Fed meeting might also be a factor for macro this week.OTBack to market movements: I expect this week to be a slightly less volume week and next week essentially a "no volume at all week", then we have the delivery figures.

So I expect a bit of a mini-copy of last week (i.e. slightly stronger opening on Monday, down on Friday). I expect the week after to be pretty brutal and a bit of a pop once we hear the delivery numbers. In absence of any other news (and there usually is some news when I least expect it) between now and the earnings call I expect TSLA to be lowest in the coming 15 days. Then again, I'm not really good at this, I don't know more than other esteemed members of this forum and I'm frequently wrong in all walks of life and especially in all matters TSLA ;-)

What is everyone else's take?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

"Then again, I'm not really good at this, I don't know more than other esteemed members of this forum and I'm frequently wrong in all walks of life and especially in all matters TSLA ;-)"

Save yourself some heartaches and a lot of money. Consider just buying the stock and holding for 3 years, no matter what. You will never be right often enough to make money in short term maneuvers. Long term results are binary: either you're right or your wrong. In the case of Tesla, If you're right you can build a lot of wealth that you would never be able to match trying to "play the market". GLTA.

By picking a specific stock (a controversial one at that), you're starting from the premise that you know more than the market consensus.

That doesn't mean that your goal should be to time the daily ups and downs, but it does mean that you'll interpret news events differently than the market consensus, and can - if not outright "should" - respond differently to them than the market consensus.

cheshire cat

Member

Doing nothing is often the hardest thing TO do

Except NASA uses the metric system

I think the US military does too

Indeed they certainly did when I was in the US Army during the late sixties. It was to be uniform with NATO allies. I still find it easier to determine how many kilometers (which we called clicks) rather than miles I've walked, or how many meters away is an object.

The metric system is immensely easier than the imperial system. Everything is associated by magnitudes of 10. It's actually been official in this country since the mid-19th century, and Congress attempted to actively promote it during the 1970's, at least for students. But that push was allowed to fade. Nevertheless it's been making inroads, and eventually I expect it to be dominant here. Those of us more knowledgeable about metric advantages can help to speed that process.

50 billion would be similar to the current population density of India. A lot less dense than the well functioning Greater Tokyo Area. Problem is resources. We could double right now by going vegan. More if we used the oceans better. Beyond that would involve some serious geo and genetic engineering.

Owning a car would be problematic but that's solved by autonomy. Tesla is working on the energy needed too. What's really missing is the totally tasty but still eco-friendly Tesla-cow.

Why would we ever want this? Are you really saying birth control / population control is analogous to genocide as we are blocking the unborn?

Thumper

Active Member

Malthus was the Elon of demographers. His vision was correct, his timing was a bit off but the results are proving to be spectacular!Why would we ever want this? Are you really saying birth control / population control is analogous to genocide as we are blocking the unborn?

I'm sure @AndyH can speak for themselves, but reality is what it is and resources really are limited.Why would we ever want this? Are you really saying birth control / population control is analogous to genocide as we are blocking the unborn?

How to react to that? There are better ways and worse ways, but Nature has a way to find equilibrium. Without care for this particular species; perhaps especially when we try to game its systems. Like right now. Better for us to be friendly.

MOD: ALL further demographic posts to go to the "Environment" forum on TMC. No more discussion here.

Reminder: many people still haven't heard of Tesla - or even electric cars:

