Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Latest TSLA short interest number as of Feb 28th is out. Went down by about a million+ shares from 32.2m to 31m. It looks like most of price fall from $270+ to $250ish is due to longs closing their positions: Tesla, Inc. (TSLA) Short Interest

Not good

Not good

adiggs

Well-Known Member

Woot! I feel like I just got selected for a dodgeball team  The larger of my two account's shares just got lent out at .625%.

The larger of my two account's shares just got lent out at .625%.

Since the smaller account isn't (yet?) lent out, my guess is that Fidelity Capital Management is working their way down the list of accounts in the Fully Paid Lending Program, lending out shares in bigger accounts first (less paperwork / overhead is my theory).

My other guess is that the rate will stay steady at the current level until most all of the Fully Paid shares have been lent out, and then we'll start seeing the interest rate to borrow shares to short will start rising.

Since the smaller account isn't (yet?) lent out, my guess is that Fidelity Capital Management is working their way down the list of accounts in the Fully Paid Lending Program, lending out shares in bigger accounts first (less paperwork / overhead is my theory).

My other guess is that the rate will stay steady at the current level until most all of the Fully Paid shares have been lent out, and then we'll start seeing the interest rate to borrow shares to short will start rising.

TheTalkingMule

Distributed Energy Enthusiast

Looks like a small uptick 2 weeks ago, it'll be interesting to see where we stand now. Next set of numbers should be out soon I imagine?

Tesla, Inc. (TSLA) Short Interest

Tesla, Inc. (TSLA) Short Interest

It looks like demand for shares is down a little. Yesterday, the interest paid on my Fidelity shares went from 0.625% to 0.5%. Still a few odds and ends not yet lent out.

This seems to be borne out in the official short interest figures from NASDAQ. Short interest was down to 30.96 million shares on May 31.

Tesla, Inc. (TSLA) Short Interest

This seems to be borne out in the official short interest figures from NASDAQ. Short interest was down to 30.96 million shares on May 31.

Tesla, Inc. (TSLA) Short Interest

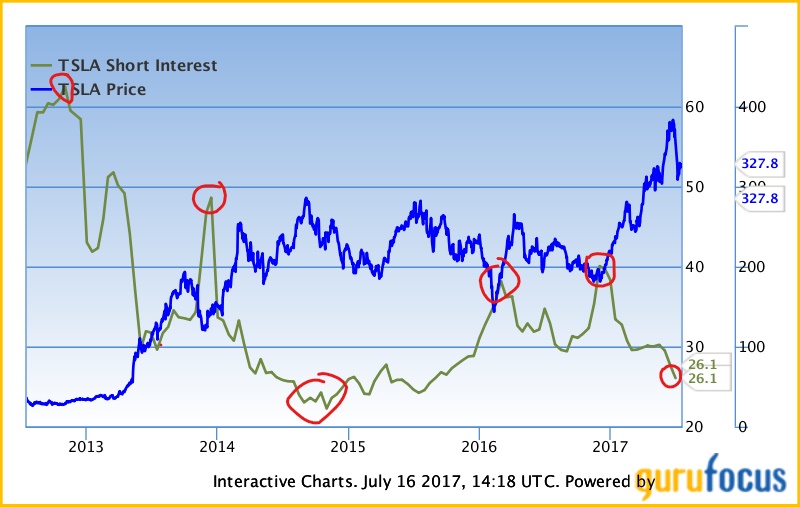

It has been interesting to watch short interest drop over the past 8 months or so as the share price has increased, so I decided to run a chart comparing SP to short interest (by percent of float) to see if this was an aberration or the norm.

From the chart below it seems clear that sell low, buy high has been the short sellers' pattern over the years, at least for the major price moves. Short interest was at a historic high of about 62% of float in November 2012 when SP was ~$30, and it dropped in half to around 30% as the SP ran upward through $100 in 2013. By late 2013, shorts had piled in again with short interest reaching nearly 50% as the SP dipped from $180 to $120. Then shorts bought/covered as the SP rose again up to ~$280 in late 2014. Short interest then stayed on the low side for a while as prices stayed relatively high until shorts again sold the dip down to ~$150 in early 2016. Shorts then covered again as the SP rose and sold short into the dip yet again in late 2016, before buying the recent rise into the $300s.

There have been some exceptions on some of the smaller price moves but it appears that the strong tendency of shorts has been to short sell when prices have been low and cover when prices are high -- which is exactly backwards.

This suggests that on average shorts are engaging in very costly herd behavior -- diving in as the SP drops and then covering (or being forced to cover by margin calls) as the price rises. So on average their returns are likely to be much worse than would be predicted just by looking at changes in the share price (which would be awful to begin with).

Based on the chart, it is tempting to conclude that shorts are being overly influenced by FUD and/or engaging in momentum investing based on perceived weakness in the SP, and are getting crushed in the process. This sell low, buy high pattern is exactly what you would expect from investors acting on emotions rather than facts and cold, hard analysis.

