Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Could you please elaborate?

The supplier said the 10k/week has been pushed back to May or June. So end of q2 2018. So realistically q3 2018 earliest.

Last edited:

Could you please elaborate?

If you look back at parts orders for the beginning of the Model 3 ramp you can see that Tesla will place orders to do its best to try to ensure that parts supplies will not be a roadblock in production. But inevitably some suppliers will fall short in terms of volume or quality and the ramp can only progress as fast as the worst performing supplier. (Elon has explained this in the past but I don’t have time to look it up.) And that assumes no problems ramping the production line.

So I would view 10K/wk by mid-2018 as much more optimistic than even the “impossible” July 2017 date for the start of Model 3 production.

More broadly, getting out ahead of Tesla’s own (usually optimistic) projections on this is very likely to prove wrong. Tesla has said 10K/week production some time in 2018. Until I hear otherwise I am assuming December 2018, and in my mind that would be a massive home run.

ValueAnalyst

Closed

If you look back at parts orders for the beginning of the Model 3 ramp you can see that Tesla will place orders to do its best to try to ensure that parts supplies will not be a roadblock in production. But inevitably some suppliers will fall short in terms of volume or quality and the ramp can only progress as fast as the worst performing supplier. (Elon has explained this in the past but I don’t have time to look it up.) And that assumes no problems ramping the production line.

So I would view 10K/wk by mid-2018 as much more optimistic than even the “impossible” July 2017 date for the start of Model 3 production.

More broadly, getting out ahead of Tesla’s own (usually optimistic) projections on this is very likely to prove wrong. Tesla has said 10K/week production some time in 2018. Until I hear otherwise I am assuming December 2018, and in my mind that would be a massive home run.

I have 10,000 per week in dec as well. Just wanted to make sure last night's supplier comments didn't change that.

I have 10,000 per week in dec as well. Just wanted to make sure last night's supplier comments didn't change that.

Moving up the date seems premature to me, although the new info does suggest Tesla still has some cushion left to hit 10K in December 2018 even factoring in some additional delays.

That seems very positive to me.

Last edited:

erthquake

Active Member

Went back to read the Taiwan supplier article carefully and found a handful of info not talked much here:

1. Seat issue: Model 3的座椅沒有設計可放置文件的背袋,也沒有扶手,甚至連座椅也太短,對身材較高大的男性而言,並不舒服,更無法滿足企業老闆或貴賓的需求 "Model 3 seat has not pocket for holding documents, no handrails, and even the seat is too short, taller men, Boss or VIP needs."

2. "至於供應鏈部分,沈國榮說,目前問題出在部分供應鏈廠商的產品良率,無法達到特斯拉要求,雙方還在磨合中,以致於產量開不出來。"As for the supply chain part, Shen Guorong said that the current problem in some of the supply chain manufacturers product yield rate, can not meet the requirements of Tesla, the two sides are still running, so that production can not be opened out."

Shen Guorong's title is Chairman of the Board of 和大集團 ( Google translation has it "and large group," wronged too much), which I believe equivalent to CEO and Chairman and President, all together, i.e. the #1 guy.

From the attached table, 和大集團 provides 减速齿轮箱 (something like reduction gearbox) to Tesla.

Anyone knows how many of these "reduction gearbox(es)" each Model 3 needs?

3. 但Model 3接單量大,特斯拉為確保零組件供應如期交貨且分散風險,採取「雙供應商」做法,即一家為舊供應商,另一家為新供應商。"But Model 3 orders a large amount, Tesla to ensure that the supply of goods on schedule delivery and risk diversification, to take "double supplier" approach, that is, one for the old supplier, the other for the new supplier."

tl;dr:

Seat design not satisfactory, could be redesigned

The boss of that Taiwanese supplier believes that the bottleneck could be partially due to supplier quality issue

Tesla employs "Double supplier" approach, i.e. two suppliers for the same parts to spread risk

BTW, it definitely talks about "per week"

I don't understand the seat thing. In every Model 3 interior I've seen, the front seat backs have pockets.

