No offense intended to either of you as you are both valued members of this community:

Can you take this discussion over to the 'roof thread' or via PMs to resolve your differences?

Good idea, and no offense taken.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

No offense intended to either of you as you are both valued members of this community:

Can you take this discussion over to the 'roof thread' or via PMs to resolve your differences?

1. I didn't present an estimation here. I pointed out that Tesla's calculator does not include financing costs. I didnt even see a disclaimer note on the website stating that financing costs are not included.

2. The 20-30 years was from estimates of lifetime for the roof looking at the first several articles in a google search that seemed to come from neutral sources, not, the warrantee.

3. Assuming the roof will be financed is far more generous towards making the case for Tesla than assuming the probable opportunity cost of using cash one could otherwise invest in the stock market. I used mortgage calculators to play with this and they defaulted to a 3.9% interest rate (IIRC), far far below market averages over long term periods.

1. You dont need a disclaimer, its not automatic that it would be financed.

2. I was a roofer in college, but I wouldn't consider myself an expert. I know one year I worked was after a huge hail storm and we where replacing nearly new roofs every day. Stuff happens. Consider my estimate an average as sometimes stuff wont happen and sometimes it will. An asphalt roof can last a very long time in the right situation and for some, its a great solution and they should put solar panels on their roof. There are also those who want or need better. Those are the folks that Tesla is marketing to and those are the folks that they built the website for. They are not trying to sell tile solar roofs to people with 3 tab shingles on a $50,000 house.

3. I said this before, ill say it again. Buy the cheapest asphalt roof you can find and put the rest in TSLA stock, then you will be able to afford 50 solar tile roofs in 25 years. I still dont see your point. You are financing something that has value and continues to have that value for a great deal of time. If you want a crappy roof, get one, you have a choice. If you want to pay cash or finance, that is up to you not Tesla and thus they have no reason to warn you that you will need find a way to pay for it. If you want a really nice roof, its gonna cost regardless of if its Tesla solar tile or not.

Edit: And I forgot to add that I think this will greatly impact the stock price in the near future.

No offense intended to either of you as you are both valued members of this community:

Can you take this discussion over to the 'roof thread' or via PMs to resolve your differences?

While I don't have any illusions of converting anyone here to a buy/hold, buy trading shares on dips into silly price levels strategy (nor am I making any prediction about the share price tomorrow, this week, month, ...), I will share a couple of possible near term vulnerabilities for those with time sensitive trades,

1) Tesla's latest blog out Sunday night is quite suggestive that we will see some articles trying to mislead via anecdotes about the safety at Tesla's factory and worker satisfaction/interest in unionizing,

We have received calls from multiple journalists at different publications, all around the same time, with similar allegations from seemingly similar sources about safety in the Tesla factory. Safety is an issue the UAW frequently raises in campaigns it runs against companies, and a topic its organizers have been promoting on social media about Tesla.

Some of the publications who have contacted us have rejected covering this “story” because they understand it is a misleading narrative based on anecdotes, not facts. However, there will likely be a few publications that choose to publish stories regardless, so we want to make sure the public also has the facts. Watch for these articles to downplay or ignore our actual 2017 safety data and to instead focus on a small number of complaints and anecdotes that are not representative of what is actually occurring in our factory of over 10,000 workers.

Creating the Safest Car Factory in the World

2) In an article on the economics of Tesla's Solar Roof by Consumer Reports I accessed through Yahoo, Tesla (and CR) and its Solar Roof were hammered, and, I do mean hammered, in the comments section for not including the cost of financing, or the opportunity cost of using tens of thousands of dollars to pay for a Solar Roof rather than investing those funds elsewhere, as well, to a lesser extent, as overstatements re the cost of asphalt roofs. I happen to think this is one of the very rare instances there are Tesla detractors with an intellectually honest criticism. The economics may or may not work out for any given homeowner, and, for some it's not strictly about economics, but, I find the broad emphatic statements last November that this will be cheaper than a traditional roof/cost of energy to have been overstatements. This is somewhat subjective, but, to me, Elon's presentation implied that the Solar Roof coming out this year would be definitively cheaper for the bulk of consumers. There's some vulnerability there, where there's more vulnerability, is Tesla not including the cost of financing in its calculator. Showing a bottom line of savings without even mention of financing costs, let alone incorporating it into the calculator is not technically a falsehood, but it is an attempt to use consumer ignorance to make the product look more strictly economically compelling than it actually is.

We've seen deluges of articles trying to talk Tesla down based on falsehoods... I think it's likely that with the opening of intellectual honesty being on their side, we will see the usual gibberish peddlers produce a deluge of articles trying to talk Tesla down on Tesla's cost calculator and their general marketing of the Solar Roof as cheaper than a conventional roof/energy costs. I'd expect many of these articles will try to inflate this instance of overselling into a broader smear that Tesla generally misleads consumers and cannot be trusted, and in some instances, even, that Tesla's entire operation is built on trying to dupe and take advantage of the public. Having put up a muddy calculator on its website, Tesla is not going to be in a very good position to clear up the considerable mud that is likely to slung at the economic attractiveness of the Solar Roof.

