Google AI indicating where the stock should be trading based on other over valued tech including googl

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

cliff harris

Member

Two thoughts:

Stop pretending that the model 3 is going to be the cheaper car. It DOESN'T MATTER if they get the model 3 cost to build lower, its still a BIG car for a lot of places in the world, especially European cities. For the love of god, do Americans think that cars like the 'mini' or the fiat500 only exist because they sell to people on the poverty line? The nextgen car SHOULD be smaller. Teslas don't sell for a bunch of reasons in Japan, but one reason is they are just too big. Go to tokyo and look at the average car size.

Wall st like predictable straight extrapolation. Things they can put in a spreadsheet. Thats why they hated the cybertruck and STILL dont get it. They wish Tesla had made a me-too pickup. A rivian. Thats great, but the global marketing budget for the cybertruck will be zero, because it speaks for itself. No other car company was thinking 48v, or megacasting, or unboxed. GM, Ford, they didn't have anything vaguely like this in their plans. They had boring, boring spreadsheets that extrapolated current mediocre profits each year while their CEOs played golf...

A big reminder that we have BEEN HERE BEFORE. No car company had 'touchscreen controls' in their plans, or 'build a supercharger network' either or 'sentry mode' or 'watch netflix in the car' or 'play games in the car' or 'collect data for a neural-nrtwork based self driving system'...

Years after Tesla makes amazing cars, all the dinosaurs try to copy them. In five years time we will be seeing wonderful corporate presentations from the few remaining legacy car companies about how they have started shifting to 48v, or are transitioning to an unboxed production system, or experimenting with developing humanoid robots.

Watch 'the revenge of the electric car', and tell me that what Tesla went through back then wasn't 100x worse than a 12% dip after earnings and some analysts being mean about elon.

Stop pretending that the model 3 is going to be the cheaper car. It DOESN'T MATTER if they get the model 3 cost to build lower, its still a BIG car for a lot of places in the world, especially European cities. For the love of god, do Americans think that cars like the 'mini' or the fiat500 only exist because they sell to people on the poverty line? The nextgen car SHOULD be smaller. Teslas don't sell for a bunch of reasons in Japan, but one reason is they are just too big. Go to tokyo and look at the average car size.

Wall st like predictable straight extrapolation. Things they can put in a spreadsheet. Thats why they hated the cybertruck and STILL dont get it. They wish Tesla had made a me-too pickup. A rivian. Thats great, but the global marketing budget for the cybertruck will be zero, because it speaks for itself. No other car company was thinking 48v, or megacasting, or unboxed. GM, Ford, they didn't have anything vaguely like this in their plans. They had boring, boring spreadsheets that extrapolated current mediocre profits each year while their CEOs played golf...

A big reminder that we have BEEN HERE BEFORE. No car company had 'touchscreen controls' in their plans, or 'build a supercharger network' either or 'sentry mode' or 'watch netflix in the car' or 'play games in the car' or 'collect data for a neural-nrtwork based self driving system'...

Years after Tesla makes amazing cars, all the dinosaurs try to copy them. In five years time we will be seeing wonderful corporate presentations from the few remaining legacy car companies about how they have started shifting to 48v, or are transitioning to an unboxed production system, or experimenting with developing humanoid robots.

Watch 'the revenge of the electric car', and tell me that what Tesla went through back then wasn't 100x worse than a 12% dip after earnings and some analysts being mean about elon.

Knightshade

Well-Known Member

Imo FSD. V12 will offer a few things:

1. Greatly improved subjective performance, wow factor for a lot of passengers selling both FSD and Teslas

2. Slightly increased take rate and price in US

Possibly.... certainly the most likely ones on your list anyway.

3. Quicker rollout of FSD outside of US ie China and release of deferred revenue from Europe

AFAIK, unlike the US, this is entirely bound by heavy regulation- so how will "all nets" change that? Even EAP is criplied by regulations over there.

4. V12 so far seems like a great leap forward, it might actually be good enough for A->B supervised for most drives and safer than average within a few weeks.

This is a thing you hope, not a thing V12 specifically offers.

5. Quicker iteration as it's not only a data/training problem.

Huh? With more NNs there'd be MORE to train, versus just tweaking static code.

Plus, the black box nature of NNs makes them harder to fine tune versus static code.

You can get much more dynamic results with NNs, but the "quicker" bit seems... like you'll need to expound on your thinking here?

6. Getting ready for small scale geofenced robotaxi

0.00% chance of this.

Anti-small-geofence has been the entire point of Teslas approach to self driving.

This will happen this year

6 for absolute sure will not. Several of the rest seem exceedingly unlikely too.

