Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Ihor Dusaniwsky on Twitter

$TSLA down another 4% this morning following a 8% drop yesterday. Short interest is $8.5 billion. #Tesla

SP at close yesterday was 279.18 -- reduced by 4% is about $268 at the time Ihor ran his numbers.

$8.5B/$268/share equals 31.7M shares shorted.

Assuming this is correct, as is typical (and counterintuitive) short interest in TSLA is increasing as the SP drops as shorts covering are outnumbered by shorts piling in or increasing their stake.

March 15 28.4M (Nasdaq)

March 27 30M (estimate backed out from Ihor's numbers)

March 29 31.7M (ditto)

If this is confirmed when the official short data comes out a 3M+ increase in shorted shares in less than two weeks is no joke -- the largest increase over the past 12 months for any two week period was 2M (from 10/31/17 - 11/15/17)

If you are going off Ihor's tweet, it looks like it was sent at around 10:30 am PT/1:30 pm ET with SP at about 297 which equates to roughly 30M shares, which is up roughly 1.6M shares from the last official report for 3/15 (28.4M shares). (Could be a little lower depending on when he ran his numbers if SP was higher.)

Amount shorted in dollars is down because SP is down, but overall shorted shares appear to be up since mid-March.

Edit: corrected SP to 297 for 10:30 am PT/1:30 pm ET

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

The notion of buying $320 May18 calls @ $4 appeals to my crazy side. I WILL NOT.

Lets see what next week looks like......

I'm torn on whether I want Elon to simply ride this out or make some kind of grand gesture to stabilize things. I guess I prefer silence if he feels the ramp is going OK and no big money raise is needed. Let the weak flee.

Lets see what next week looks like......

I'm torn on whether I want Elon to simply ride this out or make some kind of grand gesture to stabilize things. I guess I prefer silence if he feels the ramp is going OK and no big money raise is needed. Let the weak flee.

ah, ha! I knew there was a reason that number was stuck in my mind. Thanks!

SP at close yesterday was 279.18 -- reduce by 4% is about $268 at the time Ihor ran his numbers.

$8.5B/$268/share equals 31.7M shares.

Assuming this is correct, as is typical (and counterintuitive) short interest in TSLA is increasing as the SP drops as shorts covering are outnumbered by shorts piling in or increasing their stake.

March 15 28.4M (Nasdaq)

March 27 30M (estimate backed out from Ihor's numbers)

March 29 31.7M (ditto)

Bearish Bets in Tesla Climb

Waiting4M3

Active Member

Talking about burying the lede, what about M3 ramp # in Q1. IMO your #4 and #5 will come for sure if the M3 ramp# is good. #4 may need to wait till early May during Q1ER. #5 can come any time, my guess is after the share price run up is mostly done, as the big boys will buy themselves before they tell others to get in on the actionWith the recent bout of bad news stories, a surge of good news needs to commence soon, hopefully starting with the production numbers. Any of the following would help move the stock and could read out in the next few weeks: (1) Favorable judgment in one of the anti-Tesla states (Michigan, Missouri, Connecticut, Texas, etc.); (2) NHTSA ends its investigation with no serious findings (Tesla into fire truck incident); (3) Congress extends EV tax credit; (4) Tesla has no need to raise additional cash; (5) a new or existing institution given a strong buy signal to investors.

Right on time!

The right hand side of the chart (March) shows almost a perfect correlation of increased shorting just as we have had the recent price drop.

Not the only factor contributing to the recent drop but definitely adding to the downward pressure.

And (hopefully) loading the spring for a strong bounce back up when the market is ready.

Some shorts are starting to cover. My Loaned out shares just got returned to me on fidelity. Take it for what you want

Interestingly, I had the opposite experience. I had a good chunk of shares loaned out afresh today by Fidelity. And the interest rate went from 0.625% to 0.75%.

Some shorts are starting to cover. My Loaned out shares just got returned to me on fidelity. Take it for what you want

Interestingly, I had the opposite experience. I had a good chunk of shares loaned out afresh today by Fidelity. And the interest rate went from 0.625% to 0.75%.

brian45011

Active Member

They have 3.5B cash and going to be bringing in 50,000*60,000=3B revenue in a quarter or two from m3, why do a follow on now?

As this video which has been linked at least twice--https://teslamotorsclub.com/tmc/posts/2624289/ and https://teslamotorsclub.com/tmc/posts/2629887/ -- states: "The answer is CASH!"

Tesla's "pipes 1 and 2" will require growing amounts of cash over the next several years if it is to achieve its expansion and growth plans (for instance GF-1 is less than 30% complete not to mention the investments needed in GFs #3-5+) Tesla's recourse is for "pipe 3" to continue to fill the cash bucket as pipes 1 and 2 extract from the cash bucket.

