Kimball has to strip at night to make ends meet (no pun intended). The hat is him getting dressed for the evening shift.Cowboy hat a part of the uniform allowance or was that axed to stave off bankwuptcy?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Tslynk67

Well-Known Member

Artful Dodger

"Neko no me"

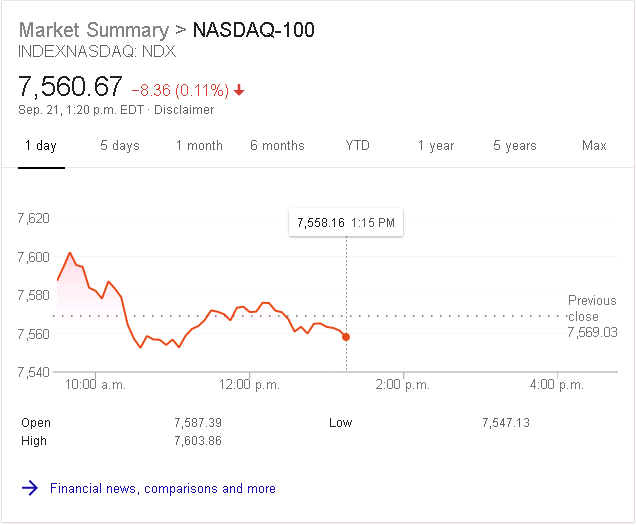

TSLA market action nearly mirroring the NASDAQ-100 today.

Bro that made me so happy.

Happy isn't even the right word. Straight up inspiring, tearjerking even

Sudre

Active Member

My friend who was supposed to get his Model 3 early next month is picking it up this weekend.

Our PM3 was supposed to be delivered yesterday, but there's no such car according to our DA. Should be next weekend instead.Here you go:

It seems @Tesla has readied some 7,000 #Model3 vehicles to be delivered just in the San Francisco Bay Area over the course of seven days.

Bay Area Bonanza: Tesla Insider Leaks Model 3 Delivery Extravaganza

Tslynk67

Well-Known Member

Seriously?? It is in the print paper. Get a grip.

Here is my top secret insider link:

Opinion | Tesla’s Biggest Problem Isn’t Elon Musk

dr;tl? I read it so YOU didn't have to...

Here's a key paragraph of total FUD - split it up into soundbites and each one is factually correct, but amazing how you can twist things when you string them all together into sentences:

From January to June of this year, Tesla generated revenues of $7.4 billion, but it had an operating loss of $1.7 billion, burning through its cash on hand. It has $2.2 billion left, most of which will be needed to cover operating losses. Romit Shah, a research analyst at Nomura Instinet and once one of Tesla’s biggest boosters, reversed course last week, calling the company “no longer investable.”

Artful Dodger

"Neko no me"

Last edited:

Joe F

Disruption is hard.

Funny. Well versed on that hand signal too! It's also the state bird I believe!If it was "blowing past you" more likely my wife was drivingThen again, she usually doesn't honk at others, she prefers "hand signals".

If you ever care to grab a beer/water/drink/whatever and talk with another TMC member, send me a PM!

Will keep the offer in mind, thanks! Usually tethered to the terminal 12 hours a day so I don't get out much. When I do on the weekends, it's for driving Miss Daisy. No, that's not the name of the MS, but you know, her.

neroden

Model S Owner and Frustrated Tesla Fan

dr;tl? I read it so YOU didn't have to...

Here's a key paragraph of total FUD - split it up into soundbites and each one is factually correct, but amazing how you can twist things when you string them all together into sentences:

From January to June of this year, Tesla generated revenues of $7.4 billion, but it had an operating loss of $1.7 billion, burning through its cash on hand. It has $2.2 billion left, most of which will be needed to cover operating losses. Romit Shah, a research analyst at Nomura Instinet and once one of Tesla’s biggest boosters, reversed course last week, calling the company “no longer investable.”

Yeah, actually a key point there is NOT factually correct, because the idiot who wrote it makes the unfounded ASS-umption that Tesla will have operating losses in Q3. Anyone who knows the utter simplistic basics of business economics 101 knows that this is false, but the loser who wrote the opinion piece doesn't, because he has never had a brain. It's embarassing that anyone even considered hiring Mr. Cohan for a job loosely related to business. Maybe he would be OK in a ditch-digging job, or as an artist, where you aren't required to have any business sense.

William Cohan claims to have been a former investment banker and claims to have written four books about Wall Street. I have no reason to doubt these claims. It is, however, apparent that he does not understand the first thing about business, is completely incompetent at evaluating whether a business is creditworthy, is completely incompetent at evaluating investments, and is generally a total ignoramus when it comes to business. This raises the question of how he ever had his career, since he was evidently incompetent at it -- perhaps he was an "old-boy network" hire who "failed upwards" like George W. Bush or Donald Trump. Or maybe he was just a smarmy scam artist, like Paul Ryan. I certainly wouldn't read his books after he made such a basic, freshman-level analytical error as *ignoring economies of scale*.

Last edited:

dr;tl? I read it so YOU didn't have to...

