Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Wow. Ok... we should also get (excellent) Q2 d3livery numbers in the same release or a day later.

The stock market will be open on Monday, right? With Tuesday being July 4th....

Yes -- open until 1 pm ET Monday (half day). Closed Tuesday.

Waiting4M3

Active Member

Could be a stormy weekend

Pl WORLD______MAY_________ YTD_________ %______ '16Pl

1 Tesla_________6.713________35.663________10 _______2

2 BMW________7.242_________33.035________ 9________3

3 BAIC_________6.530________25.004________7_________5

4 Nissan_______3.981_________23.915________7________4

5 BYD__________8.651________23.548________7________1

6 Toyota________7.579_________20.877________6_______30

7 Chevrolet_____4.448_________18.339_________5_______8

8 Renault_______ 2.582________14.850_________4______10

9 Zhidou________4.471________14.004_________4_______14

10 Volkswagen__3.502_________13.064_________4_______6

EV Sales: World Top 10 May

Funny comment from the blog:

"A special reference to the Chevrolet Bolt

and very bullish on BYD:

"BYD was the Best Selling manufacturer for the second time in a row, with 8.651 deliveries, its best performance since last October, so it seems that the 10k-plus performances are ready to unfold for the Chinese company and the bid for 2017 Best Seller is very well on the table.

...

But, if someone can take the 2017 Ceptre from going to Palo Alto, it will be BYD. "

