Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

GhostSkater

Member

“Hi, this is Jack from MSM FUD inducing council

I’m proud to report that the work has been having stellar results

Keep the great work team”

I’m proud to report that the work has been having stellar results

Keep the great work team”

GhostSkater

Member

Actually they wereRight, so that doesn't necessarily mean that the pack is no good.

The refresh S/X weren't/using all new cell designs in an all new vehicle...

It was a new vehicle, a completely new way to build a pack for Tesla and a brand new cells from Panasonic

Yes, less radical change than 4680s, but still

Wasn't there some Tesla employee (or contractor?) that was "giddy" about 4680 recently?Good would be a charging curve that doesn’t take 40+ minutes from 10-80%

That might as well be the case, but it will be quite a while until we know, other Tesla packs that started with limited charging speed took many months for a update to improve it

On the other side, we had the Model S/X refresh which debuted with an awesome curve from the get go, first time this happened with Tesla afaik

Giddy on this would be to find out that all the one's sold will be capable of some amazing charging speeds and/or added range.

Encouraged or excited would be the word for it's getting solved but...

Right, hence my phrase "all new cell designs in an all new vehicle"... the S/X were minor refreshes of an existing platform and an update to a long-used existing cell design.Actually they were

It was a new vehicle, a completely new way to build a pack for Tesla and a brand new cells from Panasonic

Yes, less radical change than 4680s, but still

We are in new territory for 4680's in the CT.

FEERSUMENDJIN

Member

Hundreds of other tech stocks have not recovered from that 21/22 peak. Nothing to do with EVs. Look at Cathie Woods holdings.hmmm. over past 5 years, you don't see the giant peak that TSLA had in late 2021 in AAPL, AMZN, or GOOG. Even with the bubble pop, TSLA is outperforming those over last 5 years

View attachment 1015615

FEERSUMENDJIN

Member

The first LiFe model 3s from China had a really sucky charge profile on introduction. Tesla will optimise this.Good would be a charging curve that doesn’t take 40+ minutes from 10-80%

That might as well be the case, but it will be quite a while until we know, other Tesla packs that started with limited charging speed took many months for a update to improve it

On the other side, we had the Model S/X refresh which debuted with an awesome curve from the get go, first time this happened with Tesla afaik

GhostSkater

Member

The first LiFe model 3s from China had a really sucky charge profile on introduction. Tesla will optimise this.

The issue we have is that Tesla always improve charging curve as time go on

But we also have the 4680 Model Y which is one of the worst charging EVs and it hasn’t seen a improvement in months now

So we are on the 50/50 territory, maybe 30/70 with Lars comments that it will charge faster

Interesting. “Guarantee” really does not apply, although “reduced risk” might.The post in which mongo goes off-brand (and I've taken so long to write this it looks like a pile on, which it's not meant to be)

You can lose just as much money holding as with options. It's all in position size/ risk.

Call it paper gains, but for those with tax deferred accounts, 400 to 180 is a pure >50% loss, just as much as selling all stock, putting half one's cash into options, and having them expire worthless would be. Holding is rebuying in place without taxes.

If TSLA goes $100 again and stays there, if FSD doesn't pay off in the next X years, if, if, if, will our depleted accounts be any better having had stock losses vs option losses? Will Martin send us Christmas cards?

Say TSLA goes up. Holding is still just "paper gains". The only return on investment comes from selling shares (unless dividend). Curt was smart, took some gains, bought a house. Seriously, kudos to him.

*not advice*

Via selling call options, one can take a route that has two outcomes:

1. Stock stays below the strike price: one pockets the option premium and can use it to buy more TSLA or dinner

2. Stock goes above the strike: well, you have the premium, but you've also sold shares at a lower price than you could have. Guess what? That's already true, and there is nothing to show for it.

Illustrative example, *not advise*

Want to guarantee 5%(ish) return for the next two years? Sell 340 strikes for Jan 2026. Roughly 10% cash return today. Total returns capped at 94% over two years. Is that worse than holding if the stock goes above $380 (adjusting for 10% cost of living sales)? Sure, but it's better than just holding if the stock is under that price. Both hold and sold calls are vad choices if TSLA is down more than 10% at that point.

