Does this likely mean any large energy deal in Saudi Arabia won't happen? Or maybe he is only talking strictly about investor funding: Elon Musk says Tesla 'probably would not' take money from Saudi Arabia now

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

EVNow

Well-Known Member

I doubt any big energy deal with KSA by anyone right now (except Chinese). Its become too toxic.Does this likely mean any large energy deal in Saudi Arabia won't happen? Or maybe he is only talking strictly about investor funding: Elon Musk says Tesla 'probably would not' take money from Saudi Arabia now

You have an endearingly innocent view of the likes of Halliburton and friends.

You are completely ignoring the mid-term elections next week. Macros will largely determine where TSLA goes.

My feeling is when you have Trump as president, the mid term elections are non event. It doesn't matter if democrats will take over or republicans stay. Maybe I'am getting it wrong because I don't live in US

My feeling is when you have Trump as president, the mid term elections are non event. It doesn't matter if democrats will take over or republicans stay. Maybe I'am getting it wrong because I don't live in US

Non-event? Are you serious?

Chickenlittle

Banned

I believe he is referring to financing money. He is not refusing to sell products that tesla makesDoes this likely mean any large energy deal in Saudi Arabia won't happen? Or maybe he is only talking strictly about investor funding: Elon Musk says Tesla 'probably would not' take money from Saudi Arabia now

TradingInvest

Active Member

Yep. Looks like the biggest risk for the market continues to be a hawkish Fed. This jobs report certainly won't change the Feds mind on that.

From business point of view, a hawkish Fed is not bad for Tesla, as long as Tesla has enough customers to take the production. Seems to me that is the case.

On the other hand, higher rate tend to reduce material cost, also makes it easier for Tesla to hire people.

Tesla is like a octopus the shorts are wrestling with 1 or 2 arms while the other ones grow and grow.

The SP continues it's inexorable rise.

Hmm. What part of the SP looks "inexorable" to you?

Don't get me wrong - I do think we're probably now re-basedlined to a higher level. I think a sub-$250 SP would require a pretty significant force majeure event. And I think the peeling off of some of the shorts should decrease the volatility.

But it should neither eliminate volatility nor resistance. Tesla still needs to prove to the general investment community that it can do what it did in Q3 sustainably. What upcoming news is going to do that?

Exactly the thought. Stockpile them next to a port and you can have them wired into the grid anywhere in the world a few weeks later.

A 40-foot ISO container has 43,9 times the internal volume as a 100kWh powerpack. Now, with powerpacks, you also have to have power modules, not just energy modules, which argues for multiplying by less than 43,9 - but you'll also be able to use space more efficiently, and energy density will be growing. Let's just say 45x. So 4,5 MWh per container. A single cargo ship could carry tens of GWh. Equivalent to hundreds of the Australian battery farm.

Not bad at all.

Powerpacks are 210 kWh, so 1 MWh container is possibly in reach.

Chickenlittle

Banned

I suspect they are planning for day that modlS and modelX sales slow and maybe use some of the robots and factory sales for other modelsSo what I meant is that the minimal capex 7,000/week target looks conservative, and they might be able to reach 7,500 or 8,000/week.

But IMO the actual level doesn't even matter much: Tesla made over a billion dollars in Q3 alone, they could afford even "significant" capex. Their Model S/X/3 lines are almost literally printing money.

The level of capex mostly matters in terms of timing of future growth:

- "minimal capex": low cost improvements with little lead time, with a time frame of "months". 4,000/week to 7,000/week is probably this.

- "incremental capex": equipment probably already specced and ordered, buildings under construction. Time frame of "quarters". Shanghai might be an example of this.

- "capex": long lead time of at least a year. I'd expect the Model Y to be this.

tivoboy

Active Member

Indeed they are, but not specific to any reported amounts, its a seasonally adjusted amount based on their prior models. My prior point that was this year is so disproportionate to any prior year in the past 10 for seasonal hiring, that the MODEL they use can be realistically low, but still influenced by BLS reporting.The jobs reports are usually seasonally adjusted.

We'll see in January.

@BenPrice @neroden OFF Topic warningThe only reason not to do this is the expense of installing metering and tracking usage. (Which is actually the original reason why Tesla didn't; Tesla chargers are cheaper to install than many because they don't have payment or usage tracking in the chargers.)

Sometimes it's significantly easier, at installation time, to not meter it at all. You can do pay-per-hour on the honor system, which is substantially less capital-intensive. And since you don't really care whether it's accurate -- the price is a deterrent to overuse, not a profit center -- the honor system is OK. Works well as long as there's *someone* at the front desk willing to handle the payments/check-in/check-out.