ValueAnalyst

Closed

That seems premature to me, although the new info does suggest Tesla still has some cushion left to hit 10K in December 2018 even factoring in some additional delays.

That seems very positive to me.

Agreed. I have 350k model 3's in 2018, so 7,000/week avg for 50 weeks. And 100k to 125k combined model s/x.

Agreed. I have 350k model 3's in 2018, so 7,000/week avg for 50 weeks. And 100k to 125k combined model s/x.

Thats consistent with my calculation

ValueAnalyst

Closed

Tesla cuts Model 3 part orders to Taiwan supplier Hota: report

"Tesla may delay scheduled weekly shipments of 10,000 parts in March by a few weeks until May or June, the report added."

At least there a chance we may see 10,000/week some time in 3Q18. I wonder if this'll come up in the call.

"Tesla may delay scheduled weekly shipments of 10,000 parts in March by a few weeks until May or June, the report added."

At least there a chance we may see 10,000/week some time in 3Q18. I wonder if this'll come up in the call.

Gerardf

Active Member

I don't understand the seat thing. In every Model 3 interior I've seen, the front seat backs have pockets.

Maybe it is not for the seat in the front, but the back.

In China the Boss / VIP has a driver.

erthquake

Active Member

Maybe it is not for the seat in the front, but the back.

In China the Boss / VIP has a driver.

Wouldn't that kind of person be riding in an S or X?

Wouldn't that kind of person be riding in an S or X?

That’s exactly what my wife said when she read that line in the article.

ValueAnalyst

Closed

So, the original article in Chinese has some very interesting information. Apparently the 5k/week level was set for October. Temporary adjustment to 3k/wk in December. Going to 10k/wk in late Q2 2018. Says something about supplier problems.

Can someone with Chinese language skills provide a better translation?

I agree — I am optimistic about the prospects for 2018 but was pleasantly surprised by that.

I don't know of a single sell-side analyst projecting 10,000 per week by end-18, let alone 2Q18.

The $21B 2018 revenue consensus assumes 150k Model 3's in 2018, or ~5,000 per week by end-18, per my estimate.

I'm from India and even people driving compact economy cars (by US standards - Civic, Corolla etc.) sometimes have drivers.Wouldn't that kind of person be riding in an S or X?

NASDAQ up 1% but TSLA down 2.5%. This tells us a few things. Market is woefully behind us. We thought 3k/wk is positive because we are coming from a much worse/unpredictable perspective, which Mr.Market was apparently not aware at all.

I also think the risk is to the downside in terms of further delays. Note that the 3K/wk supplier rate is also a prediction, just the same way the earlier 5k/wk rate was also a prediction. Nobody knows if they will hit that prediction, at least until the line is actually moving. Currently the line is entirely stalled based on VIN sightings. So all in all when market discovers that the production is much worse than the news implied, stock price could further tank.

People who are holding out some firepower might find some good deals.

On a related note, each season we seem to get a go-go bull-troll of our own. JC utterly polluted these threads in the X era, pushing people to make ever crazier bets. This time around we got TT. Moral of the story, don't fall for the trolls.

While the criticism of JC during the X era is warranted, the criticism of TT is overblown, in my opinion. TT based his predictions on technical data. Perhaps the greatest lesson of the past few weeks is the limitations of technical analysis when a) a fundamental issue such as the ramp-up of Model 3 holds far more power to affect the stock price than technicals in the short term and b) the combination of a dread (where are the Model 3s?) and downward pressure on the SP by serious manipulations by the shorts yields a long downward run. None of us knew the timing of the Model 3 ramp-up. If good news had come earlier (we were exceeding 360 on Oct 18, barely a week ago), TSLA could be way up right now, as TT suggested. JC was talking about shorter term calls (which turned out to be a really bad move in the X era), TT has mostly been a stock and J19 call investor although he also holds some J18s. Investors who bought stock and J19 calls over the range when TT was doing it will likely still do fine over the coming year. Remember that TT began pushing investors to buy at lower prices than we see today. You would still be in fine shape if you had mimicked his buying.