Just ask @mongo how many absolutes there are.

For context most of those Tesla employees allegedly bought on margin and/or bought unspecified options.

Equating Tulip mania with Tesla mania must be the funniest comparison of the year, maybe even twelve months. Obviously you read Charles Mackay but maybe forgot the bit about 'delusions'. Being an overly enthusiastic investor in a thriving company is not really delusional. Nor would it be delusional or hysterical to be convinced Tesla is overpriced and doomed to lose to more powerful and well-placed manufacturers.I complain because this is an amazing company with an amazing future and amazing people but dear leader spends more time diving head first into culture wars. I've been HODL for many years and saw over 20x but let's be honest anyone who with pride says "I never sold a single share" after we just went through [and in think are still in to some degree] a huge bubble should be kicking themselves. Holding tulips the entire time wasn't the winning more. NFA lol. Does the stock eventually go much higher? Sure. When it gets to double digits I'll buy in again.

In this forum there is room for vast differences in expectations for our securities. Luckily we are not entirely of common mind or opinion. Intelligent discourse is an excellent basis for learning. This I am happy many disagree with opinions I hold.

If I find new information that disproves my opinions, I change my opinions. Hopefully most of us do that.

I really wonder if, in today's world it makes any material difference how Elon feels about any given thing other than advancing the Tesla mission. I know I disagree with many of his stated views. Rationally, is that any of my business?

On another topic, FUD does definitely harm Tesla, therefore harms my financial condition.

Luckily you are not negative.Fantastic. What a great day it is. Now two people got off the pot. I look forward to the significant decrease of negativity in the forum now.

Then you will have become the singular god, not just one of a pantheon of gods.It’s always nice when you can predict the future.

Kenypowa

Member

If anyone wants to cheer up, read up some tweets by Tesla Economist Emotionist.

Total mental breakdown.

Total mental breakdown.

