime movers, and thereby minimizes Musk's contribution. That said, it's not the worst article ever.Some interesting background to Elon's antipathy towards OpenAI. I would have put this in the Elon thread, but it seems that thread has been closed.

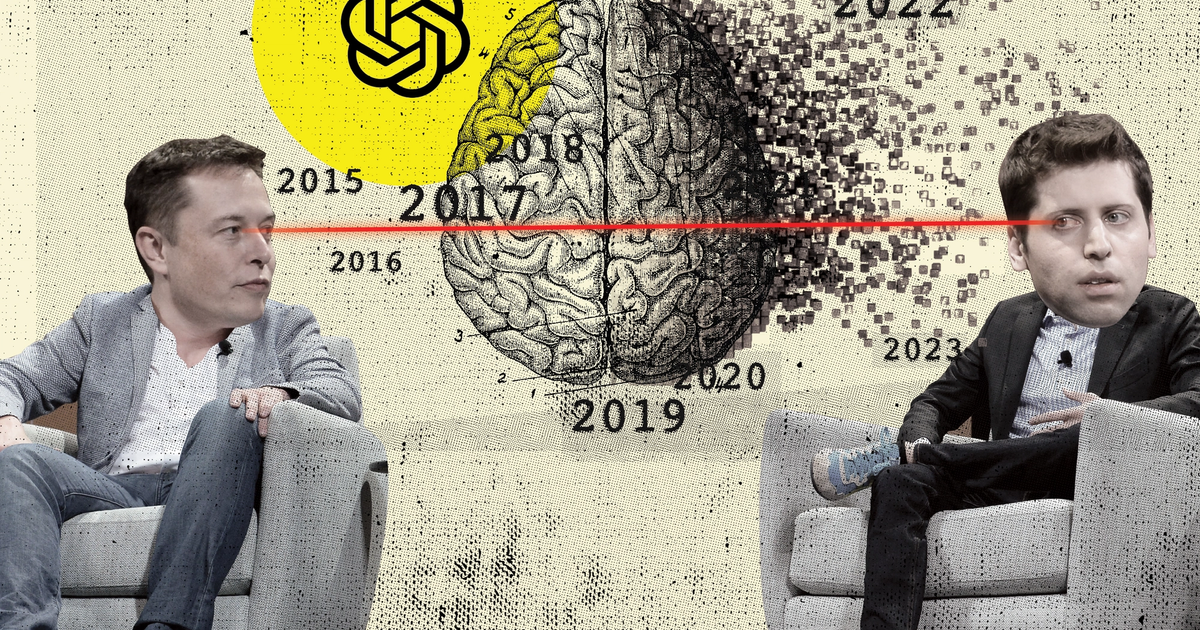

The secret history of Elon Musk, Sam Altman, and OpenAI | Semafor

In 2018, Musk wanted to take charge of OpenAI to beat Google but others opposed the move, putting Altman at the helm.www.semafor.com

The article only mentions in passing (and skeptically) Musk's recruitment of Karpathy to Tesla that was a big part of why Musk left OpenAI. It completely missed that Karpathy has recently returned to OpenAI and that Musk immediately unfollowed him on Twitter when it was announced. And it also doesn't really respect Musk's bedrock criticism that OpenAI lacks openness (and now, that it is a for-profit enterprise in the clutches of a monopolist).

For sure, this will be the subject of several business history books in the future. Hopefully, they will not be so one-sided.

Last edited: