If True, QuantumScape Has Made the Biggest Leap in Batteries Since the Debut of Lithium-Ion

Holme pulled together all his engineers. “Time out,” he recalls saying. “Put your work down. Everybody, stage left. We’re going to start working on this dendrite problem. If we don’t solve this, we don’t have a product, we don’t have a company.” For a year, the entire engineering team worked only on dendrites. They collected every known theory about what causes them. First was that if the separator were hard enough, dendrites could physically not poke through and short circuit the battery. Only, that turned out not to be true, because lithium managed to knife their way through hard ceramics anyway. Then they looked at the theory that a soft separator would do the trick. It didn’t work, either.

Finally, they discarded the literature. “We had to go back to first principles and come up with our own theory of what causes dendrites,” Singh said. “And we had to actually develop our own metrology, which are measurement techniques to measure the quality of the material we were making because it turns out that some of the things that cause dendrites were not even measurable with normal metrology techniques.”

In 2015, the team finally settled on an explanation for lithium dendrites. They began testing it on the materials they had gathered. Finally, they found one that policed the dendrites. It was great. “My personal depression started to lift,” Singh said.

Only, they had spent five years to reach this stage, and all they really had was a tiny shard of material. They needed to make it larger and larger and better and better, with absolutely no defects such as pinholes that would attract dendrites. Each step up in size took six months to a year. In all, this phase required another five years. The last step, made in the end of 2019 and into last year, was taking the cell from 30-by-30 millimeters in size to 70-by-85.

So what did they discover? What causes dendrites? They aren’t saying. “We may make it public eventually,” Singh said. “But the industry doesn’t know this yet and it took a lot of work and sweat and blood to get there, so we feel that if we share that it makes it easier for competitors to enter as well. So we’re trying to avoid sharing that.”

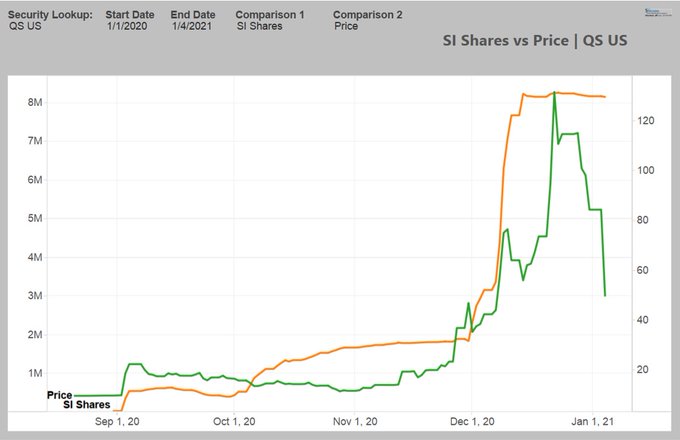

. I suppose something not too far off the initial price of $10-15 before it took of, at least until there's some more tangible evidence of the product and when it comes to market.

. I suppose something not too far off the initial price of $10-15 before it took of, at least until there's some more tangible evidence of the product and when it comes to market.