GhostSkater

Member

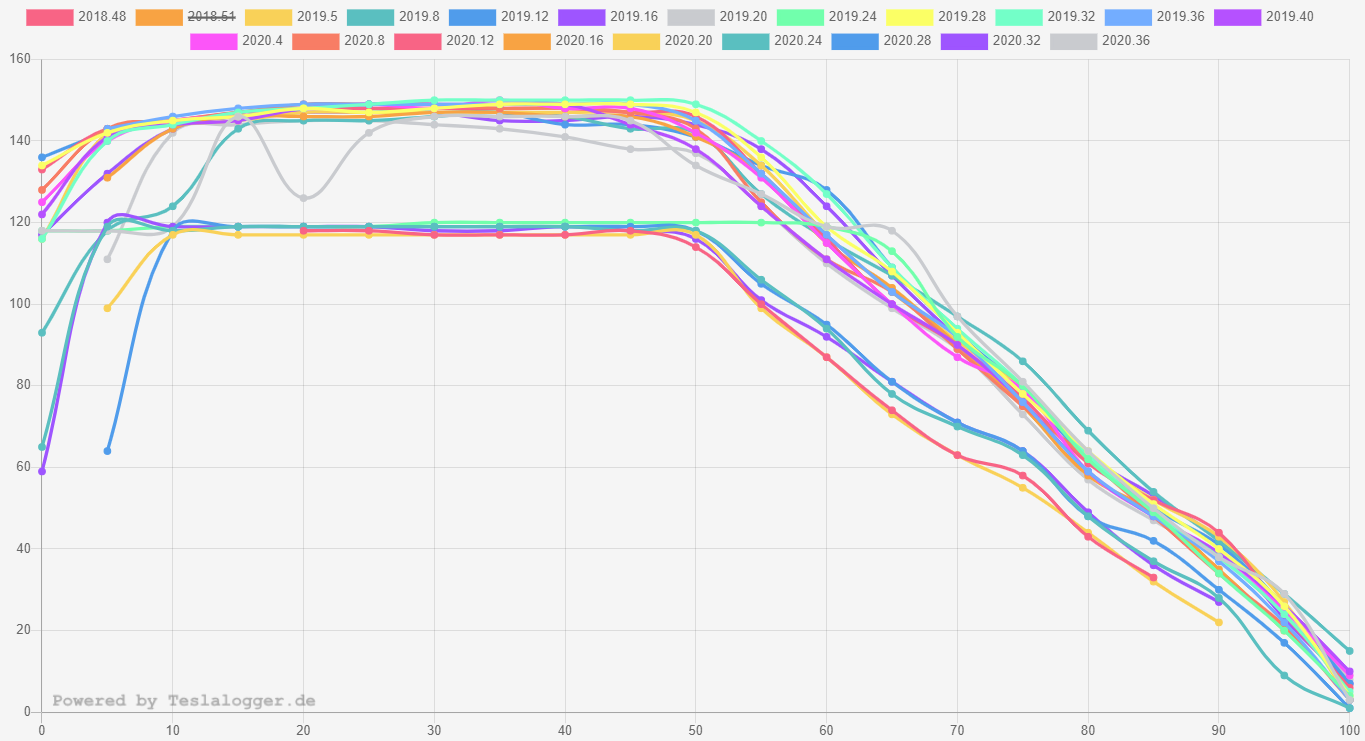

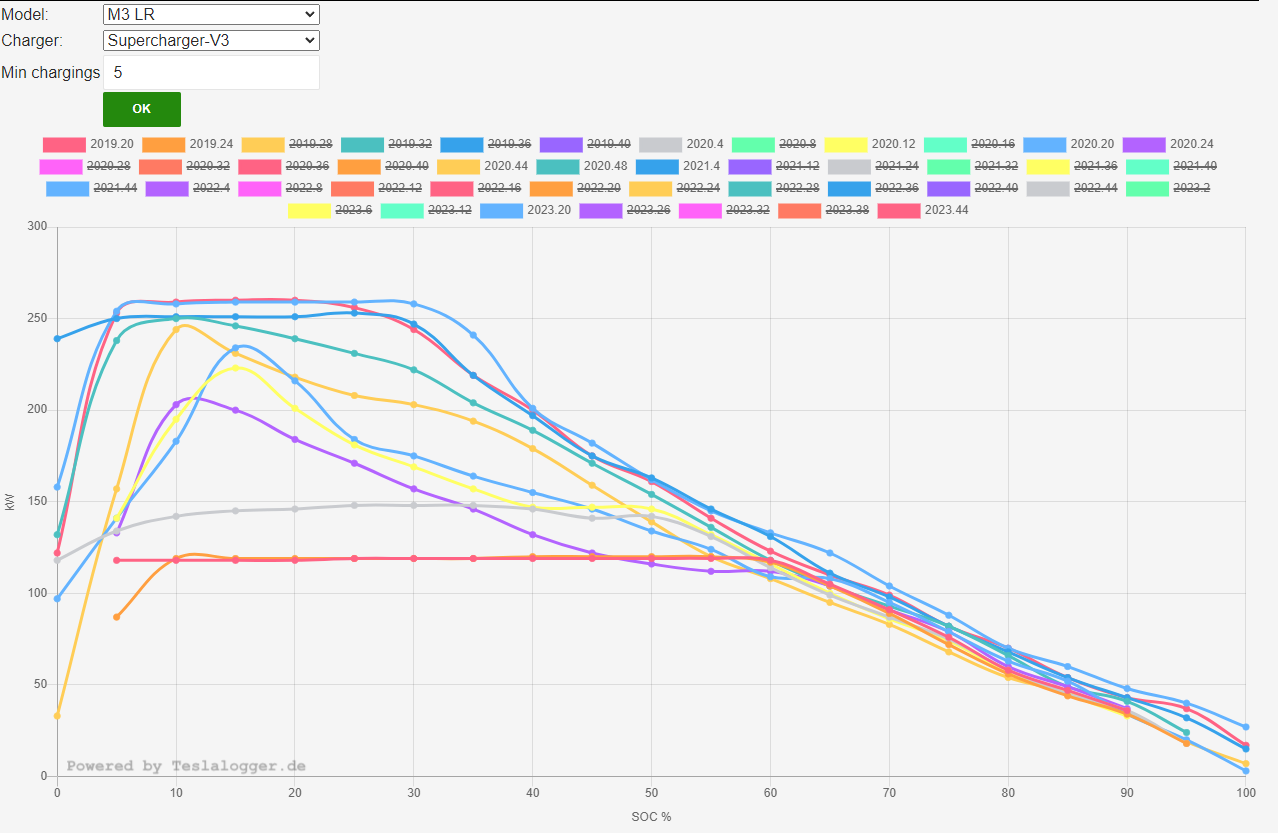

Since we are talking charging curve improvements, take a look at this since I don't think many people know, they keep tabs on charge curves for many if not all software versions, the naming of each model is a bit of a mess and I think they get the peak across all session because some numbers doesn't make much sense

For example, here in a Model 3 LR it shows in software 2023.20 maintaining over 250 kW for more than 30% SoC, don't think I ever saw that in a documented charging session other than when Tesla had unveiled Supercharger V3 which they latter dialed back due to excessive degradation