. Optimus this year will see small scale work on Tesla factory floor. Wallstreet will not get it until they see the product out to some customers in 2025.

The hopium is strong with this one

Anyway deeper dives on the FSD stuff (like why you think iterations will magically be way faster in V12) likely belong shere:

AI, Autopilot, & Autonomous/FSD

Discussion about AI, Tesla Bot, Tesla Autopilot (AP), the promise of Full Self Driving (FSD), as well as other Autonomous Vehicles.

If anything, I think they could go lower voltage for next gen platform. Way fewer cell monitoring chips for the BMS, and no added benefit of going higher voltage in a "low power" and small battery vehicle

Those monitoring chips were a real pain to get until a while ago, so reducing them by going lower voltage is a big win, but don't know how it is currently due to being fired lol

While I could see standardizing on a single architecture for simplicity's sake, I could also see keeping 400v for smaller vehicles.

I sincerely doubt they'd introduce a third architecture, however. And there's still benefit I^2*R still holds for a smaller vehicle, allowing smaller gauge wire. And not sure you'd need less BMS chips... The needed power dictates the number of cells, not the voltage. For a given KWh pack you need fewer bricks of cells in series, but you need double the cells in parallel (i.e. more current capacity) in each brick. I suspect that means 2X temp sensors to monitor...

Any decision that reduces the number of anything you can be sure Tesla is taking it

That includes reducing SKU's and parts you need to source, manufacture, stock, and track. And variables you have to manage.

Last edited:

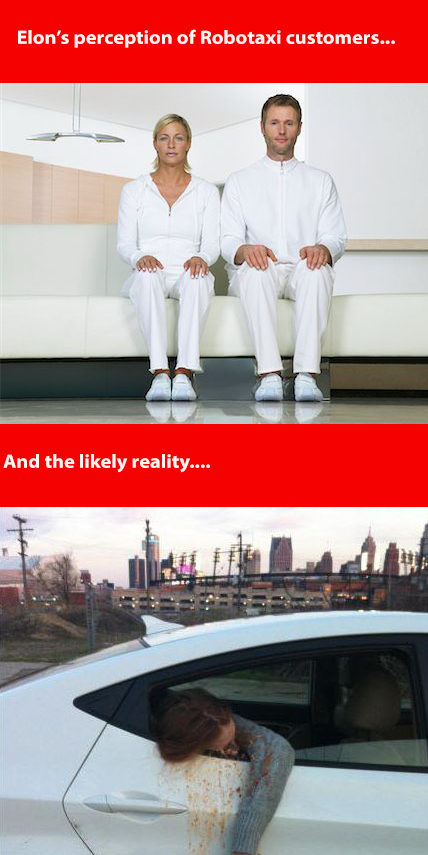

I've frankly grown weary of the Robotaxi hype. Sure FSD is a big part of that, but why has no one talked about the business model? How will the cars get charged during the day? Who'll clean them? How will my white interior not become a grafitti magnet? What about insurance and liability? What will Tesla's take be? How will novice riders know how to open the friggin' doors? What will the cars do when eco-terrorists lie down in front of the cars or Uber drivers pen them in? To me it's a pipe dream.

It is wrong

Perhaps the least challenging part to figure out. Waymo's all electric iPace are already on the streetI've frankly grown weary of the Robotaxi hype. Sure FSD is a big part of that, but why has no one talked about the business model? How will the cars get charged during the day? Who'll clean them? How will my white interior not become a grafitti magnet? What about insurance and liability? What will Tesla's take be? How will novice riders know how to open the friggin' doors? What will the cars do when eco-terrorists lie down in front of the cars or Uber drivers pen them in? To me it's a pipe dream.

View attachment 1012260

cliff harris

Member

Cheburashka

Active Member

Perhaps the least challenging part to figure out. Waymo's all electric iPace are already on the street

Scale is small. There is no profitability.

Human drivers are pretty cheap, Uber keeps most of what they charge the riders with drivers receiving a small cut + maintaining their cars.

texas_star_TM3

Active Member

let's stick to the facts:Costco has a revenue growth of 6.3% with a PE ratio of 54.

Walmart revenue growth was 6.44% and has a PE ratio of 31

I think it's safe to say wall street doesn't give a crap about revenue growth or PE ratios. You would think Walmart's PE ratio should be higher but it's not. And why are these dinosaurs having higher than tech PE ratios anyways? Nobody really knows

In my view, wallstreet assigns high PE to companies that can potentially knock out the incumbent. If Walmart has a decade of poor management, it wouldn't be surprising to see Costco taking over. This is why Tesla has a high PE because legacy auto are spending most of their time defending marketshare. They have nowhere to go but down unless Tesla goes belly up...then they remain the same which is not really great for PE anyways.