Woman , blonde woman , anyhow dirty blondes have the most fun

Tslynk67

Well-Known Member

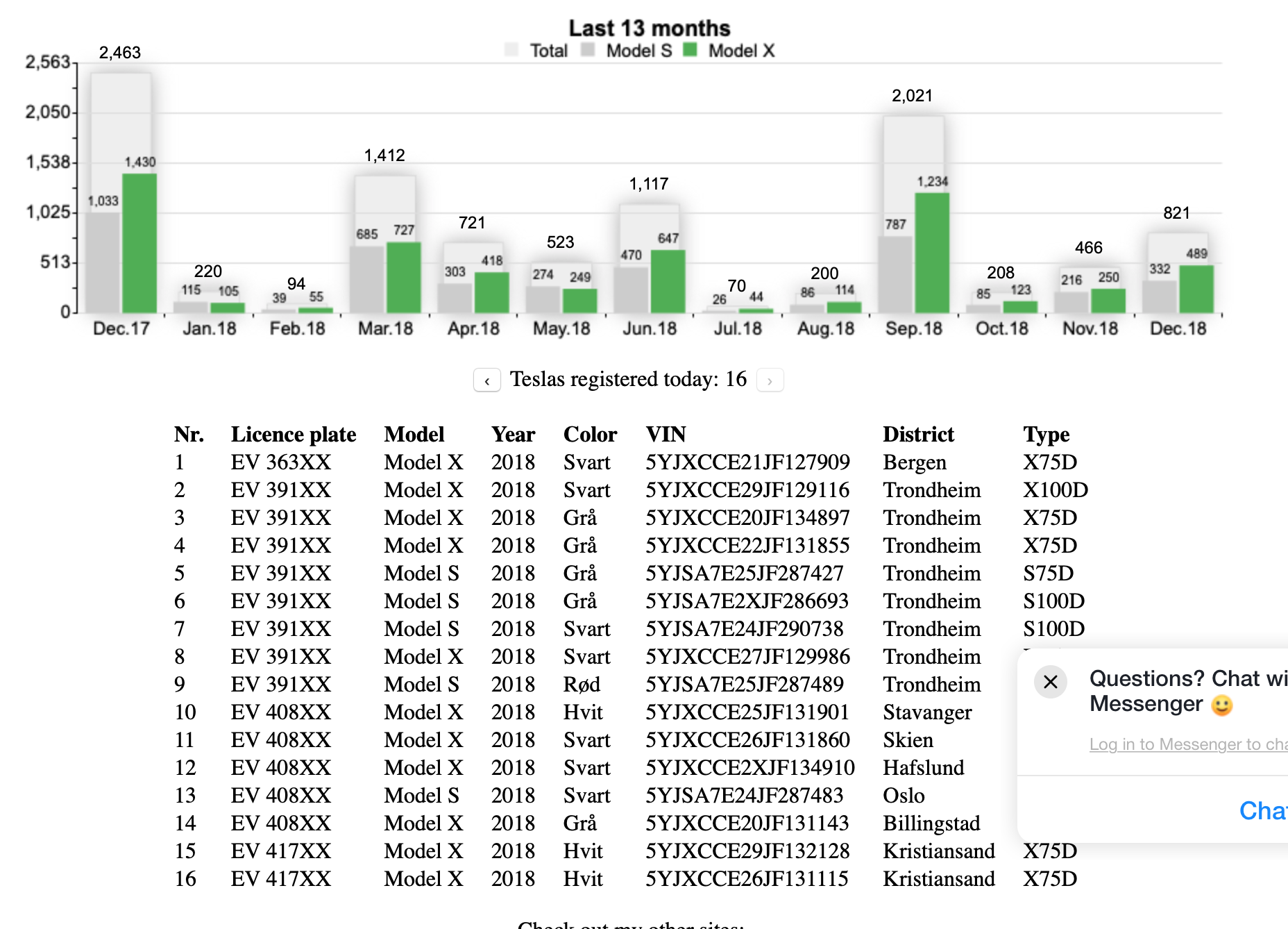

Interesting, Norway doing deliveries on a Sunday. I wonder if the boat arrived late or they had some logistical difficulties, but this is very unusual - even Saturday deliveries are rare, but 142 yesterday

looks staged to me. After she puts in a card and pull it out she did not put in zip code and select gas grade before trying to stick the gas nozzle in.Reminder: many people still haven't heard of Tesla - or even electric cars:

Especially when you're mad!Doing nothing is often the hardest thing TO do

I think the US military does too

Have you seen the 2 Liter bottles of soda in the grocery store? Is there anything more American than colored, sugared, fizzy, expensive water?

Last edited:

SebastianR

Active Member

"Then again, I'm not really good at this, I don't know more than other esteemed members of this forum and I'm frequently wrong in all walks of life and especially in all matters TSLA ;-)"

Save yourself some heartaches and a lot of money. Consider just buying the stock and holding for 3 years, no matter what. You will never be right often enough to make money in short term maneuvers. Long term results are binary: either you're right or your wrong. In the case of Tesla, If you're right you can build a lot of wealth that you would never be able to match trying to "play the market". GLTA.

Thanks.

Sorry, I guess I should be more explicit when I'm not totally serious on the internet. Entirely my mistake. Apologies.

I don't believe in active management of funds and thus only own index funds. I do believe in Tesla which is why I have a collection of TSLA shares that I intent do hold for a very long time. Aside from that I have some play money to do a bit of gambling - in the context of which I posted the above... Anyways - let's move along thinking about TSLA and the next week

Hock1

Member

By picking a specific stock (a controversial one at that), you're starting from the premise that you know more than the market consensus.

That doesn't mean that your goal should be to time the daily ups and downs, but it does mean that you'll interpret news events differently than the market consensus, and can - if not outright "should" - respond differently to them than the market consensus.

