Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Which Auto Maker Should Tesla Acquire First?

- Thread starter chateauoaks

- Start date

Brando

Active Member

No one in his right mind would take over any current auto maker and all the liabilities. Would they??

Probably easier to start making electrics rather than taking care of ICE machines, right?

Take over an old auto plant or build from scratch?

You have to calculate.

Build new vs remodel. (remodel requires disassembly then install new - so labor cost always more.)

Of course many other factors such as energy rates, transport costs, taxes, labor pool, market to service, etc.

Probably easier to start making electrics rather than taking care of ICE machines, right?

Take over an old auto plant or build from scratch?

You have to calculate.

Build new vs remodel. (remodel requires disassembly then install new - so labor cost always more.)

Of course many other factors such as energy rates, transport costs, taxes, labor pool, market to service, etc.

Brando

Active Member

Elon has said NO, more than once. Said he planned to be at Tesla the rest of his working career. NOW, what about the stock holders as Elon does not have the majority of Tesla stock? Like with PayPal the stockholders could fire him.The question is would Elon give up Tesla for BIG BUCKS?

sandpiper

Active Member

I can't see that it would make any sense.... ever.

If they can execute, Tesla can become a premium EV builder, positioned like Apple, able to stay above the inevitable race to the bottom that will happen with EVs within a decade.

And they're not saddled with the huge legacy costs that all of the legacy builders are carrying.

If they can execute, Tesla can become a premium EV builder, positioned like Apple, able to stay above the inevitable race to the bottom that will happen with EVs within a decade.

And they're not saddled with the huge legacy costs that all of the legacy builders are carrying.

Brando

Active Member

Reminder GM went thru bankruptcy which removed their legacy costs.If they can execute, Tesla can become a premium EV builder, positioned like Apple, able to stay above the inevitable race to the bottom that will happen with EVs within a decade.

And they're not saddled with the huge legacy costs that all of the legacy builders are carrying.

Which has allowed them to use $16 billion in the last 2 years to buy back stock, since they can't figure out how invest earning. What about a battery plant? Electrification? stockholder dividends? also note 2010-1016 TOTAL Tesla R&D was less than $3 billion. google search to verify

RobStark

Well-Known Member

Reminder GM went thru bankruptcy which removed their legacy costs.

Which has allowed them to use $16 billion in the last 2 years to buy back stock, since they can't figure out how invest earning. What about a battery plant? Electrification? stockholder dividends? also note 2010-1016 TOTAL Tesla R&D was less than $3 billion. google search to verify

Bankruptcy removed some of GM's debt, especially to bondholders.

It wiped out shareholder value and let GM get new monies in a new IPO.

It didn't remove their pension and healthcare obligations to UAW employees.

It didn't even protect them from lawsuits on cars built before bankruptcy, as evidenced by the ignition switch lawsuits.

It didn't remove their sunk cost in outdated technology.

thegruf

Active Member

Elon has said NO, more than once. Said he planned to be at Tesla the rest of his working career. NOW, what about the stock holders as Elon does not have the majority of Tesla stock? Like with PayPal the stockholders could fire him.

Hope Elon doesn't leave Tesla - I can't afford a SpaceX rocket

Burnt Toast

Member

The Chinese have owned Volvo since 2010. Tesla was making kit cars in 2010.Remember when Jaguar tanked, Ford bought it for a few years and then couldn't give it away? Tesla will have deep pockets soon and is destined to put a several makers out of business. Nothing like purchasing your competition to drive the stake home. A few years ago I thought nose-diving Volvo would be a perfect fit for Elon until they were bought by the Chinese. So who might be a good purchase for Tesla? Anyone hungry for a little Italian, like maybe Alfa Romeo or Maserati? Hmm, British? TVR, anyone? Sushi? Or maybe Chrysler after Marchionne finishes driving it into a wall. Let the speculation begin!