Walmart P/E is currently 27

Costco P/E is currently 46

Tech company P/Es are 82 (amazon) on the high end... apple is 31 ; microsoft 39 ; alphabet (google) 29 .; netflix stock 46

so Walmart definitely doesnt have higher than tech strock P/E ...

TSLA is 42 as of today... which is more in line with reasonable given the outlook although still high ... especially compared to the money and growth machine MSFT has become

DarkandStormy

Active Member

Times like this its aways good to hear Tasha reminding everyone why they should HODL

Why would you want to hear from someone whose firm's flagship fund has underperformed the NASDAQ by 110% in the last five years (their favorite timeline)?

Knightshade

Well-Known Member

I've frankly grown weary of the Robotaxi hype. Sure FSD is a big part of that, but why has no one talked about the business model? How will the cars get charged during the day? Who'll clean them?

Optimus answers both questions. Have one at each supercharger site to plug/unplug taxis, plus clean the cars.

How will my white interior not become a grafitti magnet?

Interior cameras and Tesla having your credit card to charge you for damage you do.

What about insurance and liability?

If only Tesla had an insurance offering.

WADan

Member

I am sitting (impatiently) on some ROTH backdoor conversion $ too since I think SP will drop further. I might go 50/50 TSLA and BYDDF.Converted 100 more shares from IRA to ROTH....lemons to lemon aid.

Costco has a high p/e, given its long duration. They will around for a long time. With Gross marginsCostco has a revenue growth of 6.3% with a PE ratio of 54.

Walmart revenue growth was 6.44% and has a PE ratio of 31

I think it's safe to say wall street doesn't give a crap about revenue growth or PE ratios. You would think Walmart's PE ratio should be higher but it's not. And why are these dinosaurs having higher than tech PE ratios anyways? Nobody really knows

In my view, wallstreet assigns high PE to companies that can potentially knock out the incumbent. If Walmart has a decade of poor management, it wouldn't be surprising to see Costco taking over. This is why Tesla has a high PE because legacy auto are spending most of their time defending marketshare. They have nowhere to go but down unless Tesla goes belly up...then they remain the same which is not really great for PE anyways.

of 13%, their merchandise is priced very competitively , especially in an inflationary environment.

View attachment 1012246

I personally know several households that are struggling despite working as much as they can. I have an above average and above median salary in the USA and the difference in my disposable income for the past 4 years is significant

texas_star_TM3

Active Member

Optimus crawling into cars with a vacuum, cleaning them, wiping interior services while not damaging anything ? sure. cool stuff. let's talk in 2030+ again.Optimus answers both questions. Have one at each supercharger site to plug/unplug taxis, plus clean the cars.

Interior cameras and Tesla having your credit card to charge you for damage you do.

If only Tesla had an insurance offering.

Tesla insurance isn't run by Tesla... they outsource it to insurance providers and just label it Tesla insurance but Tesla isn't the underwriter. Given the enormous liabilities of FSD I don't see anyone jumping onboard to underwrite that.

also: FSD is nowhere near that and won't be without redundancy like lidar, radar. "vision only" doesn't cut it when cameras are blinded by the sun or it's pouring rain. are FSD robotaxis supposed to come to a screetching halt on the interstate if the low winter sun blinds the camera sensor?

Featsbeyond50

Active Member

Drivers get about half.Scale is small. There is no profitability.

Human drivers are pretty cheap, Uber keeps most of what they charge the riders with drivers receiving a small cut + maintaining their cars.

That's cuteCostco has a high p/e, given its long duration. They will around for a long time. With Gross margins

of 13%, their merchandise is priced very competitively , especially in an inflationary environment.

Google gross margin is 56%, revenue growth is 11%. Their net margin is almost 2x of Costco's gross margins. Tell me why it has a PE ratio 17 points lower than Costco?

Featsbeyond50

Active Member

In my opinion, private Tesla owners won't be able to put their cars into the fleet. It will either be 100% operated by Tesla or a combination of Tesla and commercial fleet operators.I've frankly grown weary of the Robotaxi hype. Sure FSD is a big part of that, but why has no one talked about the business model? How will the cars get charged during the day? Who'll clean them? How will my white interior not become a grafitti magnet? What about insurance and liability? What will Tesla's take be? How will novice riders know how to open the friggin' doors? What will the cars do when eco-terrorists lie down in front of the cars or Uber drivers pen them in? To me it's a pipe dream.

View attachment 1012260

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K