Pipe 3 has two sources of cash: debt and equity capital raises. Moody's credit rating downgrade effectively eliminates future debt raises from conventional institutional sources, until Tesla can demonstrate that it will generate cash from pipe #1 to begin repaying existing secured and un-secured creditors. Tesla does have about $700 MM in un-used commitments from the secured ABL creditors, but not only are LIBOR rates popping, but the entire line must be repaid or refinanced by June 2020. I'll leave it to those who have never experienced a corporate liquidity/refinancing crisis from the inside to assure there are no worries about a credit downgrade.

If new debt is difficult or unavailable that leaves follow-on sales of additional common shares from pipe #3 to re-fill the cash bucket.

Curious Sunbird offered his thoughts above in response to your question. https://teslamotorsclub.com/tmc/posts/2644698/

Wheeler knew cash is king--the credit down grade means favorable trade credit terms will be more difficult and likely consume more of the un-committed ABL line for LOCs. From experience, the decline in share price doesn't help internal morale when stock-based compensation is a meaningful part of remuneration for employees.

bdy0627

Active Member

Waiting4M3

Active Member

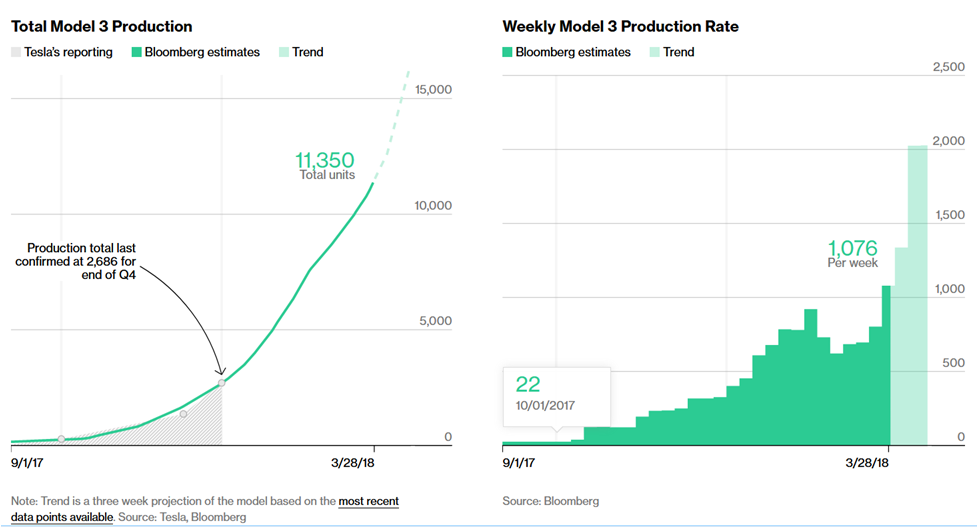

Bloomberg's forcast of 2k/wk into April is back

We Set Out to Crack Tesla's Biggest Mystery: How Many Model 3s It's Making

We Set Out to Crack Tesla's Biggest Mystery: How Many Model 3s It's Making

Waiting4M3

Active Member

Yea, heard this all before, it comes down to whether the market believes when pipe 1 will start to pay off. IMO the market is way underestimating the potential of pipe 1, and how close it is to pouring out $$$$.until Tesla can demonstrate that it will generate cash from pipe #1 to begin repaying existing secured and un-secured creditors.

Bloomberg's forcast of 2k/wk into April is back

We Set Out to Crack Tesla's Biggest Mystery: How Many Model 3s It's Making

View attachment 290001

Since it feels like they are a bit behind, I'm setting my expectations at 2000 right now.

TheTalkingMule

Distributed Energy Enthusiast

There's always the old SpaceX trick. They're sitting on millions of gov't dollars committed to launches way off in the future. No reason they can't buy up a bunch of Tesla bonds. Tesla is unstoppable IMO, there are far too many forces 100% committed to it's success.

Unless of course you doubt Elon's ability to eventually execute......

Sample 1

Unless of course you doubt Elon's ability to eventually execute......

Sample 1

A

anon

Guest

Now NHTSA has joined NTSB in probing the recent crash:

U.S. auto safety agency to probe fatal Tesla California crash

And a lawsuit over the SolarCity merger has been allowed to proceed:

Tesla shareholder lawsuit against SolarCity deal set to proceed

U.S. auto safety agency to probe fatal Tesla California crash

And a lawsuit over the SolarCity merger has been allowed to proceed:

Tesla shareholder lawsuit against SolarCity deal set to proceed

Krugerrand

Meow

What has been the catalyst for such a drop when the production ramp feels way more real now than when a few weeks ago ?

Pistachio ice cream, wool socks, or American Idol.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K