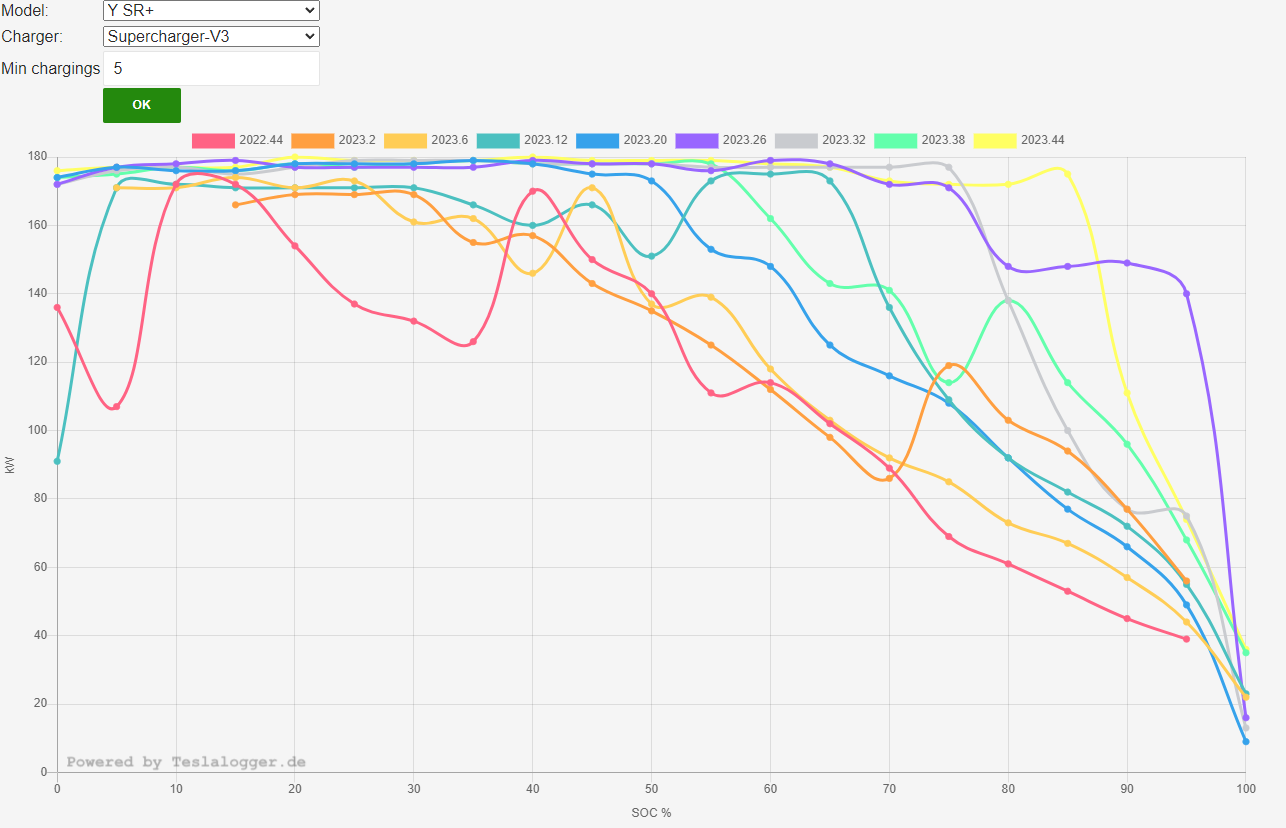

Model Y with Blade battery supports that they get the peak across multiple sessions, because it will peak at maximum power even at high SoC, but quickly will ramp down. You won't ever have it maintaining 180 kW from 0 to 85%, else it would be Taycan go home

For example, here in a Model 3 LR it shows in software 2023.20 maintaining over 250 kW for more than 30% SoC, don't think I ever saw that in a documented charging session other than when Tesla had unveiled Supercharger V3 which they latter dialed back due to excessive degradation

Model Y with Blade battery supports that they get the peak across multiple sessions, because it will peak at maximum power even at high SoC, but quickly will ramp down. You won't ever have it maintaining 180 kW from 0 to 85%, else it would be Taycan go home

I got blocked from the guy after pointing out Elon's compensation plan required certain EBITDA and length of time frame of marketcap to be sustained when he claimed Elon pumped the stock with a bunch of false promises that didn't materialized just to trigger his compensation package.If anyone wants to cheer up, read up some tweets by TeslaEconomistEmotionist.

Total mental breakdown.

The guy is full blown Tslaq. I do hate these TslaQ the most but they once were pretty informative.

It's kind of sad so many helpful people have gone TslaQ purposely spreading BS.

Certainly they didn't just wake up one morning and decide to flip and start working for big oil.I got blocked from the guy after pointing out Elon's compensation plan required certain EBITDA and length of time frame of marketcap to be sustained when he claimed Elon pumped the stock with a bunch of false promises that didn't materialized just to trigger his compensation package.

The guy is full blown Tslaq. I do hate these TslaQ the most but they once were pretty informative.

It's kind of sad so many helpful people have gone TslaQ purposely spreading BS.

Exactly what is their incentive, whose playbook are they following and where can we get a copy to peruse?

I don't know...seems like this is how some people deal with their frustrations. KarenRei is a good example, Fred is another, then there's Frunkpuppy. After the feud about blue check marks, Jerryrigeverything also goes on long Tesla rants.Certainly they didn't just wake up one morning and decide to flip and start working for big oil.

Exactly what is their incentive, whose playbook are they following and where can we get a copy to peruse?

Last edited:

Me thinks losing a *sugar* ton of $$ gambling could be one of the main driving factors in turning.Certainly they didn't just wake up one morning and decide to flip and start working for big oil.

Exactly what is their incentive, whose playbook are they following and where can we get a copy to peruse?

Drumheller

Active Member

He played with options and lost a significant amount of his father's money. That was a year or so ago.I got blocked from the guy after pointing out Elon's compensation plan required certain EBITDA and length of time frame of marketcap to be sustained when he claimed Elon pumped the stock with a bunch of false promises that didn't materialized just to trigger his compensation package.

The guy is full blown Tslaq. I do hate these TslaQ the most but they once were pretty informative.

It's kind of sad so many helpful people have gone TslaQ purposely spreading BS.

Maybe he played with options again, I don't know. There does seem to be a lack of personal accountability.

Artful Dodger

"Neko no me"

Not the same, but you know that. I don’t care about any of it either way, so don’t try and pretend I’ve taken a side. I’m just pointing out you’re being disingenuous.

What’s your reason for doing that? Do you need other people to agree with your disingenuousness to make yourself feel better about being so? Or are you just dishonest that way by nature? Or did you really not know the two examples are not the same, and now people know your level of intellectual understanding?

Oh kitty!

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M