First TurboTax wouldn't let me file because there was an IRS delay in releasing forms to claim energy credits related to electric vehicles. That seems to have resolved 2/15. Now TurboTax says they can't file my return until they clear another form for claiming energy credits for home (solar) which they say will be done 2/21. Is anyone else having this problem, or am I just lucky? Or just impatient.....

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TurboTax Delays in Filing for Home Solar Rebate

- Thread starter JMGNC

- Start date

Matt-FL

Member

I am using HR Block, and was in the same boat. However, I was able to file mine after the 2/15 update. However, my energy credit was a leftover from 2022 taxes, not a full install credit. Not sure if that had any impact, but figured I'd share.

ATPMSD

Active Member

This is not a TurboxTax issue, it is the IRS. You will just have to wait.

Matt-FL

Member

My Turbotax Premier for PC-WIN doesn't seem to say anything about Form 5695 Residential Energy Credits. Seems like it's calculating the Clean Energy investment federal credit properly as well as the Energy Efficiency Improvements credit.

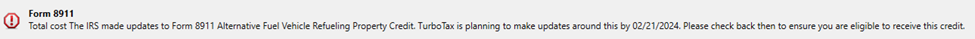

However, it is saying I cannot proceed with form 8911 Alternative Fuel Vehicle Refueling Property Credit until Feb 21.

However, it is saying I cannot proceed with form 8911 Alternative Fuel Vehicle Refueling Property Credit until Feb 21.

My Turbotax Premier for PC-WIN doesn't seem to say anything about Form 5695 Residential Energy Credits. Seems like it's calculating the Clean Energy investment federal credit properly as well as the Energy Efficiency Improvements credit.

However, it is saying I cannot proceed with form 8911 Alternative Fuel Vehicle Refueling Property Credit until Feb 21.

View attachment 1019850

Gahhhh nevermind... you guys are right. Form 5695 isn't popping any error messages for me, but the form is currently straight up broken on the PC-WIN version. It's not worth trying to file until they fix it (hopefully 2/21).

Typing in values under these sections on the forms doesn't actually flow properly into the calculation on line 30.

- Qualified Energy Efficiency Improvements Smart Worksheet

- Residential Energy Property Smart Worksheet

Thanks guys. Appreciate the replies and confirmation. Got to cool my jets….

Kind of funny how when you owe taxes, you file/defer as long as possible (hopefully without interest penalties). But when you're owed money, the W2 and 1099 stuff can't come soon enough haha.

charlesj

Active Member

The answer is YES.Kind of funny how when you owe taxes, you file/defer as long as possible (hopefully without interest penalties). But when you're owed money, the W2 and 1099 stuff can't come soon enough haha.

Blah. The update for 8911 got pushed back to Feb 28.

And form 5695 is still not working properly for me on the PC-WIN version.

And form 5695 is still not working properly for me on the PC-WIN version.

Yep, not only was the form pushed back, but it asks for your property GEOID and latitude and longitude. Good luck with that.

Lol I wonder if filling in 5695 or 8911 puts you into the 100% audit tier.

Yep, not only was the form pushed back, but it asks for your property GEOID and latitude and longitude. Good luck with that.

The GEOID should be the same as the Census Tract FIPS or 2020 CDFI Tract. It's accessible here. Try to get your 11 digit code before TurboTax, HR Block, and others actually fixes their forms and this government website gets blown up.

I can't find any other resource out there that can query this thing for the tax forms. The GEOID tools from NOAA seem to be for a different GEOID thing. This seems like a dead end.

Thanks guys. Appreciate the replies and confirmation. Got to cool my jets….

5695 is working now on PC-WIN and Turbotax Online. If you started 5695 already, you will need to manually go into the forms and [delete] the bad one. Then re-do the step by step questionnaire and it'll add a new/working 5695 to your return.

Form 8911 got delayed again until 3/1. I entered some of the information directly on the form as it no longer asks me to enter GEOID and latitude and longitude in the program. So I called up the form and entered it that way. I don't have anything that qualifies for form 5695. It all seems a little wonky.

Finally was able to post tax returns today after latest TurboTax/IRS update. Just one observation FYI. The rebate for installing a level 2 charger no longer applies to most Tesla owners. The reason they ask for your latitude and longitude or GEOID is to locate your home. You only get the rebate if your home is in a rural area or if in an urban area, then that area must be under the poverty level, i.e., distressed. That omits the typical Tesla owner.

Finally was able to post tax returns today after latest TurboTax/IRS update. Just one observation FYI. The rebate for installing a level 2 charger no longer applies to most Tesla owners. The reason they ask for your latitude and longitude or GEOID is to locate your home. You only get the rebate if your home is in a rural area or if in an urban area, then that area must be under the poverty level, i.e., distressed. That omits the typical Tesla owner.