Also, the chart suggests that, as basic laws of supply and demand would predict, increased short interest appears to be correlated with depressed SPs, leading to buying opportunities. Short interest currently is low compared to historic TSLA numbers but very high compared to market norms. This high short interest tends to artificially depress the SP, even leaving aside the FUD and market manipulations that come along with it.

In the long run, I personally believe shorts will be forced to exit which will tend to provide upward pressure on the SP. But it is unclear how long that will take even if Tesla executes well through the Model 3 launch, etc. It is also possible that if Tesla encounters problems with Model 3 launch, macro difficulties, etc. shorts will pile back in again as the SP drops, which will probably at least temporarily exaggerate any downward price movements, just as short covering should tend to add fuel to strong upward price movements.

From the chart below it seems clear that sell low, buy high has been the short sellers' pattern over the years, at least for the major price moves. Short interest was at a historic high of about 62% of float in November 2012 when SP was ~$30, and it dropped in half to around 30% as the SP ran upward through $100 in 2013. By late 2013, shorts had piled in again with short interest reaching nearly 50% as the SP dipped from $180 to $120. Then shorts bought/covered as the SP rose again up to ~$280 in late 2014. Short interest then stayed on the low side for a while as prices stayed relatively high until shorts again sold the dip down to ~$150 in early 2016. Shorts then covered again as the SP rose and sold short into the dip yet again in late 2016, before buying the recent rise into the $300s.

There have been some exceptions on some of the smaller price moves but it appears that the strong tendency of shorts has been to short sell when prices have been low and cover when prices are high -- which is exactly backwards.

This suggests that on average shorts are engaging in very costly herd behavior -- diving in as the SP drops and then covering (or being forced to cover by margin calls) as the price rises. So on average their returns are likely to be much worse than would be predicted just by looking at changes in the share price (which would be awful to begin with).

Based on the chart, it is tempting to conclude that shorts are being overly influenced by FUD and/or engaging in momentum investing based on perceived weakness in the SP, and are getting crushed in the process. This sell low, buy high pattern is exactly what you would expect from investors acting on emotions rather than facts and cold, hard analysis.

Also, the chart suggests that, as basic laws of supply and demand would predict, increased short interest appears to be correlated with depressed SPs, leading to buying opportunities. Short interest currently is low compared to historic TSLA numbers but very high compared to market norms. This high short interest tends to artificially depress the SP, even leaving aside the FUD and market manipulations that come along with it.

In the long run, I personally believe shorts will be forced to exit which will tend to provide upward pressure on the SP. But it is unclear how long that will take even if Tesla executes well through the Model 3 launch, etc. It is also possible that if Tesla encounters problems with Model 3 launch, macro difficulties, etc. shorts will pile back in again as the SP drops, which will probably at least temporarily exaggerate any downward price movements, just as short covering should tend to add fuel to strong upward price movements.

That chart is hilarious. Thank you for posting that.It has been interesting to watch short interest drop over the past 8 months or so as the share price has increased, so I decided to run a chart comparing SP to short interest (by percent of float) to see if this was an aberration or the norm.

I wonder about that too, but I think tsla will be relatively volatile for a long time to come, so maybe that will be good for short term shorting.All of my shares that were lent out were returned to me over the weekend by Fidelity. I am guessing that the phase of the company's evolution where lending was a very profitable activity has ended.

I wonder about that too, but I think tsla will be relatively volatile for a long time to come, so maybe that will be good for short term shorting.

I believe that the number of shorts and their available bankrolls is finite. As Tesla grows as a company, the short interest naturally will recede, even if the stock stays volatile.

Too bad, because I was really enjoying sitting at the trough.

short interest went up to 29.2 million shares sold short as of 8/31 http://www.nasdaq.com/symbol/tsla/short-interest

any update on the chart as of 11/1/2017 (also this is a place holder reply)It has been interesting to watch short interest drop over the past 8 months or so as the share price has increased, so I decided to run a chart comparing SP to short interest (by percent of float) to see if this was an aberration or the norm.

From the chart below it seems clear that sell low, buy high has been the short sellers' pattern over the years, at least for the major price moves. Short interest was at a historic high of about 62% of float in November 2012 when SP was ~$30, and it dropped in half to around 30% as the SP ran upward through $100 in 2013. By late 2013, shorts had piled in again with short interest reaching nearly 50% as the SP dipped from $180 to $120. Then shorts bought/covered as the SP rose again up to ~$280 in late 2014. Short interest then stayed on the low side for a while as prices stayed relatively high until shorts again sold the dip down to ~$150 in early 2016. Shorts then covered again as the SP rose and sold short into the dip yet again in late 2016, before buying the recent rise into the $300s.

