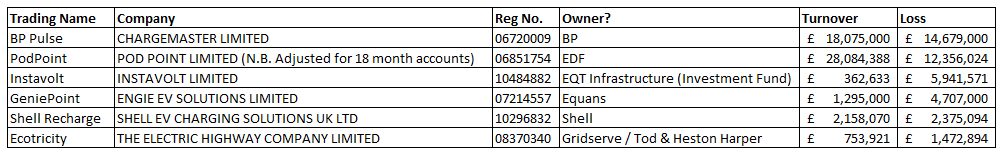

Another thread sent me down a rabbit hole and I thought I would share my findings. I was interested in who made or lost money operating EV chargepoints in the UK. Rather than assume I thought I would go and find out. I couldn't find anyone making a profit. Not entirely surprising but still. Here's just a sample of household names for the Financial Year Ending 2020 (some do have newer accounts).

This bunch (and they're most of the largest operators) lost £41m between them. In the scale of UK EV charging I'm looking at the sums of money and thinking EV charging isn't the most expensive problem to solve if there was a will to do so. Glad the UK Gov stumped up some money for the Rapid Charging Fund last year to help though.

This bunch (and they're most of the largest operators) lost £41m between them. In the scale of UK EV charging I'm looking at the sums of money and thinking EV charging isn't the most expensive problem to solve if there was a will to do so. Glad the UK Gov stumped up some money for the Rapid Charging Fund last year to help though.