Your max refund is what you paid in taxes the year, you purchased the vehicle. The government suggested removing the manufactory cap, in this case, Tesla will qualify for this credit again. But it is only a plan for now. Also, the government going to introduce a fully refundable tax credit for EV $7500 (even you did not have such an amount in taxes) for the cars purchased after 12/31/2021. But it is only a plan.Anyone able to explain the federal tax credit to me? Do I have to owe taxes at the end of the year to the feds? Or is it if I paid 3k in federal taxes I get 3k back? (such as work taking taxes from me) I've been trying to wrap my head around this for months now.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Charge-Up NJ rebate program Phase 2

- Thread starter rjpjnk

- Start date

HastroX

Member

So from what I understand....Your max refund is what you paid in taxes the year, you purchased the vehicle. The government suggested removing the manufactory cap, in this case, Tesla will qualify for this credit again. But it is only a plan for now. Also, the government going to introduce a fully refundable tax credit for EV $7500 (even you did not have such an amount in taxes) for the cars purchased after 12/31/2021. But it is only a plan.

After 5/24/2021 = non refundable tax credit 7.5K$

After 12/31/2021 = refundable tax credit 7.5K$

With the NJ rebate (2-5K$?) hoping to start at 7/1/2021, I'm hoping to buy it maybe after 12/31/2021 but worried the $30M will run out of funds like last year at the early start.

The non refundable tax credit in my opinion is dumb. My wife and I can just change my W4 from single to both saying married so they withhold less on each paycheck and I'll end up owing >7.5K$ so I can take full advantage.

The non-refundable credit has nothing to do with your withholding or W4. It's you tax liability that matters, not what you owe at the end of the year.The non refundable tax credit in my opinion is dumb. My wife and I can just change my W4 from single to both saying married so they withhold less on each paycheck and I'll end up owing >7.5K$ so I can take full advantage.

HastroX

Member

I'm confused, so comes filing taxes of next year, if my TurboTax says they withhold 7.5K$ federal to little to the IRS, what is that considered? How do I check my "tax liability?" Or is this merely 100K$ salary - 7.5K$ off taxes when calculating?The non-refundable credit has nothing to do with your withholding or W4. It's you tax liability that matters, not what you owe at the end of the year.

veriojon

Member

if you made $100k with no deductions and were in the 28% tax bracket (all made up numbers). Your liability to the feds is $28k. You would take the $7.5 off this number. If you paid more than $21.5k you would get a refund of the amount over $21.5k. If you paid $21.5k you are square with the feds. If you paid under $21.5k you would still owe them.

Today is the last day to file comments on the matter of the fiscal year 2022 charge up new jersey program. Please send your comments to [email protected]

My suggestion was:

Hi, all,

As a mom of two kids, I would like to thank you for letting the air in NJ became more clear. And I would be happy to become a part of this great program.

The original law and incentive program was signed into law on Jan 9th, 2020, and the incentive program was active from Jan 17th to Dec 15th, 2020, and eventually ran out of funds allocated for the year.

This year the law was changed and the start of funding moved from the beginning of the calendar year to the beginning of the fiscal year. Also, $6 mln from the 2021 year budget starting Jul, 1 will be used to cover 2020 year purchases.

At the same time people stuck in more than 6-months gap and no go green, they use their gas vehicles for transportation and wait for the point of sales program to begin.

To be more consistent and fair I suggest letting people claim the incentive for the first half of the calendar year on the post purchase basis and prepare and run point of sales incentives in a no-rush regime at the same time. Nobody will be frustrated and the program will be smoothly transferred from the post-purchase to point of sales incentives.

My suggestion was:

Hi, all,

As a mom of two kids, I would like to thank you for letting the air in NJ became more clear. And I would be happy to become a part of this great program.

The original law and incentive program was signed into law on Jan 9th, 2020, and the incentive program was active from Jan 17th to Dec 15th, 2020, and eventually ran out of funds allocated for the year.

This year the law was changed and the start of funding moved from the beginning of the calendar year to the beginning of the fiscal year. Also, $6 mln from the 2021 year budget starting Jul, 1 will be used to cover 2020 year purchases.

At the same time people stuck in more than 6-months gap and no go green, they use their gas vehicles for transportation and wait for the point of sales program to begin.

To be more consistent and fair I suggest letting people claim the incentive for the first half of the calendar year on the post purchase basis and prepare and run point of sales incentives in a no-rush regime at the same time. Nobody will be frustrated and the program will be smoothly transferred from the post-purchase to point of sales incentives.