Here's a key paragraph of total FUD - split it up into soundbites and each one is factually correct, but amazing how you can twist things when you string them all together into sentences:

From January to June of this year, Tesla generated revenues of $7.4 billion, but it had an operating loss of $1.7 billion, burning through its cash on hand. It has $2.2 billion left, most of which will be needed to cover operating losses. Romit Shah, a research analyst at Nomura Instinet and once one of Tesla’s biggest boosters, reversed course last week, calling the company “no longer investable.”

It's the classic "omission of data" fallacy, and it's killer whether deliberate or accidental. If you only report "bad points", and not "good points", you can lead people to an entirely fallacious conclusion.

A classic example was in the leadup to the Challenger disaster. One of the docs being reviewed to decide whether it was safe to launch or not was this graph of O-ring failures vs. temperature:

They looked at that and thought... well, there's no really obvious trend. Some of the engineers had some suspicions that there was something off with the graph, but couldn't put their finger on it.

The problem? They were only reporting the negative cases. All of the positive cases (no O-ring failures) were left out. Here's what you see when you include them:

All of the sudden there's a very clear trend. There had never been a launch with no O-ring failures below 65°F. And the colder you get, the worse it got. The act of only reporting failures completely changed the view from what you see when reporting both the good cases and the bad.

The exact same thing applies to news coverage of companies like Tesla. There's thousands upon thousands of pieces of news a reporter can mention when writing an article. If they only include datapoints / arguments that support one particular viewpoint (take your pick of negative FUD), and completely omit the datapoints that contradict it (Tesla's fundamentals are totally rocking right now), you can leave your readers with a twisted viewpoint. Which is exactly the opposite of what journalism is supposed to do.

humbaba

sleeping until $7000

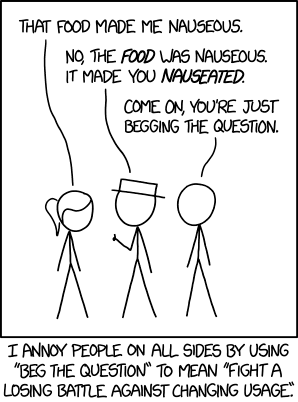

This raises the question of...

Are you sure? I thought that was "Begs the question"

/me ducks and runs for cover

Fact Checking

Well-Known Member

William Cohan claims to have been a former investment banker and claims to have written four books about Wall Street. I

None of those books could have involved any math. Or accounting. Or basic business logic for that matter.

Here are my guesses as to what the book titles are:

- "How to lose money in a bull market, for Dummies"

- "Why I chose GM over Tesla, and other big investment mistakes in life"

- "The art of only seeing trees in a forest"

- And my favorite one: "Confessions of a failed investment banker"

humbaba

sleeping until $7000

None of those books could have involved any math. Or accounting. Or basic business logic for that matter.

Here are my guesses as to what the book titles are:

Am I close?

- "How to lose money in a bull market, for Dummies"

- "Why I chose GM over Tesla, and other big investment mistakes in life"

- "The art of only seeing trees in a forest"

- And my favorite one: "Confessions of a failed investment banker"

well...

"House of Cards: A Tale of Hubris and Wretched Excess on Wall Street"

is it autobiographical?

The Blue Owl

Endangerous Herbivore

It's embarassing that anyone even considered hiring Mr. Cohan for a job loosely related to business. Maybe he would be OK in a ditch-digging job, or as an artist, where you aren't required to have any business sense.

Apart from juxtaposing them with ditch-diggers, which was an interesting choice, if you think artists don't need any business sense, you are mistaken.

That said, Mr Cohan is no artist. As for ditches, I don't know if he digs them, but he probably should.

Very much looks like MM's are gonna keep it flat all day and close just under 300 to scalp all the call buyers.

Snoozefest of a day but things are guaranteed to pop off... eventually...

Snoozefest of a day but things are guaranteed to pop off... eventually...

The Blue Owl

Endangerous Herbivore

Who wrote it?

Well anyway, NYT is such a disappointment. They should be a Tesla backer, not a detractor.

Oh well, after 70 years of family subscription, I dropped them this year.

I do hope you let them know why. I did.

Artful Dodger

"Neko no me"

... and we're GREEN red GREEN

Are you sure? I thought that was "Begs the question"

/me ducks and runs for cover

EVNow

Well-Known Member

While this is true - it is not as simple as that in practice.The exact same thing applies to news coverage of companies like Tesla. There's thousands upon thousands of pieces of news a reporter can mention when writing an article. If they only include datapoints / arguments that support one particular viewpoint, and completely omit the datapoints that contradict it, you can leave your readers with a completely twisted viewpoint. Which is exactly the opposite of what journalism is supposed to do.

Journalists need to make a judgement call on what arguments are "credible". Otherwise you end up giving the same weightage to Nazis as to the Holocaust survivors. When journalists start doing that - we get Trump (and Putin and Modi et al).

The problem is doubly evident in niche areas like Tesla. Journalists just don't have the basic knowledge necessary to make good judgements. They tend to just repeat what they heard or read. So depending on the "conventional wisdom" - the narrative takes on a negative bent (when positive arguments no longer "feel" credible to a journalist) and the other way round too.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 122

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K