Bloomberg is estimating 5,942 Model 3s/wk production rate. Sweet.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

geneclean55

Active Member

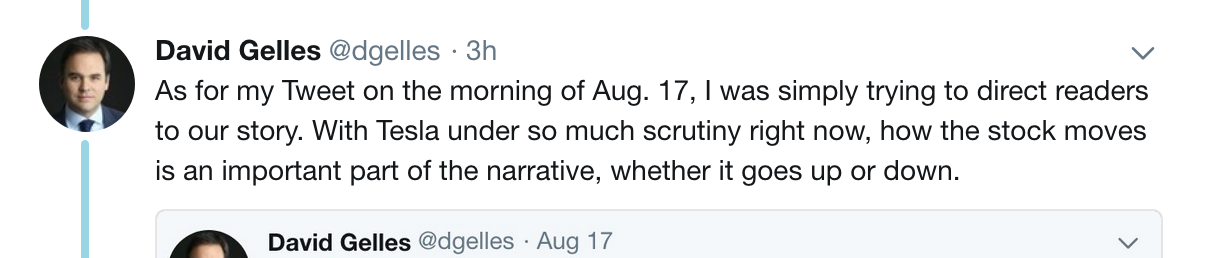

Looks like Gelles felt compelled to defend his Friday morning sp tweet

Krugerrand

Meow

I really do admire all of your posts, your integrity, and humor. But there's something in this one that doesn't ring true and causes, for the first time, some doubt about your honesty. Rather than play with a mouser, I'll spill the beans, or indulge in another mind fart: you were not upside down when you took the picture or pasted it. I know, you had a caveat, but still.... Not an advice for avatar change.

Pfft! Have always been a lousy actor and liar. First and foremost, the cat is freaking amazing and funny as all get out. But it is a perfect reflection of how I often find myself seeing others particularly at times like this.

Krugerrand

Meow

Wall street sucks. Funny thing is my best childhood friend claimed to be a direct decedent of one of the 30 walloon families "first settlers" of New Amsterdam. Knowing his politics he is probably short tsla too.

I won’t hold your choice of a childhood friend against you, you were a child after all. But if you’re hanging out with him now...

He's a politician. Don't see him much anymore.I won’t hold your choice of a childhood friend against you, you were a child after all. But if you’re hanging out with him now...

Krugerrand

Meow

But they could be purchasing some of those shares today at 30% off. They still get the same benefit when it goes private.

But they won’t see the volatility. They won’t need to cash out to make numbers look good to the accountants and then stress about getting back in lower. Presumably they can expect a steady rise in value like SpaceX shares. That’s got to be worth something.

Krugerrand

Meow

Looks like Gelles felt compelled to defend his Friday morning sp tweetView attachment 326955

Liar, liar, pants on fire.

UnknownSoldier

Unknown Member

Looks like Gelles felt compelled to defend his Friday morning sp tweetView attachment 326955

I don't have a Twitter but people should be going at him right now for openly gloating and then trying to walk it back like normal journalists gloat about crashing a company's stock price on Twitter.

Then again, this might be considered normal journalism these days at NYT.

Looks like Gelles felt compelled to defend his Friday morning sp tweetView attachment 326955

He can shove his "story" where it hurts.

Anyone know more about the UBS M3 tear down and Sandy Munro’s?

Munro’s results were 30%+ gross margin, rave review of the avionics.

Did UBS buy Munro’s report and add on SG&A, factories, assets, R&D... to come up with a net margin estimate?

How do we know if UBS used accurate numbers, what’s their source?

Munro’s results were 30%+ gross margin, rave review of the avionics.

Did UBS buy Munro’s report and add on SG&A, factories, assets, R&D... to come up with a net margin estimate?

How do we know if UBS used accurate numbers, what’s their source?

Last edited:

Electroman

Well-Known Member

How do we know if UBS used accurate numbers, what’s their source?

Even UBS doesn't know. I think you are taking these reports seriously. These are not meant to be seriously researched accurate reports. No one outside of Tesla are in a good position to do accurate tear down cost analysis. That goes to UBS or Munro or the German's analysis.

Read these reports for entertainment value and move on.

Unknown_Wizard

Member

Goldman probably does have serious insights, now...

Anyone know more about the UBS M3 tear down and Sandy Munro’s?

Munro’s results were 30%+ gross margin, rave review of the avionics.

Did UBS buy Munro’s report and add on SG&A, factories, assets, R&D... to come up with a net margin estimate?

How do we know if UBS used accurate numbers, what’s their source?

"Still, compared to BMW's i3 and the Chevy Bolt — which retail for $44,450 and $36,000, respectively — Tesla is the hands down winner, according to UBS.

"Through the teardown of the battery and drivetrain, we saw numerous advancements and innovations within the Model 3," the firm said.

"The technology in the battery pack appears to be ahead of all current production EVs and the BMS operates within tolerances not seen in others. The focus on modularity and compact design also suggests potential for automated production…. More importantly, the overall performance is superior with much better power, torque, and acceleration."

^^^^^ is a BEARISH article..? da fuq..

Is this a new bar set for left handed compliments?

Last edited:

Is it possible, that Tesla is not undervalued...The definition of undervalued is pretty complicated when a typical tech company might trade at 40-50x forward P/E and Tesla is trading around 190x expected 2019 earnings. So the concept of value for a Tesla investor is at best nebulous and at worst absolute fantasy. Everyone puts a lot of intrinsic value into Tesla being run by Elon which is why a single NYT article can make the value drop by 10% in a day. I know I don't own TSLA because of extrinsic value (read: fundamentals) because the numbers literally make zero sense, that is after all why all the Wall Street financiers are short TSLA.

.

Is it possible, that Tesla is not undervalued...

