Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

trading

- Thread starter Boomer19

- Start date

bdy0627

Active Member

A 30-50% pullback from the climb would be healthy. We climbed $46, so a $14-23 dip would be reasonable. I'd really like to see $200 hold, assuming it gets tested. That would give us a higher low and set us up for a nice climb out of this crappy downward channel.

you called it,

$ talks and bullsh!t walks

but the technicals that put us at 177 was that bullshit, clearly.

q1 disaster, but unless you believe yesterday was a sham, q2 won’t be as bad. demand isn’t issue, as most of already knew.

so when do we know NOT to follow TA versus when to trade on the reality that tesla is growing, growing, and growing...

$ talks and bullsh!t walks

but the technicals that put us at 177 was that bullshit, clearly.

q1 disaster, but unless you believe yesterday was a sham, q2 won’t be as bad. demand isn’t issue, as most of already knew.

so when do we know NOT to follow TA versus when to trade on the reality that tesla is growing, growing, and growing...

anthonyj

Stonks

Chill out and use it to your advantagethis price action is absolutely effing ridiculous

how many shares can be shorted, 50m? 75m? 100m? before people start to realize it’s a joke. it’s just destruction waiting to happen.

Zhelko Dimic

Careful bull

I'm thinking about pressing my bet - maybe buying some 15 calls of Jan '21 $300 strike.

Not quite sure if I do it tomorrow at this price point or to wait for some more decline...

I'm also wondering if it would irresponsible to sell 80 AMZN I have left, and move into those the same leaps mentioned above. Basically, the way I'm looking at it, it's almost impossible that between now and feb '20, we don't hit $320, which is close to 200% return.

Someone talk me out of this plan please!

Not quite sure if I do it tomorrow at this price point or to wait for some more decline...

I'm also wondering if it would irresponsible to sell 80 AMZN I have left, and move into those the same leaps mentioned above. Basically, the way I'm looking at it, it's almost impossible that between now and feb '20, we don't hit $320, which is close to 200% return.

Someone talk me out of this plan please!