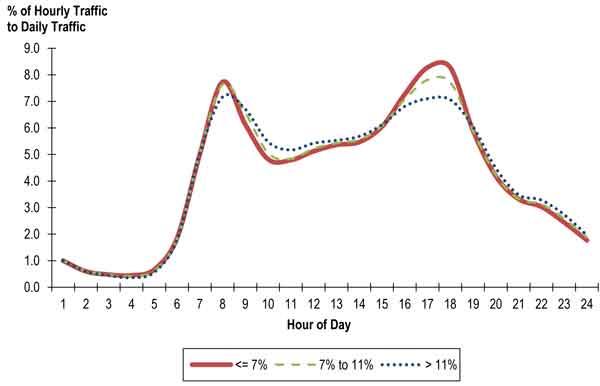

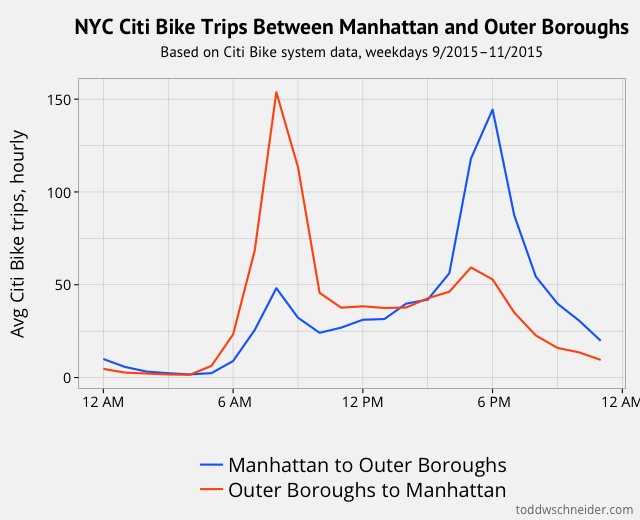

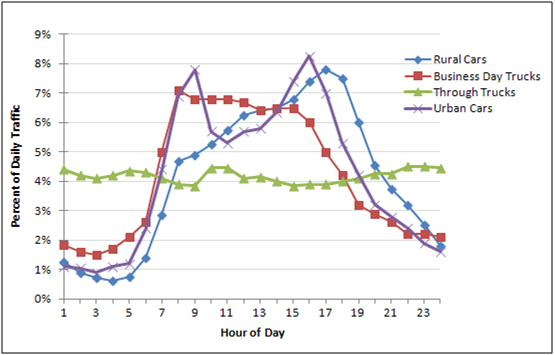

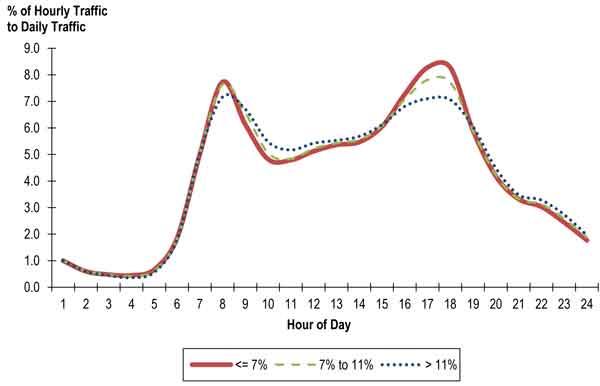

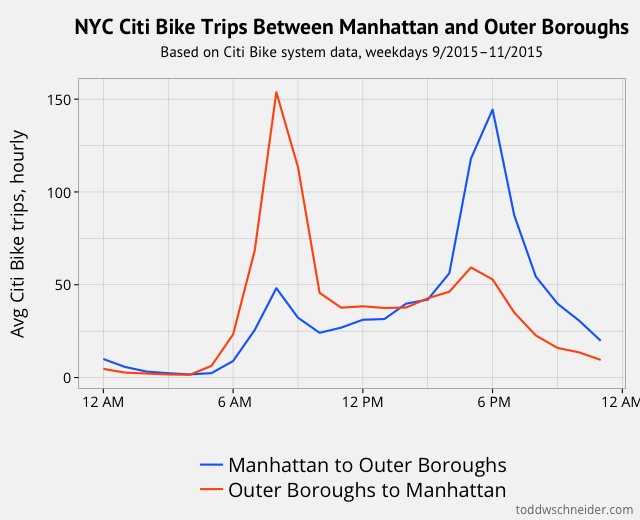

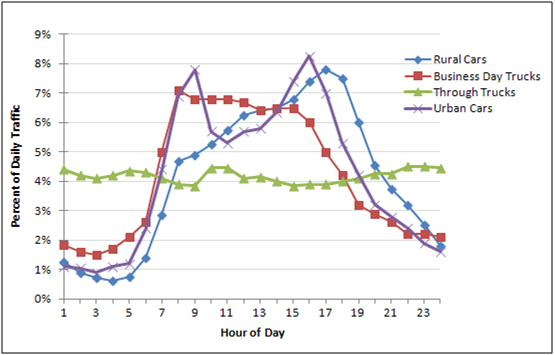

Here are some graphs from different sources showing taffic by hour of the day:

They're pretty similar across the board, and this can be expected to be pretty close to the demand curve for the Tesla Network. Say you then have Tesla Network capacity for covering 5% of daily miles per hour (total capacity on the Tesla Network is then 120%), except 7-8 pm and 5-6 pm, when many people are using their cars and the capacity drops to 2%. For 1-5 pm, the market would be completely saturated, under one fifth of Tesla Network cars will be moving. While at 7-8 pm and 5-6 pm, only a quarter of the demand can be met.

This is a challenge. If you have a sufficient capacity in the Tesla Network to meet peak demand, you would need to be able to meet something like 25% of daily demand per hour. That means total capacity is 600% of daily demand. And each car on the Tesla Network is likely to be standing still for ~20 hours per day.

Edit: This may be a bit conservative, though. You will get some self-selection of participants, where people who work nights or work at home are more likely to participate, due to higher payoff. Say the Tesla Network is scaled to 400% of daily demand. At that point, each car will be participating on the Tesla Network for 6 hours per day. Revenue might be something like 20 mph (average) x 6 hours x 0.25 USD/mile = 30 USD/day. Revenue per year might be 11,000 USD. If Tesla takes a 10% cut, and has 2 million participating vehicles, that's an income of 2.2 billion USD per year.

Thanks! I love charts and graphs... pretty pictures... much easier for me to comprehend.

Esme Es Mejor

Member

Is anyone considering the value of Tesla Network for delivery during non-peak hours? Uber is already delivering food & packages; w/out a driver, this seems like a far more attractive option.

ValueAnalyst

Closed

Here are some graphs from different sources showing taffic by hour of the day:

They're pretty similar across the board, and this can be expected to be pretty close to the demand curve for the Tesla Network. Say you then have Tesla Network capacity for covering 5% of daily miles per hour (total capacity on the Tesla Network is then 120%), except 7-8 pm and 5-6 pm, when many people are using their cars and the capacity drops to 2%. For 1-5 pm, the market would be completely saturated, under one fifth of Tesla Network cars will be moving. While at 7-8 pm and 5-6 pm, only a quarter of the demand can be met.

This is a challenge. If you have a sufficient capacity in the Tesla Network to meet peak demand, you would need to be able to meet something like 25% of daily demand per hour. That means total capacity is 600% of daily demand. And each car on the Tesla Network is likely to be standing still for ~20 hours per day.

Edit: This may be a bit conservative, though. You will get some self-selection of participants, where people who work nights or work at home are more likely to participate, due to higher payoff. Say the Tesla Network is scaled to 400% of daily demand. At that point, each car will be participating on the Tesla Network for 6 hours per day. Revenue might be something like 20 mph (average) x 6 hours x 0.25 USD/mile = 30 USD/day. Revenue per year might be 11,000 USD. If Tesla takes a 10% cut, and has 2 million participating vehicles, that's an income of 2.2 billion USD per year.