HastroX

Member

Thanks. So if I paid them 28K$ for 2021 we would still get the 7.5K$ credit back in 2022 after 5/24/2021? What's the difference with the refundable one?if you made $100k with no deductions and were in the 28% tax bracket (all made up numbers). Your liability to the feds is $28k. You would take the $7.5 off this number. If you paid more than $21.5k you would get a refund of the amount over $21.5k. If you paid $21.5k you are square with the feds. If you paid under $21.5k you would still owe them.

goldeneagle

Member

just received following response from charge up, prompt & not so useful IMHO

Thank you for your email and interest in Charge Up New Jersey. The Point-of-Sale Program, which will provide an incentive at the time of purchase, is expected to launch at eligible dealerships and showrooms with renewed funding at the start of the State’s next Fiscal Year in summer 2021 pending Board approval of this timing and approval of the FY2022 Budget.

Vehicles ordered, purchased or leased after the launch of the point-of-sale program will be eligible for the incentive through participating dealerships. Orders before the official launch of the new program will not be considered as eligible. Please note that program details such as incentive amounts, eligible vehicles and MSRP cap are still subject to change and have not been finalized yet.

Please continue to check our website for further updates.

Thank you for your email and interest in Charge Up New Jersey. The Point-of-Sale Program, which will provide an incentive at the time of purchase, is expected to launch at eligible dealerships and showrooms with renewed funding at the start of the State’s next Fiscal Year in summer 2021 pending Board approval of this timing and approval of the FY2022 Budget.

Vehicles ordered, purchased or leased after the launch of the point-of-sale program will be eligible for the incentive through participating dealerships. Orders before the official launch of the new program will not be considered as eligible. Please note that program details such as incentive amounts, eligible vehicles and MSRP cap are still subject to change and have not been finalized yet.

Please continue to check our website for further updates.

goldeneagle

Member

difference is even if you don't make enough to owe $7500 you will be refunded difference between 7500 and what you owe. this would encourage people who don't make enough money to afford an expensive EV to purchase one. most financial savvy people may not go that route.Thanks. So if I paid them 28K$ for 2021 we would still get the 7.5K$ credit back in 2022 after 5/24/2021? What's the difference with the refundable one?

HastroX

Member

difference is even if you don't make enough to owe $7500 you will be refunded difference between 7500 and what you owe. this would encourage people who don't make enough money to afford an expensive EV to purchase one. most financial savvy people may not go that route.

Thanks so basically it sounds like if you make 100K$, buy the Tesla car as of today 6/2 and they lift the cap you will qualify for the previous non-refundable tax credit

goldeneagle

Member

if you make 100K then you already owe more than 7500 for federal taxes, and need not worry about refundable vs non refundable. Refundable tax credit would make difference to only those people who do not owe 7500 taxes to federal because either they have deductions OR they do not make enough to owe 7500 in which case they will receive the difference between 7500 and what they owe. Most people who are even thinking about buying a tesla make enough to owe 7500 to Federal taxes, e.g. look @ the table below any one making more than about 65K owe at least 7500 to federal. Anyone making less than that is probably not thinking about buying model Y @ 52K anyways IMHO.Thanks so basically it sounds like if you make 100K$, buy the Tesla car as of today 6/2 and they lift the cap you will qualify for the previous non-refundable tax credit

| 10% | $0 to $14,100 | 10% of taxable income |

| 12% | $14,101 to $53,700 | $1,410 plus 12% of the amount over $14,100 |

| 22% | $53,701 to $85,500 | $6,162 plus 22% of the amount over $53,700 |

| 24% | $85,501 to $163,300 | $13,158 plus 24% of the amount over $85,500 |

Officially summer starts June 20 so maybe after that date, we could be eligible?just received following response from charge up, prompt & not so useful IMHO

Thank you for your email and interest in Charge Up New Jersey. The Point-of-Sale Program, which will provide an incentive at the time of purchase, is expected to launch at eligible dealerships and showrooms with renewed funding at the start of the State’s next Fiscal Year in summer 2021 pending Board approval of this timing and approval of the FY2022 Budget.

Vehicles ordered, purchased or leased after the launch of the point-of-sale program will be eligible for the incentive through participating dealerships. Orders before the official launch of the new program will not be considered as eligible. Please note that program details such as incentive amounts, eligible vehicles and MSRP cap are still subject to change and have not been finalized yet.

Please continue to check our website for further updates.

goldeneagle

Member

they also removed the verbiage of July 1st from there website, that was only concrete information they provided so far and then just to take it away. Weight of evidence suggest that they are trying to be as vague as possible and not trying to be clear and forthright. stated objective of this incentive is to increase number of green vehicles on NJ roads and unintended consequence of there implementation is they are preventing people from purchasing EV. Today if you purchase an EV / PHEV knowing that you are going to miss out on an incentive if you wait few months.Officially summer starts June 20 so maybe after that date, we could be eligible?

I removed hold yesterday and got EDD of Aug 5-25. Got to be something by thenI removed hold on June 1st and today I have EDD of June 17 - 30. I really hope BPU gives some clarity this week so I can hold or take a decision.