I'll paste the instructions from Turbo Tax here for posterity ...

@h2ofun put in like 6 EVSE's so he'll be swimming in mad-monies. Yes, I did actually put in your address. And Yes, your census tract is in the list provided by the IRS. Which is crazy considering this guy's house is by the lake and he's a baller-badazz (aka he has a Tesla).

*********************************

Starting in 2023 only Alternative Fuel Vehicle Refueling Property that is an eligible census tract is available for a tax credit. Eligible census tracts in general are areas that have been deemed rural or moderate to low income. The IRS is accepting census tracts from either a 2015 or 2020 census list.

Steps to find your 11-digit census tract eligibility

2015 Census List Steps

- Go to website https://www.cdfifund.gov/cims

- On the page choose "CDFI" which should take you to a page titled "CDFI Public Viewer"

- In the left-hand side column choose "Layers" Under "CIMS Layers," put a checkmark in the box next to "2015 CDFI Tract"

- Type in the refueling property address or latitude and longitude in the "Search Addresses" bar at the top. This will take you to the tract of the location you entered. If you click your mouse on that location, the 11-digit population census tract identifier (that is, the GEOID) will appear.

- Once you have the 2015 Census number see if it is on the following list:

- https://www.irs.gov/pub/irs-drop/ap...-boundary-30c-eligible-tracts-v2-1-4-2024.pdf

- If your census tract is on the 2015, list you can use this number and are eligible for the credit. If your census tract number is not on the 2015 list, you can see if it is on the 2020 list.

2020 Census List Steps

- Go to this website to search by address - Census Geocoder

- Or to search by longitituse/latitude - Census Geocoder

- On both sites - In the "Benchmark" drop-down menu, choose "Public_AR_Census2020." In the "Vintage" drop-down menu, choose "Census2020_Current."

- Type in the location and Click on Get Results- The 11-digit population census tract identifier is in the GEOID under "Census Tracts."

- Once you have the 11-digit population census tract identifier confirm if it is on the following list

- https://www.irs.gov/pub/irs-drop/ap...-boundary-30c-eligible-tracts-v2-1-4-2024.pdf

If your location is not on the 2015 or 2020 census list property placed at that location is not eligible for the Alternative Fuel Vehicle Refueling Property Credit

Last edited:

h2ofun

Active Member

I never expect to get anything backI'll paste the instructions from Turbo Tax here for posterity ...

@h2ofun put in like 6 EVSE's so he'll be swimming in mad-monies. Yes, I did actually put in your address. And Yes, your census tract is in the list provided by the IRS. Which is crazy considering this guy's house is by the lake and he's a baller-badazz (aka he has a Tesla).

*********************************

Starting in 2023 only Alternative Fuel Vehicle Refueling Property that is an eligible census tract is available for a tax credit. Eligible census tracts in general are areas that have been deemed rural or moderate to low income. The IRS is accepting census tracts from either a 2015 or 2020 census list.

Steps to find your 11-digit census tract eligibility

2015 Census List Steps

- Go to website https://www.cdfifund.gov/cims

- On the page choose "CDFI" which should take you to a page titled "CDFI Public Viewer"

- In the left-hand side column choose "Layers" Under "CIMS Layers," put a checkmark in the box next to "2015 CDFI Tract"

- Type in the refueling property address or latitude and longitude in the "Search Addresses" bar at the top. This will take you to the tract of the location you entered. If you click your mouse on that location, the 11-digit population census tract identifier (that is, the GEOID) will appear.

- Once you have the 2015 Census number see if it is on the following list:

- https://www.irs.gov/pub/irs-drop/ap...-boundary-30c-eligible-tracts-v2-1-4-2024.pdf

- If your census tract is on the 2015, list you can use this number and are eligible for the credit. If your census tract number is not on the 2015 list, you can see if it is on the 2020 list.

2020 Census List Steps

- Go to this website to search by address - Census Geocoder

- Or to search by longitituse/latitude - Census Geocoder

- On both sites - In the "Benchmark" drop-down menu, choose "Public_AR_Census2020." In the "Vintage" drop-down menu, choose "Census2020_Current."

- Type in the location and Click on Get Results- The 11-digit population census tract identifier is in the GEOID under "Census Tracts."

- Once you have the 11-digit population census tract identifier confirm if it is on the following list

- https://www.irs.gov/pub/irs-drop/ap...-boundary-30c-eligible-tracts-v2-1-4-2024.pdf

If your location is not on the 2015 or 2020 census list property placed at that location is not eligible for the Alternative Fuel Vehicle Refueling Property Credit

Similar threads

- Replies

- 11

- Views

- 1K

- Replies

- 8

- Views

- 3K