I think for TSLA to double from here before 2025, ...

Otherwise I think it's a grind higher to 400-450 area by mid 2025 as Energy continues to ramp and margins/profits start to add meaningful numbers to the bottom line or as Gen 3 vehicles start to ramp in production and thus the realization of the COGS starting to show up in earnings.

Realistically one epiphany is unlikely. Nearly every unprecedented development is dismissed by securities people, whose livelihood depends on having a keenly developed sense of the generalized past, coupled with a view that the past defined the future. Corollary: Nothing new has value because it has not been done before.

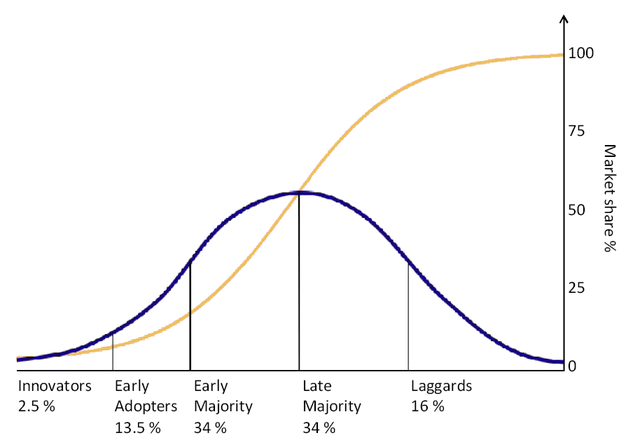

Tesla breaks too many shibboleths, ones that are still thought to be certainties. Because of that TSLA will be volatile and relatively undervalued until large scale capitulations has happened. That can only happen when:

1.

Massive charging infrastructure is as ubiquitous as were places that sold gasoline ten years ago. Among automakers Tesla is the only one that understood that crucial impediment;

2.

Sales places are comparable in distribution as are those of, say, Toyota. One way or another local physical sales places must be in place to supplement online sales. Everywhere!

3.

Service facilities must be obvious, blatantly obvious, which can quite conveniently be done by multiplying mobile service. Particular items such as emergency charging, tire repair and replacement can make such extensive offering less unprofitable.

All of those they already do, but nearly everyone understates just how enormous the challenge is when countries such as Yemen, Sudan, Bolivia, Myanmar etc are not even dreamed of today, except perhaps in nightmares. In those four, according to my data, Toyota is the #1 seller although chinese ones are coming.

Raising such countries brings up the obvious next points:

4.

Tesla Energy, among others, must supply stable electricity supplies from almost all solar and wind with Megapacks and others supplying storage. Why this one? It is fundamental. Those countries and about 100 others have no present electrical supply in much of their territory.

5.

Water supplies must be facilitated through desalination, minimizing erosion etc.

The last two points are now plausible and are crucial to the human transition to renewable energy. Those tow point also are directly causes for global poverty, immigrant crises in rich countries and countless armed conflicts.

It may seem absurd to cast all this in such grand context. These are precisely what is implied in Elon's goals. 20,000,000 autos per year really means having a thriving business nearly everywhere in the world. Tesla Energy and all it implies are necessary ingredients to have that happen. When Elon says Tesla Energy will be larger than the autos, maybe less profitable, all this is obviously included.

The most poignant point of all is that everything above is achievable with continuation of the present plans. The ONLY part not explicitly included is water, but the technologies there already do exist.

As all those become evident and have been achieved in initial success, the stock prices will rise. In the meantime talking about the points above makes analyst eyes glaze over as they already do with FSD and Dojo. For these actions speak louder than words. The words will be regarded as signs of dementia. So, don't talk much, just do it!