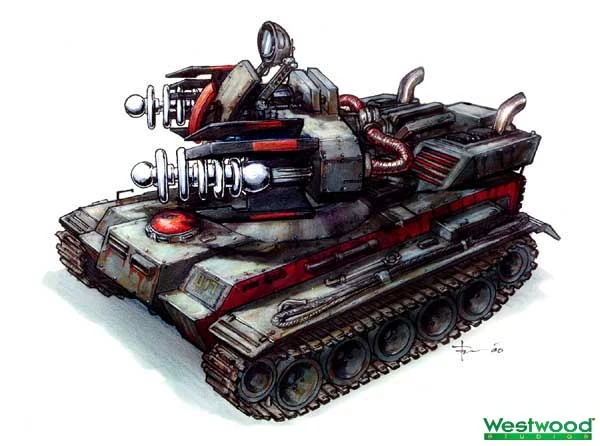

They could buy Westwood Studios to gain the rights to construct the Tesla Tank.

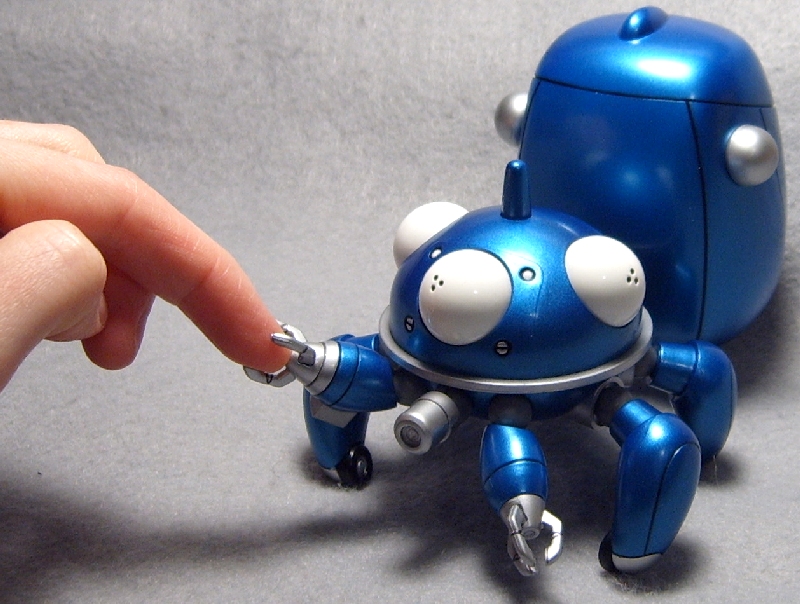

While we're in fictional universes, they could acquire Kenbishi Heavy Industries and make disturbingly good use of Neuralink in their next vehicles

Not To Scale

It think that Lightyear Lightyear - Introducing the electric car that charges itself with sunlight would be an interesting project for Tesla to participate in.

Participating and NOT buying, because I like the innovative mindset of the people currently working on the Lightyear One

Tesla would be able to help ramping up production and both companies could profit from each other's knowledge....

Participating and NOT buying, because I like the innovative mindset of the people currently working on the Lightyear One

Tesla would be able to help ramping up production and both companies could profit from each other's knowledge....

If Tesla is rolling in cash when other companies are failing, I could see them buying up assets of a failed or failing car company. The US government may strongly encourage them into a merger with one of the failing US companies like they forced banks into merging in 2009.

To be worth their while, Tesla would want to pick up a company with a strong global brand and with factories on every continent. They would probably want to completely retool those factories to make Tesla designs, though there might be a transition period where they would have to make some ICE (ironically).

The larger European and Asian brands would likely be propped up by their governments and wouldn't want to sell out to an American company. So that would leave one or more of the Big 3. I think Fiat-Chrysler will be the first to fail, but I think Tesla would be least interesting in acquiring them, even if just the Chrysler division (I thought I saw somewhere Fiat is already making noises about selling off Chrysler). Of the Big 3 FCA has the most anti-EV culture and would have the most trouble merging cultures with Tesla.

GM does have an EV now that Tesla could take and with a little re-work it could become part of the Tesla lineup. Of the Big 3 GM has the strongest nameplate in China - Buick. The last emperor of China collected Buicks and it is quite a status symbol to have one. Tesla could market their cars in China under the Buick nameplate and it would probably improve their market share. GM also has a good global presence with their cars selling in most of the world as well as having factories in many countries. Though if they sell off Opel in Europe that might make them less attractive a target.