Zhelko Dimic

Careful bull

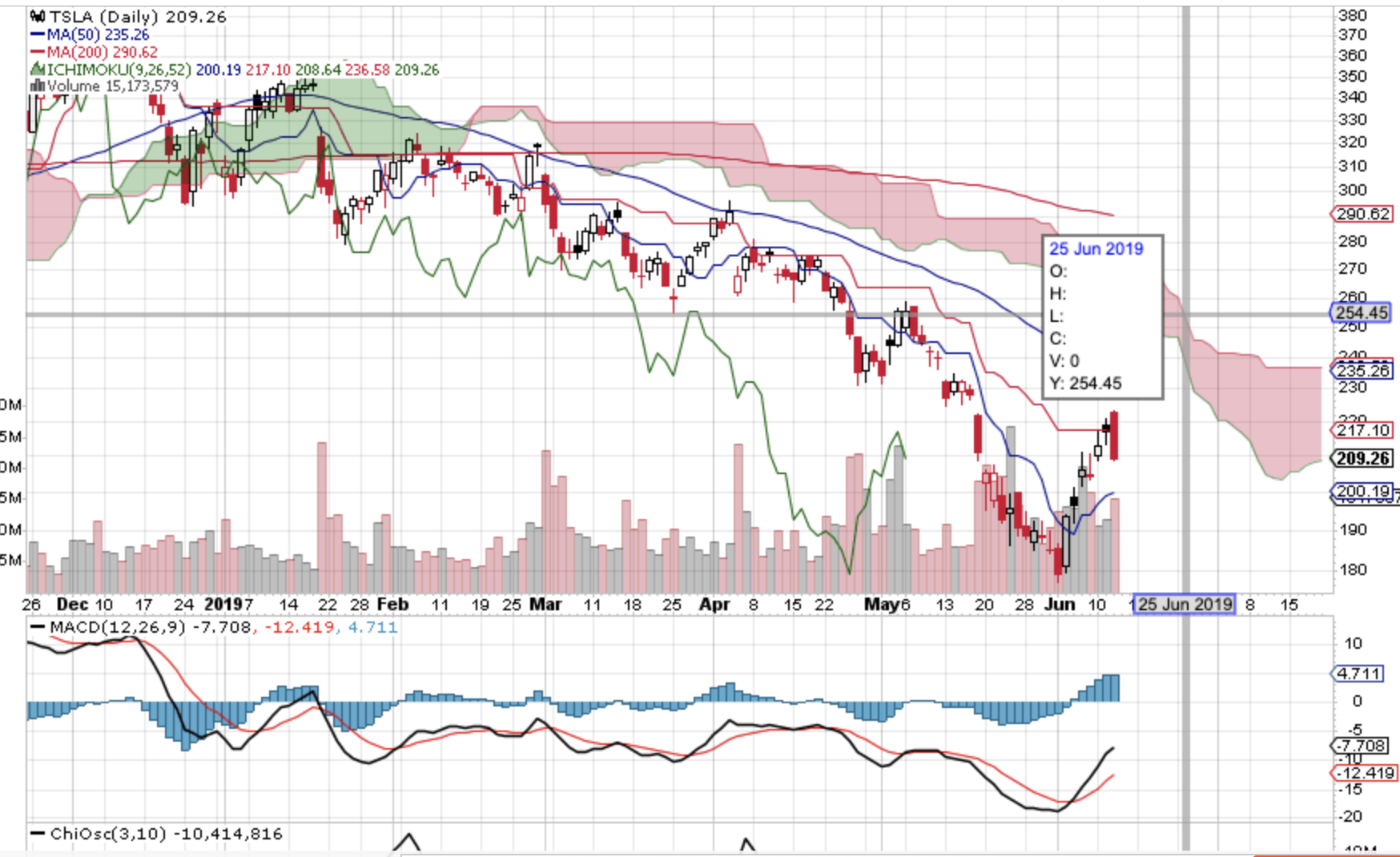

I sometimes/often see that SP crosses ichimoku cloud where it's thinest.

Considering we will be in for a delivery news wait, I;m wondering if June 25-26 is when we cross $250 and hence Ichimoku cloud. That would also give MMs enough time to orderly unravel positions and hedging whatever they've put in place recently to compensate for all of the put buying...

Considering we will be in for a delivery news wait, I;m wondering if June 25-26 is when we cross $250 and hence Ichimoku cloud. That would also give MMs enough time to orderly unravel positions and hedging whatever they've put in place recently to compensate for all of the put buying...

bdy0627

Active Member

I would suggest waiting to see what the Nasdaq does here. It has been running pretty hot and hit resistance at the 50 SMA. It may now trade back down to the channel low or the 200 SMA. If it drops quite a bit, TSLA will likely drop with it, and there will be a better entry point before the P&D report. The market seems to be expecting the Fed to drop the interest rate next week, but if it doesn't, there may be a negative reaction.I'm thinking about pressing my bet - maybe buying some 15 calls of Jan '21 $300 strike.

Not quite sure if I do it tomorrow at this price point or to wait for some more decline...

I'm also wondering if it would irresponsible to sell 80 AMZN I have left, and move into those the same leaps mentioned above. Basically, the way I'm looking at it, it's almost impossible that between now and feb '20, we don't hit $320, which is close to 200% return.

Someone talk me out of this plan please!

Antares Nebula

Active Member

As I suspected (but one never knows!). I sold my remaining options yesterday at 220. Will add shares (and only shares) if it dips under 200. Looking at 195 and possible retest of 180 (gaps also approx there).

I had a holding stack and a trading stack and was doing well up until the 250 support break recently. Now everything is gone to crap. I have no idea (or have lost confidence) in any near term trading strategy, as I have no idea what the price will do!! Still very bullish long term. But from here anything can happen: rapid V recovery, further dip to 120/140, and/or stagnation for months or even a couple of years (given Tesla specific and overall macros). Therefore, and because the share price is very cheap relative to options (and because I've decided I have no more time to babysit/monitor this stock, after having done so for so long), I am only buying shares going forward. (Okay, maybe a few options here and there.)

I had a holding stack and a trading stack and was doing well up until the 250 support break recently. Now everything is gone to crap. I have no idea (or have lost confidence) in any near term trading strategy, as I have no idea what the price will do!! Still very bullish long term. But from here anything can happen: rapid V recovery, further dip to 120/140, and/or stagnation for months or even a couple of years (given Tesla specific and overall macros). Therefore, and because the share price is very cheap relative to options (and because I've decided I have no more time to babysit/monitor this stock, after having done so for so long), I am only buying shares going forward. (Okay, maybe a few options here and there.)

anthonyj

Stonks

How bout 5 calls tomorrow, 5 at $190s, 5 at $180s. Assuming we reach those again of course. Perhaps I will join in this gamble...I'm thinking about pressing my bet - maybe buying some 15 calls of Jan '21 $300 strike.

Not quite sure if I do it tomorrow at this price point or to wait for some more decline...

I'm also wondering if it would irresponsible to sell 80 AMZN I have left, and move into those the same leaps mentioned above. Basically, the way I'm looking at it, it's almost impossible that between now and feb '20, we don't hit $320, which is close to 200% return.

Someone talk me out of this plan please!

anthonyj

Stonks

Tesla has the most entertaining mess of a chart. It’s like the SP is run through a random number generator every dayThat's interesting, Zhelko. I looked back at dips in 2014 and 2016 and, sure enough, the stock climbed up through the thin part of the cloud.

