Forget the stock buyback, I’m dreaming that Tesla is going to build more service centers with that money, because otherwise this business plan is not sustainable. The exponential part of the ramp is great until those cars need to be serviced in addition to cars from as far back as 2012. I don’t see how Tesla can service all these cars. Each year, there will be a half million or greater new cars on the road but the same number of service centers. Something doesn’t add up. Explain to me how this is going to work please...

They are going to train and deploy significant number of Tesla rangers.

Tesla solved problem with battery+BMS, motors reliability by 2017, you don't see serious complains about latest model S anymore.

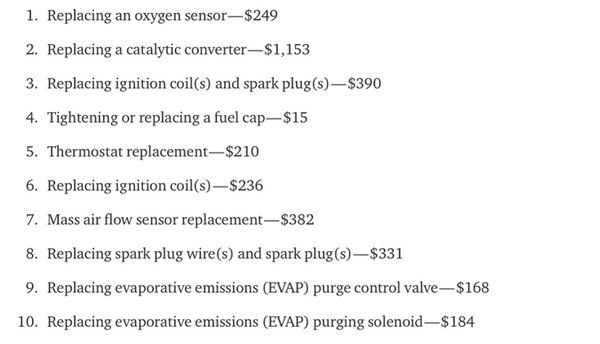

Yeah, and we should also remember how mindbogglingly simple EVs are mechanically and power-train wise. Here are the top 10 ICE car repairs of 2015 in the U.S., ordered by frequency:

Only the fourth service cost is even remotely applicable to EVs, and it's the cheapest one at $15 - most other items are several hundred dollars expensive. Just consider the economic significance of this list: literally 99.4% of the top 10 service costs (which add up to $3,318) do not apply to the Model 3.

The high service costs of ICE cars comes from the physics of ICE power-trains:

- A modern ICE power-train has thousands of moving parts - while Teslas have less than 20 (!)

- A modern ICE engine has an extremely high temperature combustion process running at 600-800°C, generating 10 times as much waste heat as an EV generates. The higher the temperature, the more efficient gasoline combustion becomes - which creates an inevitable trade-off conflict, as high temperatures strain components and generate corrosion much faster. An EV not only generates much less heat, the temperatures are permanently lower as well, across the board: basically only the brake system gets hotter than 100°C - which brake system is avoided in a lot of normal driving scenarios where regenerative braking can be utilized.

And yes, we can bring examples of very reliable ICE cars like lower end Toyotas - but these tend to be simple ICE car designs not really competitive with Tesla in any fashion anymore.

None of the ICE cars in Tesla's price and engine power range are simple.

The Model 3 has also been simplified with service costs in mind: no Falcon Wing Doors, no complex self-presenting door handles, no sunroof, using easier to cool PM motors, using a re-designed battery pack, etc. etc - and the cherry on top is a

very clever minimalist interior design that also happens to reduce manufacturing and servicing costs and increases vehicle life time. Car interiors tend to age the fastest.

I believe in a few decades the Model 3 will be taught in business school as an example of modern manufacturing breakthroughs.

So yes, certain versions of the Model S had service cost problems, but that was not really an inherent property of the EV concept, it was more like a side effect of the aggressive innovation cycle and learning curve Tesla went through as a newcomer to the automotive industry.

Note that early Model 3 batches obviously have a higher chance of being more service intense, and there's inevitably going to be recalls - but with the Model 3 I think we are going to see the first high-volume demonstration of how good EVs

really are, in terms of significantly reduced service costs.

Once consumers realize this Tesla might have to start auctioning off Model 3's to the highest bidder, until they are able to increase manufacturing volume. Note that the current high-margin-first staggered introduction of Model 3 variants is already essentially a Dutch auction process in disguise.