Waiting4M3

Active Member

I look at the supplier's comment as an estimate, I doubt Tesla has placed order out to 2018. They might've originally been told by Tesla to expect an order as large as 10K/wk by March. And now with this 5K->3K/wk reduction in Dec, the supplier may have guessed that Tesla's schedule is pushed back by 2 months. I didn't get an impression that the new 10K/wk in May/Jun timeframe came from Tesla.Moving up the date seems premature to me, although the new info does suggest Tesla still has some cushion left to hit 10K in December 2018 even factoring in some additional delays.

That seems very positive to me.

That being said, if Tesla originally ballparked 10K/wk in March, it's likely their internal target for that run rate is Q2'18. They've emphasized that they negotiated 60-day payment terms and hope to produce/sell M3 quicker than 60 days to bank the cash temporarily on each car. So it would make sense that they will use parts as soon as they can.

Last point, if Tesla's issue in ramp is parts, and not tooling, then I think setting up a 2nd line to ramp from 5K to 10K may not be any more difficult than ramping from 0-5K. It may be that whatever they need to do to free up the space to ramp M3 to 10K, such as potentially revamping, simplify, and consolidating MS/X lines to free up space for a 2nd M3 line, that could be challenging. But I don't see why it should be more difficult than ramping M3.

What am I missing here?Musk’s Plant Makeover Even More of a Long Shot as Model 3 Lags

By Dana Hull and John Lippert on Bloomberg Tech, today at 5am

The plant -- which the United Auto Workers has been trying to help employees organize -- has more than 10,000 workers, almost double the 5,500 who workedthere in 2006.

5500 = 426k

Why 10k = 100k?

I think one needs to be careful drawing any production run rate conclusions from today's news. There's a bunch we don't know - most importantly how many pieces are they ordering per vehicle, how long does it take to get the product from Taiwan to California, is the part single sourced or do other vendors supply it as well.

It's possible they're shifting orders to the other vendor if they have one. If Tesla needs 2 pieces per vehicle, you can cut your production estimates in half. I would also guess maybe a month in transit for the parts - I doubt they're air dropping them.

It's possible they're shifting orders to the other vendor if they have one. If Tesla needs 2 pieces per vehicle, you can cut your production estimates in half. I would also guess maybe a month in transit for the parts - I doubt they're air dropping them.

dc_h

Active Member

Congrats to you and wife on pulling out and getting back in after a correction. Bet you had a hard time with fomo 6 weeks ago.Me too. Just went all in with June $340's and J19 $350's.

No, this time they are on time:

Now, will we actually be able to achieve volume production on July 1 next year? Of course not.

The reason is that even if 99% of the internally produced items and supplier items are available on July 1, we still cannot produce the car because you cannot produce a car that is missing 1% of its components.

Nonetheless, we need to, both internally and with suppliers, take that date seriously, and there need to be some penalties for anyone, internally or externally, who does not meet that timeframe. This has to be the case because there's just no way that you have several thousand components, all of whom make it on a particular date.

The reality is that the volume production will then be some number of months later, as we solve the supply chain and internal production issues.

Not to be "that guy", but I totally saw this coming. (in hindsight, I failed to heed my own advice, instead brushing it off as being overly pessimistic, go figure...)

(comment about not being downward momentum yet was true, but sharp reversals at ATH's spook buyers, and downgrades are a free whack-a-mole hammer shorts love to use on TSLA)

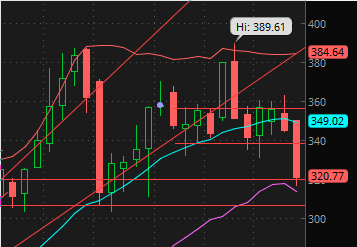

Here's weekly. Red topping candle confirmed double top. Failed to break and hold above $360, head & shoulders breakdown confirmed this week.