View attachment 418610

View attachment 418611

bdy0627

Active Member

I'm hoping to see either an inverse head and shoulders pattern (really asymmetric) develop or a double bottom. We did have an asymmetric head and shoulders pattern at the top before this long drop. I think as long as we make a higher low here on this pullback, which seems pretty reasonable to me but not at all certain, then an inverse head and shoulders is quite possible. It's early yet, but I can easily envision a right shoulder forming, particularly if we make a higher low around $200. Breaking up through the neckline could happen around the P&D report. If the pullback gets lower, closer to $180, then we have a possibility for a healthy double bottom. We'll see. I'm just going to sit on the sidelines right now and watch.

bdy0627

Active Member

Just watched Pulitzer's midweek video. It's pretty simple here. TSLA between 20 and 50 MA is neutral. 20 MA must hold or it's a short. Above 50 MA is bullish. I don't put the 20 MA on the chart since the mid BB provides it.

I'm thinking about pressing my bet - maybe buying some 15 calls of Jan '21 $300 strike.

Not quite sure if I do it tomorrow at this price point or to wait for some more decline...

I'm also wondering if it would irresponsible to sell 80 AMZN I have left, and move into those the same leaps mentioned above. Basically, the way I'm looking at it, it's almost impossible that between now and feb '20, we don't hit $320, which is close to 200% return.

Someone talk me out of this plan please!

i can’t talk you out of it.

i already have jan21 300c

and june21 280c

BUT!!!!, only 1 or 2 each so far. was going to add on way down. i rarely buy/sell everything in one fell swoop