Of the Big 3 American auto makers, Ford probably has the strongest global sales. They are a well known brand in Europe and Australia as well as having factories in those countries. They aren't quite as strong in China as GM, but they do sell cars there. Lincoln is a very upscale brand there.

Ford's electric selection is stronger in hybrids than pure EVs though they have announced a 300 mile pure EV for 2020.

Tesla would have to massively retool the plants of any company they take over and they would need some regulatory pressure in the US to allow them to sell direct in every state. The car dealers for the company they buy out would not be happy. Some factories would probably be shut down permanently and some shut down for a year or more as Tesla retools, but they would be able to quickly expand production with a lot more factories and a larger workforce.

Tesla might merge with another auto maker someday, or they might just buy up assets of a failed company after they go under, but I don't think the US government would want to see Ford and GM fail completely. I'm not sure Chrysler is saveable at this point, but it might be saved too.

Nobody really knows for sure what the automotive industry is going to look like in 5 years. Tesla could be quite wealthy and a lot of other players struggling hard to survive in a world that doesn't want ICE anymore. Or the competition may be able to keep up and most companies will make it. If Tesla has gobs of money and the Big 3 are on the ropes, the US government might push hard to get Tesla to do a merger with at least one of them. Tesla will be in a strong position to get regulatory changes they want at that point.

To be worth their while, Tesla would want to pick up a company with a strong global brand and with factories on every continent. They would probably want to completely retool those factories to make Tesla designs, though there might be a transition period where they would have to make some ICE (ironically).

The larger European and Asian brands would likely be propped up by their governments and wouldn't want to sell out to an American company. So that would leave one or more of the Big 3. I think Fiat-Chrysler will be the first to fail, but I think Tesla would be least interesting in acquiring them, even if just the Chrysler division (I thought I saw somewhere Fiat is already making noises about selling off Chrysler). Of the Big 3 FCA has the most anti-EV culture and would have the most trouble merging cultures with Tesla.

GM does have an EV now that Tesla could take and with a little re-work it could become part of the Tesla lineup. Of the Big 3 GM has the strongest nameplate in China - Buick. The last emperor of China collected Buicks and it is quite a status symbol to have one. Tesla could market their cars in China under the Buick nameplate and it would probably improve their market share. GM also has a good global presence with their cars selling in most of the world as well as having factories in many countries. Though if they sell off Opel in Europe that might make them less attractive a target.

Of the Big 3 American auto makers, Ford probably has the strongest global sales. They are a well known brand in Europe and Australia as well as having factories in those countries. They aren't quite as strong in China as GM, but they do sell cars there. Lincoln is a very upscale brand there.

Ford's electric selection is stronger in hybrids than pure EVs though they have announced a 300 mile pure EV for 2020.

Tesla would have to massively retool the plants of any company they take over and they would need some regulatory pressure in the US to allow them to sell direct in every state. The car dealers for the company they buy out would not be happy. Some factories would probably be shut down permanently and some shut down for a year or more as Tesla retools, but they would be able to quickly expand production with a lot more factories and a larger workforce.

Tesla might merge with another auto maker someday, or they might just buy up assets of a failed company after they go under, but I don't think the US government would want to see Ford and GM fail completely. I'm not sure Chrysler is saveable at this point, but it might be saved too.

Nobody really knows for sure what the automotive industry is going to look like in 5 years. Tesla could be quite wealthy and a lot of other players struggling hard to survive in a world that doesn't want ICE anymore. Or the competition may be able to keep up and most companies will make it. If Tesla has gobs of money and the Big 3 are on the ropes, the US government might push hard to get Tesla to do a merger with at least one of them. Tesla will be in a strong position to get regulatory changes they want at that point.

RobStark

Well-Known Member

I thought I saw somewhere Fiat is already making noises about selling off Chrysler

Sergio Marchionne is interested in selling the entire FCA empire,merging with GM or VW, or even selling Alfa Romeo/Lancia to finance FCA a little longer. Sergio and the Agnelli family know FCA can't survive alone for the next 20 years. FCA is incorporated in The Netherlands and domiciled in the UK for tax purposes but most of the senior officers now live in Michigan. It is unclear where FCA's next bailout may come from.

Though if they sell off Opel in Europe that might make them less attractive a target.