Sure.. but time frame matters?

How much did Intel buy MobileEye for.. 15.3 billion? That's OVER 1/4th of Tesla's current market cap for only ONE aspect of what Tesla is providing.

ONE aspect.

Tesla's current supercharger network is a practical non-assailable moat in the next decade. By the time fast charging or whatever rolls out, it would be HALF the speed of Tesla's charging and Tesla would have doubled their supercharging speeds by then.

Tesla's data collection fleet practically doubled in size in 2018. Will double or triple again in 2019.

I'm talking out of my ass here but an educated guess is Tesla might just solve the FSD issue with brute force computing. Throw enough power at it, and the best chess master loses to a computer. AP3 hardware + half a million car fleet is pretty significant raw compute. Another moat.

While one can argue that chess has a limited ruleset, one can argue that vehicular travel is a leap.. but not an impossible leap to overcome.

What helps is travel is still along the x-y plane. That cuts down on possible moves and counter moves of other cars. As the streets fill with more Tesla's, one could rightfully assume they are going to be able to coordinate very effectively with one another for 0 accidents.

Last edited:

UnknownSoldier

Unknown Member

Sure.. but time frame matters?

How much did Intel buy MobileEye for.. 15.3 billion? That's OVER 1/4th of Tesla's current market cap for only ONE aspect of what Tesla is providing.

ONE aspect.

Tesla's current supercharger network is a practical non-assailable moat in the next decade. By the time fast charging or whatever rolls out, it would be HALF the speed of Tesla's charging and Tesla would have doubled their supercharging speeds by then.

Tesla's data collection fleet practically doubled in size in 2018. Will double or triple again in 2019.

I'm talking out of my ass here but an educated guess is Tesla might just solve the FSD issue with brute force computing. Throw enough power at it, and the best chess master loses to a computer. AP3 hardware + half a million car fleet is pretty significant raw compute. Another moat.

FSD cannot be solved at the individual vehicle level with brute force because the car cannot communicate with the server or the rest of the fleet in real time to decide what to do. It has to be able to decide what to do by itself and immediately, it doesn't have time to think about what to do either. The best chess master loses to the computer because the computer has all the sum total of computations it has ever done to reference. The car on the road doesn't have all data gathered by the whole fleet on board nor could it have a computer powerful enough to reference all that data in real time, nor can it rely on the computer which has done all the computations because that's on a server somewhere and the car isn't 100% guaranteed a connection, and especially not one with zero latency, to help it think about the road it's on right now.

FSD cannot be solved at the individual vehicle level with brute force because the car cannot communicate with the server or the rest of the fleet in real time to decide what to do. It has to be able to decide what to do by itself and immediately, it doesn't have time to think about what to do either. The best chess master loses to the computer because the computer has all the sum total of computations it has ever done to reference. The car on the road doesn't have all data gathered by the whole fleet on board nor could it have a computer powerful enough to reference all that data in real time, nor can it rely on the computer which has done all the computations because that's on a server somewhere and the car isn't 100% guaranteed a connection, and especially not one with zero latency, to help it think about the road it's on right now.

This discussion should probably move to AI development but I’ll say that even it’s infancy - EAP does a pretty damn good job within its parameter set. And all calculations are performed on a per car basis.

Driving requires a cooperative skill set. Almost all cars follow and observe the rules, leaving few corner cases.

Highway 5 isn’t going to break out into a brawl where cars start to try and ram each other bumper car style and drive on wrong side of the free way taxing FSD systems.

Tesla board had sent rebuttal to NYT, which was later added in the article (see the last paragraphs) .I wonder why Elon or Tesla have not posted anything about the NYT article?

The first mistake was trying to go against the media... They are just too powerful.

We should just let the cars and results do the taking. Invite the media to factory tours etc etc but that's it.

Correct action would be to make a special message with rebuttal of course. But that is not what "Pulitzer" journalists do.

Practical spin would be that many venture groups have intertwined investments in Musk or with Musk companies, and it is in their interest to keep him float.My financially savvy neighbor (Worked on the street for 20 years) does not believe the $420 private buyout is possible and I couldn’t provide a compelling reason why it is.

He said when Warren Buffett was asked why would you pay a 20% premium to take a company private, his answer was control. Control of the company gives you a lot of power.

My neighbor says that there is no way a consortium of buyers would pay such a premium for the stock in the absence of such control and that board seats would be a sufficient inducement. There is no reason for them to do this and not be purchasing the stock now at such a discount to $420.

Does anyone know of a past instance of several entities coming together to pay a premium to delist a company?

Real answer is that practical investments in public Tesla are impossible. (see counting core investments in robot factories, softwares etc. as "cash burn" spin.) Investments in private Tesla would be lucrative on SpaceX scale.

As an example Tesla battery packs in their current module "plag&play" form and Tesla motors generate enormous interest in adjacent industries (seeboats, industrial platforms etc.). Tesla needs significant investments to tab such interest. They don't build enough of them even for Model 3 production yet.

That is beside necessary second factory in USA for Y and semi and plenty of other significant issues requiring financial flexibility.

Fact Checking

Well-Known Member

Your explanation makes the most sense to me, even more than mine—Musk is trying to control the outcome by setting some parameters. $420 a share, for example. The board might be pissed he did not give them a heads up, and in any case, as you clearly point out, they had no other course than to remain agnostic on his proposal. That may change, however, as the committee's due diligence bears fruit.

Shorts are trying to confuse this issue, and it's visible in the price action: the predictably agnostic, neutral, cautious reaction of the board was spun as a negative and the price dropped - i.e. longs got successfully confused.

Such deals take months to finalize.The

board cannot be "mad": had Elon told any of them privately they might have to recuse themselves from the decision due to conflict of interest, I believe.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K