insaneoctane

Well-Known Member

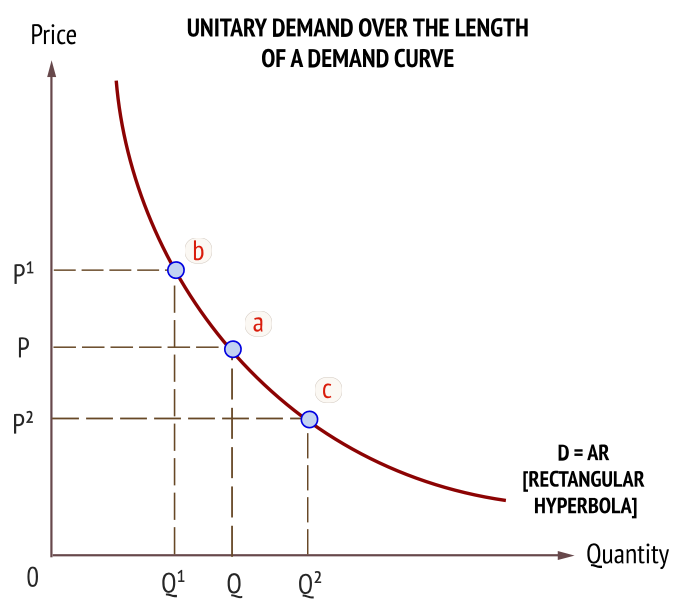

Not to over simplify ....but, due to price elasticity being a real thing, by Tesla committing to significantly ramp production rates, aren't they, by definition, committed to lowering the price per the PED curve?

Certainly we can argue about what the PED curve slope/shape is and how the current macro environment is affecting it, but Tesla has all the real data and they have it all real-time. As long as they are committed to materially moving to the right on this PED curve (which they are), prices must come down. Tesla has said margins be damned because they currently have industry leading margins and want to double quantities....again and again.

Certainly we can argue about what the PED curve slope/shape is and how the current macro environment is affecting it, but Tesla has all the real data and they have it all real-time. As long as they are committed to materially moving to the right on this PED curve (which they are), prices must come down. Tesla has said margins be damned because they currently have industry leading margins and want to double quantities....again and again.