I am not talking about any random stock. Tesla is like no other opportunity I have seen in my 50 years of investing. And yes, in this case I do ,know that I know more than the market consensus. I know that you and many people here do, also. News???? What news? Do you believe any news from MSM? I believe in what I read here. When one has more knowledge than the market consensus and has the benefit of owning and experiencing a truly disruptive product, I say yes, put as much money as you can afford to lose in the stock and hold on (obviously, unless the story changes). I'll repeat what I've said before here: options are a losing game and so is short-term trading of stock. Unfortunately, most people have to learn for themselves, the hard way. GLTA

No, sorry if it sounded that harsh. I wouldn't mind if a lot more people were around that's all. We can put them on Mars instead.Why would we ever want this? Are you really saying birth control / population control is analogous to genocide as we are blocking the unborn?

sundaymorning

Active Member

This sounds familiar, like Nokia and Motorola:

Toyota struggles to save breakthrough Prius hybrid

Sales of the Prius have been tumbling for several years and were down 23.2 percent for the first 11 months of 2018. The new version delivers updates Toyota hopes will revive the hybrid's momentum, including a new all-wheel-drive system that could improve its appeal in the Snowbelt. But whether that will be enough is uncertain and company officials admit they're struggling to figure out what to do next.

There are a variety of reasons why Toyota sold just 3,180 of its Prius hatchbacks in November. Sales of the entire Prius "family," including a plug-in hybrid version, are running barely a quarter of its peak.

Toyota struggles to save breakthrough Prius hybrid

Sales of the Prius have been tumbling for several years and were down 23.2 percent for the first 11 months of 2018. The new version delivers updates Toyota hopes will revive the hybrid's momentum, including a new all-wheel-drive system that could improve its appeal in the Snowbelt. But whether that will be enough is uncertain and company officials admit they're struggling to figure out what to do next.

There are a variety of reasons why Toyota sold just 3,180 of its Prius hatchbacks in November. Sales of the entire Prius "family," including a plug-in hybrid version, are running barely a quarter of its peak.

Last edited:

I am not talking about any random stock. Tesla is like no other opportunity I have seen in my 50 years of investing. And yes, in this case I do ,know that I know more than the market consensus. I know that you and many people here do, also. News???? What news? Do you believe any news from MSM? I believe in what I read here. When one has more knowledge than the market consensus and has the benefit of owning and experiencing a truly disruptive product, I say yes, put as much money as you can afford to lose in the stock and hold on (obviously, unless the story changes). I'll repeat what I've said before here: options are a losing game and so is short-term trading of stock. Unfortunately, most people have to learn for themselves, the hard way. GLTA

I think you're misinterpreting.

That was in no way a criticism of the concept of you knowing more than the market. I was pointing out precisely the opposite thing: everyone here (including both you and I) thinks that they know more than the market consensus relative to Tesla. Otherwise, we wouldn't be here investing in it.

So, given this: why should people who think that they know more than the market consensus re: Tesla just take the market consensus's response to news at face value? Because that's what you're doing if you just adopt a "buy and hold" strategy.

Example 1: Elon does some interview and talks about how he's been working himself to death to make Tesla succeed, and mentions he uses Ambien to help himself sleep. The interviewer spins this as Musk going through a nervous breakdown and Tesla is going to collapse. The market consensus is: sell! The stock drops 5-10%. Do you agree with the market consensus that this is sell-worthy news?

Example 2: Tesla posts a quarterly report. Shock of all shocks, the imminent doom and gloom that the shorts have been talking about turns out to be utter BS. The market consensus is: we were wrong about the company, buy! The stock rises 5-10%. Do you agree that the company is suddenly 5-10% more valuable after the report, when all it did was confirm what you already knew?

Of course not in each case. And the logical response is thus that you should be selling when the market suddenly comes to realize something that you've known all along, and buying when they're freaking out about something that you know to be BS or ultimately meaningless.

Again, this doesn't mean day trading. But the point is: if you think you know more about the stock than the market consensus - which everyone here pretty much by definition does - then you should probably be swing trading on news. Offset by any downsides related to taxes and fees. The other caveat is that you need to model a reasonable estimate on volatility and general stock trends to know how much "random news" / overall trends will affect the stock over the period that you're maintaining liquidity, as liquidity doesn't realize gains / losses due to random news or overall trends.

Last edited:

Hogfighter

Professional Lurker

Tesla’s consistently producing 1300+ cars per day lately. That’s over 9,000/week. Hope that news gets out!

Source: a Tesla worker

Source: a Tesla worker

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K