This is a recent estimate:-

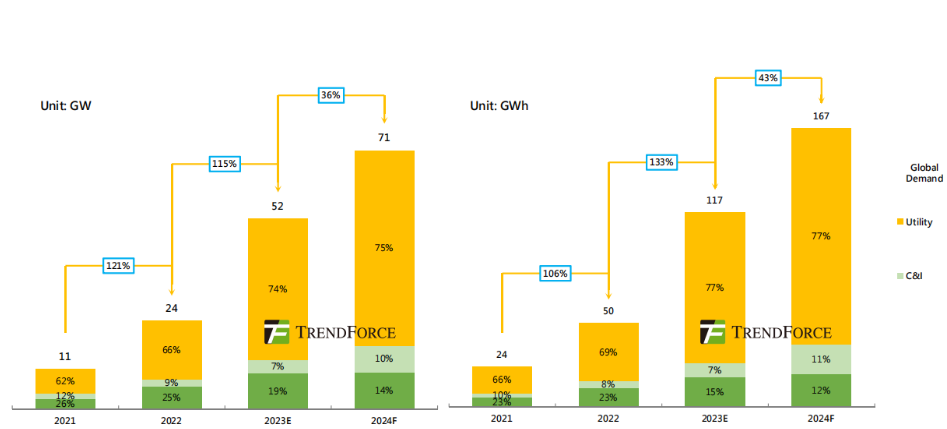

Analysis firm EnergyTrend has forecast that a “surge” in global large-scale energy storage system deployments is likely in 2024.

www.energy-storage.news

We are at the very early stages of an exponential growth wave, market demand will increase as prices drop, growth will help drive price reductions.

For context, I don't assume Tesla making 20 vehicles per year by 2030 is completely off the table, What it needs is the initial Gen3 production to go well and 3-4 new Gen3 factories starting no later than early 2026. demand isn't an issue scaling production is..

Energy storage is similar the hard part of 2 TWh per year by 2030 isn't demand (assuming the right prices can be hit), it is supply ramping all parts of the production process in sync to get to the final outcome. By many companies and countries can contribute to 2 TWh per year by 2030. if we say Tesla only needs to do 10% of that then we are talking about 200 GWh, 8 fully ramped 4680 lines. Not hat Tesla will necessarily use 4680s, but by 2030 they probably will be using them.

So it is all a combination of multiple exponential curves, vey hard to predict, and humans are not good at predicting, The pace is always harder to predict than the end result.