anthonyj

Stonks

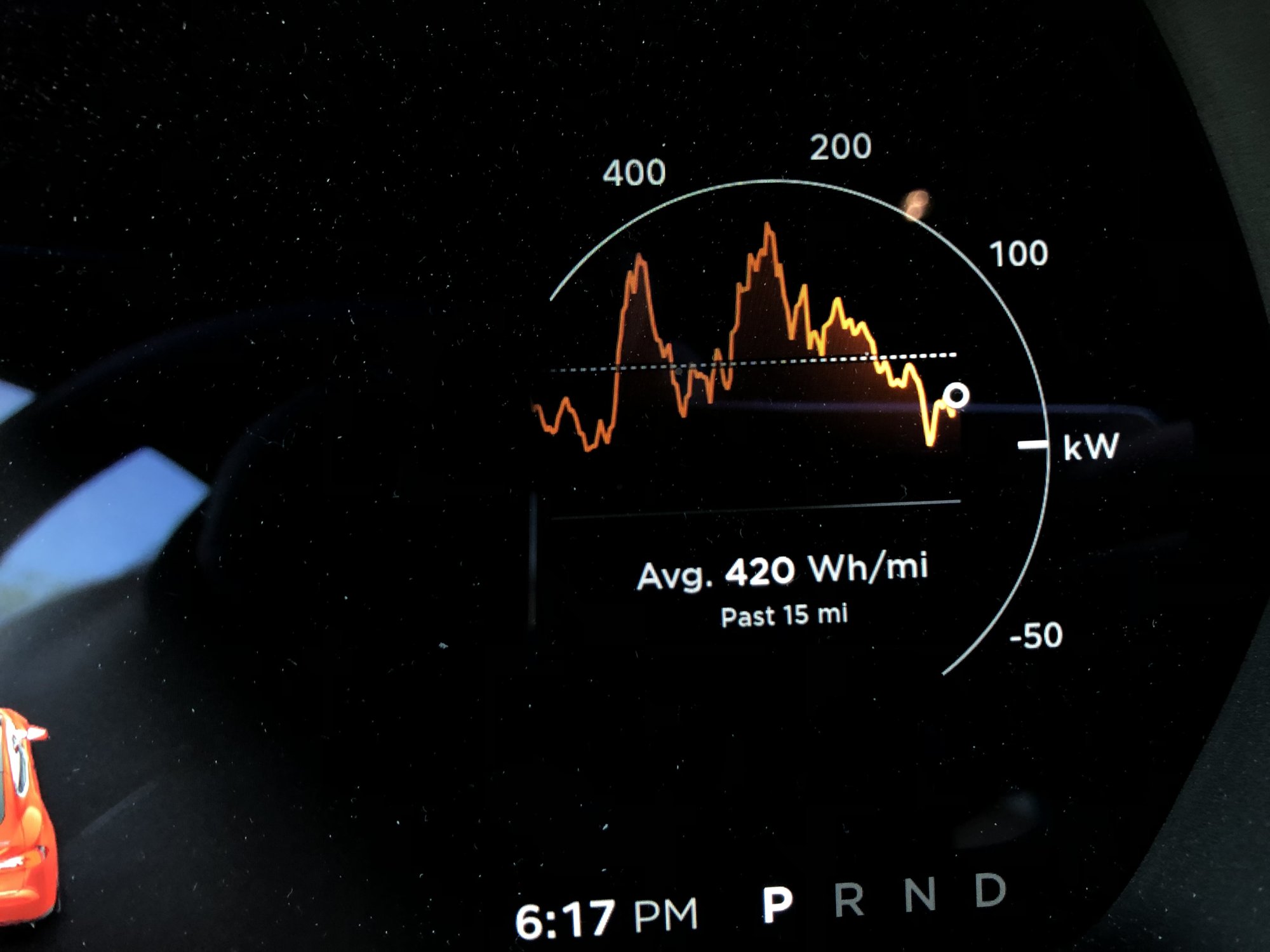

My car is telling us something. It’s showing Tesla’s chart and my price target

at some point the short interest is going to have to trim a little bit.

i’m not in the camp of squeeze

but i’m in the camp of reality, that such a trim should contribute at least 10-20% of movement

borrow rates are not nearly crazy enough to cause squeeze, although they accelerate as street liquidity dries up. a pullback to 40-then 36 mm shares shorted should move he stock up enough to possibly reach the next support level that bdy and others have mentioned

235-255?

i’m not in the camp of squeeze

but i’m in the camp of reality, that such a trim should contribute at least 10-20% of movement

borrow rates are not nearly crazy enough to cause squeeze, although they accelerate as street liquidity dries up. a pullback to 40-then 36 mm shares shorted should move he stock up enough to possibly reach the next support level that bdy and others have mentioned

235-255?

bdy0627

Active Member

Shorts will cover when there is clear data that will trigger a climb, which will almost certainly result in a violent climb. We may get that in about 3 weeks with the P&D report. It looks to me like we have pretty solid support around the $210 level, which is good to see. TSLA and the overall market is just choppy, holding onto gains from the last week. Next week will be interesting for the overall market with the Fed meeting. I feel like there may be some weakness coming but who knows.

anthonyj

Stonks

Shorts don’t cover on rumors or speculation. They cover on fundamentals. October 2018 we saw this. If Tesla reports great financials for Q2, you can expect a very brutal explosion to the upsideat some point the short interest is going to have to trim a little bit.

i’m not in the camp of squeeze

but i’m in the camp of reality, that such a trim should contribute at least 10-20% of movement

borrow rates are not nearly crazy enough to cause squeeze, although they accelerate as street liquidity dries up. a pullback to 40-then 36 mm shares shorted should move he stock up enough to possibly reach the next support level that bdy and others have mentioned

235-255?

Shorts don’t cover on rumors or speculation. They cover on fundamentals. October 2018 we saw this. If Tesla reports great financials for Q2, you can expect a very brutal explosion to the upside

in this specific scenario, i’m not so sure, the market isn’t always action -> reaction

although from naysayer POV, it’s boy who cried wolf too many times, at this point they may require proof..but i think that’s flawed reasoning on their end.

the 2nd qtr is going well, record breaking or not, well enough to NOT go bankrupt

otoh, i’d assume 75-80k deliveries are priced in at this time, a loss.

depending on cost of logistics, the magnitude of loss may not be priced in. at the same time we’re probably priced below a small loss, and i’d say definitely if breakeven.

but how far ahead are we pricing in now, is another factor. there’s q3 and onwards headwinds, like another ev credit cutoff, gf3 tooling (although supposedly the machines are booked q1) and ramp up of 3 there, and Y in US, then tariff threats, politics etc

the combination of uncontrollable headwinds, with the weak q1 leads to bear raid and resulting most (or close) shares shorted all time for tsla. attack the weak. it will take a lot to overcome.

we need to systematically remove the tesla controlled problems, and catch a break on the macros to get a major, major move.

so i’m still not on the brutal explosion covering any time soon. obviously i’d love it if that happened.

point being, it would be wise to reduce some short exposure (which will most likely happen). i think we’ll get back to 40 then 36mm share short in the short term (1-3 months). if good news starts to accumulate, and depending on how fast, then you’ll see it drop and price rise somewhat more. but i still don’t see ATHs (which i’m assuming is brutal explosion) i guess wed have to agree on what the terms meant.

Similar threads

- Locked

- Marketplace listing

- Replies

- 2

- Views

- 293

- Marketplace listing

- Replies

- 0

- Views

- 124

- Locked

- Marketplace listing

- Replies

- 5

- Views

- 406

- Marketplace listing

- Replies

- 0

- Views

- 325

- Locked

- Marketplace listing

- Replies

- 5

- Views

- 502