Thank you for this information. Could you please explain why grosss revenues for cars on Tesla network would be $30/day when an Uber driver today makes $200+ working 8 hours a day?

ValueAnalyst

Closed

Is anyone considering the value of Tesla Network for delivery during non-peak hours? Uber is already delivering food & packages; w/out a driver, this seems like a far more attractive option.

Great point!

ValueAnalyst

Closed

+1

In addition, if there were a far lower number of cars but each operating 24/7, they would be quickly worn out and need to be far more frequently replaced by fresh production.

I expect the avg life of a car (in terms of miles) to increase significantly in the coming years, as all-electric cars have one-third the number of parts of ICE so do not require the same level of maintenance, and battery life will have improved dramatically (up to 1m+ miles?) and so on.

I have, however, assumed five years of average life for a car on Tesla network.

ValueAnalyst

Closed

Saying peak hours should not count towards estimating Tesla Network's value, because owners use their cars, is like saying there can't be investment properties because people live in them.

There will be owners (like myself) who will own more than one car just for income purposes. $50,000+ ($8/rd x 2rd/hr x 10hr x 365) per year per car incentive is too high not to do so.

There will be owners who choose to walk/bike/ride-share to work as their autonomous car earns income. $20,000+ ($10/rd x 3rd/hr x 2 rush hours x 365) per year per car incentive is too high not to do so.

Not all people commute for the full hour duration between 7am to 8am; if someone commutes 7:00am to 7:30am, their car can earn income between 7:30am to 8am.

There will also be people who choose to go to work early or late and their car earns income during rush hour. Would you not do that if someone paid you an extra $20,000 per year for it?

Tesla will also have their own cars that drive riders around during rush hours (in which case, it is incorrect to say margin should drop dramatically to incorporate maintenance as this is already accounted for in the 75% rev share for the driver). Assuming a lower margin, but applied to the gross revenue rather than net revenue, may actually end up being much higher value for Tesla.

There are too many possibilities that are being ignored for the purposes of conservatism. On top of all this, if I'm wrong and the participation rate is significantly lower than 35%, then avg fare will be much higher, which actually may up bringing in more gross profit to Tesla.

There will be owners (like myself) who will own more than one car just for income purposes. $50,000+ ($8/rd x 2rd/hr x 10hr x 365) per year per car incentive is too high not to do so.

There will be owners who choose to walk/bike/ride-share to work as their autonomous car earns income. $20,000+ ($10/rd x 3rd/hr x 2 rush hours x 365) per year per car incentive is too high not to do so.

Not all people commute for the full hour duration between 7am to 8am; if someone commutes 7:00am to 7:30am, their car can earn income between 7:30am to 8am.

There will also be people who choose to go to work early or late and their car earns income during rush hour. Would you not do that if someone paid you an extra $20,000 per year for it?

Tesla will also have their own cars that drive riders around during rush hours (in which case, it is incorrect to say margin should drop dramatically to incorporate maintenance as this is already accounted for in the 75% rev share for the driver). Assuming a lower margin, but applied to the gross revenue rather than net revenue, may actually end up being much higher value for Tesla.

There are too many possibilities that are being ignored for the purposes of conservatism. On top of all this, if I'm wrong and the participation rate is significantly lower than 35%, then avg fare will be much higher, which actually may up bringing in more gross profit to Tesla.

Last edited:

Yggdrasill

Active Member

I assumed 25 cents per mile while Uber is much more expensive. ~6 miles is pretty typical for Uber, say 8 miles including getting between fares, means 2 USD/ride.Thank you for this information. Could you please explain why grosss revenues for cars on Tesla network would be $30/day when an Uber driver today makes $200+ working 8 hours a day?

Now let me quote you:

UBER does 100+ million rides per day at an average cost of $10 per ride. My assumption of $2 per ride incorporates the increased availability of mobility-as-a-service, but it will be decades before the market is "entirely saturated." The world will need several hundred million autonomous cars.

Also, I assumed 6 hours vs 8 hours, and you can see how I arrived at 6 hours.

ValueAnalyst

Closed

I assumed 25 cents per mile while Uber is much more expensive. ~6 miles is pretty typical for Uber, say 8 miles including getting between fares, means 2 USD/ride.

But why would per-mile charge drop so dramatically if autonomous ridesharing will not be material as some here claim?