Naderh3697

Member

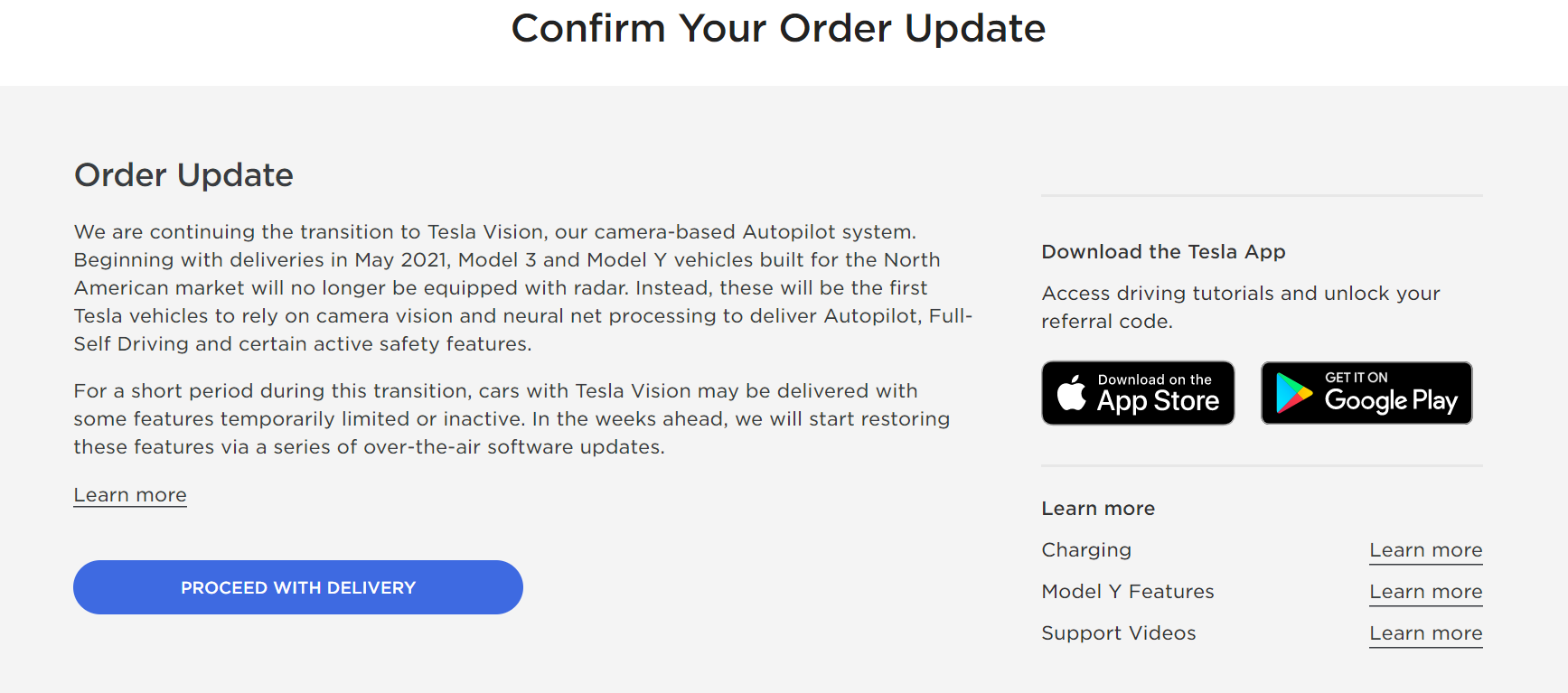

When I check on the status of my tesla I now get the confirm your order update window. I am not going to accept till July 1st. hopefully this is kind of like an unofficial hold so I dont lose my spot in line.

I also did not click the blue button and Tesla setup a tentative delivery data for me June 5 anyway, but still no VIN.

I replied that I would rather wait until July. They contacted me again and asked when in July, because if I don't take this car it will go to someone else and current delivery times are 2-13 weeks.

I replied that I am concerned about the removal of the radar and reports of AP performance issues at night and in poor weather, and that I am waiting to see if the software updates promised in the "weeks ahead" fix this.

No response yet.

I replied that I would rather wait until July. They contacted me again and asked when in July, because if I don't take this car it will go to someone else and current delivery times are 2-13 weeks.

I replied that I am concerned about the removal of the radar and reports of AP performance issues at night and in poor weather, and that I am waiting to see if the software updates promised in the "weeks ahead" fix this.

No response yet.

SpicyPaneer

Member

Now , I'm confused about the NJ rebate, available after July 1st & Federal rebate $10k is only valid after 12/31/2021?

veriojon

Member

I removed my hold on May 27th and got July 26-Aug11. Hoping there is some clarity on the rebate by then.

SpicyPaneer

Member

How did you do that? You can place an order and they would hold or delivery after July and you would still qualify for the rebate - NJ?I removed my hold on May 27th and got July 26-Aug11. Hoping there is some clarity on the rebate by then.

Similar threads

- Replies

- 4

- Views

- 1K

- Replies

- 0

- Views

- 574

- Replies

- 13

- Views

- 3K