It's amusing to see shorts/bears/trolls raising the accounts payable and inventory argument, because it's actually a Tesla positive factor, i.e. it's harmful to their negative thesis about Tesla. It gives the impression that these shorts don't really know what they are talking about.

Firstly, you are committing a very basic accounting mistake in your argument:

you are counting liabilities while not counting assets. In particular you are considering accounts payable while you are not counting either accounts receivable nor inventory. This kind of omission is a permanent feature of most variants of the Tesla short thesis I've seen so far, but you are clearly trying to reach new intellectual lows here.

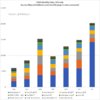

While accounts payable increased in Q2 (which will happen for any manufacturer that ramps up fast and thus has much more goods 'in the pipeline'), its inventory counterpart increased at an

even faster rate. A quick look at the data confirms:

| Quarter |

| Dec 31, 2018 |

| Mar 31, 2018 |

| Jun 30, 2018 |

[TD2]

Inventory

[/TD2] [TD2]

+$increase

[/TD2] [TD2]

Accounts payable

[/TD2][TD2]

-$increase

[/TD2] [TD2]

$net

[/TD2]

[TD2] +$2,263m [/TD2] [TD2] … [/TD2] [TD2] -$2,390m [/TD2][TD2] … [/TD2] [TD2] … [/TD2]

[TD2] +$2,565m [/TD2] [TD2] +$302m [/TD2] [TD2] -$2,603m [/TD2][TD2] -$213m [/TD2] [TD2]

+$89m

[/TD2]

[TD2] +$3,324m [/TD2] [TD2] +$758m [/TD2] [TD2] -$3,030m [/TD2][TD2] -$426m [/TD2] [TD2]

+$331m

[/TD2]

Note how the value of 'Inventory' has leaped ahead of 'Accounts payable' in Q2 already: this is an early sign of the Model 3's cash generation capability.

Inventory is in large part 'finished goods' (Model S3X's on way to the customer), raw materials, work in progress and service parts - i.e. future Model S3X's. Money spent on inventory isn't money disappearing like a short bet gone wrong, it's a real (temporary) asset that transfers into future revenue and cash at a high conversion rate.

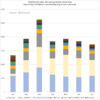

If we consider accounts payable as a product pipeline liability, and inventory and accounts receivable as assets, we can tentatively (and somewhat sloppily: see the disclaimers below) compare them with cash levels and estimate "equilibrium" cash levels - what would happen if all Model S3X's in the pipeline were sold and accounted for:

| Quarter |

| Dec 31, 2018 |

| Mar 31, 2018 |

| Jun 30, 2018 |

| Sep 30, 2018 (est.) |

[TD2]

Inventory

[/TD2] [TD2]

Payables

[/TD2] [TD2]

Receivables

[/TD2] [TD2]

Cash

[/TD2] [TD2]

"Equilibrium" Cash (est.)

[/TD2] [TD2]

Cash delta

[/TD2][TD2]

"Equilibrium"-Cash flow (est.)

[/TD2]

[TD2] +$2,263m [/TD2] [TD2] -$2,390m [/TD2] [TD2] +$515m [/TD2] [TD2] +$3,367m [/TD2] [TD2] +$3,756m [/TD2] [TD2] … [/TD2] [TD2] … [/TD2]

[TD2] +$2,565m [/TD2] [TD2] -$2,603m [/TD2] [TD2] +$652m [/TD2] [TD2] +$2,665m [/TD2] [TD2] +$3,280m [/TD2] [TD2]

-$702m

[/TD2][TD2]

-$475m

[/TD2]

[TD2] +$3,324m [/TD2] [TD2] -$3,030m [/TD2] [TD2] +$569m [/TD2] [TD2] +$2,236m [/TD2] [TD2] +$3,100m [/TD2] [TD2]

-$429m

[/TD2][TD2]

-$180m

[/TD2]

[TD2]

+$4,626m

[/TD2] [TD2] -

$4,684m

[/TD2] [TD2]

+$1,082m

[/TD2] [TD2]

+$2,933m

[/TD2] [TD2]

+$3,957m

[/TD2] [TD2]

+$696m

[/TD2][TD2]

+$857m

[/TD2]

(Note that this is only a coarse estimate, I'm estimating equilibrium flows from balance sheet items: in reality cash equivalents will also fluctuate for other reasons than the product pipeline; inventory value doesn't transform into revenue at a 100% rate; some consumer payments arrive before the car is made and thus increase cash balance; doesn't account for deferred revenue; plus it's all a dynamic snapshot with different time delays of the flows, etc. It's still an interesting and quick way to look at the equilibrium cash state behind the very dynamic Model 3 ramp-up which is by far the quickest moving part of the picture. This estimate probably over-estimates the equilibrium cash position - but I challenge shorts to come up with a Tesla-negative estimate on inventory effects, without misleading/lying that is.)

I.e. while cash dropped by -$429m in Q3, when coarsely corrected for accounts payable, accounts receivable and inventory values, "effective cash" only dropped by about -$180m in Q2, i.e. Tesla was much closer to an estimated equilibrium cash flow break-even point in Q2 already.

In Q3 Tesla is generating serious cash flow: cash equivalents are expected to rise to $2,933m, a growth of +$696m over Q2. I.e. the extra cash generated in Q3

alone is enough to pay off 75% of the $920m 2019 convertible notes - and then there's the additional cash generated in Q4 and much of 2019/Q1...

Conclusion: the Tesla "cash crunch" or bankwuptcy thesis is not supported by facts, it remains an elusive fever-dream by Tesla shorts/bears who are fundamentally disconnected from reality.