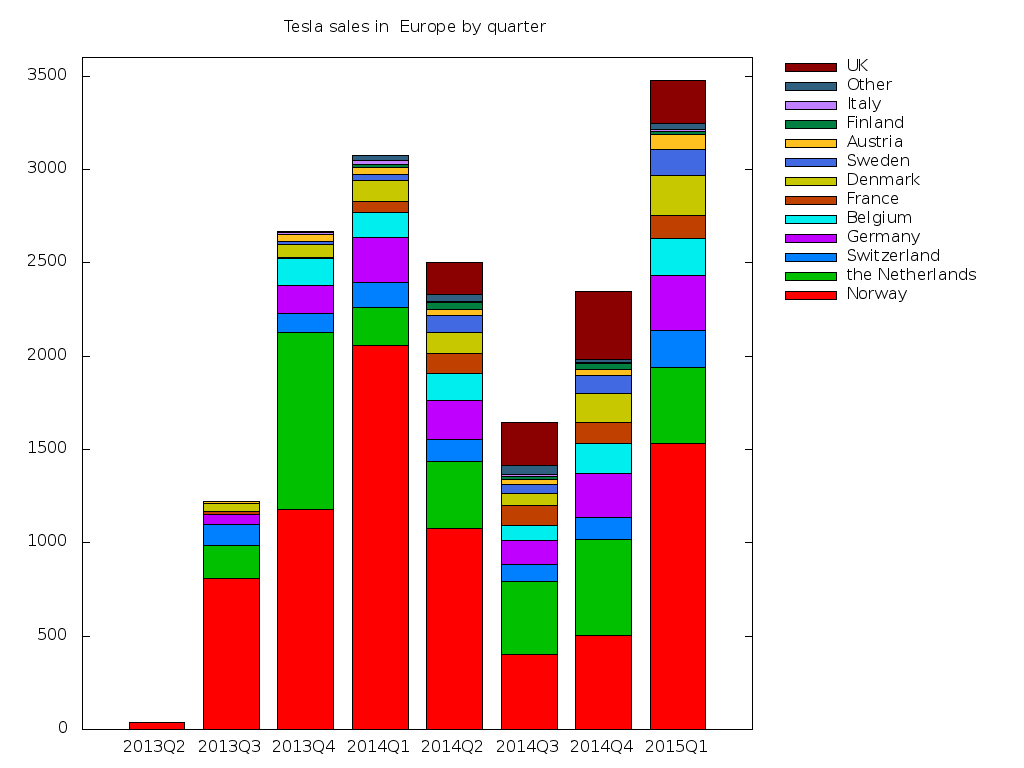

Thanks for the diagramm schonelucht!

Looking at the Q1 registrations/sales reaffirms that in most European markets (except for Germany) Model S is more popular than most of the equally sized and priced competitors from other premium brands in the 75-135k price range.

As in Denmark, Sweden, the Netherlands and Norway, in Switzerland, too, the Model S outsold BMW 6/7 series, Audi A7/A8, Porsche Panamera, MB CLS Class and equivalent. (with only one exception for Switzerland: MB S-Class which is slightly ahead).

Here's some numbers from the official statistics of Netherlands and Switzerland, which are very detailed and have great archives. I mined the Q1 numbers from the bigger tables for a comparison of top 4 models in the segment in 2013, 2014 and 2015.

Netherlands:

| 2013 Q1 | 2014 Q1 | 2015 Q1 |

| #1 | BMW 6 series (136) | Tesla Model S (213) | Tesla Model S (407) |

| #2 | Audi A7/S7 (60) | Porsche Panamera (169) | MB S-Class (142) |

| #3 | Audi A8/S8 (55) | MB S-Class (131) | Porsche Panamera (46) |

| #4 | MB CLS-Class (52) | BMW 7 series (61) | BMW 6 series (45) |

Switzerland:

| 2013 Q1 | 2014 Q1 | 2015 Q1 |

| #1 | MB CLS-Class (151) | Maserati Ghibli (145) | MB S-Class (240) |

| #2 | BMW 6 series (93) | Tesla Model S (133) | Tesla Model S (198) |

| #3 | Audi A7/S7 (62) | MB S-Class (129) | MB CLS-Class (197) |

| #4 | MB S-Class (47) | MB CLS-Class (120) | Maserati Ghibli (117) |

If you think about it for a minute, this is the beginning of a paradigm shift in the European premium/luxury large sedan segment. A total newcomer in the automobile industry conquers the whole segment with only one model. Moreover, basically from start of product launch. I'm very often surprised how European and US media doesn't get this context and what's happening in the relevant segment.

Since the premium SUV segment is slightly bigger, expect the same disruption with the X in that segment throughout Europe, too. (except for Germany, which is a quite special market / see my post further above)

Can't wait to see what will happen to the much bigger European mid-size sedan segment in 2018/19 after the launch of the 3...