It is already a done deal.GM has sold Opel to PSA, PSA will continue to source Ampera-e(Bolt) from GM and maybe future GM BEVs. GM only sells Cadillac,Camaro,and Corvette in Europe. GM has pulled out of the Indian market (it still has an Indian factory but manufactures for export), Indonesia(4th most populous country)and Republic of South Africa plus other south African countries. GM is a Sino-American automaker.

Of the Big 3 American auto makers, Ford probably has the strongest global sales. They are a well known brand in Europe and Australia as well as having factories in those countries. They aren't quite as strong in China as GM, but they do sell cars there. Lincoln is a very upscale brand there.

No one has an auto factory in Australia. GM,Ford, and Toyota pulled out a few years ago. Now they just have Sales subsidiaries there. Australia eliminated is automotive tariff because there is no domestic industry to protect.

Lincoln started selling in China in 2014. It is still building its brand and filling out a national dealer network.

jelloslug

Active Member

The bylaws are written so that him getting fired by the share holders would be almost impossible.Elon has said NO, more than once. Said he planned to be at Tesla the rest of his working career. NOW, what about the stock holders as Elon does not have the majority of Tesla stock? Like with PayPal the stockholders could fire him.

Brando

Active Member

Want to show this bylaw? no see, no believeThe bylaws are written so that him getting fired by the share holders would be almost impossible.

Elon has said he would have to really mess up to piss off enough stockholders to get fired, but they could.

Care to show us this bylaw?

Sergio Marchionne is interested in selling the entire FCA empire,merging with GM or VW, or even selling Alfa Romeo/Lancia to finance FCA a little longer. Sergio and the Agnelli family know FCA can't survive alone for the next 20 years. FCA is incorporated in The Netherlands and domiciled in the UK for tax purposes but most of the senior officers now live in Michigan. It is unclear where FCA's next bailout may come from.

Whatever happens, FCA will probably not exist in its current form in 10 years.

It is already a done deal.GM has sold Opel to PSA, PSA will continue to source Ampera-e(Bolt) from GM and maybe future GM BEVs. GM only sells Cadillac,Camaro,and Corvette in Europe. GM has pulled out of the Indian market (it still has an Indian factory but manufactures for export), Indonesia(4th most populous country)and Republic of South Africa plus other south African countries. GM is a Sino-American automaker.

So GM's reach has shrunk quite a bit.

No one has an auto factory in Australia. GM,Ford, and Toyota pulled out a few years ago. Now they just have Sales subsidiaries there. Australia eliminated is automotive tariff because there is no domestic industry to protect.

I had read Ford had some presence in Australia. I looked it up and they do have an R&D center there that has expanded in recent years. Though it looks like all cars in Australia are imports now.

Lincoln started selling in China in 2014. It is still building its brand and filling out a national dealer network.

It looks like all their cars are struggling in the Chinese market, even ones only made for that market. China has a growing domestic car industry that challenges all non-Chinese car makers.[/QUOTE]

calisnow

Banned

The point of this would be - what?Remember when Jaguar tanked, Ford bought it for a few years and then couldn't give it away? Tesla will have deep pockets soon and is destined to put a several makers out of business. Nothing like purchasing your competition to drive the stake home. A few years ago I thought nose-diving Volvo would be a perfect fit for Elon until they were bought by the Chinese. So who might be a good purchase for Tesla? Anyone hungry for a little Italian, like maybe Alfa Romeo or Maserati? Hmm, British? TVR, anyone? Sushi? Or maybe Chrysler after Marchionne finishes driving it into a wall. Let the speculation begin!

right. the only plausible scenario is they buy assets out of the bankruptcy of another car manufacturer.

probably just the manufacturing facilities, and perhaps some cup holder and coat hanger patents.

probably just the manufacturing facilities, and perhaps some cup holder and coat hanger patents.

They might buy abandoned manufacturing facilities, but why the rest?

The closest to that I can imagine would be Tesla buying a factory, at fire-sale prices, that had just been closed down by another manufacturer.

buy up assets of a failed company after they go under,

Similar threads

- Replies

- 98

- Views

- 26K

- Replies

- 241

- Views

- 34K

- Replies

- 9

- Views

- 45K