25% participation from 40 million autonomous cars, an additional supply of 10 million cars, to serve billions of people around the world (not just the US), would not by any means even cover the number of people (globally) who will stop owning cars even accounting for each autonomous car meeting the needs of say 4x people.

Also, autonomous cars would make it easier to achieve truely efficient ridesharing (multiple riders in one trip) which as UBER has found out leads to higher avg fare and is significantly more profitable. If Tesla can get this right, by say building cars that can carry multiple people while providing each rider with privacy, the avg fare may actually be more than the current $10!

Yggdrasill

Active Member

I think autonomous ridesharing will be very widespread and material. At first, I think the per vehicle revenue will be high, but as more and more vehicles are added, per vehicle revenue will fall and fall, down to something close to the numbers I used.But why would per-mile charge drop so dramatically if autonomous ridesharing will not be material as some here claim?

But fair enough, you won't get the saturation I expect with a mere 2 million participating cars and 6 hours of participation per day. That amounts to only 30 million rides per day. You need significantly more cars. If we say there's a market for 500 million rides per day in the US, you'd need ~33 million participating cars doing 6 hours of participation and 15 rides per day. That works out to something like 13% of the number of cars today.

As a control to this figure, 33 mill x 15 x 8 miles = ~4 billion miles per day. Vehicle-miles travelled per day in the US is ~8.8 billion, so that's a ~45% market share of all miles travelled. I think that's plausible.

If we assume 500 million rides is the market in the US and Europe is 750 million, and Tesla secures a 20% market share, at a 10% cut of the revenue and 2 USD/ride, that's 18 billion USD per year in revenue for Tesla. This is probably a few decades down the road, though.

Yggdrasill

Active Member

After doing some more calculations, I think this is a fairly reasonable estimate for the potential for the Tesla Network for 2025:

- 10 million cumulative Tesla vehicle production

- 2.5 million participating vehicles on the Tesla Network

- 16 hours per day, 300 days per year, 2.5 rides per hour, 4 USD per ride, 10% cut for Tesla

- Average of 82 million rides per day total

- Total annual revenue of 120 billion, Tesla gets 12 billion

- Revenue per vehicle of 160 USD/day, 48k USD per year

- Daily mileage of 320 miles per vehicle, 96k miles per year

I don't think saturation will be an issue with 82 million rides per day, so I think the cost per ride will be lower than an Uber, but still high-ish.

Still, this all hinges one one critical point. Tesla needs to get that self driving tech working and approved!

- 10 million cumulative Tesla vehicle production

- 2.5 million participating vehicles on the Tesla Network

- 16 hours per day, 300 days per year, 2.5 rides per hour, 4 USD per ride, 10% cut for Tesla

- Average of 82 million rides per day total

- Total annual revenue of 120 billion, Tesla gets 12 billion

- Revenue per vehicle of 160 USD/day, 48k USD per year

- Daily mileage of 320 miles per vehicle, 96k miles per year

I don't think saturation will be an issue with 82 million rides per day, so I think the cost per ride will be lower than an Uber, but still high-ish.

Still, this all hinges one one critical point. Tesla needs to get that self driving tech working and approved!

Last edited:

ValueAnalyst

Closed

I think autonomous ridesharing will be very widespread and material. At first, I think the per vehicle revenue will be high, but as more and more vehicles are added, per vehicle revenue will fall and fall, down to something close to the numbers I used.

I agree. After reducing participation rate further to 30% with a slower-than-originally-estimated ramp-up of 4 years, I also lowered the decline rate in avg fare in earlier from $8.50 to $7 in 2021, with the decline accelerating thereafter to $2.50 in 2025. Annual gross profit ~$50 billion.

But fair enough, you won't get the saturation I expect with a mere 2 million participating cars and 6 hours of participation per day. That amounts to only 30 million rides per day. You need significantly more cars. If we say there's a market for 500 million rides per day in the US, you'd need ~33 million participating cars doing 6 hours of participation and 15 rides per day. That works out to something like 13% of the number of cars today.

I think your estimate of number of rides needed are too high. NYC market, population of ~8.5 million, currently does 800k rides per day (Taxi/UBER/Lyft/Other), so closer to 10% of population.

The important thing to note, however, is that number of rides has increased from less than 500k rides per day since UBER has emerged in Jan2015, so 60% rise in just 2.5 years! See this: Taxi, Uber, and Lyft Usage in New York City

4 billion people in the world live in urban areas, and this number is increasing. Due to steep declines in avg fare cost, increased convenience, and the upcoming declines in car ownership, if we assume number of rides needed as a percentage of population doubles in the next 8 years (vs. 60% in 2.5 years), then 20% rides-to-population would mean 800+ million daily rides will be needed by 2025.