There have been some exceptions on some of the smaller price moves but it appears that the strong tendency of shorts has been to short sell when prices have been low and cover when prices are high -- which is exactly backwards.

This suggests that on average shorts are engaging in very costly herd behavior -- diving in as the SP drops and then covering (or being forced to cover by margin calls) as the price rises. So on average their returns are likely to be much worse than would be predicted just by looking at changes in the share price (which would be awful to begin with).

Based on the chart, it is tempting to conclude that shorts are being overly influenced by FUD and/or engaging in momentum investing based on perceived weakness in the SP, and are getting crushed in the process. This sell low, buy high pattern is exactly what you would expect from investors acting on emotions rather than facts and cold, hard analysis.

Also, the chart suggests that, as basic laws of supply and demand would predict, increased short interest appears to be correlated with depressed SPs, leading to buying opportunities. Short interest currently is low compared to historic TSLA numbers but very high compared to market norms. This high short interest tends to artificially depress the SP, even leaving aside the FUD and market manipulations that come along with it.

In the long run, I personally believe shorts will be forced to exit which will tend to provide upward pressure on the SP. But it is unclear how long that will take even if Tesla executes well through the Model 3 launch, etc. It is also possible that if Tesla encounters problems with Model 3 launch, macro difficulties, etc. shorts will pile back in again as the SP drops, which will probably at least temporarily exaggerate any downward price movements, just as short covering should tend to add fuel to strong upward price movements.

View attachment 236108

any update on the chart as of 11/1/2017 (also this is a place holder reply)

YTD is very consistent with the long-term "sell low, buy high" trend -- not a pretty picture for the shorts. Tesla Inc Interactive Charts --GuruFocus.com

If you zoom in to July-Oct. there are not many data points but they seem to be doing a little better. Short interest appears to have increased as the SP went up through mid-September and then dropped as the SP went down. Tesla Inc Interactive Charts --GuruFocus.com

We can check back a year from now and see if this is a new trend or not. There have been similar short-term trends in the past, but then the long-term "short low cover high" pattern resumes. I suspect it will be the same here but we shall see.

ah, thank you for the link. i accidentally got the whole thing back through 2010. It looks like "the valley of death" from 2013 - 2014, then again. the last year or so, but just from a cursory look.YTD is very consistent with the long-term "sell low, buy high" trend -- not a pretty picture for the shorts. Tesla Inc Interactive Charts --GuruFocus.com

If you zoom in to July-Oct. there are not many data points but they seem to be doing a little better. Short interest appears to have increased as the SP went up through mid-September and then dropped as the SP went down. Tesla Inc Interactive Charts --GuruFocus.com

We can check back a year from now and see if this is a new trend or not. There have been similar short-term trends in the past, but then the long-term "short low cover high" pattern resumes. I suspect it will be the same here but we shall see.

I'm having an actual civil discussion on SA with a "short" who says I don't understand either "shorting or Tesla financials"

my response is "my financials are very nice and tasty and sincere thanks for their monies and they should focus on their financials, not Tesla's, and I understand shorts have transferred Billion$ to the longs"

for some poorly understood reasons, these type of comments seem to drive shorts into barely coherent frenzies of responses

for some other reason, it bothers them when I suggest they visit Kaua'i on a short subsidized vacation and visit "MonkeyPodJam bakery" and try the baklava (my recipe, but $6/piece, a ripoff i think, but costs need to be covered) and look at the Tesla PV array and battery installation.

I love investing and intend to keep TSLA for 30+ years

happy investing, i sure am

ah, thank you for the link. i accidentally got the whole thing back through 2010. It looks like "the valley of death" from 2013 - 2014, then again. the last year or so, but just from a cursory look.

I'm having an actual civil discussion on SA with a "short" who says I don't understand either "shorting or Tesla financials"

my response is "my financials are very nice and tasty and sincere thanks for their monies and they should focus on their financials, not Tesla's, and I understand shorts have transferred Billion$ to the longs"

for some poorly understood reasons, these type of comments seem to drive shorts into barely coherent frenzies of responses

for some other reason, it bothers them when I suggest they visit Kaua'i on a short subsidized vacation and visit "MonkeyPodJam bakery" and try the baklava (my recipe, but $6/piece, a ripoff i think, but costs need to be covered) and look at the Tesla PV array and battery installation.

I love investing and intend to keep TSLA for 30+ years

happy investing, i sure am

The chart certainly suggests that shorts have been helping drive down share prices on the dips and TSLA bargain hunters have been the beneficiaries of that. So next time you are in Kauai enjoying a Mai Tai please be sure to toast your friends on SA for being so kind as to fund your vacation.

Similar threads

- Replies

- 10

- Views

- 4K

- Replies

- 0

- Views

- 792

- Replies

- 5

- Views

- 5K

- Replies

- 2

- Views

- 930

- Replies

- 7

- Views

- 1K