Has anyone seen FOMO?

I could have sworn they would be here by now...

I could have sworn they would be here by now...

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Wow, Swedish courts are fast!

Yeah, or some form of 'warranty refund' if you don't need service. Either way, it's building brand loyalty, and a far more effective means of advertizing.I've always wondered why they Tesla doesn't progressively extend power train and battery warrantys as the reliability grows, mostly for marketing purposes, and just because they can. Retroactively to older models, even more impressive.

@Elon did you catch this?What a great smack down to ICE and unwarranted fears of replacing expensive battery packs. I'm pretty sure that very few new car buyers think about the plastics and peripherals degrading after 15-25 years, but simple drive train years and miles are the simplest measure of reliability you could ask for.

Has anyone seen FOMO?

I could have sworn they would be here by now...

The ruling is temporary until it can be heard. An Emergency Motion is what we call them here.Wow, Swedish courts are fast!

Well, they’ve got SOME kind of agenda. The link doesn’t carry me there so I cant read the exact wording but right off the top, the 2021 figures they cite aren’t even vaguely pertinent.Another FUD piece, this time an editorial written by someone with no fossil fuel agenda/S

(Paywalled, Toronto Globe and Mail)

Opinion: Why government mandates on electric cars will not work

In 2021, only 66,800 fully electric vehicles were sold in Canada, a tiny 0.04 per cent of the vehicle stockwww.theglobeandmail.com

View attachment 994122

Quote: With lithium supply growing more next year, we are likely going to see prices falling further

Is The Lithium Crash A Buying Opportunity? - RIA

Lithium prices and shares of its largest producer have fallen significantly despite sustained strong demand. Is this an opportunity?realinvestmentadvice.com

What Caused the Dramatic Drop in Lithium Prices? | OilPrice.com

The price of battery-grade lithium carbonate has experienced a significant crash due to an oversupplied market in Asia and a slowdown in the global adoption rate of electric vehicles.oilprice.com

Lithium price rout deepens with battery metal now down 75% this year

Chinese prices of lithium carbonate are down 20% so far this month.www.mining.com

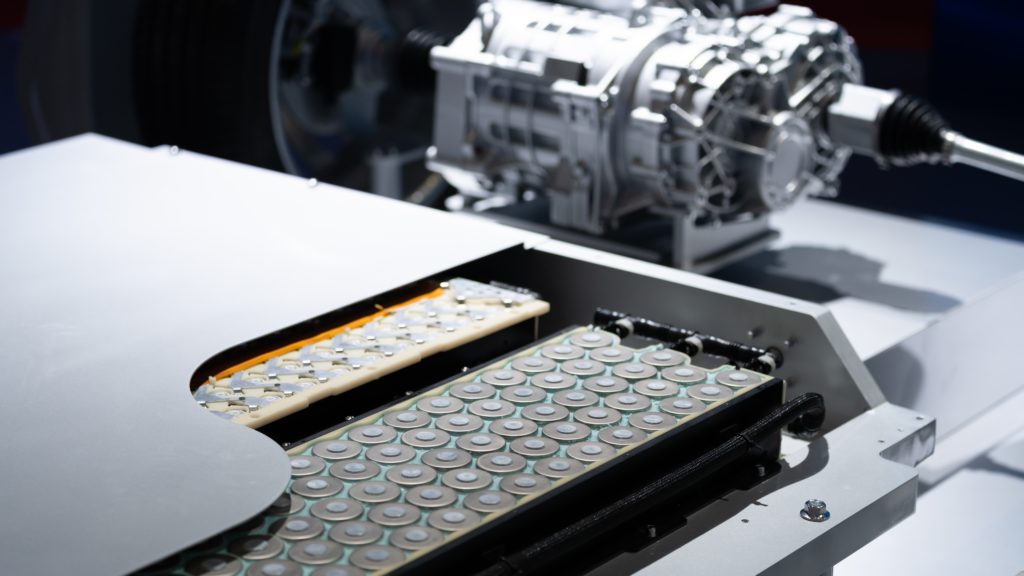

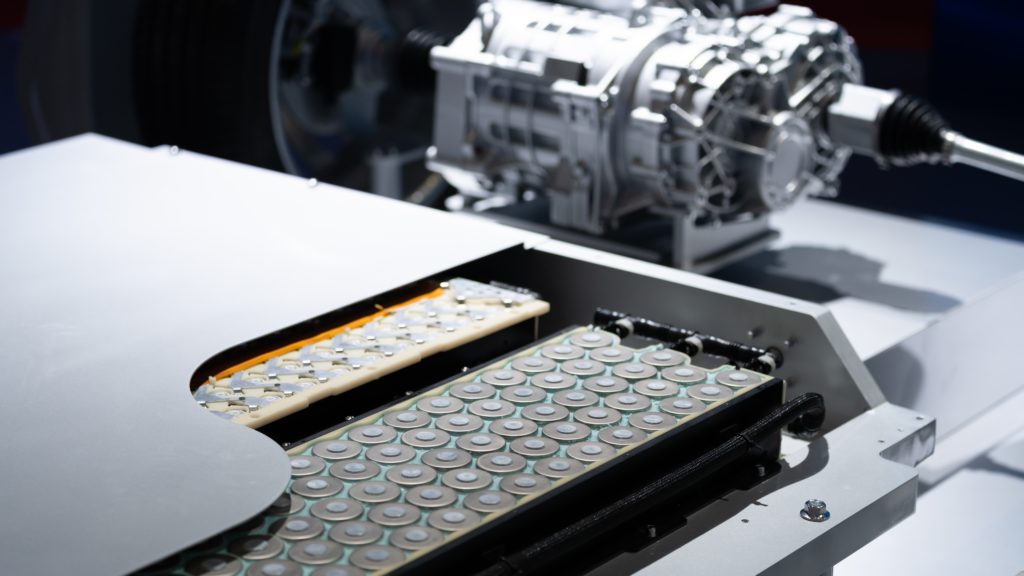

Battery prices dropped 14% from last year:

Battery prices are falling again as raw material costs drop

Prices of key battery metals — especially lithium — have fallen dramatically since January.www.mining.com

For an even better win-win, Tesla could offer reasonably priced extended warranties for existing owners of certain models, doing what you suggested while still bringing in a little more revenue.Yeah, or some form of 'warranty refund' if you don't need service. Either way, it's building brand loyalty, and a far more effective means of advertizing.

@Elon did you catch this?

WORD!

Right $2500 for a four year warranty with $500 each time you bring it in is not enticing at all. (Unless the terms have changed from what I remember).For an even better win-win, Tesla could offer reasonably priced extended warranties for existing owners of certain models, doing what you suggested while still bringing in a little more revenue.

I must admit, 2023 has not gone the way I expected it to for Tesla. Even my conservative estimates at the start of the year were not this low, I just never saw them lowering the boom on prices and margins the way they did.

Ah well, it is what it is!

My only concern about the price drop was that they may have blown their wad all at once with that huge drop at the beginning of the year. We've seen a bit more since then, but if 2024 does end up with a material recession, not a lot of ammo left...I must admit, 2023 has not gone the way I expected it to for Tesla. Even my conservative estimates at the start of the year were not this low, I just never saw them lowering the boom on prices and margins the way they did.

Ah well, it is what it is!

My only concern about the price drop was that they may have blown their wad all at once with that huge drop at the beginning of the year. We've seen a bit more since then, but if 2024 does end up with a material recession, not a lot of ammo left...