My current estimate of 260 million daily rides on Tesla Network in 4Q25 is less than one-third market share.

Some say (I'm a bit skeptical of this) that Tesla may be in a position to capture 100% of the market because of its upcoming autonomous Supercharger network, its products' unmatched smooth all-electric ride (smoothness of the ride is actually very important for Level 4/5 autonomy ridesharing ESPECIALLY if the rider is reading/watching something due to motion sickness concerns), plans to very quickly scale up its manufacturing of all-electric vehicles, and brand value. I'd rather be reasonably conservative, so I'm only assuming 33% market share for now.

Last edited:

Reciprocity

Active Member

Pl WORLD______MAY_________ YTD_________ %______ '16Pl

1 Tesla_________6.713________35.663________10 _______2

2 BMW________7.242_________33.035________ 9________3

3 BAIC_________6.530________25.004________7_________5

4 Nissan_______3.981_________23.915________7________4

5 BYD__________8.651________23.548________7________1

6 Toyota________7.579_________20.877________6_______30

7 Chevrolet_____4.448_________18.339_________5_______8

8 Renault_______ 2.582________14.850_________4______10

9 Zhidou________4.471________14.004_________4_______14

10 Volkswagen__3.502_________13.064_________4_______6

EV Sales: World Top 10 May

And as we all know, end of quarter Tesla tends to deliver as many cars in third month as the previous 2 months of the quarter, which would make that gap larger. Would be great to see these same numbers in term of revenue, which would truly show the difference at 2-3 times the revenue per car.

ValueAnalyst

Closed

After doing some more calculations, I think this is a fairly reasonable estimate for the potential for the Tesla Network for 2025:

- 10 million cumulative Tesla vehicle production

- 2.5 million participating vehicles on the Tesla Network

- 16 hours per day, 300 days per year, 2.5 rides per hour, 4 USD per ride, 10% cut for Tesla

- Average of 82 million rides per day total

- Total annual revenue of 120 billion, Tesla gets 12 billion

- Revenue per vehicle of 160 USD/day, 48k USD per year

- Daily mileage of 320 miles per vehicle, 96k miles per year

I don't think saturation will be an issue with 82 million rides per day, so I think the cost per ride will be lower than an Uber, but still high-ish.

Still, this all hinges one one critical point. Tesla needs to get that self driving tech working and approved!

Thanks for this this. How did you arrive 10 million cumulative cars produced by 2025? Among other things, this makes up the largest portion of the difference between our estimates. Remember Tesla will likely have built 8-12 gigafactories by 2025, which would likely mean more than 10m cars produced per year by 2025.

Given that avg life of a new car is 8+ years, even if we assume cars on Tesla Network will get driven a lot more, 40-50m cumulative cars produced seems reasonable to me, to which I apply the participation rate of 30%.

Last edited:

ValueAnalyst

Closed

Reciprocity

Active Member

4 billion people in the world live in urban areas, and this number is increasing. Due to steep declines in avg fare cost, increased convenience, and the upcoming declines in car ownership, if we assume number of rides needed as a percentage of population doubles in the next 8 years (vs. 60% in 2.5 years), then 20% rides-to-population would mean at least 800 million daily rides will be needed by 2025.

One of the main reasons so many live in Urban areas is because that's where the jobs are and it's too expensive to move just 20 miles away where prices for housing is actually lower. The other cost is time, time wasted committing. If the ride costs as little as mass transit and rides can even be shared by commuters, up to 5, the costs could really come down. The network can make this much more convenient. The system can even know if your not going to be ready and by pass you and route another car.

Parking in Urban areas is another major issue that is solved by autonomous rides. Parking is expensive and cumbersome. I could see a time in the not so distant future where non autonomous cars are outlawed during most of day in the most density populated areas.

We may not all agree on the total I think we can all see a case where some cars can be displaced by autonomous EVs. The new greater availability of affordable transport may offset any losses and maybe do many miles will require those vehicles to be replaced at a higher rate and offset some losses. personally I feel that in 10 years or so it will be a very compelling option to not own a car at all. Many will be people who could never afford a car anyway, or elderly or the blind, but many will be you average commuter.

Don't put me in the same camp with VA, I think change will come but more evolutionary then revolutionary. I don't think cars will be driving 24 hours a day, just more then 1 hour on average they do today. Even just an extra 2-3 hours on average per day could have a large impact on mobility.

- Status

- Not open for further replies.

Similar threads

- Replies

- 9

- Views

- 1K

- Replies

- 6

- Views

- 11K

- Sticky

- Replies

- 465K

- Views

- 51M

- Locked

- Replies

- 27K

- Views

- 3M