If you do, as we did at NIH in Bethesda and only supply 15 - 20 amp, 110v plugs and make folks bring their chargers, the most you can get in 8 hours is around 10kWh, or about $1.5 electricity and 21 work days/month. Only supply plugs at non premium spots nominal charges / month to use,, not free, you will still be overwhelmed by the usage, maybe a small electric shuttle if parking is way out in the boondocks like a GEM or similar

/back on topic

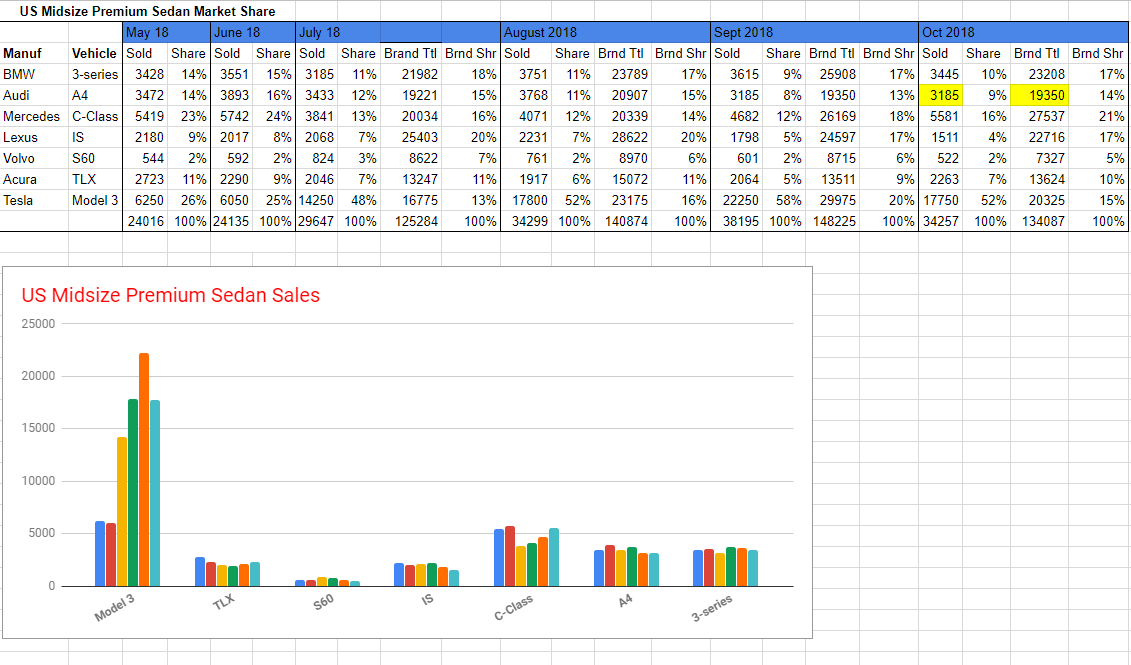

Updated my monthly chart. Still waiting for Audi to report, but they shouldn't impact the overall percentages all that much, so here we go.

My takeaways:

-Oct is the first month of a quarter, and we know Tesla ships further away in the first quarter than the last, so July is the obvious comparison. Oct vs July has Model 3 US market share rising from 48% to 52%, and Tesla US brand share rising from 13% to 15%.

-Model 3 market share in the US is now sustainably > 50% of the premium sedan market--In July it hit 48%, and since then has been 52%, 58%, 52%.

My takeaways:

-Oct is the first month of a quarter, and we know Tesla ships further away in the first quarter than the last, so July is the obvious comparison. Oct vs July has Model 3 US market share rising from 48% to 52%, and Tesla US brand share rising from 13% to 15%.

-Model 3 market share in the US is now sustainably > 50% of the premium sedan market--In July it hit 48%, and since then has been 52%, 58%, 52%.

Artful Dodger

"Neko no me"

Does this likely mean any large energy deal in Saudi Arabia won't happen? Or maybe he is only talking strictly about investor funding: Elon Musk says Tesla 'probably would not' take money from Saudi Arabia now

No, it means CNBC just knocked $4 off TSLA. Let's see how long this lasts. Cheers!

shlokavica22

Member

Can someone confirm with an official link, had the Saudi PIF ALREADY purchased 2B in Tesla, or were SAYING they were going to purchase 2B+ in Tesla.

They already did- Subscribe to read | Financial Times

However, as Elon mentioned in the last interview- they might have already sold that stake for all we know.

Edit- Source for the above (Full Q&A: Tesla and SpaceX CEO Elon Musk on Recode Decode):

All right. So the challenge you face is financial, though. Getting funding and stuff like that. And you’ve gotten ... Saudis had bought a big bunch of your stock, that’s just separate, they —

They might have sold it, I don’t know.

tivoboy

Active Member

Sorry, can't read link.. FT is the worst with their paywall.They already did- Subscribe to read | Financial Times

However, as Elon mentioned in the last interview- they might have already sold that stake for all we know.

Edit- Source for the above (Full Q&A: Tesla and SpaceX CEO Elon Musk on Recode Decode):

All right. So the challenge you face is financial, though. Getting funding and stuff like that. And you’ve gotten ... Saudis had bought a big bunch of your stock, that’s just separate, they —

They might have sold it, I don’t know.

But, I saw all the posts back in August when this was first reported, but we also heard that Funding was Secured. I'm just wondering, was there an official statement or filing from the company that showed the PIF as having actually taken that direct investment? At this point with Elon's comments, it seems they are hedging a bit - again.

TradingInvest

Active Member

They already did- Subscribe to read | Financial Times

However, as Elon mentioned in the last interview- they might have already sold that stake for all we know.

Edit- Source for the above (Full Q&A: Tesla and SpaceX CEO Elon Musk on Recode Decode):

All right. So the challenge you face is financial, though. Getting funding and stuff like that. And you’ve gotten ... Saudis had bought a big bunch of your stock, that’s just separate, they —

They might have sold it, I don’t know.

Saudi's fund bought "almost 5%" a while back. It's very unlikely for them to sell.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 107

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K