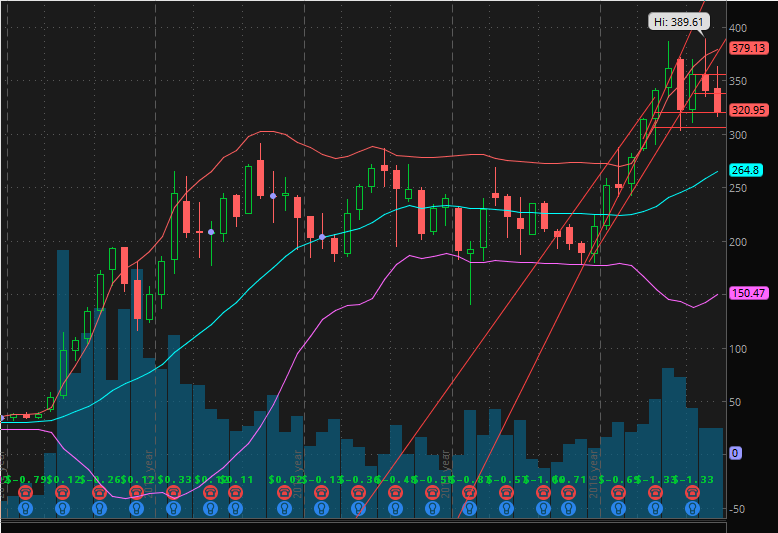

Monthly view. Really nasty long wick red candle last month shows strong rejection from highs, (first indicated by June's long top wick, confirmed by July's very bearish engulfing candle) breakdown confirmed by this month's candle showing further rejection from highs. This chart is what long term bears dream of because it gives a much better chance of "next stop 270". (naturally, $160 after that, on the way to $0, duh)

The positive side of this (which TT007 would argue, I'm sure) is it somewhat resembles a bull flag on monthly.

the combination of a dread (where are the Model 3s?) and downward pressure on the SP by serious manipulations by the shorts yields a long downward run.

Fair warning everyone, this week's candle is shaping up to be really ugly. 2015 topped in a similar manner (though compressed timeframe between peaks compared to 2017).

Granted, there's a lot of catalysts coming up, but once there's downward momentum shorts tend to regain confidence and the last month or two of progress can be quickly erased...

(comment about not being downward momentum yet was true, but sharp reversals at ATH's spook buyers, and downgrades are a free whack-a-mole hammer shorts love to use on TSLA)

Not calling it downward momentum yet. However, ending the week <370 will look like a topping red candle on weekly. Anymore downside next week (another Monday morning downgrade, etc) will easily make for some downward momentum - which would "confirm" this week's candle, and closing next week below $356 will additionally make for an ugly red topping candle on monthly. Anything less than an awesome delivery report in early October will only serve to embolden shorts further after that. And all that is even assuming macro doesn't act up too much...

Guess what I'm saying is, with low market volumes and no major positive news on TSLA, short manipulation becomes way easier. Without some positive surprise or two, (TSLA Friday beast mode, "material" news next week, something surprising in Australia, and/or awesome Q3 deliveries), it's very possible we could end up back in the lower $300's again before $400, perhaps when public Model 3 deliveries start to pick up in November/Dec.

tl;dr: be careful, $350 or less very well could happen before $400.

Here's weekly. Red topping candle confirmed double top. Failed to break and hold above $360, head & shoulders breakdown confirmed this week.

Monthly view. Really nasty long wick red candle last month shows strong rejection from highs, (first indicated by June's long top wick, confirmed by July's very bearish engulfing candle) breakdown confirmed by this month's candle showing further rejection from highs. This chart is what long term bears dream of because it gives a much better chance of "next stop 270". (naturally, $160 after that, on the way to $0, duh)

The positive side of this (which TT007 would argue, I'm sure) is it somewhat resembles a bull flag on monthly.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 866