Note: If you disagree with me about Tesla overstating the economics of the Solar Roof, that's fine, it's debatable. fwiw, I've had enough of that debate for now on the general thread, and I'm not looking to bring that discussion here. my point is, don't be surprised if we see a stream of critical articles coming very soon, whether you agree with me that some criticism is valid in this case or not.

Seriously! There seems to be no moderation of this thread towards OT posts.

All I know is:Can you expand on this please? Why couldn't he convert to stock once SP, say, goes up by 5x?

Seriously! There seems to be no moderation of this thread towards OT posts.

What we know is that no matter how destructive to the forum a particular member is, even members who deliberately try to sabotage the feedback system by "disagreeing" with every positive post are given complete free rein, but that even mentioning the only tool that we have to deal with that problem (ignore) in conjunction with naming an offender is literally treated like posting an obscenity.

All I know is:

Actionable Trading Ideas, Real Time News, Financial Insight | Benzinga

Chamath Palihapitiya, the founder and the CEO of Social Capital, spoke with CNBC's Kelly Evans, during the Sohn Conference, about his trading idea in Tesla Inc (NASDAQ: TSLA).

He said he loves the five-year convertible bond in Tesla, because it gives you 95 percent of the potential upside of equity and it has a downside risk of a bond. Palihapitiya sees it as a call option on one of the greatest entrepreneurs. It now trades at zero yield, but when Palihapitiya started buying it, the convertible bond yielded 5.5 percent. It can be converted at a premium of 5 percent from the current price.

Palihapitiya explained that when it comes to Tesla, he is betting on CEO Elon Musk, because he sees him as a closest thing to Thomas Edison of our generation.

I thought that 95 percent meant that if the TSLA SP hits up to his target or the -$675 bond amount that you would make 95% of the profits of of holding shares. If that's incorrect or even if it's correct I'd be interested in finding out exactly how they work.

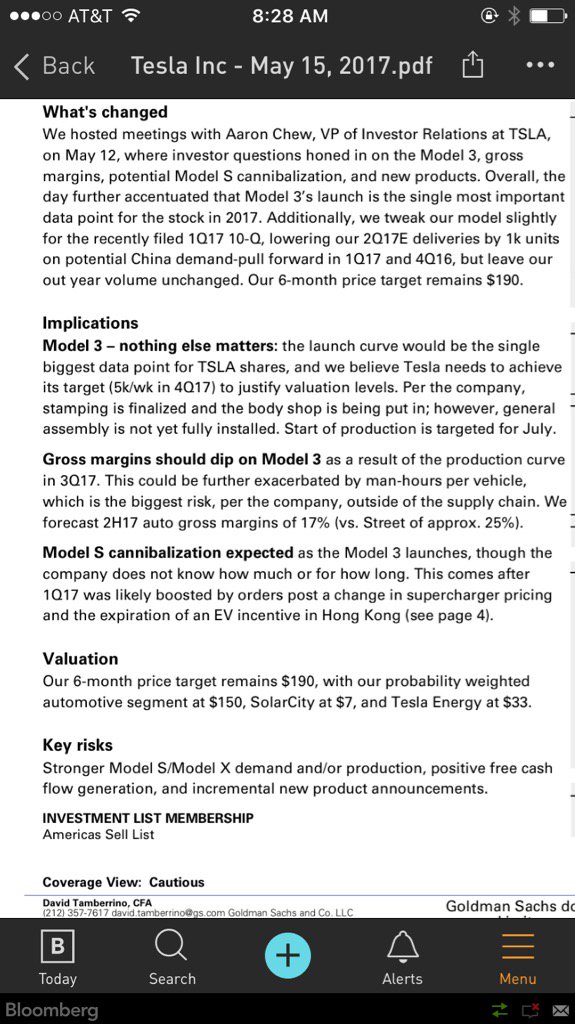

Goldman Sachs on Tesla

You gotta understand that the analyst department for TSLA is pretty broke right now for shorting it. They are probably using the free version of the excel. No budget for the premium member service.Does the Goldman team look at anything beyond the next six months when they value companies? Have they run out of excel columns?

Full Microsoft Office Pro 2016 with license key can be bought for 3-4 dollars on ebay. Just a tip if the Goldman team is reading thisYou gotta understand that the analyst department for TSLA is pretty broke right now for shorting it. They are probably using the free version of the excel. No budget for the premium member service.

My understanding is that the bonds, at the time of his presentation, were trading a premium. So his analysis is correct.

But I frankly wouldn't want to give up 5% of the potential return for basically insuring against a risk that is not material (i.e. Bankruptcy). So yes, good sound bite, but poor investment decision.

According to the motley fool author bankruptcy is the one thing that's not protected against.My understanding is that the bonds, at the time of his presentation, were trading a premium. So his analysis is correct.

But I frankly wouldn't want to give up 5% of the potential return for basically insuring against a risk that is not material (i.e. Bankruptcy). So yes, good sound bite, but poor investment decision.

According to the motley fool author bankruptcy is the one thing that's not protected against.

I think based on his comments that what they protect against is loss of principle.

Former SolarCity CEO Lyndon Rive will leave Tesla

Rive, 40, said SolarCity was "healthier than it's ever been," and the time had come for him to move on.

Gap up tomorrow?